onurdongel

The climate economy is on the cusp of an explosion that could see the decarbonization of the power grid and the broader economy completed at a virtually unrivalled scale over the next decade. This adoption ramp is being driven by the intersection of favorable renewable energy unit economics, high fossil fuel prices, and the 2022 Inflation Reduction Act. Plug Power (NASDAQ:PLUG) stands to ride this wave over the next decade. The company is a producer of green hydrogen and fuel cell solutions for the growing global demand for hydrogen-based remedies to the decarbonization challenge. Hydrogen facilitates a number of use cases around low-carbon heavy-duty trucking to stationary power systems for telecommunications systems and data centers.

Plug Power has the Series product line, which is used for material handling, with customers now using hydrogen to power forklifts and pallet jacks to tow tractors and tuggers. Plug Power counts BMW (OTCPK:BMWYY), Amazon (AMZN), and Walmart (WMT) as customers with companies in the high-volume manufacturing, warehousing, and distribution operations in play for continued expansion. Critically, hydrogen fuel cells can be used as an alternative to lithium-ion battery-powered propulsion. A use case which is likely to become more important as the world becomes more cognizant of an acute lithium supply shortage which the Boston Consulting Group has placed at 1.1 million metric tons, or 24% less than demand by 2035. Lithium reached record-high prices this year, reversing a more than decade-long fall in EV battery prices. BloombergNEF’s annual battery price survey placed this increase at 7% in 2022 over the prior year.

Fundamentally, a lithium-only approach to the decarbonization of the economy is neither going to be prudent nor entirely economical. This is heightened by environmental opposition to new mines in the US, Europe, and increasingly in South American countries like Chile.

The Fuel Of The Future?

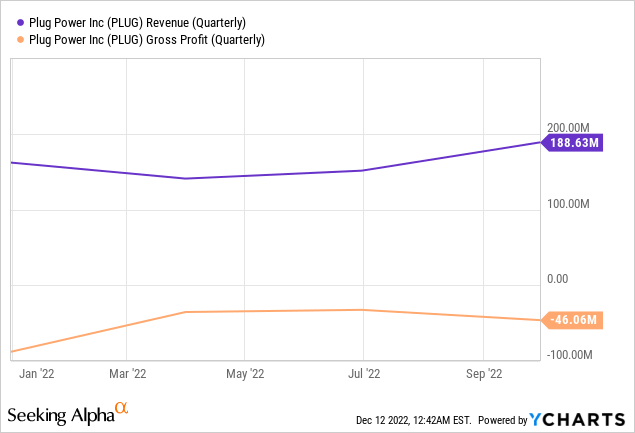

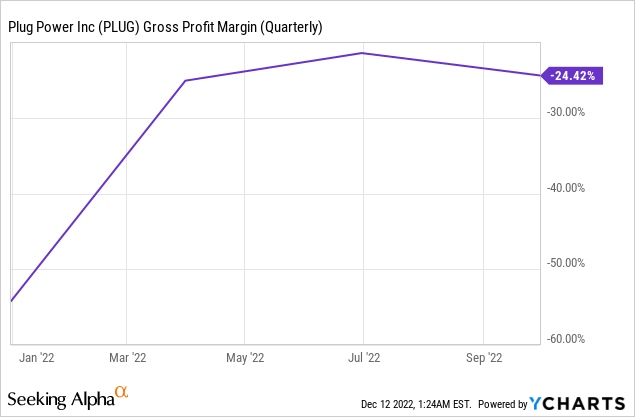

Plug Power’s success is really built around two areas; the cost of hydrogen and selling more of its equipment. The company last reported earnings for its fiscal 2022 third quarter saw revenue come in at $188.6 million, an increase of 31.1% over the year-ago quarter but a miss by $58.61 million on consensus estimates. Gross profit remained negative at $46 million, with a gross margin at negative 24%.

This structural unprofitability is a feature of Plug Power that its management has been unable to shift even as demand ramped up to allow revenue to reach new records. Indeed, revenue for its full fiscal year 2022, guided to be 5% to 10% below prior guidance of $900 million to $925 million, is set to be around a 70% increase from fiscal 2021. That the company’s gross margins remain negative on a gross margin basis is worrying and calls into question the overall viability of hydrogen.

This has been my sticking point in investing in hydrogen companies. The transition to low and zero-carbon technologies has been underway for well over a decade, and plenty of companies in the overall climate economy space already generate profits and free cash flow.

The US government has taken off the gloves with its Inflation Reduction Act which aims to subsidize the growth of most tranches of the climate economy, hence, this outlook could change. Hydrogen production is set to enjoy production tax credits which begin at $0.60/kg for blue hydrogen production that captures at least half of carbon emissions. For Plug Power’s mainly green hydrogen production buildout, the company is set to benefit from an incredible subsidy of $3/kg.

The company recently revised its hydrogen production estimates for 2022 with 50 tons/day of green hydrogen expected by the end of 2022, down from a prior forecast of 70 tons/day. This has been a result of permitting delay and the abandonment of plans for two plants. However, management stated that hydrogen production is on track to hit 200 tons/day by the end of 2023.

The Long Journey Towards Decarbonization

The IRA represents the step change Plug Power requires to fully shift its margins to positive territory and more fully benefit from the significant opportunities posed by the long journey towards decarbonization. Management was upbeat on this during their third quarter earnings call, stating that they can transform into a positive margin business by just turning on their hydrogen production plants. With the company targeting revenue of $1.4 billion in 2023, they expect their margins to look materially different a year from now going into fiscal 2024.

Whilst the short-term outlook for shares looks dim on the back of broader Fed-driven stock market malaise, the growth outlook for hydrogen is genuinely very strong. Companies that build the infrastructure for the difficult decarbonization journey are set to be winners, and Plug Power has a distinct leadership position in this.

The shift away from fossil fuels looks set to become a reality to play out over the next decade as part of the economic zeitgeist of most of the developed world. This forms the bullish backdrop for Plug Power’s investors as the IRA entirely transforms its hydrogen production fortunes. I’m passing on the shares until margins improve and the current risk-off sentiment of the stock market changes.

Be the first to comment