eugenesergeev/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the SPDR S&P Retail ETF (NYSEARCA:XRT) as an investment option at its current market price. The fund’s objective is “to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Retail Select Industry Index.”

I covered this fund four months, suggesting readers limit their exposure to retail as a whole. I saw a challenging environment, and XRT’s slight gain in the interim suggests this outlook has been vindicated:

Fund Performance (Seeking Alpha)

Going forward, I think a neutral/hold rating on XRT continues to be the right move as we approach 2023. I see a difficult macro-environment, slowing wage growth, and higher interest rates continuing to pressure U.S. retail sales. This limits the investment potential of XRT at this time.

Where Are We? In A Weak Environment

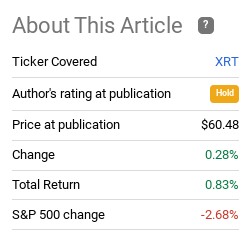

To begin, I want to take a look at where we are currently with respect to retail. It shouldn’t come as much of a surprise that this has been a challenging year. Consumer Discretionary as a whole has been one of the worst performing sectors. The downtrend has been a little exaggerated in my opinion, but the truth is most of the weakness is justifiable. While the year started out strong, retail sales have continuously disappointed, especially in the second half of the year:

Retail Sales (US) (Census Bureau)

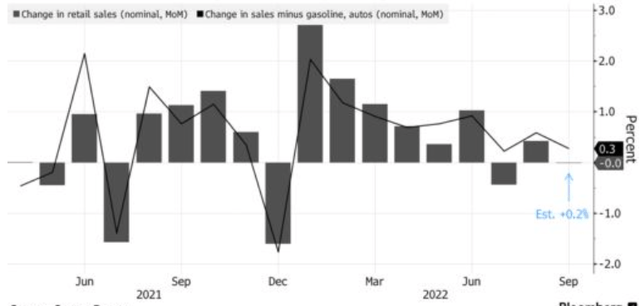

This helps explain why XRT has struggled. Sales translate into revenue and profit, and lack thereof means less of all three. This limits share price gains, as well as the premium investors are willing to pay for these shares. With consumer sentiment stuck near multi-year lows, we can see why consumers have been reluctant to part with their cash on discretionary items:

Consumer Confidence Index (Conference Board)

While sentiment and actual sales are not always perfectly correlated, they have been fairly consistent in 2022. In the short-term, this means we will want to see a more enthusiastic consumer before getting too bullish on retail plays. In my opinion, generating that shift in sentiment is going to take some time, supporting my continued caution on XRT.

Where Are We Headed? Tough To Say

So this year has been difficult – what might the rest of Q4 and 2023 bring? To me, at least in the short-term, is that things are not going to change much. One of the reasons why is the inflation remains a sharp thorn in the side of U.S. households. It has not cooled down much in 2022 (remember when it was supposed to be transitory in 2021?) The reality is that inflation takes away from how much consumers can buy. They may be spending the same amount, but inflation means they are getting less for the same amount of money. This has been the story in 2022 and I don’t see that changing in Q1 2023 at all.

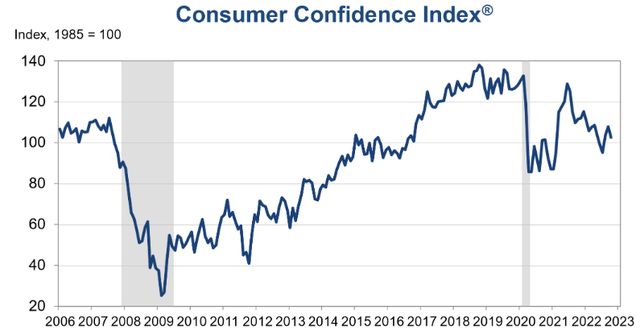

The extension of this is the Fed is moving ahead with its path to a degree many market participants hoped would turn by this time. After the Fed’s meeting yesterday, the market has repriced the futures curve to expect a 5% funds rate in mid-2023:

Futures Curve (Fed Funds Rate) (Charles Schwab)

Similar to inflation, this has implications on the U.S. consumer. They are going to have to pay more for credit and loans, sapping away cash that could have been used for discretionary purchases.

Ultimately, the higher rate/high inflation environment makes the consumer space a challenging one. Until we see either the Fed pause, inflation recede, or both, we cannot expect retail sales to regain the strength we saw in the immediate aftermath of Covid-stimulus. That will certainly happen at some point, but I wouldn’t expect to see it until at least Q2 next year. Thus, it will take a bit more time for me to shift to a “bullish” view on XRT.

XRT Relies On Consumers Spending Freely

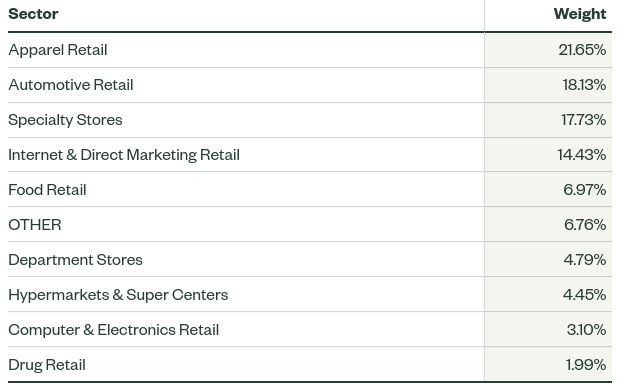

Looking into XRT as a fund, we see that it is quite diverse. This is a positive overall, but I would note that sectors like “apparel” and “specialty” stores require consumers to spend quite a bit on “wants” rather than “needs”:

XRT Sub-sector Breakdown (State Street)

This isn’t to say XRT is entirely discretionary. Food retail, automotive, and drug retail centers all sell many consumer staples and day-to-day products. This helps provide some stability and defensiveness to XRT’s portfolio. But the fact remains this fund still relies on consumers paying up for total return – whether on items they don’t really need or on more expensive substitute products (i.e. at specialty/niche stores).

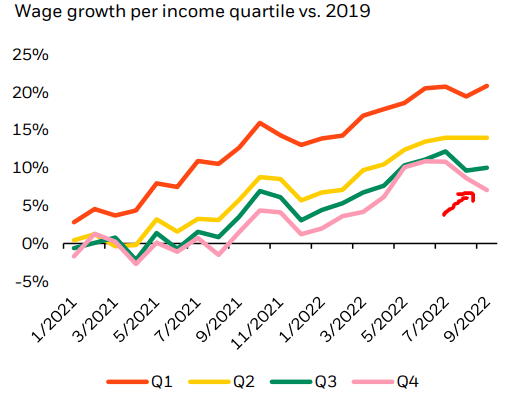

So – what does this mean? To me it means that consumers need to be willing to pay for luxury or premium goods in order for some of the companies in XRT to really thrive. In this vein my concern is that wage gains are starting to weaken. While wages have been rising through each quarter this year, the rate of pace has been on the decline, especially in Q4 so far:

Wage Growth (By Quarter) (BlackRock)

To be fair, one could look at this and say the U.S. worker is averaging between 5-10% wage growth – that’s great! That is certainly one way to look at it. But we have to remember that inflation is running in the 6-8% range. So a wage gain in that range only keeps people from losing ground, not gaining it. With prices rising, wage gains at this level are not enough of a catalyst for me to really get bullish on discretionary spend. This is a key reason why I am not changing my “hold” rating on XRT at the moment.

Any Good News? Yes: Valuation & Employment

The tone of this review has certainly been pessimistic. That was the point – but I don’t want to come across as alarmist. The reality is that the market as a whole has performed poorly and XRT is down over 33% year-to-date. What I take away from that is that a lot of this downside is already baked in. Retail is challenging – and the share price already reflects that.

While not necessarily “good”, it does offer some opportunity. What I mean is that XRT’s slide has left it sitting with a fairly cheap valuation. So while the underlying companies have been shunned by investors this year, earnings have been solid enough to keep the P/E in single-digits. Sitting at just under 9, XRT has a P/E well below the broader market:

XRT’s P/E (State Street)

This is critical to understanding why I haven’t shed my XRT position. While I am not adding here, it is very possible we are at or near a bottom. To sell-off my holdings with a clouded outlook can make sense, but not when the price to buy-in is this cheap. This suggests there is merit to either initiating or holding positions, but I would emphasize to moderate expectations due to the other attributes I have discussed in this review.

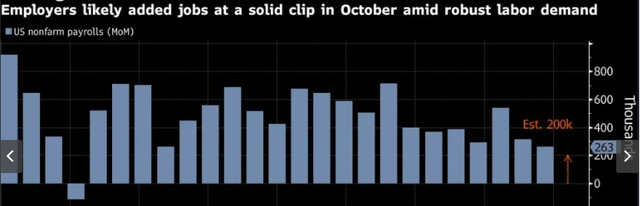

Beyond just the valuation, there are other reasons to be optimistic. While wage gains have slowed, the overall employment picture in the U.S. has been surprisingly strong. Despite high inflation and Fed tightening, employers have been adding jobs each month this year:

US Jobs Market (Yahoo Finance)

This helps to offset some of the wage growth headlines and general consumer weakness. Even if workers are earning less on an inflation-adjusted basis, the fact there are more workers as a whole is a positive trend. More people working generally means more money is going to get spent in a retail environment. As long as we don’t see a deep or prolonged recession, this employment background is a positive takeaway for investors.

Bottom-line

XRT has had a tough go of things in 2022. As we wrap up the year, I would typically be bullish going into the holiday shopping season. However, global inflation, weak consumer confidence, and slowing wage gains all cloud the investment potential for retail. There is good news to be had, of course, such as rising total employment and a cheap valuation for retail stocks as a whole. This makes it difficult to see a clear “buy” or “sell” justification right now. As a result, I believe a hold rating continues to be the prudent course of action for XRT, and retail as a sector. Therefore, I suggest readers be very selective about new entry points as we move closer to 2023.

Be the first to comment