RiverNorthPhotography/iStock via Getty Images

Main Thesis/Background

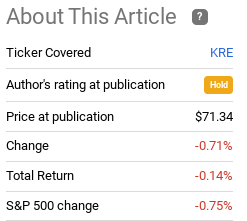

The purpose of this article is to evaluate the SPDR S&P Regional Banking ETF (NYSEARCA:KRE) as an investment option at its current market price. This is a fund with an objective to “provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Regional Banks Select Industry Index.” I last covered KRE about five months ago, when I slapped a hold rating on the fund. In hindsight, this was a well founded outlook, as KRE’s return since then has essentially been flat:

Fund Performance (Seeking Alpha)

With the markets seeing plenty of volatility so far in 2022, I wanted to take another look at KRE to see if I should change my rating. After review, I do believe a more bullish/buy rating is warranted for a few reasons. One, regional banks are attractively priced, as is the broader Financials sector, when we consider valuations compared to the broader market. Two, regional banks are less exposed to foreign revenue streams, which make it attractive in an environment where geo-political risks are dominating headlines. Three, the Fed’s rate hiking cycle, which is consistent with other central banks around the world, will provide a tailwind to lenders and financial institutions.

Why Consider Banks In This Climate?

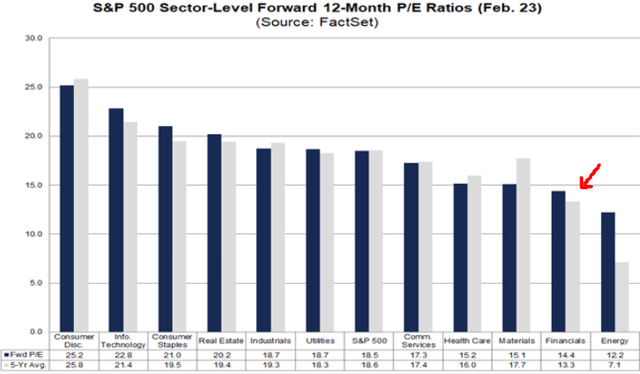

To begin, I want to touch on a few key points as to why readers may want to consider banks/financial stocks more broadly. This is relevant to KRE, but also to the myriad other ways investors can play this space. The first is valuation. While most sectors are still sitting with forward P/Es above the five-year average (indicating stocks are a bit pricey), the Financials sectors remains competitively priced. For comparison, note that Financials have a forward P/E lower than every other sector, with the exception of Energy:

Sector P/E Ratios (Google Finance)

Of course, this doesn’t necessarily mean the sector will out-perform, or even produce a positive return. But it should give investors some comfort, given the wild ride we have been on recently.

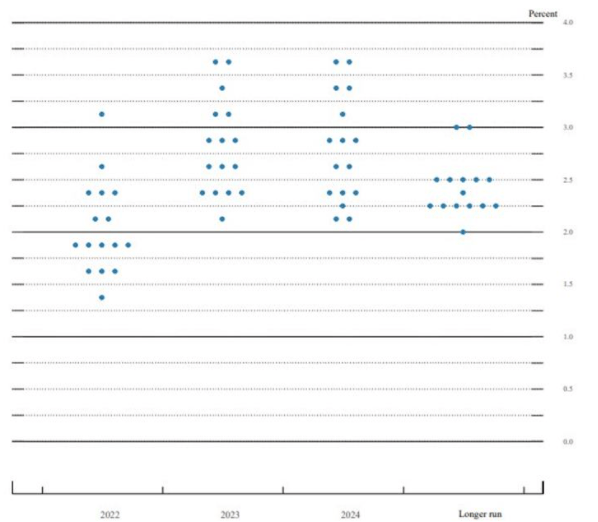

Another point that is positive for KRE and most banking funds, is that the Fed has begun its rate hiking cycle. This past week, the Fed announced a .25 basis point increase, the first since 2018. While this was widely expected and most likely priced in to stocks at this point, the broader takeaway is that the Fed plans to continue hiking rates throughout 2022. In fact, according to the current “dot plot”, the Fed expects to end the year with rates in the 1.75% – 2.5% range, as shown below:

Fed Dot Plot (Federal Reserve)

Ultimately, this is a positive for issuers of credit and other lenders. The rates charged will go up accordingly, and this typically happens at a faster pace than rates on deposits and savings increases. The end result is a net gain to profit and interest margins, and that provides an earnings tailwind for the underlying companies in the year ahead.

Regional Banks Are Predominately US-Focused

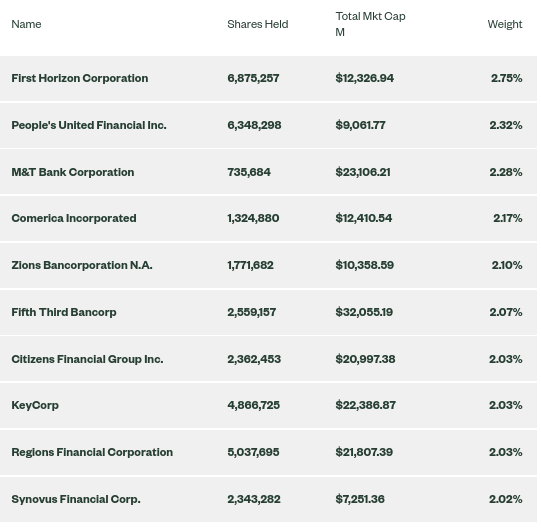

I will now shift to KRE, and regional banks, more specifically. When looking at this particular fund, readers should note this is a bank-only ETF. Yet, unlike many of the popular Bank/Financials ETFs, it excludes the biggest names in banking. These mega-banks dominate broad market and Financials ETFs, so I view KRE as a nice diversifier to begin with. Further, it is not “top heavy”, with the top holding coming in at less than 3% of total fund assets. Beyond that, readers can see its holdings list is filled with companies who generate the vast majority (if not all) of these revenues and profits domestically:

KRE Top Holdings (State Street)

I bring this up now because I feel it is especially timely to evaluate one’s international exposure and to foreign sources of revenue. Now, I want to reiterate I do not think foreign exposure is inherently bad or wrong, but that investors simply need to manage their risk and be prudent in this environment. While returns can be greater by taking on more risk, that may not be right for everyone, so invest accordingly.

In this vein, I feel this is a particularly relevant time to be considering how exposed one’s portfolio is to broader, international geo-political concerns. While the banking industry is not heavily exposed to Russia, there is some exposure by the largest U.S. banks. The ongoing crisis in Ukraine is causing many institutions, within banking and other sectors, to rethink their exposure to Russia and Eastern Europe as a whole. For now, the situation has been mostly contained to that region, but there is not any guarantee that will remain the case.

The good news for U.S. investors is that the banks and economies with the most Russian exposure are, not surprisingly, in Eastern, Southern, and Central Europe. But, again, that does not mean the U.S. does not have any. While the exposure is not substantial when we look at the banks’ balance sheets holistically, we do see there is some exposure. The important point to note is this rests with the large U.S. banks (think JPMorgan Chase (JPM) and others), there is risk of contagion if this conflict spreads more widely across Europe:

Country Exposure to Russia (Bank For International Settlements)

The takeaway here is simple. Regional banks are less at-risk of a sell-off from geo-political events. Their fortunes are not tied to Europe, Russia, or any other region aside from the U.S., for the most part. With the past few months being a stark reminder on the risks for international investing, a fund like KRE may be just what some readers are looking for.

Growth Through Mergers

Another positive for the broader regional bank sector has been the strong uptick in mergers and acquisitions over the past few years. Last year was a particularly big year for M&A activity, which led to some record deals, in terms of size:

Regional Bank M&A (Corporate Investor Presentations)

There are multiple positives from this. One, it creates synergies and scale, which allows these institutions to better compete with the top mega banks. Two, it leads to cost reductions for the combined institution. A top priority of the newly merged bank is to begin reducing branch count, which has been an ongoing trend for years, accelerated by both mergers and the pandemic. This leads to a big reduction in operation expenses. Three, the bank being acquired is typically bought up at a premium to the market share price. This amplifies returns for the stockholders of the acquired company.

To manage expectations, readers should note that 2021 was a record breaking year for regional bank M&A, and it is unlikely it will persist at that pace. Still, the trend for the sector is strong, and should continue to at least some degree in 2022 as well. Further, even if M&A does slow down, which is expected, the newly combined banks that have emerged from the past couple of years of M&A have likely become stronger and more competitive institutions. All of these factors combine to give me some confidence a fund like KRE is going to have a reasonably strong year.

The S&P 500 Remains Top Heavy

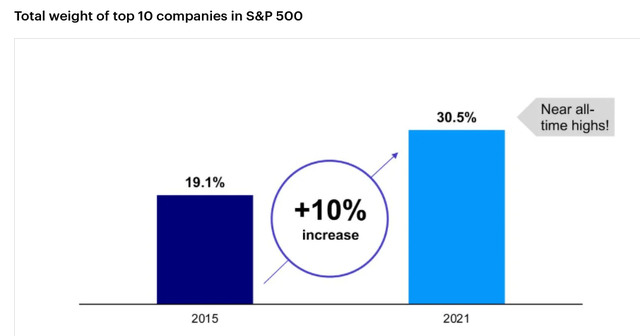

My final point touches on why I like branching in to funds like KRE, as opposed to simply adding more cash to my S&P 500 ETFs. Yes, the S&P 500 has a strong track record, and it will continue to make up a good chunk of my portfolio. However, since I have been invested, the S&P 500 has gotten more and more concentrated. Specifically, the Tech-weighting within the index has grown, and it has also been amplified by its over-reliance on just a handful of names. In fact, if we look back at just the past six-seven years, we see that the S&P 500 is more concentrated by a large margin:

The thought here is broad. Investors could do well to get more creative with their ETF exposure. This over-reliance within the S&P 500 is a key reason why I own sectors such as Utilities, Value stocks, Casino/Gaming, Retail, and, importantly, Banks/Financials. In truth, the S&P 500’s domination by just a handful of companies supports moving in to any of the sectors or themes I mentioned above, not just regional banks or KRE. But, as I mentioned, I see a couple of catalysts for KRE individually that warrant some thought. When I couple that with the desire to expand beyond the standard U.S. index, the bull case becomes even clearer.

Bottom-line

The market’s drop, and the subsequent rebound that has followed, took many investors off-guard to start the year. That said, plenty of geo-political risks remain, the rate hiking cycle has started in the U.S., and consumer sentiment remains subdued. This emphasizes the need for investors to remain diversified – whether in foreign vs. domestic stocks, stocks vs. bonds, or by taking on sector themes that may be under-represented in their portfolio. KRE is a nice way to play this concept, since it holds companies that are very under-weight the S&P 500 (or not included at all). Further, while Fed rate hiking may be a headwind for the broader market, it should be a positive catalyst for KRE, and other banking funds. The fund has seen a slight decline since 2022 started, and that suggests to me that now is a reasonable time to start buying. As a result, I may be initiating a position in this fund, and suggest readers give the idea some thought at this time.

Be the first to comment