Chattrawutt/iStock via Getty Images

Update & Thesis

Back in June, I wrote a piece comparing Match Group (MTCH) and Spark Networks (NASDAQ:LOV). In summary, I gave Match a “hold” since I disliked the company but didn’t have enough of a reason to initiate a bearish view. I gave Spark a “sell” based on their business models and income statements. Match is down 41% since the publication and Spark is down 45%. While both stocks have decreased in value, I will credit the bear market for the decline instead of my foresight.

I still believe Spark has much more room to fall if they continue the status quo. There has been no observable improvement in the business model flaws discussed in my last writing.

Spark Networks is an online dating conglomerate with 12 different platforms. Prior to the Zoosk acquisition, the company mainly operated dating sites on an exclusionary basis and did not utilize the Networking Effect. For example, Jdate is likely to discourage a Christian from using the platform. Even more odd is that Spark operates JSwipe as a second separate Jewish-based dating platform. Why would a business compartmentalize such a specific demographic and not merge them? This would be akin to Amazon (AMZN) operating completely separate sites for adults under 30 and over 30.

Spark Networks Subsidiaries (Spark Networks)

In my opinion, this is a terrible business strategy and the company’s financials prove it to be true. As discussed in my last piece on Spark, the business model limits the company’s scalability. What’s peculiar is I believe this flaw is extremely obvious and can’t comprehend how management doesn’t see it. Transcripts are full of excuses with no results. I see no positive long-term prospects for Spark Networks other than a possible buyout.

Management: Excuses, Excuses

Sparks failed to capitalize on the Covid lockdowns like other dating companies have. As you can see here, the company did grow their revenue during the lockdown period. This was the opportunity of a lifetime for online dating companies: in-person dating was put on hold and the only way to mingle was through the internet. If Spark was going to grow its user base, this was the time to do so.

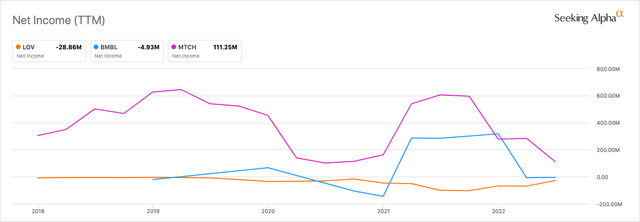

It is now October 2022, a full 30 months since the start of Covid. As you can see from the income statement, the company is now recording losses in operating and net income now that the lockdowns are over. Other than the Zoosk acquisition, the company still hasn’t pivoted away from its exclusivity business model.

Transcripts show what I believe to be a lack of direction on management’s part. The absence of insider purchases even as the stock price declined this year suggests a lack of belief. Below are some quotes from the CEO, none of which give me confidence in the company for the long term.

“We saw an increase in fraud on our SilverSingles and EliteSingles platform, which we believe led to lower performance versus our expectations.”

“Our Board has been highly engaged with the company’s external financial, legal and strategic advisers to identify and assess a range of alternatives to enhance Spark’s value”

“We are working to simplify our technology infrastructure by moving our primary brands from 3 platforms to 2. While we have made good progress in our plan, we prioritize some of our resources to focus on safety, delaying our transition to H1 next year.”

“We continue to make progress on getting Zoosk back to growth.”

“If you have subscribers that are going to renew but had a bad experience, they wouldn’t renew.”

– CEO Eric Eichmann

To be fair, management did make statements that can inspire some optimism. The company restructured its debt, by negotiating a package with MGG Investment Group, and which you can read about in detail here. In short, the company elected to take on more debt but with a longer maturity date. As you can see on Spark’s balance sheet, long-term debt increased from $85M to $105M YOY. Total Cash on hand remained roughly flat from the June 2021 quarter as well.

So why am I still bearish?

The concern here is not that the business has challenges, such as fraud and security on the platforms. The concern is that Spark’s competitors such as Bumble (BMBL) and Tinder are meeting them head on and continue to be top companies in the industry while Spark Networks is stalled. From a financial standpoint, both competitors mentioned have a history of profitability.

5-Year Net Income (Seeking Alpha)

From an operational standpoint, Spark’s competitors are already delivering value to their user base. Match is looking to add features to its platform and does not appear not focused on restructuring debt. Bumble and Tinder are also extremely simple to use, which is why I believe their user base is so engaged.

These quotes suggest to me that management is behind the curve and playing catch-up. The statements are focused on correcting past mistakes rather than specific plans of how they will grow their user base. This suggests to me that management doesn’t have what it takes to be an innovator in the online dating space.

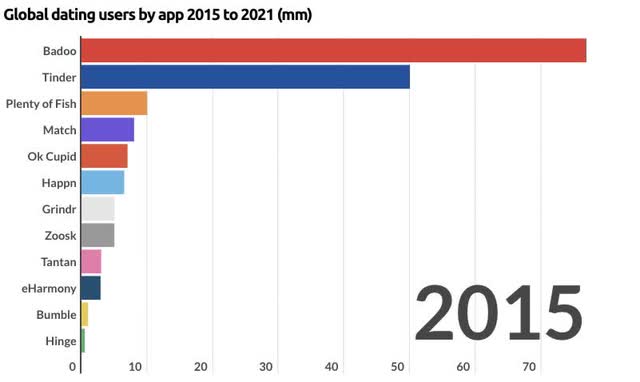

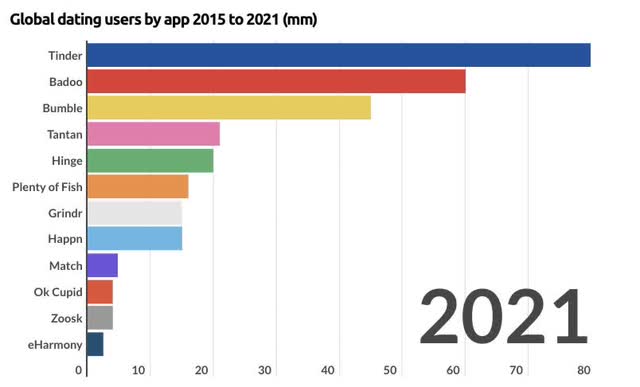

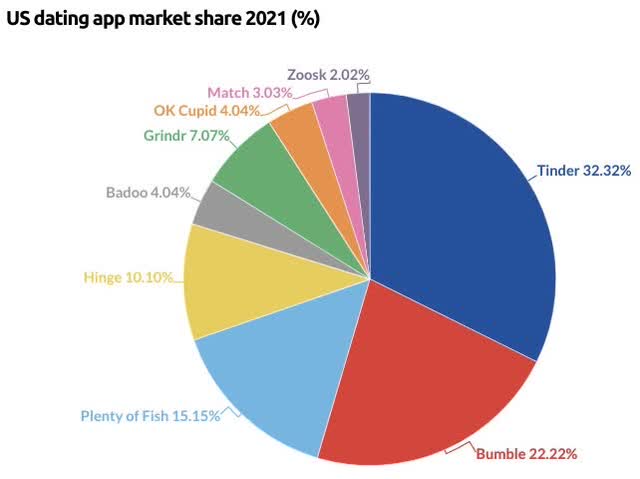

Further proof of this is Spark’s largest platform based on number of users is Zoosk, which came from an acquisition and not from organic growth. Zoosk is also ranked #11 in total users according to Business Of Apps. Zoosk has also decreased in rank since 2015 as the images below show. It should also be noted that five of the 2021 top 10 dating platforms are owned by Match Group: Tinder, Plenty of Fish, Hinge, OkCupid, and Match. Bumble has two in the top 10 as Bumble owns Badoo.

Online Dating Number of Users 2015 (BusinessOfApps.com) Online Dating Number of Users 2021 (BusinessOfApps.com) Online Dating Market Share (BusinessOfApps.com)

Risks & Valuation

Risks to the thesis include a general change in overall market sentiment. A decrease in overall inflation could push the market higher and take Spark Networks with it. The second risk is a buyout from a larger competitor. However, I do feel this possibility of a buyout will decrease over time. The online dating market is projected to grow at 6.9% CAGR from 2022-2028. If Bumble, Match, and others continue to grow while Spark remains relatively flat, the relative value for the potential buyout decreases.

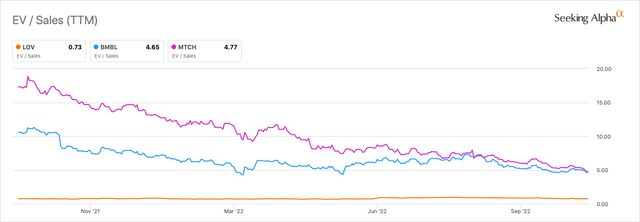

Defensive investors may see Spark as a potential value investment. But I believe Spark is more likely to be a value trap than a potential value investment or GARP. Spark’s P/S ratio is currently 0.22x! Despite my very bearish outlook on the company, the extremely low valuation must be assessed prior to considering any short position on Spark. As you can see below, Spark is justifiably priced much cheaper than its competitors.

EV/Sales 1-Year (Seeking Alpha)

Conclusion

The constant accumulation of losses is a clear sign to me that Spark Networks is a sell. But the financials are not a blip or a fluke. They are a symptom of a deeper underlying problem – management. I do not believe management has clear answers on how they will turn this around nor are they increasing skin in the game. The once-in-a-lifetime opportunity for online dating was in 2020, and they failed to capitalize on it.

As the images show, pop culture and the general public are not embracing Zoosk as the go-to for online dating. The only upside I can envision for Spark Networks is the hope for a buyout from a competitor who may be interested in data that Spark may have on its users.

Be the first to comment