Florent Molinier

Recent Recommendations of S&P 500

Here is my recent record on S&P 500 (NYSEARCA:SPY) (SP500) (SPX):

- After being a long-term bull, I turned bearish and recommended a sell on SPY on March 25th 2022, at 451 on SPY. My bearish thesis was very simple: I anticipated that the Fed would increase the interest rates aggressively to combat the rising inflation, which will cause a recession and the recessionary bear market.

- On April 22, I reiterated the expectation that the Fed would aggressively raise interest rates in 2022, when I recommended a sell on SP500 with the index value at 4271.

- On May 3rd, I pointed out that the liquidity risk due to expectations of monetary policy tightening is easing and that monetary policy expectations are priced in (the peak Fed hawkishness) and I suggested covering short positions and going neutral on SPY at around 415.

- On May 30, I recommended to start buying S&P 500, with SPY at 413, and continued to recommend buying S&P 500 on June 27 with SPY at 388, and July 18 with SPY at 388. The bullish thesis was also very simple: we were past the peak inflation and expected to be past the peak headline inflation given the falling commodity prices, and thus, past the Fed hawkishness. Further, given the still positive yield curve spread between the 10Y Treasury Bond and the 3-month Treasury Bill, the probability of an imminent recession was very low. Thus, I expected at least a nice (and significant) counter-trend summer rally.

Downgrade from buy to neutral

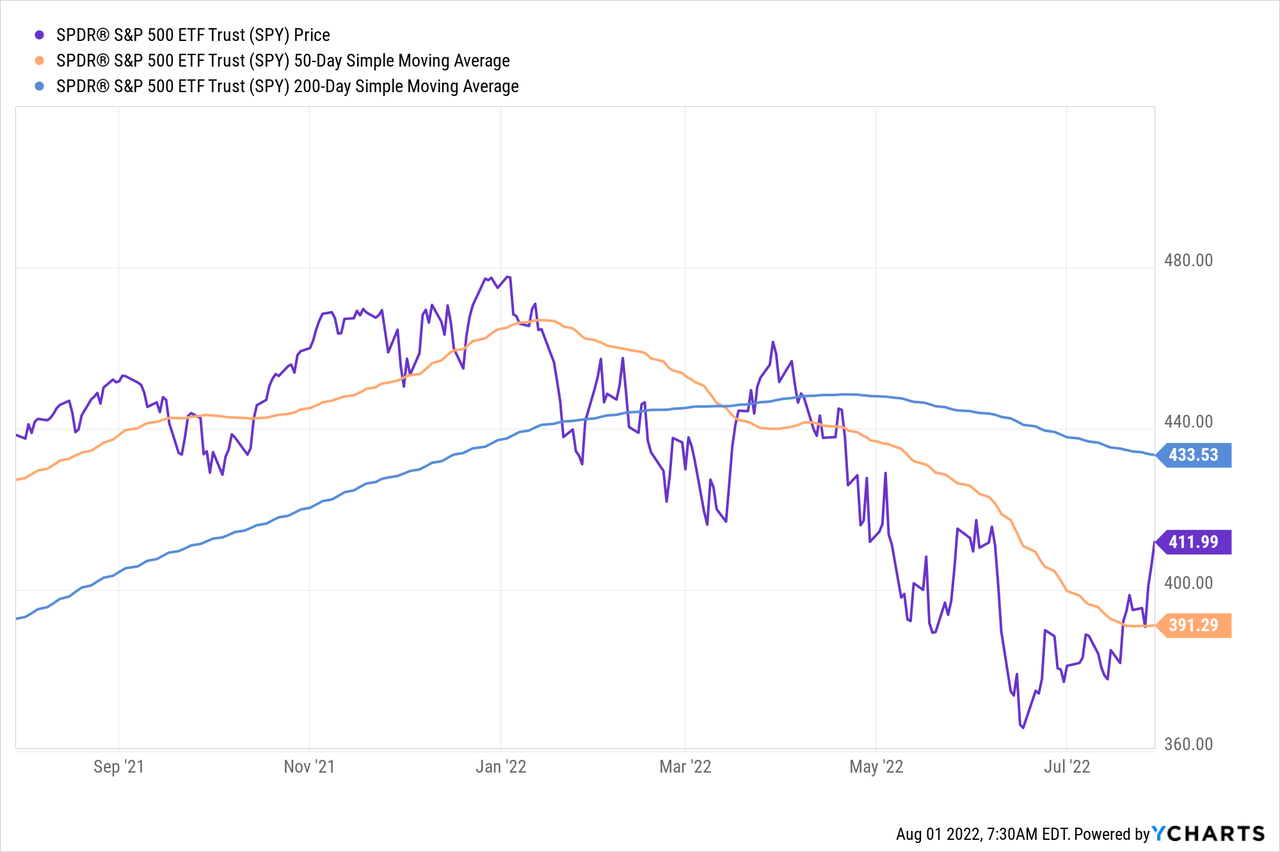

Since reaching the (cycle) bottom on June 16th, S&P 500 is up almost 13%, and SPY is currently at 411 near the breakeven of my May 30th buying point, and significantly higher than my June 27th and July 18th buying points. I am willing to take profits on these long positions. Here is the SPY chart that illustrates the significant countertrend bounce to the top range:

I am downgrading SPY to neutral for these reasons:

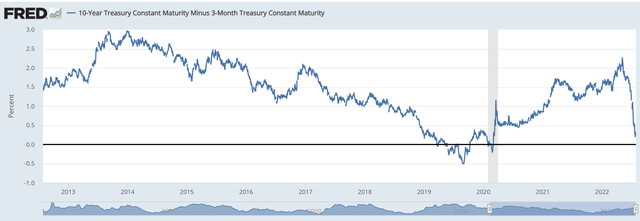

1) The 10Y-3mo spread has significantly narrowed to 0.26%, which is although still positive, getting really close to inversion. Thus, the probability of an imminent recession is too high to ignore now. Here is the chart;

FRED

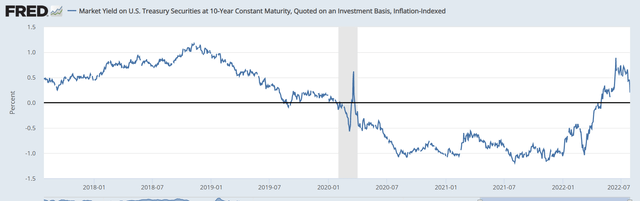

2) Even more problematic is that the narrowing of the 10Y-3mo is also created by the falling 10Y yields, which signals the economic slowdown. More importantly, the 10Y yields are falling due to the falling real rates, which is signaling a possible flight to quality and expectations on policy easing (not tightening). Here is the chart of 10Y TIPS (real interest rates), which have fallen towards the zero percent level (0.20%):

FRED

3) The credit risk is rising. The spread between BBB-10Y is reaching the cyclical high at 2.42%. Although this spread is still modest and requires the rise above 3% to be considered high, the trend is to the upside.

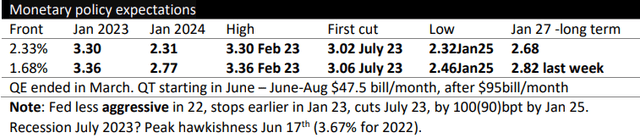

4) The market is now pricing that the Fed would start cutting interest rates in July of 2023, which indicates the expectations of a possible recession in 2023. Here are the current monetary policy expectations, based on Global Academic View report:

Global Academic View

Considering the point 2 (falling real interest rates) and 4 (expectations on interest rate cuts), the market is likely to respond negatively to slowing economic data and start pricing the Phase 2 of the bear market – an imminent recession selloff.

Thus, I am willing to take profit on the summer rally bounce and evaluate what exactly the market is pricing next and initiate the new positions accordingly.

The Bearish case

The bearish case is now the baseline expectations, as long as the 10y-3mo spreads invert, and the 10Y continues to fall. The bearish case is the Phase 2 of the full bear market – the pricing of an imminent recession, where the economic data slows and corporate earnings get downgraded.

The Bullish case

The bullish case is the soft landing case, where the Fed makes the full dovish pivot and does not increase interest rates above the 10Y yields.

The Neutral case

The fact is, we still don’t have enough information with respect to the bearish case or the bullish case. We don’t know how is the Fed reacting to the potential rising unemployment, with still elevated inflation. Will the Fed tolerate a higher inflation to prevent a rising unemployment? Will the Fed specifically acknowledge that the 10Y yields are the celling for the Federal Funds rate?

The Fed Chair Powell indicated that the Fed is currently in the neutral, but also that further interest rate hikes are warranted. Well, this will invert the 10y-3mo curve and likely cause a recession.

More importantly, the S&P500 is now rising, and many are likely to start buying, while the shorts are likely to be forced to cover. So, the summer rally could continue – despite the worsening fundamentals.

I view this technical picture more as an opportunity to initiate short positions (if the bear case prevails). Thus, at this point, the neutral position means, I am not buying the summer rally anymore, and taking profits and tactical longs. It also means, I am waiting to initiate new positions, as the new set up emerges.

Note on recent SPY performance

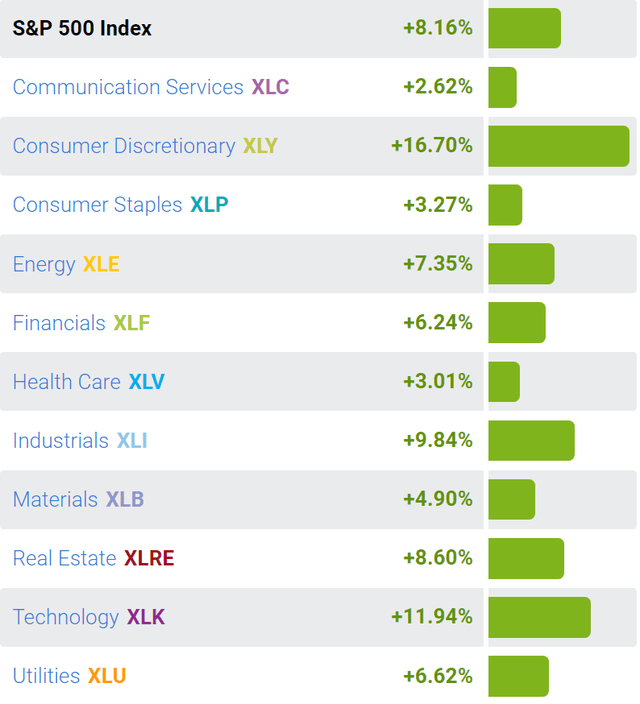

Over the last month, SPY, which is the ETF that tracks S&P500, is up by 8.16%, led by Consumer Discretionary sector (XLY) up by 16.7% and Technology (XLK) up by 12%. Both of these are cyclical sectors that have bounced from the deep sell-offs, but given the expectations of an imminent recession, the performance of these sectors is unsustainable. It is likely that the recent performance is just a bounce, meaning, as the economy starts to visibly slow down, these cyclical sectors are more likely to continue to sell off, dragging the SPY to the next leg lower.

SelectSectorSPDR

Be the first to comment