aluxum/iStock via Getty Images

Although neither company is owned in any size, Toll Brothers (TOL – homebuilder) and Costco (COST – warehouse club) will be scrutinized when they report their latest earnings this week. TOL is still expecting 13% y.y growth in EPS, despite the interest rate increases. Costco had a tough day last week after it showed comps slowing, but that’s not a bad thing. The stock has been an absolute monster and it seemed to gain share in the pandemic, but now it’s simply returning to normal. (I frequent the Costco in Oak Brook, Illinois, and between the gas station and the parking lot it’s an absolute madhouse. It sure doesn’t look like there is a traffic or customer shortage.)

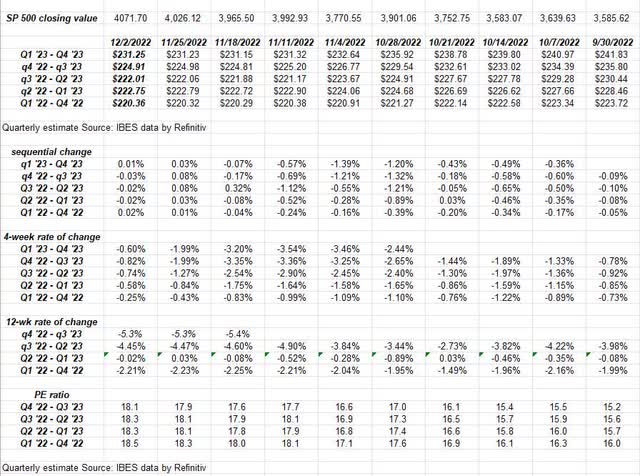

S&P 500 earnings data:

- The forward 4-quarter estimate (FFQE) fell slightly to $224.91 from last week’s $224.98 and versus the 9/30/22 FFQE of $230.43.

- The P/E ratio as of last Friday, December 2nd, 18.1x versus the 9/30/22 PE of 15.5x.

- The S&P 500 earnings yield as of Friday night was 5.52% versus the prior week’s 5.59% and 9/30 compare of 6.43%.

Rate-of-change:

Expand the chart and readers will see the EPS erosion has slowed the last 3 weeks, after heavy negative revisions from mid-October through mid-November ’22.

There is such little earnings activity I wouldn’t read too much into it (i.e. the improving rate of change).

Oracle (ORCL), FedEx (FDX), and Nike (NKE) and a few other big companies will report before Christmas or over the next 20 days, so watch those results.

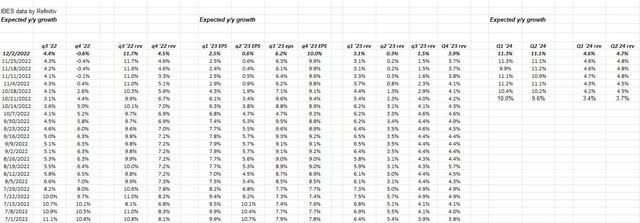

2023 expected quarterly growth rates:

This was pointed out last week, but note how the S&P 500 EPS growth rates are thought to trough in Q2 ’23. Ignore ’24 – it’s just too early, but there is softening expected for the next 3 quarters, but it’s not harshly negative.

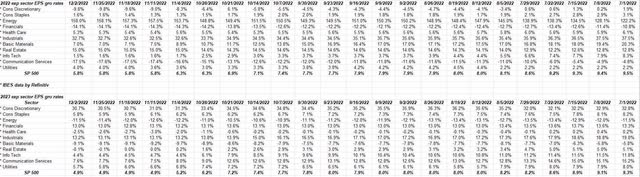

Annual Sector Growth for 2022 and 2023:

Here’s a table from Refinitiv which allows a longer perspective on sector EPS growth rates.

Both 2022 and 2023 were expecting S&P 500 EPS growth of 10%; both are now cut in half, with 2023 seeing harsher cuts than 2022.

Summary / conclusion:

S&P 500 EPS growth has been slowing both the present and the expected 2023 growth rates. Other than health care and parts of industrials, like defense, it’s hard to find any clear earnings momentum. Even energy looks a little wobbly, both in its trading action and note the energy sector’s estimate above in the latest table.

It can always get worse too, but how much of this is already baked into current stock prices and valuations?

Technology is actually – per the last table – expected to show slightly faster growth in 2023 than 2022, which makes sense with the falling dollar, but it’s clearly not the robust earnings and revenue growth of the last 5 years for tech.

It’s almost like the entire Wall Street community has bet on a recession and it hasn’t shown up. Today’s ISM non-manufacturing was pretty healthy: remember too “services” are a far bigger part of the US economy than manufacturing. It’s almost an 80% services / 20% manufacturing ratio, today. From one report out of the St. Louis FRED (Federal Reserve Economic Database) “durable manufacturing” which is manufacturing with a very long cycle, like Boeing (BA), (and some of the defense companies) and Ford (F) and GM (GM), now comprise just 5% of annual GDP growth versus 50%–55% in the 1960s.

The slowing in the tech mega-caps and the software names is not a plus: those names always get a lot of media attention.

Take this all with a grain of salt and substantial skepticism. It’s just one opinion and it can change quickly.

As always, thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment