GrafiThink/iStock via Getty Images

Two months ago I published the article iShares Semiconductor ETF: The Chip Shortage Is Here To Stay. Since then, iShares Semiconductor ETF (NASDAQ:SOXX) fell 7.7% due to overall market volatility, while YTD performance is -30%.

I believe that investors’ pessimism is, in fact, excessive and the massive potential of the industry overshadows short-term risks.

Declining demand

TrendForce recently published a study that says demand for chips is declining. At the same time, data shows that the prices of new semiconductors remain at a high level as there is still a huge demand for these models and prices are only reduced for chips of past generations.

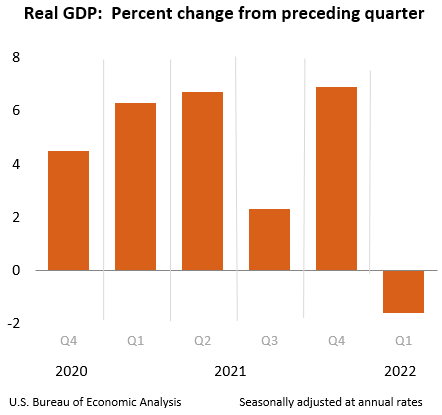

This is a consequence of the slowdown in economic activity in the US and around the world. So far, there are no unequivocal signals indicating a critical slowdown in the US economy. In the first quarter, the decline in Gross Domestic Product was 1.6%, but the forecasts for the second quarter, although adjusted downwards, remain in the positive zone. The main sign of a technical recession is the fall in GDP for two quarters in a row. Thus, the recession could start in late 2022 or likely not at all. However, the economy is still starting to slow down, which will definitely affect the volume of orders for semiconductors.

bea.gov

Second, high inflation puts lots of pressure on the cost of the chips themselves and massively increases CAPEX that the leaders of the industry, like TSMC (TSM) and Intel (INTC), have already been ramping up in an attempt to increase production. These companies have a high pricing power, which allows them to effectively pass the inflation to end consumers, however, it may lead to a market meltdown and a decrease in consumer activity. That is evidenced by the fact that Apple (AAPL), NVIDIA (NVDA), and AMD (AMD) have expressed a desire to partially reduce chip production at TSMC factories or redistribute shipments to a later date.

These factors could be a signal for a temporary end to the chip crisis in 2023.

Industry outlook

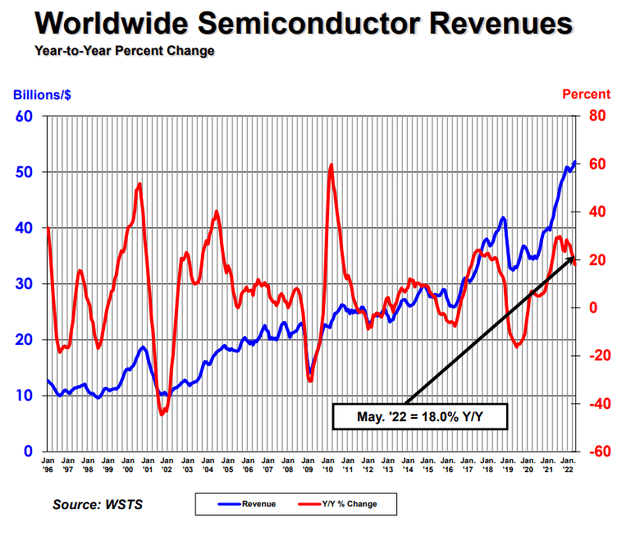

In 2021, the semiconductors market grew 26% YoY and is expected to continue its growth. According to the World Semiconductor Trade Statistics, worldwide semiconductor revenues were up 18% YoY in May 2022 with the Americas leading the race as year-over-year sales were up 36.9% in this region. The WSTS expects the market to reach $646 billion (+16.3% YoY) in 2022. In March, the organization only saw a $613.5 billion opportunity (+10.4% YoY).

For 2023, the World Semiconductor Trade Statistics provides an estimate of 5.1% YoY growth. I believe that it is more than possible for the market to beat these expectations if the US will avoid the recession as analysts always give a conservative outlook for the following year.

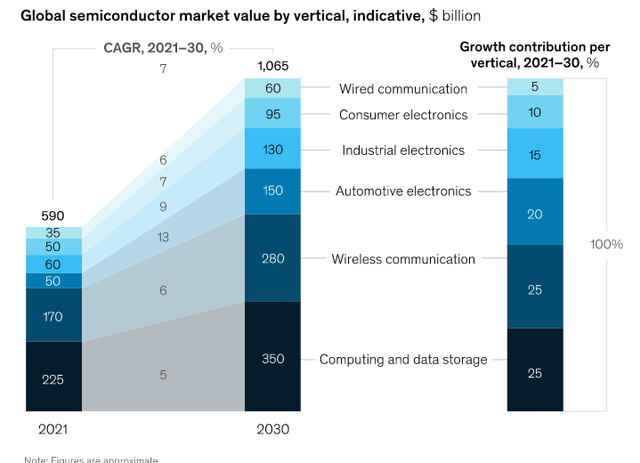

As for a longer-term perspective, I believe that the end of the semiconductor crisis is rather a positive sign for chip manufacturers. In the near future, pronounced pent-up demand is expected in sectors such as automotive, wireless, and computing and data storage. McKinsey expects about 70% of the growth of the industry to be driven by just three sectors.

High demand should have a positive impact on chip production volumes in the coming years, especially given the planned mass launch of new factories in the next five years.

Valuation

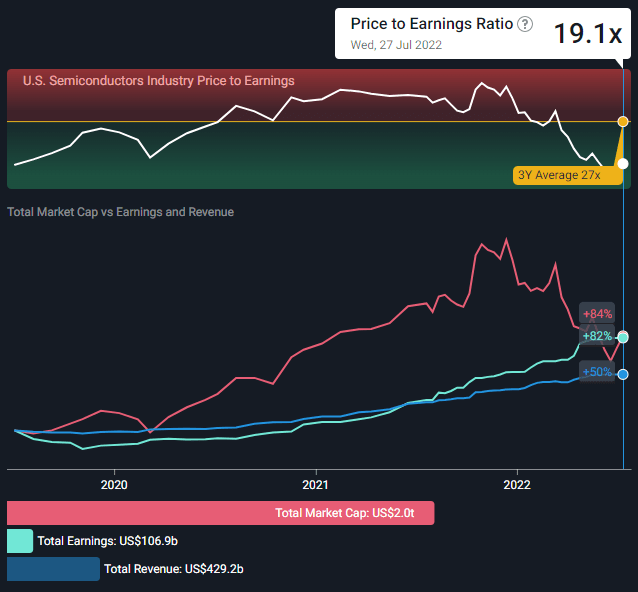

With market conditions driving capital outflows from growth stocks, the semiconductor industry has fallen more than the market and is now trading at a P/E of 19.5x, below the average three-year average P/E of 27x.

simplywall.st

I believe the market has been too tough for the industry, given that semiconductor companies are among the few that will continue to do well even in poor macroeconomic conditions, given the demand for the companies’ products.

Top 3 holdings

SOXX’s three largest holdings are NVIDIA, Broadcom (AVGO), and Intel. They account for 23.6% of all holdings and are the absolute leaders of the industry.

NVIDIA, the largest SOXX holding (7.9%), remains the undisputed market leader in GPUs, AI processors, and related software. A commitment to innovation has made GPUs critical for the expansion of gaming and data center segments. I expect strong demand for the company’s gaming GPUs and look forward to further strengthening its position in areas such as artificial intelligence, networking, computer graphics, and data centers. I think that the large share of NVIDIA stocks in SOXX’s portfolio confirms the fund’s long-term outlook.

Broadcom‘s product portfolio targets markets that are currently experiencing explosive growth. Broadcom is a true juggernaut in areas such as the broadband and mobile markets. The company’s growth will be driven by a transition to next-generation Ethernet switches, adoption of Wi-Fi 6, expansion of latest-generation fiber coverage, and global growth of 5G coverage. Broadcom is another giant long-term bet with a weight of 7.86%.

Intel Corporation is a former industry trendsetter, which has revised its strategy and plans to regain lost market share. With huge investments in research and development and the construction of new factories in the US and Europe, the company has a chance to return to the leading position in the global chip manufacturing market. By 2026, the company expects to double its earnings.

All of these companies may continue to raise their prices and expect strong demand for their products in the future.

Conclusion

While the market outlook remains bright, investor pessimism has resulted in SOXX being heavily undervalued. I think that despite a possible slowdown in economic growth around the world, companies will continue to see strong demand for their products. Semiconductor remains one of the best industries to invest in, and SOXX remains the best fund to bet on.

Thus, I rate iShares Semiconductor ETF as a Buy.

Be the first to comment