deepblue4you

Right after the breakup of the Beatles in 1970, Credence Clearwater Revival CCR was considered the most popular rock and roll band in the world. From 1967 to 1972, CCR lead by John Fogerty had multiple hit songs, many of which have been deemed as late ’60s / early ’70s rock classics. Overlooked by some is a tune written by Fogarty, Keep on Chooglin’, and it accurately describes my recommendation for utility firm Southern Company (NYSE:SO).

Southern Co is the second largest electric and natural gas utilities in the country. In market capitalization, SO’s $74.4 billion market cap is right behind NextEra Energy’s (NEE) $155.5 billion and just ahead of Duke Energy’s (DUK) $74.0 billion. Southern Company is one of the largest utilities by customer count, servicing 8.46 million electric and gas connections in 6 states. SO is the holding company for Alabama Power with ~1.5 million customers, Georgia Power with ~2.4 million customers, Mississippi Power with ~190,000 customers and multi-state Southern Gas with ~4.3 million customers. Southern Gas serves ~2.3 million customers in Illinois using the Nicor name, ~1.7 million in Georgia, ~300,000 in Virginia, and ~70,000 in Tennessee. In addition, SO operates a merchant wholesale power division, Southern Power.

As of 6/30/22, electric utilities generated 69% of SO TTM revenues or $17.8 billion, Southern Gas utilities generated 19% or $4.9 billion, Southern Power contributed 10% or $2.6 billion. As shown, 88% of TTM revenues of $25.6 billion were from state regulated activities.

As long-time readers know, Regulatory Research Associates RRA, a service of S&P (SPGI), has offered an assessment of the utility regulatory environment by state. RRA’s regulatory review goes back decades and is used as a resource by both the utilities and regulatory agencies in many rate filings. While proprietary and not always made public, the latest revisions I use are as of August 2020, and changes are not very frequent. RRA rates each state’s regulatory environment for financial support of the utilities under their jurisdiction. The rating system categorizes states into three major groups and within each major group are three minor groupings, with 1 = Above Average, 2 = Average, and 3 = Below Average. This translates into the highest rating being 1-1, the lowest being 3-3, and the Average being 2-2.

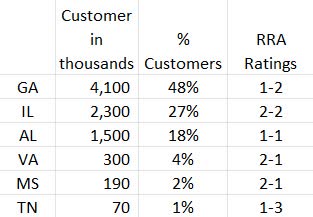

The table below outlines SO customer by state, the percentage of total customers by state, and the RRA ratings for regulatory environments. Southern Co has 73% of customer connections overseen by regulators considered to be some of the best in the country for financial support. This profile is unusual for large and diverse utilities.

RRA Ratings by State (S&P Global)

I have a phrase “The 5 Stars of the Utility Sector” to describe the multi-state, multi-utility companies with heavy exposure to better rated regulators: Southern Company, Dominion Energy (D), Duke Energy, NextEra and Emera (OTCPK:EMRAF). These are diverse utilities with a large percentage of customers in preferred states. While there are other utilities with single state exposure in preferred states, these are usually smaller utility firms. Regulatory Research Associates’ list of the states for the best utility regulatory environment rated 1-1 to 1-3 include Alabama, Florida, Iowa, Georgia, Michigan, Pennsylvania, Tennessee, North Carolina, and Wisconsin. RA offers a map of their ratings as of the Aug 2020 and has been updated with NC and DC moving up in rating and Arizona moving down to the lowest state rating of 3-3.

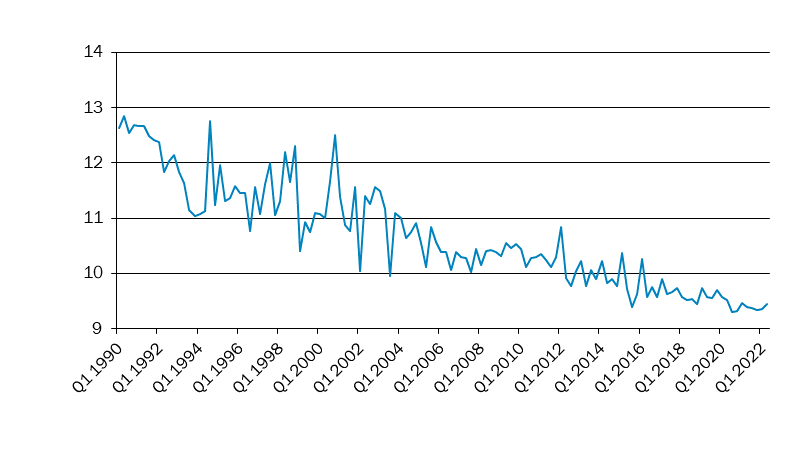

In my utility due diligence, RRA state ratings take precedence over almost all else. I believe during the next several years, the regulatory environment will become more critical for utility performance and profitability. Over the past 32 years, the average allowed return on equity ROE for regulated utility investments has declined 26%, falling from 12.85% ROE in the 1990s to 9.45% ROE as of 2nd quarter of 2022. EEI.org is a leading industry association that tracks utility trends, and the chart below is the average regulatory awarded approved ROE by quarter since 1990. As shown, the average allowed ROE has hovered around 9.5% for the past 6 years.

Average Allowed ROE 1990-2022 (Edison Electric Institute)

One would think that utility profits would have crumbled under the weight of a 26% decline in allowed profitability for the same dollar of invested equity. The key ingredient in translating the decline in allowed ROE to regulated profits is the equally dramatic decline in cost of capital over the same timeframe. As the utility sector is extremely capital intensive, it relies on substantial amounts of debt financing and the past 40-yearr downward trend in interest rates has reduced the sector’s cost of capital, offsetting reductions in allowed ROE. An upward trend in interest rate will negatively impact the cost of capital, potentially putting a squeeze on future utility profits.

Regulators will be asked to increase utility rates to offset the increase in cost of capital in addition to inflationary operating costs to be passed on to consumers. This comes at a time when higher generating and transmission costs from replacing base load with intermittent load power generation are beginning to be reflected in electric ratepayer’s monthly bills. State utility regulators are under increasing political pressure from ratepayers and politicians due to skyrocketing utility bills. My investment strategy is to focus on utility exposure in states with a history of financial support of its utilities. As the ultimate gatekeepers of profitability, I believe over the next 5 years state regulators will remain the single most important factor in picking sector relative winners. Hence “The 5 Stars of the Utility Sector”.

No discussion of Southern Company would be complete without a comment on the very controversial nuclear power expansion at their Vogtle facility. Billions in cost overruns and multi-year delays are just the beginning of the story and could be an article by its own right. My view is the project is almost behind us with Unit #3 recently receiving government approval to come online and the nuclear power construction project on Unit #4 should be winding down. However, I fully expect more write-downs and delays before the project is totally complete and the multi-year, $30-billion investment turns “positive” for SO. One of the unfortunate aspects for shareholders is the decision by management to sell the Florida panhandle electric utility Gulf Power to NextEra in 2017. SO decided to divest its almost 100-year-old subsidiary, Gulf Power, to partially offset investments in its scuttled Kemper “clean coal” power generating plant in Mississippi and budget-busting Vogtle nuclear plant expansion.

Southern Company management has a history of piloting new technologies in power generation, sometime with not-so-beneficial results. SO attempted to develop “clean coal” power technology but failed miserably. Eventually, state regulators made SO convert the plant to natural gas and decreased the allowed investment included in its asset rate base. SO’s Alabama Power subsidiary is currently working with the Gas Technology Institute to integrate hydrogen as a fuel supply for a portion of a natural gas combined cycle power plant. As described in trade magazine Utility Dive magazine last April,

GTI’s team aims to use hydrogen, rather than natural gas, in the duct firing burner to quickly boost power production at times of high demand or when renewable power is not available. While the main turbines will still need natural gas, injecting hydrogen into the duct firing burner would eliminate emissions from that part of the plant while cutting electrical costs by 17-18% compared to alternatives with carbon capture technology.

SO’s Georgia Power subsidiary recently announced it was developing a pilot project with startup Foam Energy to deploy Foam’s new battery storage technology. While proof of concept has been completed with Foam and a Wisconsin electric co-op, the Georgia Power project will be a test of the technology’s scalability. As described by Utility Dive,

Form Energy made waves with its announcement last summer of a long-duration battery technology relying on iron pellets that could be made at a fraction of the cost of lithium-ion batteries. The pellets rust when exposed to oxygen while the battery is discharging, then revert back to iron when oxygen is removed and the battery is charging.

Utility sector investments are usually bought for long-term stable income and capital gains. In reviewing Southern Company total returns with dividends reinvested, SO has matched or outperformed the S&P Utility ETF (XLU). According to dividendchannel.com, SO 3-yr annualized total return is 6.25% vs XLU 3.54%, 5-yr annualized total returns for SO is 10.55% vs XLU 7.42%, and 7-yr annualized total return for SO is 10.46% vs XLU 9.46%.

Going forward, most income investments will be under extreme competitive yield pressures for at least the next 6 months. The current 4.0% dividend yield is not excessively attractive and the reason for my “Hold” recommendation. I anticipate the utility segment will follow the market down until the 2-yr Treasury Note yield peaks and begins to decline. I am waiting for the 2-yr yield to fall below its 50-day moving average as an indication yields may have peaked. Currently, the 2-yr Treasury Note yield is 4.26% and its 50-day MA is 3.6%. Until yields have peaked, income investors should expect utility share prices to remain weak. As the market develops a bottom, most likely identified by a decline in the 2-yr Treasury yield and a simultaneous decline in the US Dollar reaching levels below their 50-day moving averages, Southern Company should be on a buy list for income investors.

I have been an investor on and off in Southern Company since the early 1980s when I moved to Atlanta for a few years. My most recent exposure dates back over 10 years, and includes the common shares SO, the recently converted Southern Company 2019 Equity Units SOLN, and the soon-to-be-called subsidiary Alabama Power Preferred (ALP.PQ). I anticipate adding any new subsidiary traditional preferreds SO offers in the future as they become available.

Concerning the term chooglin’ invented by John Fogerty, CCR drummer Doug Clifford described the message to keep on chooglin’ as inspirational, “It means keep on going, keep on truckin’. Things may be bad and look bleak, but believe in yourself, pull up the old bootstraps and get the job done.” This is an adequate description of my long-term position in Southern Company as part of my investment bucket titled “Bought Primarily for Income” – I plan on my investment to just Keep on Chooglin’

Author’s Note: The song ‘Keep On Chooglin’ was a mainstay of CCR’s setlist for live performances, many times being the closing or encore offering. In 2019, I had the opportunity of attending a John Fogerty concert in a small venue in upstate NY and was drawn by the combination of Fogerty’s blues guitar and soulful harmonica. To me, it was one of the highlight of the evening. CCR performed this song at the 1969 Woodstock Festival and went on stage at 3am. A simple internet search of “CCR Woodstock performance” will provide a great video of this song.

Be the first to comment