suerob/iStock via Getty Images

This is my second article taking a look at Sorrento Therapeutics (NASDAQ:SRNE). My previous review, “Sorrento Therapeutics: The Enigma”, characterized the company as a “real puzzler”. Now having had the benefit of a second review, I am less sanguine.

The hype surrounding Sorrento is unwarranted given its performance

As I lamented in my previous article, Sorrento does not provide quarterly earnings conferences. As a pale and inadequate substitute, it does present at a variety of investor conferences during the year. A smattering of webcasts for these are available on its cited website (accessed 11/04/2022).

In this article I refer to its latest presentation material available. Seeking Alpha includes the transcript (the “Transcript”) of CEO Ji’s appearance at its 09/29/2022 Benzinga Healthcare Small Cap Conference. Sorrento’s website includes its slide materials (the “Presentation“).

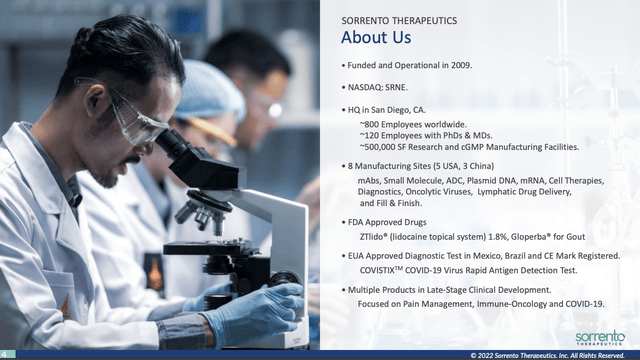

Presentation slide 4 gives a quick overview of the company:

investors.sorrentotherapeutics.com

This slide sets off warning bells for prospective shareholders. Sorrento is a busy operation with a worldwide footprint, outsized facilities, and a highly degreed workforce. What could possibly be the matter? Revenue, that’s what.

Its single FDA approved drug, ZTLIDO (lidocaine – patch; topical), seems like a frail workhorse to support such an elaborate overhead. Indeed it is not even close to being up to the task. Its Q2, 2022 10-Q reports just how badly the situation is deteriorating:

As of June 30, 2022 and December 31, 2021, we had an accumulated deficit of $1,646.0 million and $1,386.6 million, respectively. We continue to incur significant research and development and other expenses related to our ongoing operations. We have incurred operating losses since our inception, expect to continue to incur significant operating losses for the foreseeable future, and we expect these losses to increase…

Of course it is not unusual for development stage biotechs to run up losses as they run their therapies through clinical trials. What is startling with Sorrento is the size of the deficit it has run up in a mere 13 years, and the $260 million it ran up in the most recent year available.

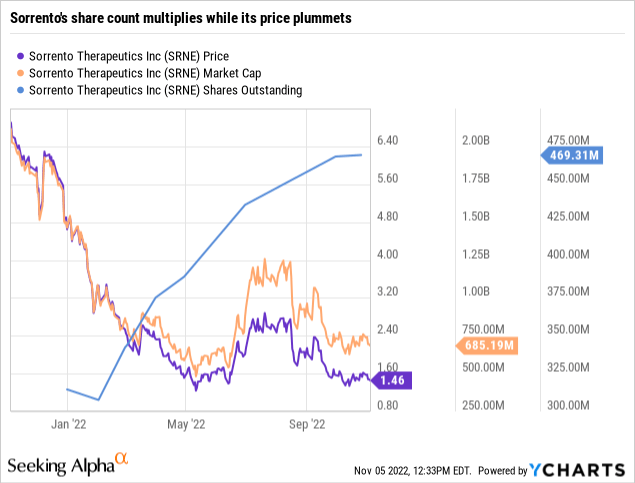

As revealed by its share price trajectory below, the market is not responding well:

Something is amiss from a shareholder perspective. Unfortunately, management seems unperturbed. The Transcript includes CEO Ji’s insights on the company’s potential as follows:

My goal is to build a company $200 billion to $400 billion. And we think with the trajectory that Moderna has from $5 billion to $180 billion, it seems doable. We have the pipeline. We have a much bigger pipeline. And meanwhile, we are doing the vaccination, multivalent and our animal testing shows our multivalent strategy works much better than the current Washington or Wuhan-based vaccine.

Sorrento’s tripartite pipeline has staked exciting projects that are works in progress

Sorrento has set its sights on three areas of therapeutic focus. These include oncology, COVID-19 and non-opioid pain relief.

Oncology

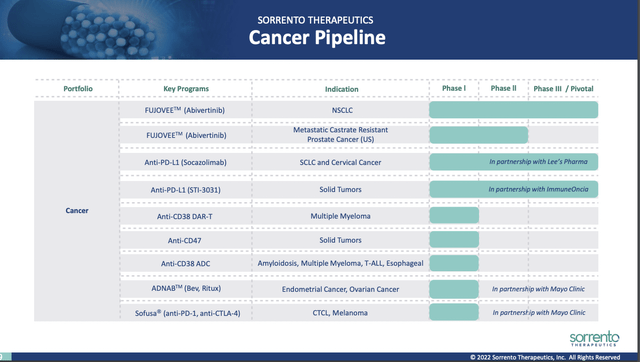

In the Presentation, Sorrento devotes slides 8-15 to its cancer programs. Slide 9 lists its cancer pipeline:

investors.sorrentotherapeutics.com

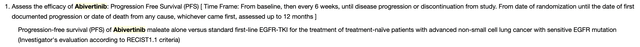

FUJOVEE (Abivertinib) is its lead cancer therapeutic in treatment of non-small cell lung cancer (NSCLC). It is undergoing 13 clinical trials listed at clinicaltrials.gov, nine of which are in NSCLC, several in other cancers and two in treatment of COVID-19. Its active phase 3 trial in NSCLC is a 2019 trial of 406 patients (NCT03856697). It is a trial:

To compare efficacy and safety of Abivertinib maleate alone versus standard first-line EGFR-TKIs for the treatment of patients with advanced non-small cell lung cancer with sensitive EGFR mutation…

Its primary outcome measure is to:

Its study completion date is 03/2024. In the Transcript Ji advises that:

…Abivertinib,… has already finished non-small cell lung cancer pivotal clinical trials. We have about 500 patient being treated in the non-small cell lung cancer indication. The data is already locked and we are right now waiting for the deep analysis of the data. We shall be able to share the top line data, hopefully, October. And that’s the non-small cell lung cancer side.

As I write on 11/05/2022, the latest available news on Sorrento’s website predates the Transcript. The 08/23/2022 entry reports a:

…pivotal study conducted in China, matured data of 209 response evaluable NSCLC patients were assessed by an IRC. The overall response rate (ORR) as confirmed by the IRC was 56.5% (118/209) and among them, 11 patients had complete responses (CR) with a CR rate of 5.3% (11/209) and median overall survival (OS) of 28.2 months.

Based on these significant positive results from the IRC assessment, Sorrento is closing the study and preparing the materials for a pre-New Drug Application (NDA) meeting with the FDA and potentially submitting for approvals to regulatory agencies of other countries.

Whether the FDA would accept an application based on a single country outside the U.S. is highly uncertain.

As for its late stage trials in collaboration with Lee’s Pharmaceutical Holdings Limited (“Lee’s Pharm”), these are ongoing in China. In 05/2022 Sorrento advised that its partner:

… has completed the patient enrollment for a Phase III, multicenter, randomized, double blinded, placebo-controlled clinical trial of Socazolimab (anti-PD-L1 monoclonal antibody, formerly known as ZKAB001) combined with chemotherapy in the first-line treatment of extensive-stage small-cell lung cancer (“ES-SCLC”).

This clinical trial involves 54 centers and is led by Prof. Shun Lu (陸舜) from Shanghai Chest Hospital (上海市胸科醫院). The clinical trial approval was granted by China’s National Medical Products Administration (“NMPA”) on 1 March 2021, and the first patient was enrolled on 15 July 2021. A total of 498 patients have been enrolled into the study. An interim analysis is expected to be conducted in April 2023.

COVID-19

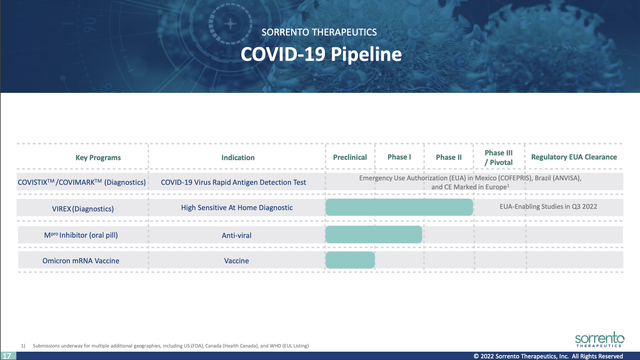

Sorrento’s COVID-19 programs are covered at slides 16-27. Slide 17 lists its COVID-19 pipeline:

investors.orrentotherapeutics.com

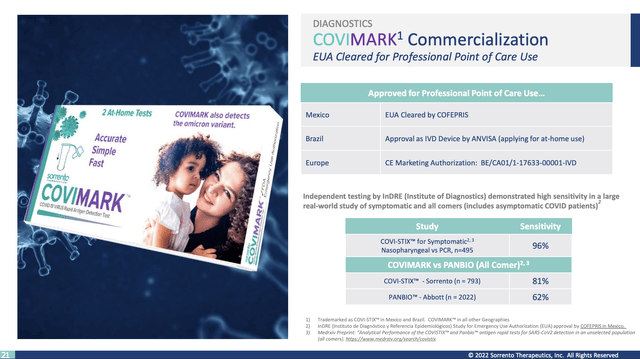

COVISTIX/COVIMARK is its lead product here. CEO Ji compares it to Abbott’s (ABT) BINAX and PANBIO for COVID-19 diagnostics with equivalent sensitivity. Slide 21 from the Presentation reports on its commercialization and comparative accuracy as follows:

investors.sorrentotherapeutics.com

In the Transcript CEO Ji enthuses about the potential market from the huge populations of Mexico and Brazil.

Its remaining suite of COVID products are in earlier stages of development. Whether Sorrento ever profits from these will depend on how the pandemic unwinds from its current waning phase.

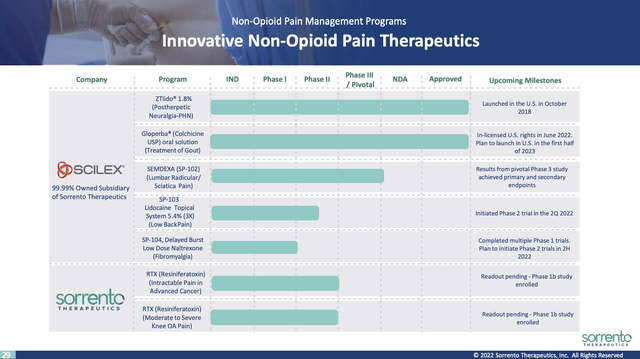

Non-opioid pain relief

Sorrento’s non-opioid pain relief programs are covered at slides 28-35. Slide 29 lists its non-opioid pain pipeline:

investors.sorrentotherapeutics.com

The late stage portion of this pipeline derives from its $47.6 million Scilex deal initiated in 2016. It is still working on advancing the potential of ZTLIDO with recently announced deals to expand its ex-US market and its insurance coverage.

As for GLOPERBA (colchicine) in treatment of gout, in 06/2022 Scilex announced that it:

…had entered into a licensing and commercialization agreement with Romeg Therapeutics for the right to market and distribute in the U.S. Gloperba, an oral solution for gout.

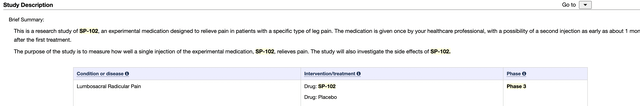

CEO Ji did not mention this deal in the Transcript. At this stage there is no way to estimate its significance. The non-opioid pain relief entry that he cited as having major potential is Scilex’s SEMDEXA (SP-102). He enthused:

We believe it’s going to be a potentially a $10 billion peak sales now. It used to be, we believe, $5 billion. However, with the shortage of the drugs for lower back, bulge discs, we have this SP-102 fully enrolled 400 patient treatment and we have a fast track. Hopefully, we will get the approval from the FDA. We can start to build revenue.

And with this drug alone, peak sales about $10 billion, we think we can be at a major biopharmaceutical company with all the extensive pipeline we have. We are very bullish and hopefully rewarding our long-term investors and stakeholders handsomely.

SP-102 is listed at clinicaltrials.gov as having completed its 401 patient phase 3 clinical trial (NCT03372161). Its description reads:

Sorrento’s executive compensation remains concerning

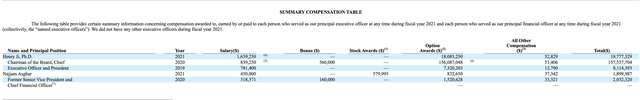

My previous Sorrento article included an excerpt from its then latest proxy statement. CEO Ji’s compensation for 2020 showed option awards valued at ~$164 million. Sorrento’s most recent proxy included with its 2022 annual shareholders’ meeting toned this down dramatically as shown below:

Nonetheless, the compensation package is an affront to shareholders whose shares have lost considerable value over the last year. Although Sorrento’s compensation seems extreme to me, it is likely not illegal.

Shareholders who are dissatisfied with executive pay in companies in which they invest have a blunt recourse. They can vote their shares against pay packages of which they disapprove. When the package gets approved anyway, as is often the case, they can vote with their feet; sell their shares.

Conclusion

In assessing Sorrento for near-term catalysts of potential significance, I would point to:

- its US phase 3 FUJOVEE trial in treatment of NSCLC set to complete in 03/2024,

- SEMDEXA back injection treatment that has completed its trial;

- its FDA approved GLOPERBA gout treatment.

Of the three I might rate GLOPERBA as the least significant, even though it is FDA approved, because there is no mention of it in the Transcript. However, the Presentation does include slide 31 touting peak sales of $6.2 billion by 2027. So I guess it is a wait and see. It could provide some near-term revenues.

As for FUJOVEE and SEMDEXA, their indications are significant and provide support for those who have a bull thesis for Sorrento.

My own view of the company tends towards the bearish. I am put off by the CEO’s promotional pronouncements. To me, I view his compensation as unacceptable and as a clear warning that management will never give shareholders an even break.

Be the first to comment