anatoliy_gleb/iStock via Getty Images

An investment strategy to develop innovative solutions is paying off for Solar Oilfield Infrastructure, Inc. (NYSE:SOI), an affordable, sturdy and undervalued oil industry company. The stock price has increased by 52.50% for this small-cap stock of $497.87 million, and its current value is 32% under its one-year price target estimate. The company has a backlog of orders for its new offerings going into 2023.

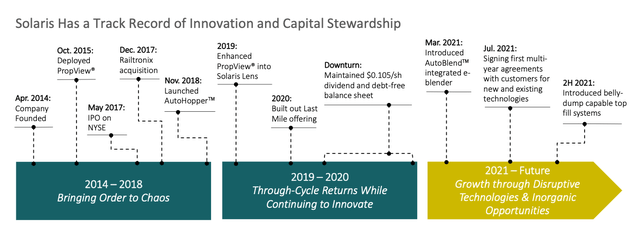

Investing in Innovation and Development (Solaris Oilfield Investor Presentation 2021)

Without diving into the technical details, it has a strong offering, namely highly automated and reliable electronic solutions that improve cost efficiencies, increase safety and minimise the increasingly important ecological footprint of its consumer’s operations on the oilfield. It is a leader in its field, claiming almost one-third of the US market share. We’ve already seen an increased top and bottom line performance over the last two financial quarters off the back of the early stage deployment of its new offerings. With the company providing more solutions to existing customers and significantly growing its addressable consumer market on the well site, I believe there is much more upside for this company.

Although cautious that the company’s performance is highly dependent on US drilling activities and the number of active rigs in the country, which geopolitical factors can impact. SOI is providing a solution to drill more effectively and efficiently, which is critical in today’s environment. Investors may want to take a bullish stance on this company with a historically sturdy performance, increasing multi-year customer contracts, consistent dividend payments and an upbeat revenue outlook for the rest of the year.

YTD Stock Price Chart (SeekingAlpha.com)

Introduction

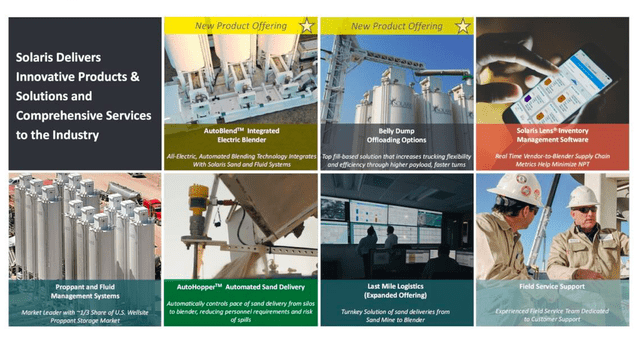

SOI has grown into a market leader in the US fracking industry in a short time. In 2014 a group of investors decided to purchase a manufacturing company based in Houston, Texas. They developed it into a patented, fully inclusive service offering of specialised electric equipment, technical support, logistic services and software solutions to assist oil and natural gas operators and suppliers to increase their efficiency by reducing development costs and environmental impact. As shown in the images below, the offerings include its original sand, water and chemical solutions, top fill solution, the AutoBlend unit, and an updated last mile offering. It is present in the most active oilfields in the United States and employs 179 employees.

Solaris Offerings (Solaris Investor Presentation 2022)

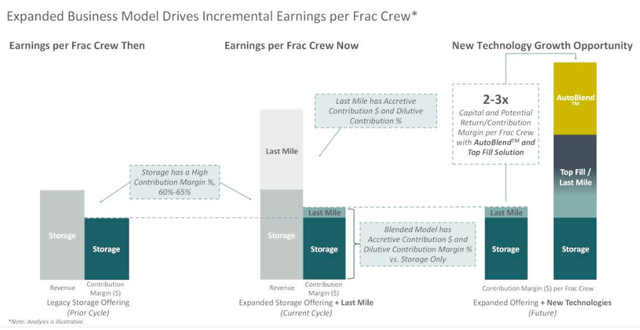

The company’s competitive advantage is its innovation and continual product improvement. Its fully electric equipment creates automation within the drilling and completion activities, improving safety and lowering costs by reducing errors, waste, and the workforce required. The new offerings have provided the company with an expanding business model, as seen in the graph below. With its top fill offering, the number of truck trips can be reduced by 20%.

Innovative New Offerings Increasing Revenue (Solaris Investor Presentation 2022)

The main customers are large exploration and production and oilfield service companies. The company works with multi-year master service agreements. End of 2021, its largest customer, Liberty Oilfield Services, LLC, accounted for 26% of its total revenue. The company has long-term relationships with suppliers and their party operators for producing and transporting goods. However, no long-term agreements exist, and no supplier has more than 10% of the company’s total spending.

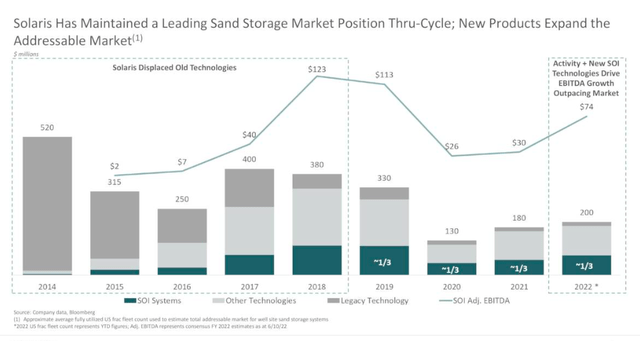

The industry is very competitive, and specific customers who purchase or use services are equal competitors in other parts of the company. The main competitors are U.S Silica, Liberty Oilfield Services, and Hi-Crush Partners LP. Nonetheless, SOI has kept its market-leading position, and new offerings ensure that its growth is outperforming the market trend, as can be seen in the graph below.

Market Share Yearly Overview (Solaris Oilfield Investor Presentation 2022)

Financials and Valuation

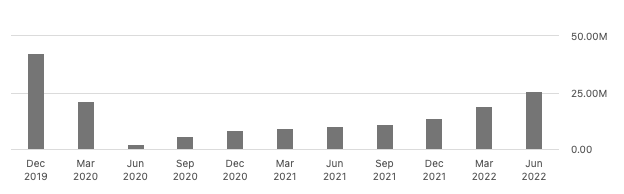

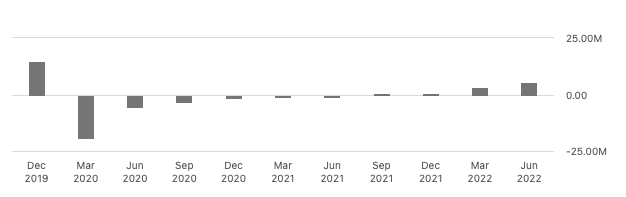

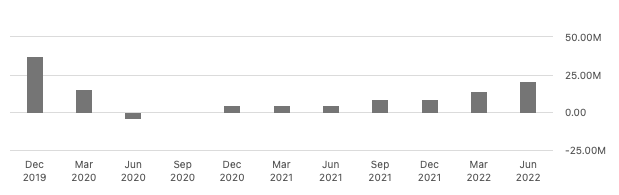

SOI has recently started deploying its newer offerings, and the results are impressive if we look at the Q2 2022 financials. The company produced almost $87 million of revenue, a net income of $8.3 million and $21.1 million in adjusted EBITDA. SOI had a 12% increase in fully utilised systems, totalling 84. Going on to the next quarters there is a high growth expectations for fully utilised systems are between 5 and 10% productivity increase for new and existing customers. The gross profit margin improved by 18% in Q2 2022 from the previous quarter, benefiting from enhanced last mile profitability and cost efficiencies due to the deployment of new technology solutions from top fill and AutoBlend units. We can also see an upward trend in gross profit, net income and EBITDA per quarter since June 2020.

Quarterly Gross Profit (SeekingAlpha.com) Quarterly Net Income (SeekingAlpha.com) Quarterly EBITDA (SeekingAlpha.com)

Having sufficient funds to invest is critical for SOI; it started the year with adequate cash to support the full 12 months of 2022‘s activities. Operating cash flow was $16 million, and working capital of $4 million financed growth costs. The free cash flow was negative $4 million for the second quarter, which could impact the company’s ability to cover expenses in the future. However, the company has mentioned sufficient funds for its growth requirements in 2022.

The company is in a good liquidity position. At quarter end, the company has total liquidity of $65 million, with approximately $15 million in cash and $50 million credit available. Primary sources of liquidity have been cash flow from operations, borrowing through credit agreements, and financing through equity offerings. The capital has been used for daily operations, investing in organic growth, maintenance, upgrades and paying dividends.

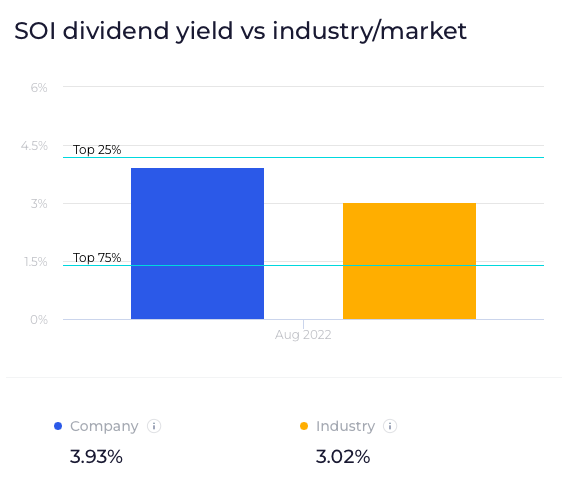

The company has an attractive annual dividend yield for its size and industry of 3.93% which has been consistently paid out since its initiation of the program in 2018, and above the US industry average of 3.02% as seen in the graph below. A dividend is paid at $0.42 per share. The company has been paying out dividends for fifteen consecutive quarters. Q2 2022 shareholders received a total of $5 million.

SOI dividend yield versus Industry (Wallstreetzen.com)

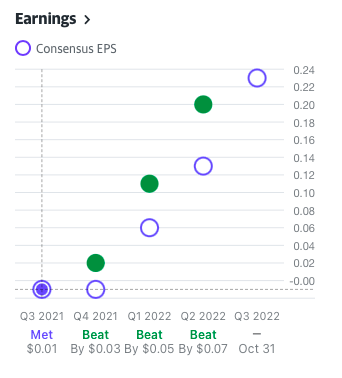

The strong and consistent results are reason enough for me to see value in this company. Various analysts have reviewed their ratings and given the company a more positive outlook for the rest of the year, expecting revenues of US$338 million in 2022, compared to the previously forecasted $252 million. SOI beat EPS expectations for the last three quarters, and various WallStreet analysts recommend the stock as a “Buy”. The company is growing at a faster rate than the industry average. Oilfield Service Index provides a benchmark to compare SOI to its average peer performance.

EPS Expectations (YahooFinance.com)

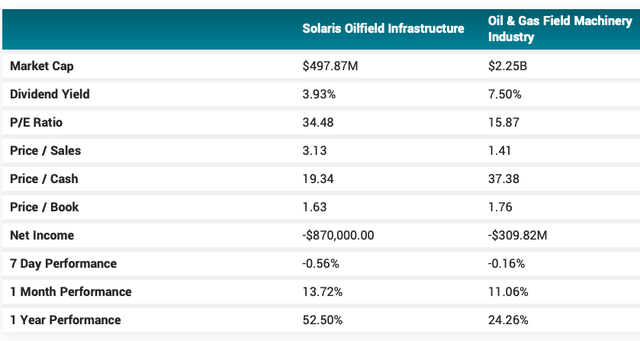

If we look at SOI compared to its industry competitors in the table below, it is a very small cap taking on much larger players and leading in its field. The P/E ratio of 34.48 indicate that the price of the stock is high relative to its earnings. However I believe earnings will continue to increase as the company is currently only in the early stages of deploying its new solutions which are already giving financially positive results. For SOI a relevant valuation to look at is its price to book ratio, which is very low at 1.63 indicating that its trading at a much lower price than the value of its assets and the company has had an impressive one year stock growth performance well above the industry average of 24.26% which will continue to give it a market leading position in a very competitive industry.

Relative Valuation of SOI versus Industry (Marketbeat.com)

Risks

The US active rig count determines SOI’s performance. It depends on the level of natural gas and oil drilling and completion activities. Year to date, there has been a 29% increase to 729 rigs. Currently, suppliers are experiencing a favourable supply-demand dynamic. Nevertheless, several factors could change the dynamic. One of these factors is environmental regulations. Recently, the US has taken a big step to reduce carbon emissions, impacting how oil and natural gas companies operate their businesses.

Another issue to look at is debt, which can impact the possibility of receiving additional capital. Although the company missed a debt repayment, the maturity date for the credit agreement is now until April 2025, with new interest rates and repayment requirements. The agreement requires that the company maintains a consolidated EBITDA to an interest rate of not less than 2.75 to 1.00. The company complies with the deal.

Furthermore, there is much volatility in the market created by policies to control inflation, ongoing geopolitical factors, and economic slowdown uncertainty which has seen a barrel of oil vary between $95 to over $120 in the last quarter, April to June 2022. There are immediate implications between the activity at the rig and the demand for SOI’s offerings. The price is still in a range that supports growth in US drilling activities. However, the company’s caution, supply chain tightness, and inflation have a definite impact.

Final Thoughts

SOI is only in the early stage of deploying its new offerings, and results are already promising on the top and bottom line performance for the last two financial quarters. The company has been growing above industry average and the financial quarters have been trending upwards since 2020. The demand and developments have made the company and analysts optimistic about future growth going into 2023. With a historically strong operational performance, a consistent dividend payment program, a leading position in the market and revenue and profits forecasted to grow on its upward trend, there seems to be a lot going for this affordable stock. For these reasons, investors may be interested in taking a bullish stance on this stock.

Be the first to comment