Dennis Diatel Photography/iStock Editorial via Getty Images

One of the more contentious topics in the blockchain space is NFTs, or Non Fungible Tokens. I’ve talked about NFTs on Seeking Alpha in the past and back in April even shared a Top Token Idea that is building a revenue stream around the usage of NFTs. There are some who believe every record of ownership will ultimately be in the form of an NFT on the blockchain. While I’m not willing to go that far, I do think the lowest hanging fruit for NFTs is through digital collectibles.

Solana NFT Activity

I covered Solana (SOL-USD) for Seeking Alpha’s public site back in late March. You can read that article here. The catalyst for wanting to write that article was the fact that leading NFT marketplace OpenSea was integrating with Solana. OpenSea has primarily been an Ethereum (ETH-USD) marketplace with level 2 chain Polygon (MATIC-USD) integration as well. My thought was the exposure on OpenSea would help boost Solana NFT adoption:

I think it could ultimately bring faster adoption of Solana-based NFTs. But only time will tell. From here, I think Solana is a hold.

What has been really interesting to see over the last three months is the way that adoption story on Solana is playing out. It hasn’t been entirely how I thought it would be, but it’s happening nonetheless. The metrics for Solana NFTs are strong. But the biggest driver of that growth has probably been Solana-native NFT marketplace Magic Eden rather than OpenSea.

| Marketplace | 03/31/22 | 06/21/22 | Change | |||

| Last 30 Days | Traders | Volume | Traders | Volume | Traders | Volume |

| Magic Eden | 95,991 | $41,050,000 | 240,567 | $160,040,000 | 150.6% | 289.9% |

| OpenSea | – | – | 53,348 | $12,210,000 | N/A | N/A |

| Solanart | 18,891 | $4,390,000 | 1,748 | $197,680 | -90.7% | -95.5% |

| Solsea | 4,994 | $657,000 | 0 | $0 | -100.0% | -100.0% |

Source: DappRadar.com

According to DappRadar, Magic Eden has seen ridiculous usage growth over the last two and a half months. 30 Day users (traders) are up 151% and 30 day sales volume is up 290% since I last covered Solana. That growth has not gone unnoticed by capital investment firms as Magic Eden just secured $130 million in Series B funding from a group of investors that includes Greylock Partners and Electric Capital. This gives Magic Eden an implied valuation of $1.6 billion. That growth even comes with OpenSea generating more Solana network activity than Solanart and Solsea combined from the March sample.

One clarification though from that DappRadar data, I think Solsea’s API must have changed because the website does show sales over the last 24 hours; that said, it’s not a serious contender at this point and Solanart doesn’t appear to be either. When we look at total NFT sales by top 3 chains rather than by marketplace, we can see strong adoption of Solana over the last 30 days measured by unique buyers.

| Last 30 Days | Buyers | Transactions |

| Ethereum (ETH-USD) | 229,903 | 1,092,925 |

| Solana | 177,555 | 1,444,365 |

| BSC (BNB-USD) | 23,418 | 74,430 |

Source: CryptoSlam.io

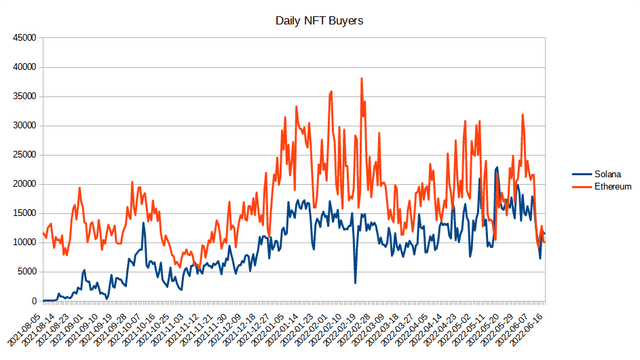

Not only is Solana creeping up on Ethereum in terms of total unique buyers but the chain actually had more NFT transactions over the last 30 days as well. Isolating those two chains, we can see what the buyer figures look like over a longer period of time.

cryptoslam

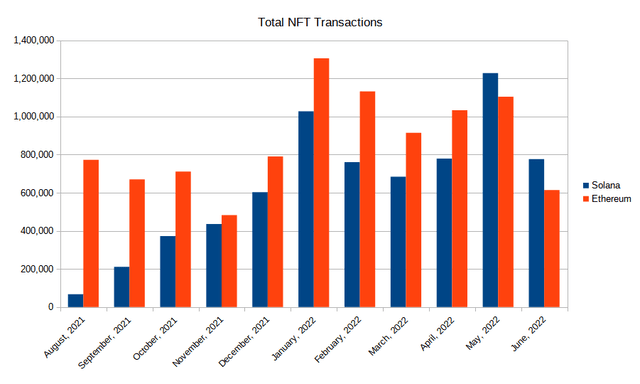

What’s been interesting to see is how Solana’s daily NFT buyer figures have been closing the gap with Ethereum’s over the last few weeks. Though both are seeing declines, likely because of the carnage in the crypto market, Solana has actually had more daily NFT buyers over the last two days. The monthly transaction figures tell a story as well:

cryptoslam

While Solana’s NFT activity has been highly concentrated to Magic Eden, the DeFi figures are much more diversified among protocols on chain.

TVL & DeFi Risk

TVL (total value locked) is another way I like to judge whether a chain has healthy network usage or not. We can take the market cap and divide it by the TVL to get a network valuation multiple. Here’s how the MC/TVL has changed compared to peers since that article:

| MC/TVL | 03/31/22 | 06/21/22 |

| Ethereum | 3.2 | 3.0 |

| BSC | 5.7 | 6.1 |

| Avalanche (AVAX-USD) | 2.6 | 1.9 |

| Solana | 5.1 | 5.0 |

Source: Defi Llama

For what it’s worth, Terra LUNA (LUNC-USD) was one of the chains that was shown in the table back in March, it’s obviously no longer a top chain for TVL. But raw TVL figures are just one way to assess the health of a blockchain’s lending activity. Another way to look at these networks is with protocol dominance figures. Currently, Solana is the most protocol diversified lending network of the top 5 DeFi blockchains.

| TVL Dominance | Top Protocol | Top 3 |

|---|---|---|

| Ethereum | 16.7% | 37.0% |

| Binance | 49.9% | 67.1% |

| Tron (TRON-USD) | 40.2% | 99.5% |

| Avalance | 41.6% | 56.7% |

| Solana | 10.7% | 29.3% |

Source: DeFi Llama, as of 6/21/22

Not only does Solana have a smaller top protocol dominance figure compared to every other top 5 DeFi blockchain, but even the top 3 protocols are better diversified than Solana’s DeFi network peers. I think this is a good sign, especially in light of the liquidation fears that Solana’s top lending protocol Solend (SLND-USD) expressed over the weekend. Solend made headlines Sunday for proposing a confiscation of assets from a single “whale” in the lending protocol. This whale’s position was viewed as a system risk by Solend. Had Solana decreased to under $23 per coin, a large portion of the “whale” position would have faced a forced liquidation. This would have reportedly put the protocol in a poor position, Solend stated:

It’d be difficult for the market to absorb such an impact since liquidators generally market sell on DEXes. In the worst case, Solend could end up with bad debt.

The proposal, which originally passed, was quickly reversed after outcry and another proposal vote when Solana’s price stabilized. Since the controversy, Solend has fallen to Solana’s second largest protocol measured by TVL.

Summary

Solana, like all chains in the crypto market, has been beat down very hard since the November peaks. All of these coins are down 80-90% from their all time highs. Additionally, Solana specifically has dealt with bad PR from network stoppages in recent weeks and months. There was also quite a bit of community pushback when Solend wanted to control the wallet of a “whale” account and force liquidation before larger network problems could happen. That pushback led to a new vote and the decision was ultimately reversed.

In my opinion, there will not be a one size fits all approach to blockchain. While many crypto market participants have philosophical issues with what Solend tried to do, as adoption grows, there will be other participants who might be more accepting of controversial ideas if they believe it will benefit the community broadly. DeFi carries risk from both a financial and trust perspective. It’s important to keep that in mind.

Despite the recent controversy and network issues, Solana itself is seeing good metrics in a variety of areas. I think Solana is one to scale into. I continue to hold SOL and recently bought when it crashed below $28. I have my SOL staked and there is added risk with that approach.

Be the first to comment