peshkov/iStock via Getty Images

I’ve adhered to the idea that Bitcoin (BTC-USD) has a four-year cycle of boom, bubble and bust, which is driven by the “halving” where supply of BTC halves every four years. There is an underlying trend of adoption and an underlying process of Bitcoin loss; literally loss from lost wallets, etc., and it is the “halving” that acts as a trigger for a repricing event. The “halving” is what they call a catalyst event in equities.

I am attached to this idea as it made me good money both in 2017 and in 2020/21.

Sadly, in the markets you can’t rely on repetition, only a trend replay where other influences come into play. So, while I was expecting a $40,000 peak, we had a $60,000+ peak. Then the crash started and halfway through up went Bitcoin on another big run.

For me, that second run was the lead up to the Ukraine/Russia war with the Afghanistan repositioning by the US under the spectre of a European upcoming conflict. This could just be misguided, but I am a firm believer that there are always many people in the know of big events far in advance of investors like us who live outside the citadels of power. In any event, up it went again, much to my surprise.

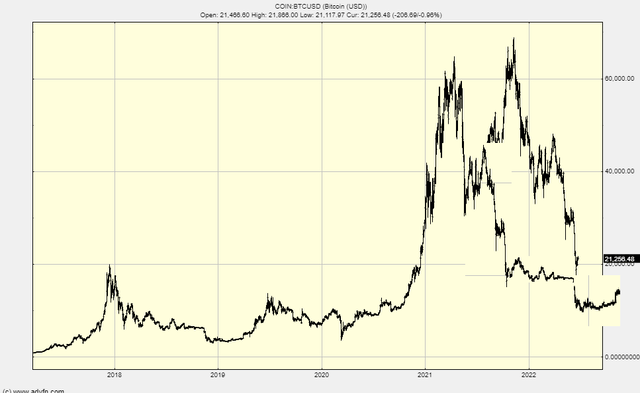

Here is the chart:

So now after that detour, Bitcoin has crashed in line with expectations; the only difference is a delay. Let me cut and paste to demonstrate:

I’ve simply shifted the recent crash back to the original crash, and you can see the similarity to 2017.

It also suggests that the same crash process is at work if you want to stretch a point.

Therefore, the question is, is this the bottom or is there another leg down?

This is my thinking:

Which could mean:

Consequently, there are two viewpoints:

- The recent lows are the bottom

- There is one more leg to go

I’m waiting for the next and final capitulation. For me, the last ‘bottom’ was not quite as extreme as I would have expected from a final move. While you could feel the pain in the market, it didn’t quite have the apocalyptic feel you experience at a market bottom.

The caveat here is that this kind of prediction is based on nothing much else kicking off to change the global geopolitical picture. As we have seen, Bitcoin – as the chosen haven asset – will react and break its price from the autopilot of its boom, bubble and bust cycle if there is an event that is worthy of resetting the market dynamic.

As I write, the G7 is banning Russian gold, so perhaps now is the time to kick off Plan A: dollar cost averaging Bitcoin. If you allocate your projected Bitcoin position over say 18 months, then you don’t need to finesse the bottom at all.

Let’s face it though, this is Bitcoin, who wants to play sensible!

What we need to see is a contraction of volatility and a narrowing sideways trading range. This will flag a decision point where Bitcoin will either take a last leg down or telegraph that $20,000 is the base for the next cycle.

I expect the last leg down but really, I should be nibbling on Bitcoin now. Nonetheless, I think patience is a better idea.

If Bitcoin goes under $15,000, I’m going to get nibbling.

Be the first to comment