martin-dm

SoFi Technologies, Inc. (NASDAQ:SOFI) just released Q3 2022 results that were somewhat better than expected, but failed to reinvigorate the fintech company’s investment thesis.

Despite raising its revenue and adjusted EBITDA estimate for 2022, SoFi Technologies’ stock remained unjustifiably overpriced.

Because SoFi Technologies is not yet profitable, the fintech faces years of losses that will add to the company’s already significant cumulative deficit.

Given the high sales valuation and the company’s rising losses, I believe SoFi Technologies will become a penny stock in the near future.

Challenged Profit Picture

SoFi Technologies reported a 56% YoY rise in total sales to $424.0 million, with adjusted EBITDA of $44.3 million, or a 332% YoY increase.

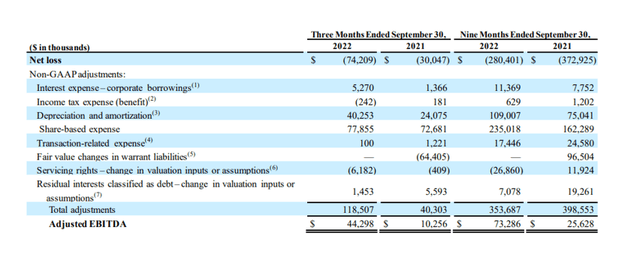

While these percentages appear to be positive, it should be noted that SoFi Technologies once again reached profitability on a non-GAAP basis, that is, by making significant changes to the company’s 3Q-22 net loss.

SoFi Technologies’ net loss in the third quarter was $74.2 million, more than double its losses in the previous quarter. SoFi Technologies’ net loss was converted to an adjusted EBITDA gain of $44.3 million, owing mostly to the addition of $77.9 million in share-based charges and $40.3 million in depreciation and amortization.

As I have stated, companies that generate profits solely on an adjusted EBITDA basis do not generate actual profits for shareholders.

SoFi Technologies’ accumulated deficit was $1.46 billion, a $280.4 million rise since the end of 2021.

Net Losses (SoFi Technologies Inc)

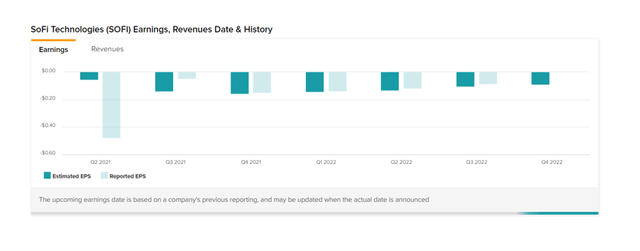

SoFi Technologies, on the other hand, managed to outperform third-quarter earnings projections by 2 cents. The market anticipated a loss of 11 cents per share, while the company posted a loss of 9 cents per share.

Having said that, SoFi Technologies’ earnings history is characterized by constant per share losses, which are unlikely to alter in the coming years.

Earnings Per Share History (SoFi Technologies Inc)

Platform Growth

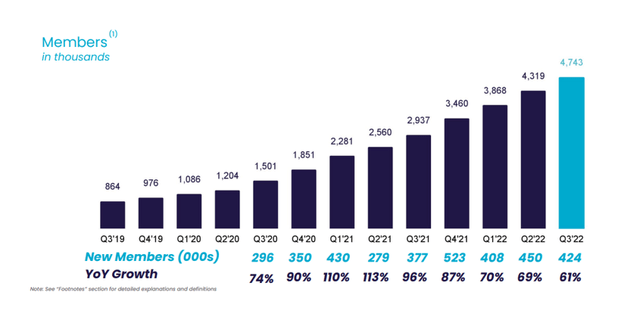

SoFi Technologies’ platforms are expanding, which is possibly the only positive aspect of the sector. SoFi Technologies’ products and services are presently used by over 4.74 million clients, an increase of 1.81 million YoY.

The trend is definitely favorable, but if SoFi Technologies continues to fail to translate this growth into meaningful shareholder profitability, more investors will flee to more promising (and lucrative) fintechs.

Platform Member Growth (SoFi Technologies Inc)

Management Raised Guidance For 2022

SoFi Technologies raised its net sales expectation from $1.508-1.513 billion to $1.517-1.522 billion, and its adjusted EBITDA guidance from $104-109 million to $115-120 million.

The fintech upped its revenue forecast for 2022 by $9 million and adjusted EBITDA by $11 million, although adjusted EBITDA profitability is meaningless to shareholders.

Undeserved Sales Multiple

Since its inception more than a decade ago, SoFi Technologies has lost about $1 billion in investor capital (the amount of its accumulated deficit shown on the fintech’s balance sheet), and the company is still not profitable.

Furthermore, the valuation multiple is exorbitant and, in my opinion, does not correctly reflect SoFi Technologies’ platform’s loss-making reality.

SoFi Technologies’ stock is currently trading at a P/S ratio of 3.33x, despite the fact that the fintech has no clear profit visibility and continues to lose money each quarter.

Why SoFi Could See A Lower/Higher Valuation

If management is successful in driving the fintech to long-term profitability, SoFi Technologies may see a greater valuation multiple. Given that the corporation is currently losing money hand over fist, I doubt that this is a feasible short-term goal.

Having said that, achieving long-term profitability could spark renewed interest in SoFi Technologies’ stock.

Another driver of a greater valuation could be a buy-out bid from a larger financial institution.

My Conclusion

The truth for SoFi Technologies is far bleaker than investors are ready to admit.

SoFi Technologies was promoted as a high-potential fintech business, but its stock has dropped 66% just in 2022, and the company is still losing money despite more than a decade of investing.

Fintech companies in general have been overpriced during the pandemic, and businesses like SoFi Technologies, in my opinion, remain dangerously inflated.

I believe SoFi will remain in its downtrend and trade below $5 in the near future. A penny stock is one that trades for less than $5, and I am afraid that SOFI is heading in that direction.

Be the first to comment