Melpomenem/iStock via Getty Images

Investment Thesis

SoFi Technologies (NASDAQ:SOFI) updates investors on its bottom-line profitability for 2022. The bull case had been for a dramatic expansion of its bottom-line profitability. But this is no longer the case given the extended moratorium and its impact on SoFi.

Last month, I concluded my SoFi article saying,

I remain neutral on this name. I can see why investors would welcome this [2022] guidance, in the context of how SoFi’s shares have performed of late.

However, I prefer to deploy my own capital into businesses that are slightly closer to generating a healthier mix of growth and potential profits.

Author’s coverage of SOFI

I was previously neutral on SoFi. Today I update my stance and turn bearish. Here’s why:

Time for Honesty

I have made friends on SA who own SoFi. I was neutral on SoFi and we were happy to be together. But then, the facts changed.

And the thing that frustrates people the most about me as an investor is that when the facts change, I change my mind.

The single most important characteristic of social media is the echo chamber. We must, at all costs, seek out ideas that are congruent with our self-identity.

Who we are is reflected in the stocks that we follow. This is who Michael is. Michael is neutral on SoFi. But if the facts change and Michael changes his mind, then Michael isn’t who I thought he was! Michael has changed. I’m disappointed.

Yes, me too, I’m disappointed that I was wrong here.

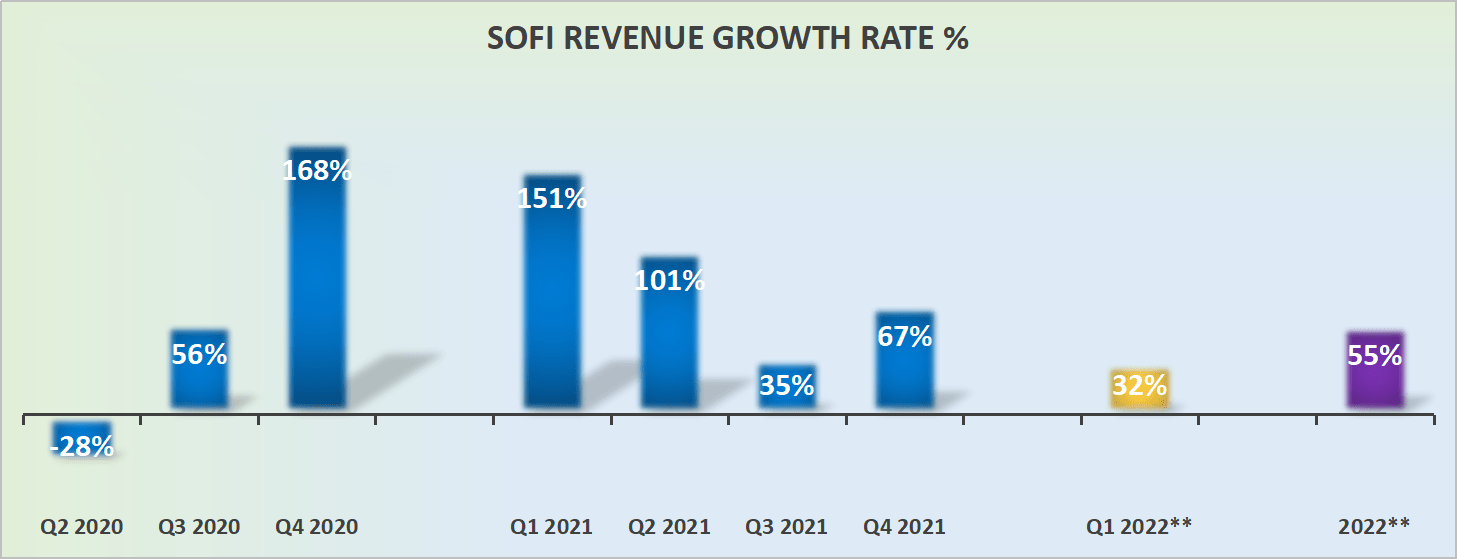

SoFi’s Revenue Growth Rates Aren’t the Full Story

SoFi revenue guidance

SoFi’s revenue growth rates have been marginally pulled lower. Then went from being guided to grow to $1.57 billion in 2022 and now are going to be down a hair at around $1.47 billion.

However, I fully expect that as the year unfolds SoFi ultimately gets back to around $1.57 billion for 55% y/y growth rates.

But that’s not where the story is at and why I changed my mind on this stock.

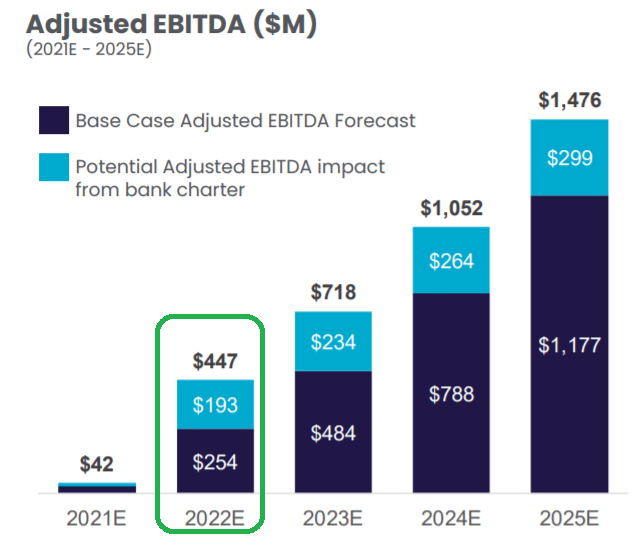

SoFi Technologies’ Path to Profitability Continues to Reverse

SoFi investor presentation

Cast your minds back to last year. SoFi at the time was arguing that if it got its bank charter approval, then its EBITDA line would soar by 10x in 2022. That it would go from $42 million of EBITDA in 2021 to $447 million in 2022. What a jump!

But then, pesky reality got in the way. And SoFi had to downwards revise its EBITDA guidance to $180 million for 2022 when it announced its Q4 2021 results.

That was a setback, but the business is a highly disruptive company, so it shouldn’t matter about its bottom line.

Indeed, $180 million of EBITDA is still way above the $30 million of EBITDA that SoFi ultimately reported in 2021. Yes, the EBITDA for 2021 ended up at $30 million rather than the $42 million that SoFi previously guided for. But let’s not dwell on this point.

Next, SoFi updated last night that it will in actuality report $100 million of EBITDA this year. While that’s disappointing, we should keep in mind that it’s more than 3x EBITDA from 2021, right? Well, before that, let’s discuss the acquisition of Technisys in Q1 2022.

SOFI Stock Valuation – Overvalued

If you remember, the acquisition of Technisys diluted shareholders by $1.1 billion. This means that SoFi’s acquisition saw the company dilute shareholders by 84 million in Q1 2022.

This implies that in the best-case scenario, when SoFi updates its Q1 2022 results in a few weeks’ time, we’ll see the total number of diluted shares outstanding reach approximately 940 million. Thus, for all intents and purposes, its market cap is now approximately $7.8 billion.

And as we look now, we are staring at a business that’s priced at 78x forward EBITDA.

And as you know, this business’ EBITDA is dubious, to say the least.

The Bottom Line

SoFi was the sort of investment that the market craved in 2021. Growth at any cost. However, in 2022, the rules have changed.

And I know the mantra is always ”buy the dip”, always. But I make the argument that this isn’t a worthwhile investment in this case.

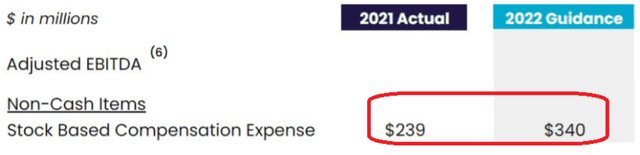

SoFi stock-based compensation added to EBITDA

If I had my doubts before and was pulled in by its alluring narrative of SoFi’s ambition to serve Henrys (High Earners, Not Rich Yet), I’m now seeing that this is more a case of management getting a lot of stock options and shareholders being left holding the bag.

Consider this, as you can see above, out of the $100 million of EBITDA, $340 million is stock-based compensation that gets added back to EBITDA. Whatever you decide, good luck and happy investing.

Be the first to comment