Pgiam/iStock via Getty Images

SoFi Technologies, Inc. (NASDAQ:SOFI) is a fintech stock that is in the middle of an epic short squeeze. No one is talking about what to do right now. Honestly, ride the wave higher, but you would be a fool not to take some of the gains off the table as the squeeze continues. The stock is up 20% at the time of this writing and going to head higher.

Two weeks ago, we told you to buy ahead of earnings as a massive move was coming. We remain bullish long term, but in the short run new money that got in at $6 should take something off the table. One advanced strategy? Sell enough to get your initial investment back, and let the rest fun forever and ever. Another approach is to sell out of the money calls a few months out for some massive premium. Long-term, we see the stock moving higher, so long as dilution remains minimal and there is a clear path to earnings.

Backdrop

If you have not been following this name, this is a fintech and one that is a leader in the space that it operates in. The company has changed significantly over the last decade, and over the last year the action in the stock suggests that the Street does not know how to value it, or which sector it belongs in. At times it moves like a speculative tech stock that has little to no earnings, while other times it moves like a bank.

No one tells you what they think you should do in a stock like this from month to month. It is a lot of work. But if you follow it, you can crush those who have parked their money and walked away. Trading around a core position is a key tenet to our investing philosophy that we teach. With this being a massive battleground stock, shave a little here on the ride up, and if we round trip lower, buy it back. Rinse and repeat. Q2 earnings are out and we want to compare it to our expectations we noted two weeks ago.

We have liked the stock since it dipped under $8 and loved it since it bottomed, but share prices have been pretty rangebound of late. The chart is pretty ugly, though the stock has stabilized somewhat.

People sell stock for all sorts of reasons, but buy them for only one. We think these volumes are very positive news.

The Q2 headline results

In the just-reported quarter, SoFi top line growth accelerated and the company saw record adjusted net revenue of $356 million, up 500% year-over-year from the same prior-year period. This also was well above the high end of management’s guidance and it beat consensus estimates slightly. Adjusted EBITDA of $20 million also was at the very high end of expectations, and this was the eighth consecutive quarter of EBITDA growth.

SoFi’s Q2 results versus our expectations

We were looking to see if loan growth demand faltered during a period of “rate shock” for borrowers, or if inflationary pressures were also leading to reduced demand or ability to repay loans. Housing data has been abysmal recently, and rates for all loans have jumped. We wanted to see if higher rates, plus a lower cost of funds, combines to expand margins.

We believed that based on Q1 trends in conjunction with management forecasts, if loan growth is hampered, they will still grow heavily, just at a lower rate. We could have seen a top line of $340-$360 million (accounting for a reduced growth rate in new loans of 5-10% vs Q1). We came in at $356 million, so we were on here, and they came in high. Winning. If margins expanded, we thought that the company would still lose money on a per share basis, but approach breakeven. In this vein, the company did see some pressure on operating margins and so we were too bullish, and on this front there was some disappointment. We targeted a loss of $0.11 to $0.01, or $0.06 at midpoint, but they hit the low end of our range and missed consensus by a penny. Still, the company continues to take market share and loans were strong.

Q2 loans and margins

We expected loan growth despite the student loan moratorium still weighing some and housing and economic data worsening. In Q2, growth accelerated across all three reporting segments. There was also strong personal loan originations, a record of $2.5 billion of loans, up 91% from last year. Winners win. Margins were mixed in lending. The lending business saw $142 million of profit, stemming from a 57% margin, up from 52% margins a year ago. There remained strong lending demand. Lending products as a whole were up 22%. Overall, the years in investing in technology and customer acquisition and cross-selling have paid off. We were anticipating margins to come in at 53-56% and the company crushed this expectation.

Tech platform growth continues in Q2

We knew that SoFi planned to leverage its combined technological capabilities of Technisys and Galileo to support multiple products and grow revenues. SoFi’s tech platform is growing and is a great source of future revenues. In fact in Q2 revenue of $84 million in the quarter was up 85% from last year. And up $23 million from just Q1. Winning. We anticipate a similar or higher rate of growth in Q3 year-over-year. Their acquisitions will continue to create cost-saving synergies. Longer-term margins should expand, as the synergies combined with Galileo will fuel revenue growth and margins should improve after the initial ramp-up investment.

Galileo in Q2 saw a 39% year-over-year increase revenue. We had predicted that when Q2 was reported we could see over 120 million accounts, and the company came close at 117 million. We were a bit too bullish. In terms of profit margin, we expected some pressure here in Q2 due to heavy investment in building out the platform. In Q2, profit was $22 million on 26% margins. This is down from a year ago, which had 34% margins, and down from 30% in the sequential quarter, which weighed some on earnings potential. But we had stated that the “company indicated it is still investing heavily so a sub 30% margin is possible here in Q2, but we stand by the assertion that margins bottom out this year and then increase as cost savings and synergies align.” We reiterate this belief.

Financial services growing but losing money

The financial services segment in Q2 saw $30.4 million of revenue for Q2. The revenues are still growing, with 20% sequential growth, and 78% growth from last year. We expected a similar degree of quarter-over quarter growth here from Q1, which was 7%, and the company surpassed our expectations here.

Both SoFi Invest and SoFi Money products have been winners. The company SoFi grew total Financial Services products by approximately 2.7 million, which doubled year-over-year, and now there are nearly 5.4 million products. SoFi Money itself added nearly 900,000 products year-over-year, while SoFi Invest products increased by over 920,000 and Relay products increased by over 700,000. Customers love the 1.8% APY being offered to put their savings with SoFi. Why do we say this? Because the market is clearly responding.

That said, this segment is still bleeding cash with a loss of $53.7 million stemming from credit card losses as well as building up their current expected credit loss reserves as required. The amount of reserves will continue to grow, as will losses near-term. But customer acquisition is a strong pace. They are winning.

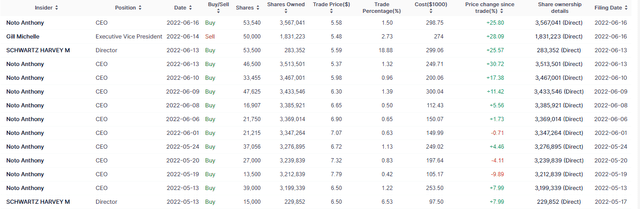

Insider buying

Keep in mind that there has been a ton of insider buying over Q2:

People sell stocks for all kinds of reasons, but only buy for just one reason: to make money. It is a benefit to see management investing along with you.

Squeezing the shorts

This stock has some massive short selling. The short interest is quite high, at the high teens as a percent of short interest at last check. As we predicted, these better-than-expected results and guidance are driving a huge short covering rally. It is wise to shave some of the position into this strength if you are one of our members trading.

We know that the stock is extremely expensive relative to a legacy bank, but as a tech stock, valuation is not as horrible as peers or other no-earnings, high-revenue growth-type stocks, so the rally could go on. It is best to shave some of it in our opinion while maintaining a longer-term position.

Looking ahead

For the longer-term, we would like stock-based compensation to come down. Every share issued to attract talent increases the float. Shareholders are being watered down. That is a risk, with $157 million in the first 6 months of 2022 issued/expended, which is nearly double from last year. Not good. That is another reason to trim.

From a guidance standpoint it was a homerun. The company stated in the release that:

Management now expects full-year 2022 adjusted net revenue of $1.508-1.513 billion (up from $1.505-1.510 billion previously) and full-year adjusted EBITDA of $104-109 million (up from $100-105 million previously).

And on the conference call:

Throughout the last 12 months, we have demonstrated the benefit of having a diversified set of revenue streams and a keen focus on continuing to underwrite high-quality credit. We expect those benefits to persist going forward even in light of the existing macro backdrop. Our outlook also assumes the federal student loan payment moratorium will last until January 2023, which would result in a late Q4 2022 benefit based on the trend experienced in 2021.

In the second half of the year, we expect to deliver $830 million to $835 million of adjusted net revenue and $75 million to $80 million of adjusted EBITDA with a more significant portion of the revenue and EBITDA getting generated in Q4. This guidance implies full year 2022 revenues of $1.508 billion to $1.513 billion, above our prior guidance of $1.505 billion to $1.510 billion. Our second half guidance implies full year 2022 EBITDA of $104 million to $109 million, above our prior guidance of $100 million to $105 million.

Overall, we couldn’t be more proud of our Q2 results and continued progress.

The company is delivering on its growth plans, and shareholders should welcome the results. The path to EPS profitability remains a long one, but as the company gains market share and margins improve, so long as shareholders are not diluted into oblivion, this is a win.

Take home

We expect fireworks after Q2, and were correct. But no one tells you what they think you should do short-term. We think you sell calls for income, and definitely shave some of the position on this short covering rally. Do not sell all at once. Sell in blocks, and if the stock tanks, buy shares back. That is called trading around the core position. It is a winning approach. Winners win. You can with SoFi, but you need to be nimble. If you came into the stock two weeks ago as a new buyer, consider backing out your entire initial investment and letting the rest run forever and ever. That is how you create generational wealth.

Be the first to comment