Justin Sullivan

It’s been a difficult road for shareholders of SoFi Technologies (NASDAQ:SOFI) in 2022. Shares topped out after Q3 2021 earnings at $24.65 and declined by -$19.83 (-80.45%) to a low of $4.82 in 2022. Going into Q2 2022 earnings, shares of SOFI bounced off their lows to a closing price of $6.41 (32.99%) on 8/2 prior to the earnings release. SOFI delivered a top and bottom-line beat, provided their second guidance raise in 2022, and improved on every Key Performance Indicator (KPI) they track. According to Marketbeat, 21.7% of SOFI’s shares (139,300,000) are sold short, with contracts expiring on 8/5/22. The investment community is rallying around SOFI as the Q2 earnings report was a home run. SOFI has an average 30-day trading volume of 38.67 million shares and saw extremely heavy trading volume resulting in 146.10 million shares traded the day after earnings on 8/3. SOFI finished the trading session up 28.39% as they appreciated by $1.82 per share.

There are many different opinions and misconceptions about SOFI. Opinions are personal, and having a negative view of SOFI is perfectly fine. Time will tell if the bearish or bullish thesis is correct regarding SOFI’s stock price. I believe the narrative will finally change after Q2 earnings as the misconception of SOFI just being a student loan company continues to be disproven. SOFI is an official bank and financial technology company that owns the entire backend, from payment processing to the cyberbank platform. The moratorium on federal student loans has been in place for more than 2 years, and SOFI’s student loan segment has been operating at 50%. SOFI grew its revenue by 38% YoY in 2020, 63% YoY in 2021 to $1.01 billion and is projecting around $1.51 billion in 2022, which is 50% YoY growth. This is during an environment where their largest revenue segment is operating at 50% due to a pause in federal student loan payments causing inactivity in refinancing federal student loans. SOFI’s leadership should be given tremendous credit for their ability to execute on their KPIs, develop products their members want, and drive revenue with one hand tied behind their back. I am very long SOFI and believe SOFI will accomplish its goals of becoming a top 10 financial institution.

SOFI delivered across every KPI part 1, revenue and adjusted EBITDA

In a free-market economy, the marketplace determines a company’s viability. Demand for goods and services is the ultimate indication if a company brings value to the marketplace as consumers vote with their wallets. Based on SOFI’s stock chart, it looked as if this was a company destined to fail, which couldn’t have been further from the truth. Outside of internal KPI’s the market focuses on the top and bottom line, so I will start there.

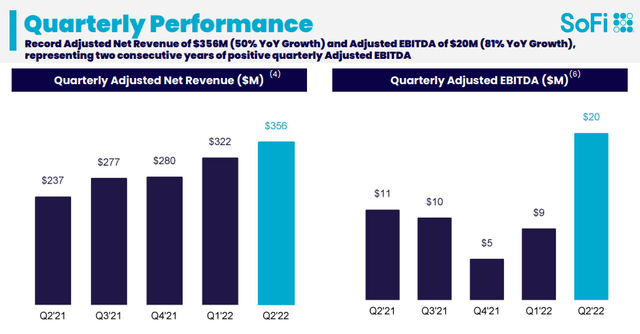

In Q2 2022, SOFI generated $356.09 million of revenue which was a beat of $11.62 million and a YoY increase of 50.01%. SOFI’s GAAP EPS showed that losses are narrowing as it came in at -$0.12, which was a beat of $0.01. SOFI’s CEO Anthony Noto explained that they feel that free cash flow (FCF) is the best value driver as GAAP net income is not a full cash measurement. Normally people determine a company’s FCF by subtracting CapEx from the cash from operations produced. He explained that financial service companies utilize their cash to fund loans, so they feel EBITDA minus CapEx is a better measurement of cash flow because that drives increasing book value. Mr. Noto has stated in the past that EBITDA is a better longer-term measure of economic cash flow because there are a lot of non-cash charges below EBITDA. Adjusted EBITDA is the financial metric that indicates earnings before interest, taxes, depreciation, and amortizations. Adjusted EBITDA removes non-recurring, irregular, and one-time items that could distort EBITDA. SOFI guided for $5 – $15 million of EBITDA in Q2 and delivered $20 million of EBITDA, which is a 6% margin.

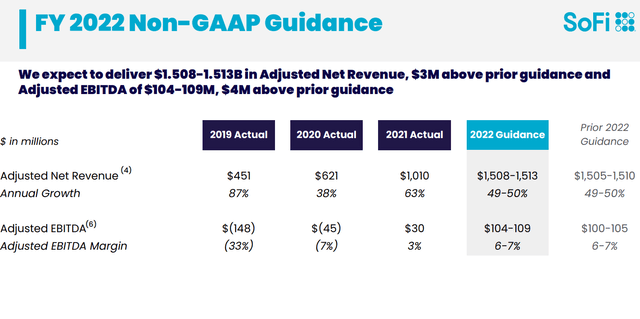

On 4/6, SOFI provided an update to its 2022 guidance as the goalpost in the student loan saga was moved once again. President Biden extended the federal student loan payment moratorium from May 1, 2022, until August 31, 2022. SOFI’s management team updated 2022 guidance, assuming that the student loan moratorium will not end during the course of 2022. SOFI updated Revenue and Adjusted EBITDA guidance for full-year 2022 of $1.47 billion and $100 million, a reduction from previous guidance of $1.57 billion and $180 million. SOFI’s revised guidance, still minus federal student loan refinancing, was a 46% YoY increase in revenue and a 233.33% increase YoY on Adjusted EBITDA with a 7% margin. In the Q1 2022 earnings presentation, SOFI delivered its first beat and raise of 2022. SOFI raised guidance to $1.505 – $1.51 billion (49-50% YoY) and $100-$105 million of Adjusted EBITDA with a 6-7% margin. In the Q2 presentation, SOFI provided its second consecutive guidance raise for 2022 after the initial reduction. SOFI is now guiding for $1.508 – $1.513 billion of revenue and $104 – $109 million of Adjusted EBITDA. The market is clearly indicating that the consumer landscape is finding value in SOFI’s products as revenue and adjusted EBITDA continue to grow, especially with their student loan business operating at under 50%.

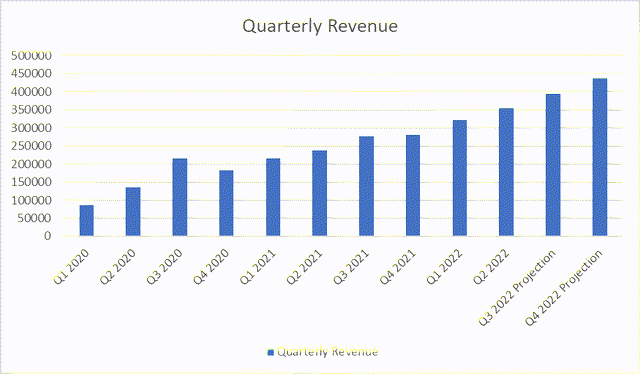

SOFI has delivered $678 million of revenue and $29 million of adjusted EBITDA in the first half of 2022. On the earnings call Mr. Lapointe (SOFI CFO) indicated that they expect to deliver $830 to $835 million of revenue and $75 to $80 million of adjusted EBITDA, with a more significant portion of the revenue and EBITDA getting generated in Q4. This indicated another 2 consecutive quarters of QoQ growth. Based on their assumptions, I am projecting that revenue will come in around $395 million in Q3 and $437.18 million in Q4. The combination of the current revenue trajectory and the possibility of federal student loan payments starting again in early 2023 could play a powerful role in 2023’s guidance. If President Biden signals an early 2023 end to the moratorium, I could see SOFI guiding for $2.25 – $2.5 billion of revenue in 2023. Without a change in the moratorium announced in 2022, I think it’s likely that 2023’s guidance would be in the $1.82 – $1.92 billion range. I believe this is very exciting as SOFI is in its infancy and has a long runway of growth ahead of them.

Steven FIorillo, Seeking Alpha

SOFI delivered across every KPI part 2: members, deposits, products, and Galileo

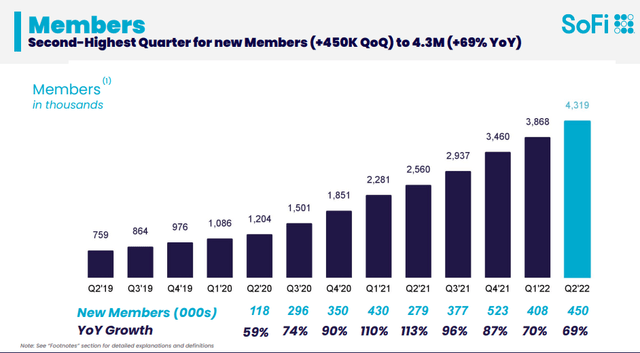

Nobody is required or forced to use SOFI’s financial products in a free market. Individuals choose which products and services they will extract the most value from. SOFI’s member growth is an indication of the value proposition it’s creating for its membership. SOFI’s member base grew by 11.66% in Q2 2022 as it added 450,000 new members bringing its total to 4.32 million members. This is a 69% YoY growth rate as SOFI has added 1.76 million members over the previous 4 quarters. SOFI added an additional 42,000 members in Q2 compared to Q1 and is on track to break 5 million members in 2022. SOFI would need to add 681,000 members for an average of 340,500 new members in each of the following 2 quarters. SOFI’s average membership add is 440,000 per quarter for the previous 4 quarters. There is a good probability that SOFI will close our 2022, adding at least 1.54 million members in 2022, which would be a 44.51% YoY growth rate on membership.

I believe the continued membership growth is a direct correlation to SOFI’s national bank charter being finalized and established. A major positive for SOFI members is that having a national bank charter allows SOFI to determine the interest rates on checking and savings accounts rather than a sponsor determining it. SOFI’s execution has been flawless and continues to deliver on its vision. SOFI wants to be the primary relationship with their members across all their financial needs, and to do that, having the banking charter is critical because capturing direct deposits is the bait to lure in new members. SOFI offers 1.8% interest on checking accounts if you’re making direct deposits with them. Having the bank charter allows SOFI to fund its loans from deposits at a much lower cost than borrowing the capital. Since SOFI’s spread increased, they are rewarding members with a checking interest rate that surpasses traditional banks.

SOFI’s deposits grew by $1.556 billion in Q2, up 134.65% QoQ. When I look at the big banks, only Citigroup (C) saw their deposits increase as JPMorgan Chase (JPM) had a -$89.66 billion (-3.5%) decline in deposits. SOFI added $17.1 million in daily deposits across Q2, which could be just the beginning. As word-of-mouth spreads and more people become aware of SOFI’s interest rates, their deposits could grow substantially and drive member growth. Any of the bear cases about using SOFI as a banking platform have been eradicated as their an official national bank. I have said from the beginning that I believe SOFI is the personal finance platform of tomorrow, and I think Q2 clearly indicates what is to follow.

|

Q1 Deposits |

Q2 Deposits |

Difference |

||

|

JPM |

$2,561,207,000,000.00 |

$2,471,544,000,000.00 |

-$89,663,000,000.00 |

-3.50% |

|

BAC |

$2,072,409,000,000.00 |

$1,984,349,000,000.00 |

-$88,060,000,000.00 |

-4.25% |

|

WFC |

$1,482,479,000,000.00 |

$1,425,153,000,000.00 |

-$57,326,000,000.00 |

-3.87% |

|

C |

$1,317,230,000,000.00 |

$1,321,848,000,000.00 |

$4,618,000,000.00 |

0.35% |

|

UBS |

$542,007,000,000.00 |

$512,216,000,000.00 |

-$29,791,000,000.00 |

-5.50% |

|

SOFI |

$1,155,900,000.00 |

$2,712,300,000.00 |

$1,556,400,000.00 |

134.65% |

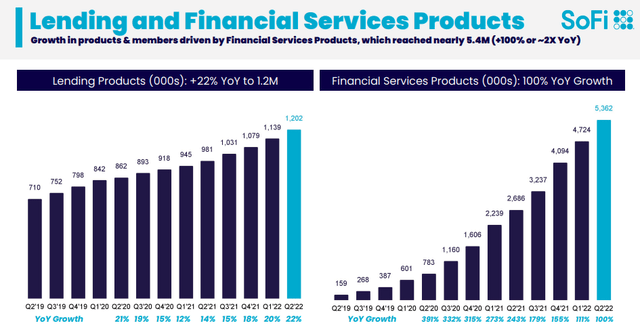

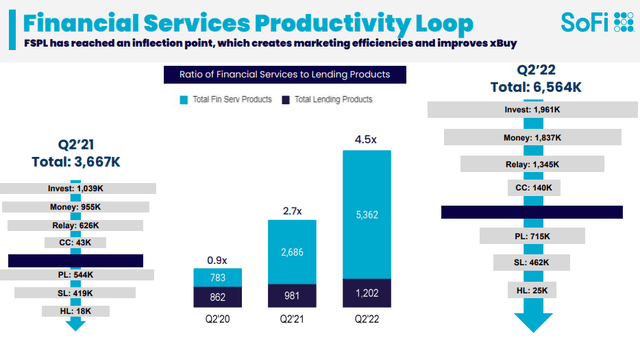

SOFI isn’t just a bank; it’s a full financial service platform. In Q2, SOFI added 702,000 new products bringing their total across lending and financial services to 6.6 million. From the new additions, financial services products of 5.4 million doubled YoY, while lending products of more than 1.2 million were up 22%. SOFI’s goal is to have every financial product a member would ever need at their fingertips. SOFI is building an ecosystem where members never have to venture out to another financial institution. This approach is advantageous for members while driving cross-product utilization. If the interest rate is the bait, then the diverse product suite is the hook as SOFI is looking to have more members utilize multiple products. This has been a successful strategy as the financial services productivity loop strategy has seen an increase of 24% YoY in multi-utilization across products.

Galileo continues to deliver as its accounts grew by 17 million in Q2 as total accounts grew 48% YoY by 38 million. Galileo’s revenue grew 39% YoY and has added new B2B capabilities as well as a secured credit card offering. On the Q2 conference call, we learned that 30% of the Galileo client pipeline is now comprised of B2B deals, up dramatically from 10% to 15% YoY. SOFI estimates that the B2B opportunity is $29 trillion, with 50% of payments still via paper check. This is a quintessential example of execution across all segments of SOFI’s business. The technological innovation at Galileo has created the capability to convert these to digital payments and virtual cards. Galileo continues to have the ability to address more market segments and diversify its sources of growth.

Conclusion

SOFI is still in its infancy, and there is a long runway for future growth. The bank charter is a proven game changer, and SOFI is now growing its deposits at a triple-digit QoQ rate. SOFI continues to innovate, and the efficiencies from Technisys haven’t been realized yet. Transitioning SOFI’s checking, savings, and credit card to Technisys technology stack will create $75 – $85 million in cumulative cost savings from 2023 to 2025. From 2025 forward, SOFI will benefit from roughly $60 – $70 million of cost savings on an annual basis. Not only will SOFI generate annual cost savings, but their AWS of Fintech will be completed and open up a new business segment as their technology platform can be marketed to other neo, challenger, and traditional bank systems. When it comes to SOFI’s future, there is a lot to like. Membership is growing, deposits are growing, SOFI is entering new markets, and eventually, the student loan moratorium will expire. SOFI is a buy and hold; if you’re not looking at 5-10 years into the future, this isn’t your investment. I see SOFI as the personal finance solution of the next generation, and I will continue to acquire shares as I believe in the long-term viability of SOFI’s strategy. SOFI has a winning recipe and a management team led by Anthony Noto, which continues to execute its vision.

Be the first to comment