wildpixel/iStock via Getty Images

Investment Thesis

SoFi Technologies (NASDAQ:SOFI)’s growth and valuation were recently hit by the inflation risk and the extension of the student moratorium at the same time. It had caused the company to reduce its FY2022 revenue guidance. However, in our opinion, the resulting sell-off is overblown, since the current climate will not persist indefinitely. In addition, SOFI had done well for itself with a 72.8% YoY revenue growth in FY2021, despite the ongoing moratorium and the segment operating at less than 50% of pre-COVID levels in the past two years.

Given SOFI’s recent cornerstone acquisition of Technisys, we expect the headwinds to be temporary as SOFI realizes the transformative synergies and projected revenue growth moving forward.

Technisys Will Be A Cornerstone To SOFI’s Technological Growth

On 3rd March 2022, SOFI closed its acquisition of Technisys, a cloud-based multi-product banking platform. Through Technisys, the company aimed to create multiple fintech products that could be standardized to meet mass markets and fully customized based on individual consumer needs.

Similar to its previous acquisition of Galileo Financial Technologies in April 2020, the expansion will help SOFI to offer a vertically integrated financial offering without over-relying on third parties. For example, as a payment processor system, Galileo had helped SOFI integrate its checking savings account into the debit and ACH networks then. To date, SOFI reported 100M Galileo corporate accounts, representing a 2.7 fold increase since the acquisition, while calling multiple global financial institutions, such as Monzo and Wise, as their clients. The acquisition had also partly contributed to the company’s growth in revenue since then.

Through these strategic acquisitions, SOFI aims to be a “one-stop-shop across borrowing, credit cards, saving, investing, protecting, and spending,” with best-in-class product offerings. The expansion in expertise would also help the company innovate faster while further improving its product efficiency and consumer experience with:

- user interface development capabilities.

- a customizable multi-product banking core and ledger.

- fully integrated processing and card issuing available for its partners.

Though SOFI had estimated annual cost savings in the range of $75M to $85M from 2023 to 2025, its impact would be minimal given that it spent $1.43B in operating expenses in FY2021. However, it will be offset by the potential acceleration in revenues growth ( and synergies ) of up to $800M through 2025. SOFI said:

Once SoFi has migrated off its current multiple third-party cores to a single owned and operated Technisys core, it expects to be able to innovate even faster, perform more real-time decisioning, and offer greater personalization for its approximately three and a half million members. (Seeking Alpha)

Nonetheless, given that the Technisys acquisition is completed through an all-stock deal with the issuance of 84M new stocks worth $1.1B, further investors’ dilution is to be expected, on top of SOFI’s existing share-based compensation. Moreover, since the Galileo acquisition is also based on $1.2B cash and stock considerations, we expect the company’s future acquisitions to be all stock deals as well, given that it has yet to report profitability and positive free cash flows.

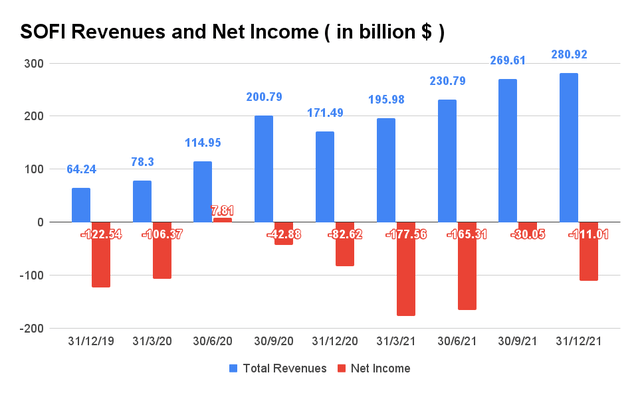

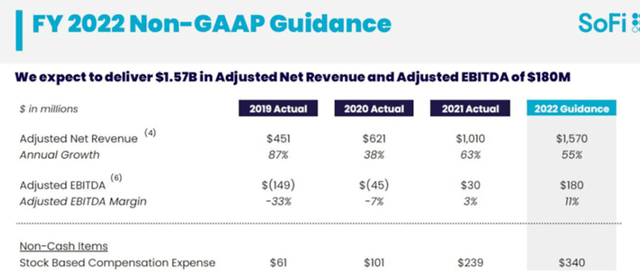

SOFI Reported Record Growth In Revenue and Stock-Based Compensation in FY2021

SOFI Revenue and Net Income

S&P Capital IQ

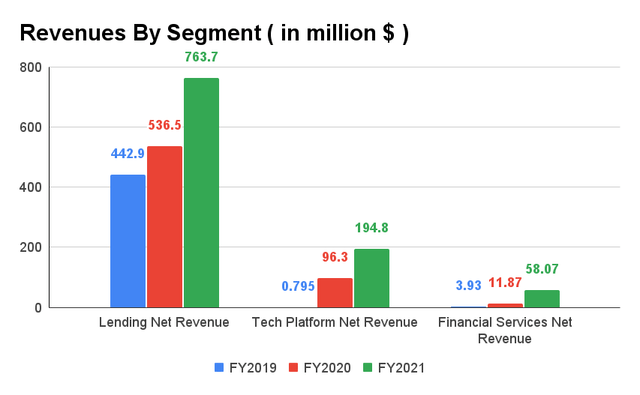

SOFI grew its revenues at a CAGR of 17.85% over the past four years, with the growth mostly attributed to FY2021. In the latest fiscal year, the company reported revenues of $977.3M, representing excellent YoY growth of 72.8%. In FQ4’21, SOFI also reported record-breaking revenues of $280.92M, representing an increase of 4.1% QoQ and 63.8% YoY.

SOFI Stock-Based Compensation

Seeking Alpha

Nonetheless, SOFI’s net losses doubled in the year, from -$224.05M in FY2020 to -$484.94M in FY2021. In addition, its stock-based compensation expenses also more than doubled, from $101M in FY2020 to $239M in FY2021. SOFI also guided a further 42.2% increase in its SBC expenses in FY2022 to $340M. It is apparent that the business is not profitable and will not be profitable yet, given its widening net income margin of -39.6% in FY2020 and -49.5% in FY2021. As a result, SOFI has yet to generate positive Free Cash Flow and has an accumulated debt of $3.94B as of FQ4’21, though approximately half of it is attributed to warehouse lending.

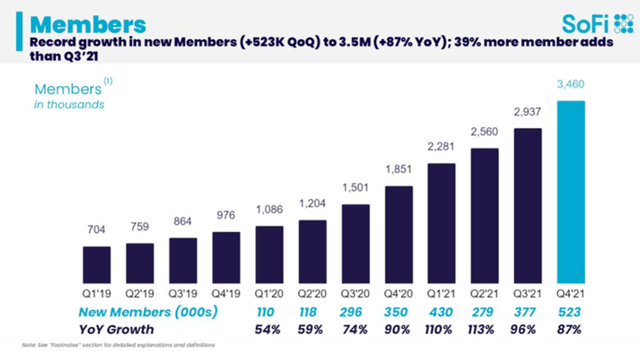

SOFI Growth In Membership

Seeking Alpha

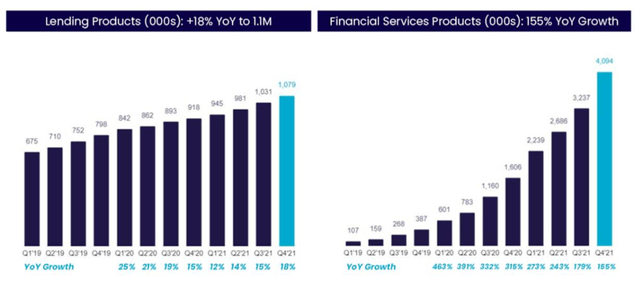

In FQ4’21, SOFI reported that it added 523K new members at 39% YoY growth and sold 906K new products at 51% YoY growth, mostly attributed to robust demand for financial services products at 155% YoY growth.

SOFI Growth In Product

S&P Capital IQ

SOFI Revenue By Segment

Seeking Alpha

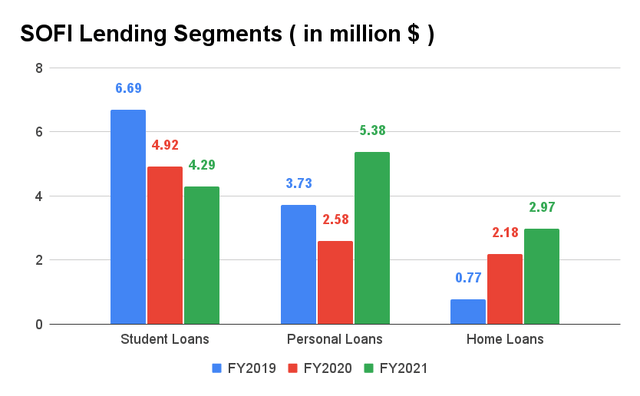

However, if we were to study SOFI’s segments in detail, it is evident that lending still forms the majority of its revenues, with a growing personal loan segment. Though the company had expected its home loans segment to ramp up, rising mortgage rates have been shown to dampen demand in FY2022, with housing sales declining QoQ.

Though the student loans moratorium could be worrying, it is important to note a few things. First, the extension is not new and has been ongoing since March 2020 during former President Trump’s term. In addition, SOFI has been reducing its exposure to the student loans segment by 35% in the past two years, from $6.69M in FY2019 to $4.29M in FY2021. The move had resulted in minimal impact on SOFI’s revenue guidance since the announcement of a further extension to August 2022, as the company only reduced its FY2022 guidance by 6.8% from $1.57B to $1.47B. As a result, we believe that the current sell-off is overblown and an over-reaction.

SOFI Lending Segments

Seeking Alpha

Given that its student loan refinancing has been operating at less than 50% of pre-COVID levels in the past two years, it is evident that its other segments are generating sufficient revenue and growth to make up for the former. In addition, the moratorium will not continue indefinitely with the states leading the reopening cadence. As a result, we believe that SOFI’s growth will be further boosted once the moratorium ends by 2023, when we may potentially see the company achieve excellent YoY growth at the higher end of double digits.

So, Is SOFI Stock A Buy, Sell, or Hold?

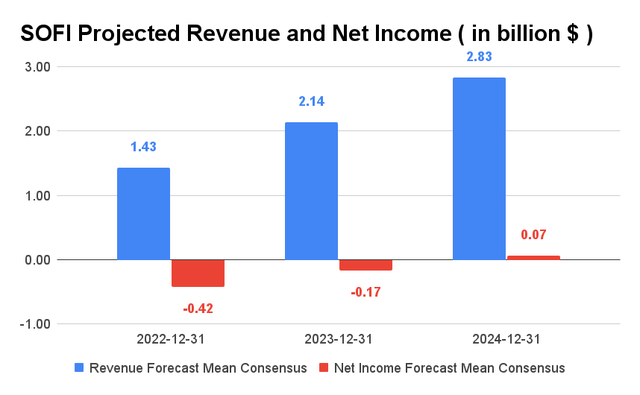

SOFI Projected Revenue and Net Income

S&P Capital IQ

SOFI is expected to report revenue growth at a CAGR of 42.55% over the next three years. In FY2022, consensus estimates that the company will report revenues of $1.43B, representing impressive YoY growth of 47.4%. SOFI may also report net income profitability by FY2024 onwards. However, with the recent extension to the student loan moratorium, we may expect further reduction in its revenues, assuming that it is extended in FY2023, due to the impending midterm US elections. However, given that the President is pushing for Public Service Loan Forgiveness, we may see 14.5% of the existing student loans cleared before the end of his term.

SOFI is currently trading at an EV/NTM Revenue of 4.9x, lower than its historical mean of 10.29x. The stock is also trading at $7.48 on 12 April 2022, down 70% from its 52 weeks high. Though consensus estimates rate SOFI stock as attractive now given its undervaluation, we expect more volatility and retracement ahead due to inflation risks. Nonetheless, the dip still represents an excellent entry point for speculative investors, given its robust business model and performance thus far.

Therefore, we rate SOFI stock as a Buy only for speculative investors.

Be the first to comment