Justin Sullivan

Heading into the Q3’22 earnings report, SoFi Technologies (NASDAQ:SOFI) traded at near all-time lows. The fintech had already made the positive scenario known to the market, yet investors ignored the positive outcome of the end to the student loan moratorium. My investment thesis is ultra-Bullish on the stock even following the initial jump after the big guide up for 2022 and positive indications for 2023.

Big Q3 Is Only The Start

The hard part to understand about the market was investors absolutely ignoring SoFi guiding for over 40% growth in Q3. The company was knowingly conservative due to student debt headwinds leading to revenues smashing estimates again and strong guidance for Q4.

Not only did SoFi deliver 51% revenue growth in Q3 to reach $419 million, but also adjusted EBITDA hit $44 million. The biggest complaint regarding the financials of the fintech was the lack of profits and the return to a normalized student debt refinancing market should provide a massive boost to the bottom line.

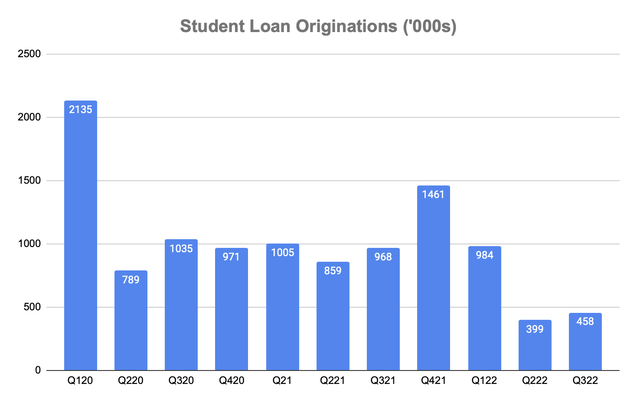

Amazingly, SoFi only saw loan originations increase 2% over Q3’21 at $3.5 billion. As expected, student loans were down 53% to only $458 million in the quarter.

Source: Stone Fox Capital, corporate filings

As well documented in previous research, the Biden Administration approved a loan forgiveness plan that doesn’t impact SoFi materially due to the exclusion of high-income borrowers. Not to mention, the Eighth Circuit Court of Appeals has already issued a stay to temporarily block the student loan forgiveness plan, as some suggest the President doesn’t have the legal authority to forgive student debt.

SoFi was refinancing up to $2 billion in student loans prior to covid moratoriums reduced demand. More student loan refinancings only increases the funnel for other Products.

The best part of the investment story is that SoFi doesn’t exactly need the student loan market to return to normal to grow. The company grew revenue in the 50% range throughout the whole moratorium issue.

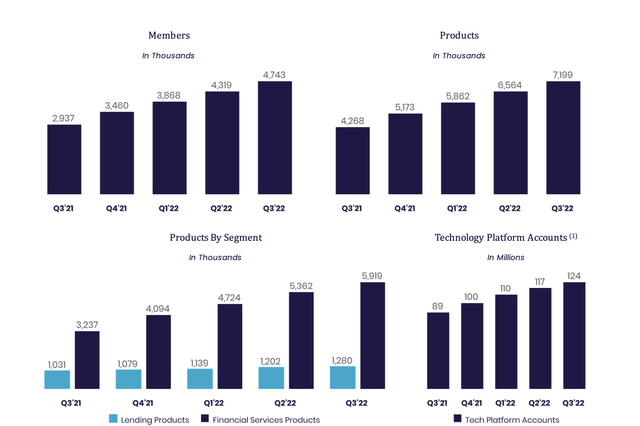

The prime reason is that Members added 424K during Q3’22 to reach 4.7 million. Those members expanded Products usage to 7.2 million in the quarter for astounding 69% growth.

Source: SoFi Q3’22 earnings release

All of the Financial Services products are only starting to ramp volumes. The Credit Card product only had 154K Members using the product by the end of September. The Invest product had the slowest growth rate, yet the product still expanded at a 68% clip.

Bottom Line Boost

The student loan moratorium had the biggest impact to the bottom line. The student loan refinancings were where the company produced the most adjusted EBITDA.

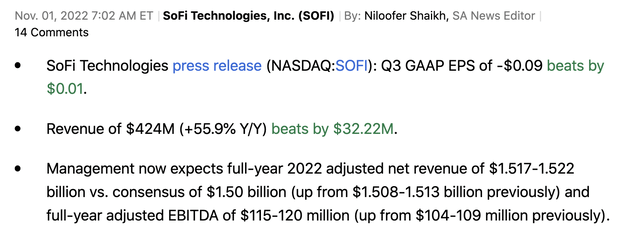

For 2022, SoFi guided to adjusted EBITDA of $115 to $120 million. The company earned $44 million in Q3 with the guidance suggesting the fintech generates another quarter of strong EBITDA of $42 to $47 million.

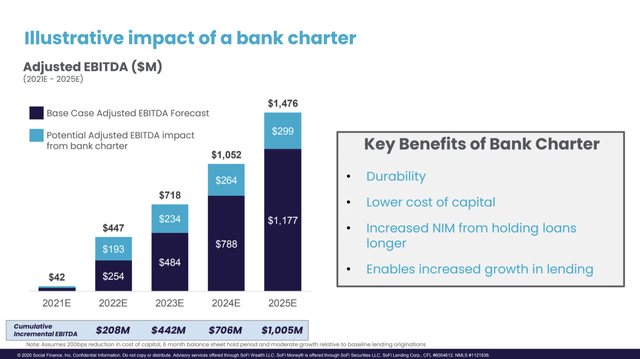

The market can now fully focus on the original business plan of SoFi. The company had forecast becoming an EBITDA machine once obtaining the digital bank charter and without the headwinds of the student debt moratorium.

SoFi originally guided to 2022 revenue of $1.5 billion, which the fintech actually topped despite the headwinds. The company guided to adjusted EBITDA of $254 million without the bank charter and an incredible $447 million with the charter.

Source: SoFi SPAC presentation

The original guidance had adjusted EIBTDA surging to $718 million in 2023 and $1,052 million in 2024. Now, these numbers aren’t still the official guidance, but investors need to understand only the student loan debt moratorium and higher investing for the future will prevent SoFi from reaching those original targets.

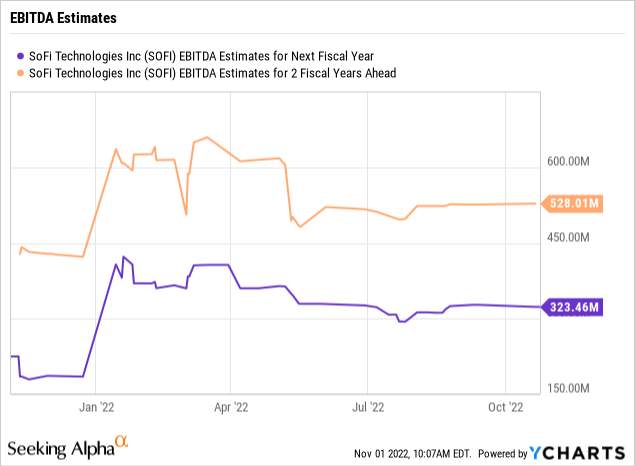

The stock has a market cap of just $6 billion now and the path to reach over $2 billion in revenue next year and over $2.5 billion in 2024 appears very clear. The only really question is the EBITDA targets. Even if SoFi only reaches 50% of the above targets, the fintech will earn $358 million next year followed by $526 million in adjusted EBITDA in 2024.

The company has over 50% revenue growth and the stock trades at ~12x 2024 baseline EBITDA targets with analyst at $538 million now. SoFi is likely to crush these numbers knowing the importance of profits in the current economic climate.

Takeaway

The key investor takeaway is that a company with these growth rates typically trades at far higher multiples. SoFi should be firing on all cylinders in 2023 and the stock is still priced similar to a slow growing mega bank.

Even after the 15% rally in initial trading, investors should use the relatively weak stock price over the last year as a buying opportunity.

Be the first to comment