Rich Fury

As many predicted, the goalposts were moved once again as President Biden’s Education Department extended the moratorium well into 2023. Shareholders of SoFi Technologies (NASDAQ:SOFI) just received an unwanted holiday gift, as up until a few days ago it seemed as if 2023 would be the year all its lines of businesses would be operating at the same time. Shares of SOFI have fallen under $5 again and have declined -70.03% YTD. While SOFI has overcome tremendous amounts of adversity and has many operational aspects to celebrate, Mr. Market has wreaked havoc on its shares. Now that Federal student loans won’t be resuming next month, 2023 will no longer be the year investors had hoped for and will have to wait until 2024 for all the businesses to work in unison.

The fact is that SOFI has been a destroyer of investor capital, and going into tax loss harvesting season, SOFI could be at the top of many lists now that there is uncertainty once again around student loans. I have been incorrect about SOFI’s stock, but I don’t believe I am wrong about SOFI, the company, and that’s why my investment thesis remains unchanged. Some may consider it throwing good money after bad money, but I just took the opportunity to dollar cost average with shares under $5, and if we see another leg down, I am likely to add to my position once again. This is not an investment for the faint of heart or investors lacking a long-term investment horizon. I continue to do my due diligence, and while it could take longer to get back to even, I believe in the long-term potential even though the short-term frustrations are immense.

President Biden’s Education Department moved the goalposts again, and SOFI has been negatively impacted

Well, the moratorium isn’t ending this holiday season and will continue in 2023. Many investors, including myself, were ecstatic when President Biden announced the broad strokes of his student loan forgiveness plan on 8/24. Up until recently, shareholders were under the impression that this would be the final moratorium extension with an end date of 12/31/22 and payments resuming on 1/3/23. A lot has changed since Q3 earnings, and 2023 won’t be the year I thought it would be.

Toward the end of October, a Federal appeals court issued a stay that temporarily blocked the administration’s plan to forgive billions in federal student loans. The stay was in effect while the Eighth Circuit Court of Appeals considers a motion from six Republican-led states to block the loan forgiveness program. The stay came one week after borrowers started applying for the forgiveness program laid out by the administration, and as of 10/28, almost 22 million people had applied.

On 11/14, Reuters reported that a U.S. appeals court extended a block on President Joe Biden’s plan to cancel hundreds of billions of dollars in student loans. The St. Louis-based 8th U.S. Circuit Court of Appeals issued an injunction barring the U.S. Department of Education from following through with President Biden’s statement from 8/24 regarding student loan forgiveness.

On 11/22, the U.S. Department of Education extended the moratorium into 2023 due to the decision made by the U.S. appeals court. On 12/1, the Supreme Court agreed to hear arguments over President Biden’s student loan forgiveness program sometime this winter, and the projection is that a decision would issue a decision in late June. While this issue is still in litigation, the Supreme Court will uphold the block on forgiveness.

Here are the specifics from the Department of Education regarding a timeline:

Payments will resume 60 days after the Department is permitted to implement the program or the litigation is resolved, which will give the Supreme Court an opportunity to resolve the case during its current Term. If the program has not been implemented and the litigation has not been resolved by June 30, 2023 – payments will resume 60 days after that.

All I care about are the facts, and I am not offering a political opinion on student loan forgiveness. I try never to be political when I write articles, especially on the topic of energy. There have been several extensions on student loan forgiveness, and the matter is currently in front of the Supreme Court. Nobody knows what the outcome will be; any prediction would be nothing more than speculation. As of right now, it seems as if the worst-case scenario regarding the moratorium would be 8/30/23, as the Department of Education has clearly stated that if a resolution is not reached by 6/30, payments will resume in 60 days after that date. This is where we currently stand, and at this point, it won’t be until the tail end of Q3 2023 when SOFI’s student loan business comes back.

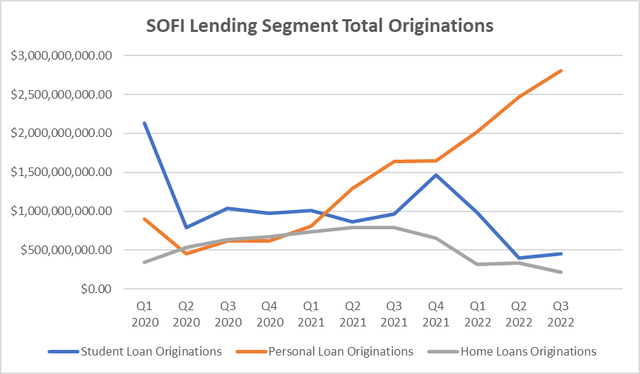

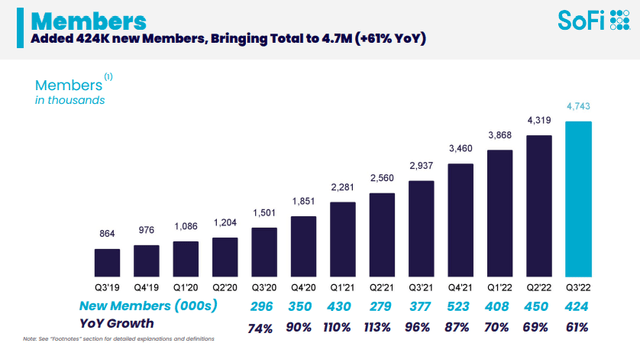

Steven Fiorillo, SOFI SOFI Q3 Presentation

This negatively impacts SOFI as Student Loan originations was its largest lending segment up until Q2 of 2021. If you were to go back to pre-pandemic, student loans represented over 2 billion of loan originations. The moratorium has crippled this business segment, and for the previous 2 quarters, SOFI has done less than $500 million quarterly. There was an uptick in Q4 2021 as it looked as if the moratorium would end, but after another extension, originations cratered once again. As of now, we’re going to have to wait another 10 months, and that’s if a resolution doesn’t occur, or another extension is brought forward. Nobody knows what is going to occur and I am preparing myself for another year without student loans, even though that is not what was stated by the Department of Education.

Why I am still bullish on SOFI and adding to my position

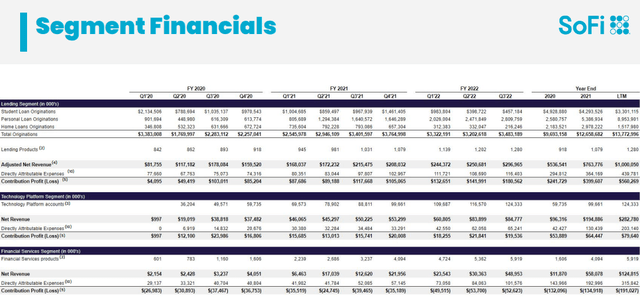

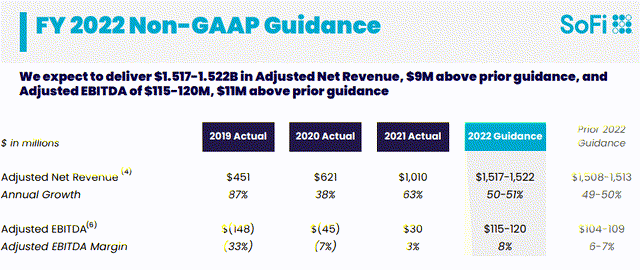

Sometimes when things don’t go as planned, you need to take a step back and see what lessons were learned. Jocko Willink has a famous word he would always say to his direct subordinates in the Navy: “Good.” It’s hard to look at SOFI’s share price and think the word good, but how about looking at their actual business and saying the word good? I am choosing to look at this situation as a trial by fire that SOFI has passed with flying colors. Their largest business segment was chopped in half and then operated at less than 50% of its Q4 2020 levels for the majority of 2022. SOFI faced adversity head-on, and was forced to make operational changes and build out its other lines of business. Without the student loan moratorium, SOFI may not have become as diversified as it did or may not have made the decisions they did since the beginning of the pandemic. We will never know those answers, but there are operational positives to this story. SOFI generated $621 million of net revenue and -$45 million of Adjusted EBITDA in 2020. Just 2 years later, without reprieve from the moratorium, SOFI is projecting that its annual revenue will have grown by 144.28% ($896 million) to $1.52 billion in 2022, while generating $115 million of Adjusted EBITDA, an increase of $160 million from where it finished in 2020.

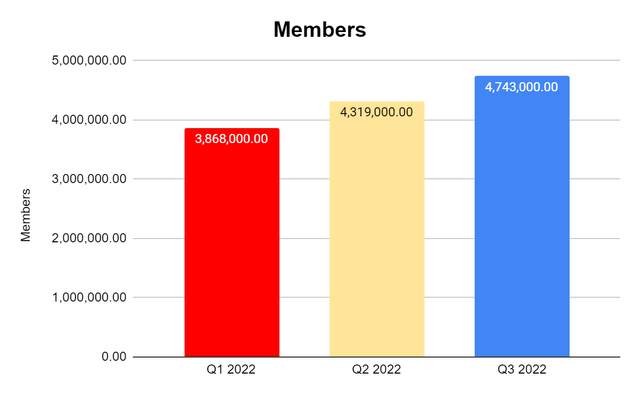

In addition to their overall results, I am also looking at other metrics that I find to be extremely positive. Over the past 6 months, SOFI has grown its member base by 22.62%, adding 875,000 people.

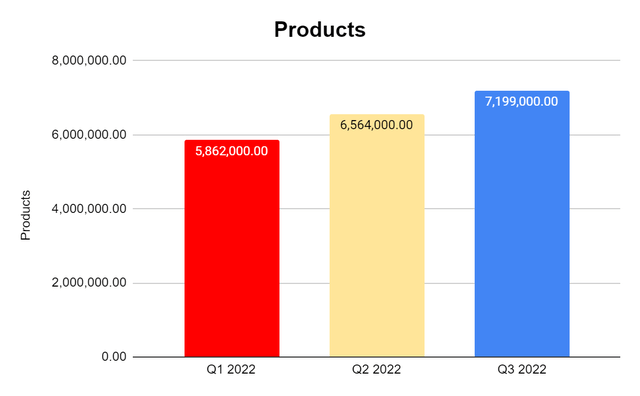

SOFI has added 1.34 million different financial products over the past 6 months.

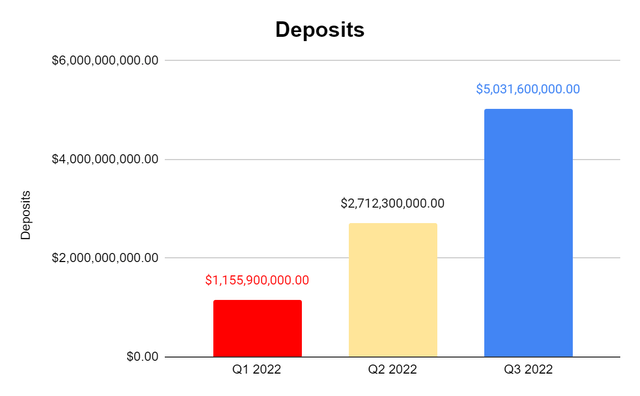

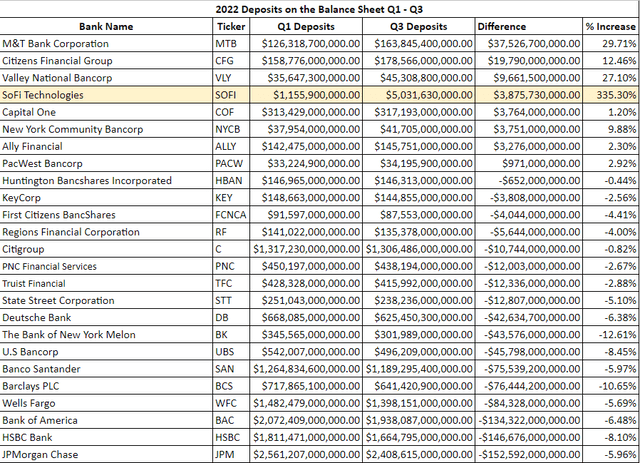

Since the close of Q1, SOFI has added $3.88 billion in deposits which is an increase of 335.30%. SOFI also added the 4th largest amount of deposits on a cash basis from 25 of the largest banks in the U.S. since Q1.

Steven Fiorillo, SOFI Steven Fiorillo, Seeking Alpha

What I am most excited about is that on a per-member basis, SOFI’s member base has increased by 22.62% since Q1, and the average member deposit, revenue per member, and revenue per product have all increased as well. The average deposit per member has increased by $762.01 (2.55%) since Q1. The revenue per member has increased by 6.26% ($5.21) over this period. This is a critical metric because as SOFI is growing it’s members, some would think it’s revenue per member would decline, but over the 6-month period, it’s increasing. This is a clear indication that members are utilizing revenue-generating services more, and/or cross-selling is occurring. SOFI has a large number of financial products and to think that they have 7.2 million products is astonishing. Since Q1, members have increased by 22.62%, and products have increased by 22.81%. I find it very impressive that the revenue per product has increased by 6.12% as well, which shows that SOFI is adding products that members are utilizing and listening to their customer base rather than adding products that people aren’t utilizing.

I think the crypto aspect is overblown, and Chris Lapointe specifically addressed this at the Credit Suisse conference. SOFI generated $3.85 million from its brokerage business, and crypto is a subset of this number, which is less than 1% of its overall revenue. He feels that SOFI is in full compliance of the mandate of its bank charter and all applicable laws when it comes to digital assets.

Conclusion

The path forward hasn’t been easy, and SOFI has withstood a trial by fire to prove its relevance. I am not under the impression that SOFI’s share price will get back to double digits anytime soon, especially after the latest news regarding the moratorium. I have always said that I am looking at SOFI as a 5-10 year hold, and this is an investment for 2030, not 2023, that is, unless something occurs to change my investment thesis. Anthony Noto and his team have delivered on every operational front despite external uncertainty. After reading the transcript from the Citi 2022 FinTech Conference, I am more bullish on SOFI’s future than previously, based on Anthony Noto’s commentary. It could be a bumpy 2023, but I am not seeing anything to make me believe that my investment thesis is incorrect from a long-term perspective. I may have been early, but that’s a mistake time can fix. SOFI not working out would be a different story, and I don’t believe that’s what is going to unfold over the next several years. I am still very long on SOFI and will continue to add to my position.

Be the first to comment