Sundry Photography/iStock Editorial via Getty Images

By Bradley Cipriano, Equity Analyst for I/O Fund

With Q4 earnings drawing to a close, many high-performing technology stocks have been penalized despite reporting excellent results. With macro headwinds taking center stage, many investors are simply tossing high performers aside as they look to de-risk.

We track numerous earnings reports from hyper-growth technology companies, and we believe that Snowflake’s (NYSE:SNOW) most recent results position the company as a premier software company. While there were some blemishes in the Q4 print that impacted near-term growth, the long-term story remains very much intact. In fact, key forward-looking metrics improved during the quarter, providing support for future sales and improving the quality of recently reported results.

However, there remains a difference between great businesses and great investments. Snowflake is a great business, but does its premium multiple pose a risk? In the discussion below, I outline Snowflake’s most recent results and what likely led to the recent sell-off, followed by a discussion of key metrics that warrant Snowflake a premium multiple. Given the recent market volatility, I believe that there is an upside in Snowflake’s valuation given a longer time horizon.

Snowflake’s Q4 Results and What to Look For in FY2022

We had previously released a deep dive on Snowflake’s product here. At this point, most would agree Snowflake is a solid tech product that promises to disrupt data warehouses by decoupling compute and storage, which reduces costs. Rather than focus on product in this discussion, I will instead focus on the company’s most recent financial results and its outlook going forward.

The key takeaway is that sales growth remains robust and high quality, however, the company’s consumption billing model can make growth lumpy in the near term. This is unique from subscription models in cloud because growth from consumption billings is non-linear: growth oscillates more than subscription models. Importantly, consumption billing is uncapped and can lead to stronger growth over the long term as customers find new uses for Snowflake’s platform and continue to ramp spending over time.

In the latest quarter, Snowflake’s Q4 product sales increased 102% YoY to $360 million, after increasing 116% YoY in the year-ago quarter. For the year, FY2022 product sales increased 106% YoY to over $1.1 billion. Despite the triple-digit revenue growth during the quarter, this represented the slowest pace of quarterly YoY growth since Snowflake went public. Considering Snowflake’s premium multiple (discussed in more detail below), the market was likely disappointed at a lack of acceleration in sales growth, which may have contributed to the recent sell-off.

Moreover, analysts had anticipated a slow-down in sales during the quarter and Snowflake still beat topline estimates by $10 million. Yet, this represented the smallest beat on record and was half of the $25 million beat reported in the prior quarter. I believe that management’s approach to prioritizing long-term growth over beating near-term expectations should be applauded, and speaks to the quality of management.

Looking forward, the company’s guide also came in largely as expected. In FY2023, product revenue is expected to grow 66% YoY to $1.9 billion, which was near the Street’s initial estimate of 67% growth. Since cloud is known for surpassing expectations, the in-line guide was likely viewed as a disappointment, contributing to the recent sell-off.

The lackluster guide was due to customer-friendly product improvements instituted in the new year which lowered the costs of using Snowflake’s platform but also lowered near-term topline growth expectations.

Importantly, the soft guide was not due to a lack of strong demand. Rather, management instituted customer improvements that are expected to be a near-term topline headwind (by lowering prices) but will ultimately lead to stronger growth over time as customers move more of their data onto Snowflake’s platform.

Essentially, the cost savings (which are crucial in the cloud, where data volumes grow exponentially) will lead to more volumes over time, leading to stronger growth in the long run. During the Q4 earnings call, management explained that the process improvements made during the year are expected to reduce costs for customers, which is also expected to reduce FY2023 revenues by about ~$100 million.

Specifically, CFO Mike Scarpelli stated on the Q4 call that “throughout this year, we are rolling out platform improvements within our cloud deployments. No two customers are the same, but our initial testing has shown performance improvements ranging on average from 10% to 20%. We have assumed an approximately $97 million revenue impact in our full year forecast, but there is still uncertainty around the full impact these improvements can have.”

SVP of Product Christian Kleinerman added that “The more improving the economics of the platform, the more use cases come to Snowflake. So we’re looking at this with a very long-term view” and CEO Frank Slootman explained further that the change is expected to stimulate more demand and that “we’ve done this over-and-over and it does stimulate demand but it doesn’t do it in real time, there’s a lag involved in this process“

Had management not made these process improvements, then its FY2023 sales guide would likely have been $97 million higher, and its guide of 66% YoY growth would have instead been close to 74% YoY, besting initial estimates. As mentioned above, these impacts are expected to be only a temporary headwind and will lead to stronger demand in the future. As I’ll discuss in more detail further below, the company’s forward-looking metrics support management’s claims that demand will remain strong going forward.

Continuing down the income statement, Snowflake’s Q4 adjusted product gross margin increased 500 bps YoY to 75%, while non-GAAP operating margin improved YoY from -24% to 5%. For the year, FY2022 adjusted product gross margin was 74% and non-GAAP operating margin was a loss of -3%. Looking forward, management expects FY2023 adjusted product gross margin to increase 50 bps YoY 74.5% in FY2023 and for adjusted operating margins to be positive at 1%. The market tends to award companies that are profitable with premium multiples, and Snowflake’s guide for 66% topline growth coupled with positive earnings warrants a premium multiple, in our view.

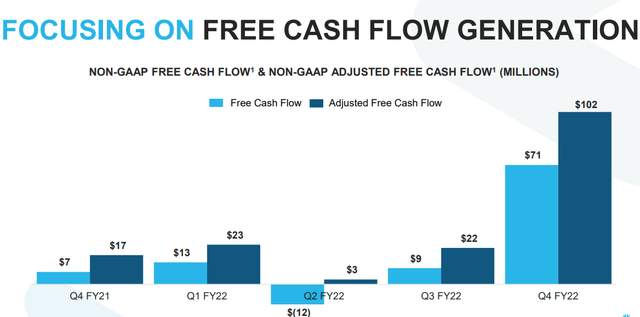

The company remains on track to meet its long-term guide for $10 billion in annual sales by FY2029 with 15% free cash flow margins. In fact, the company guided for 15% free cash flow margins in FY2023, driven by strong bookings. It is notable that Snowflake’s Q4 cash flows improved by $59 million YoY while stock-based compensation increased YoY by just $2 million during the quarter. Snowflake has kept its shareholder dilution under control and its fully diluted share count is expected to increase less than 1% in FY2023.

Despite the recent volatility in Snowflake’s valuation, we continue to believe that the company deserves a premium multiple. For instance, Snowflake’s growth is outsized relative to peers, adjusted earnings are expected to turn positive in FY2023 and cash flow growth is robust and is being driven by increased bookings, rather than excessive amounts of stock-based compensation.

Trends That Support a Premium Multiple

As noted above, management is focusing on long-term growth by reducing costs for customers in order to attract more volumes. This process improvement led to a slight miss on the company’s guidance, and the company has been penalized for this decision. However, I suspect that the market is too fixated on near-term growth and has largely ignored Snowflake’s high-quality forward-looking metrics, which improved during the quarter and outweigh the near-term growth headwinds.

Below I outline key metrics that improved, and that I believe support a premium multiple for Snowflake:

- Snowflake’s improving net retention ratio (NRR), which remains world-class

- Snowflake’s strength with enterprise customers, which are low-churn with large budgets

- Snowflake’s ramp in RPO bookings, which supports strong growth going forward

- Snowflake’s cash support for future sales, which improves the quality of its recent bookings and

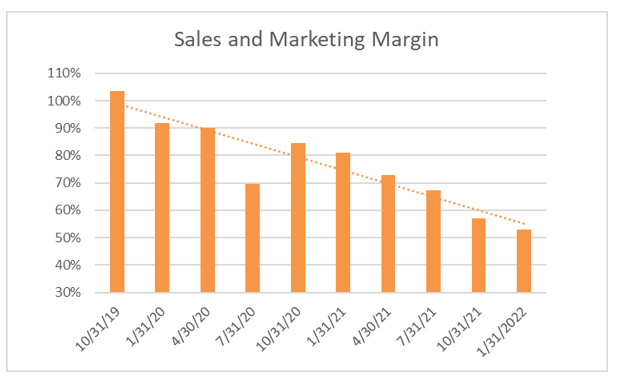

- Snowflake’s demonstrated leverage, as sales and marketing expense continues to decline relative to sales

Snowflake’s customer metrics continued to improve

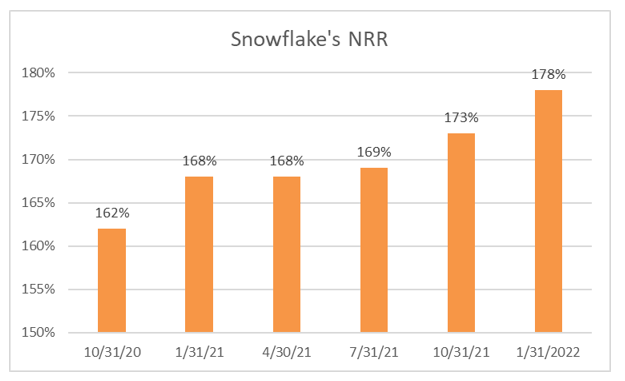

Snowflake’s net retention ratio (NRR), which measures how much existing customers are increasing their spending on the platform, net of attrition, increased to a record high of 178%. Importantly, Snowflake states that customer spending ramps over time once they start using the platform, implying that there is a long runway of growth ahead of the company.

Looking forward, management stated that its NRR will likely normalize in the near term, but will remain above 150% in FY2023. On the Call, CFO Scarpelli explained that six of Snowflake’s largest 10 customers grew faster than the company’s overall growth rate, highlighting how customer spending is largely uncapped (unlike a subscription model). The company’s NRR metric is one of the strongest in its peer group.

I/O Fund

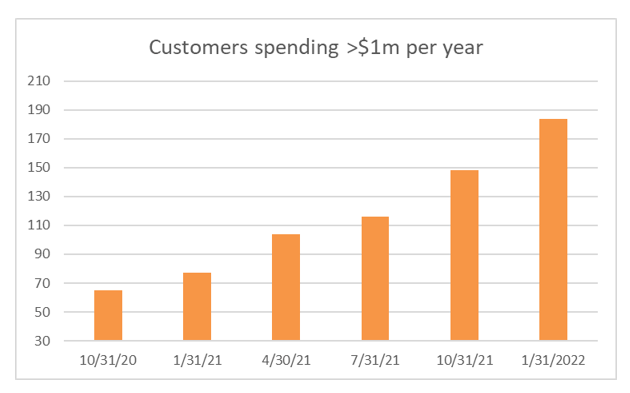

Coupled with the strong growth in NRR, Snowflake’s enterprise customers’ growth accelerated, and grew 139% YoY, above the 128% YoY growth rate in Q3. Highlighting the strength in enterprise customer growth, CFO Scarpelli explained that the company closed seven deals at or above $30 million during the quarter, up from just one in the year-ago quarter, demonstrating how the below chart includes some very large customers.

The significant contractual commitments highlight the large budgets migrating towards Snowflake’s platform, suggesting that customer consumption will continue to grow in the future. Enterprise customers generally have low churn and have large budgets, and generally pay a portion of their contracts upfront.

I/O Fund

Increasing support for future sales

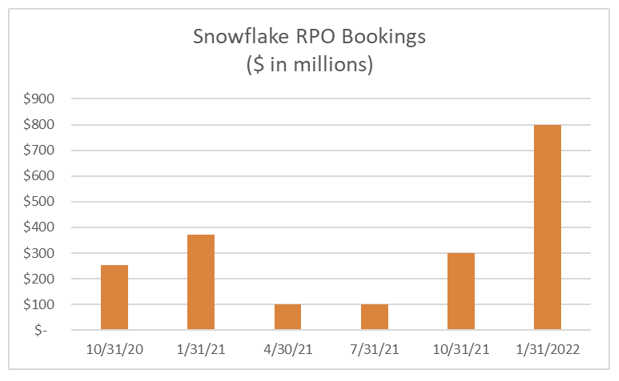

Adding further support to the company’s growth going forward is the rapid rise in contractual agreements for future sales. The remaining performance obligations (RPO) represent contracted sales that will turn into revenue in the future. RPO bookings, which is the sequential change in RPO, materially accelerated during the quarter. As shown below, RPO bookings surged by $800 million during the quarter, or nearly as much as the prior four quarters combined. The surge in RPO bookings provides contractual support for future sales, providing more visibility into future sales. Increased visibility into the future lowers uncertainty, and coupled with strong topline growth, is positive.

I/O Fund

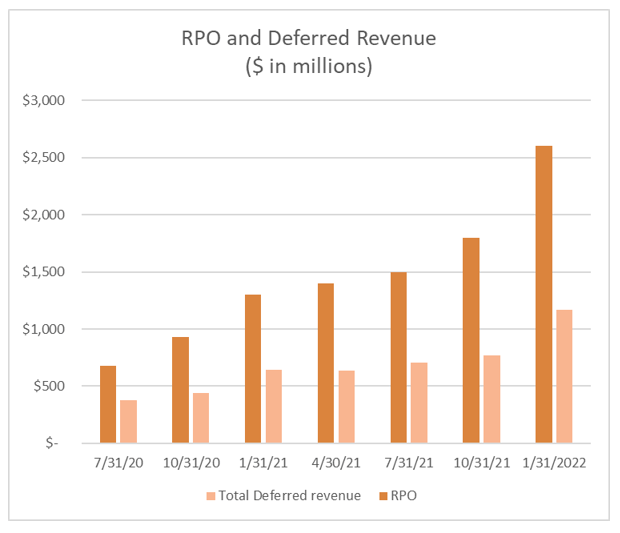

Another important trend to watch is upfront cash payments for future revenue. Cash is king and being paid upfront is a sign of strength and highlights the strong demand for Snowflake’s products. Furthermore, being paid upfront improves the quality of bookings because receiving cash from customers is a sign that they are committing to the contract, which reduces the risk of cancellations.

We can proxy upfront cash payments by observing trends in deferred revenue. As shown below, deferred revenue has increased in line with the growth in remaining performance obligations. Stated differently, the cash support for RPO implies that the recently reported surge in bookings isn’t just “fluff”, rather customers are committing cash to Snowflake’s platform for future services. Since it is better to have cash today than it is in the future, being paid upfront for future revenue improves the quality of future growth.

It is also noteworthy that RPO growth accelerated from 94% YoY growth in Q3 to 100% YoY growth in Q4, and deferred revenue growth also accelerated during the quarter. As mentioned above, Snowflake’s sales could have been more robust had management pulled from RPO and/or deferred revenue during the quarter. The acceleration in RPO and deferred revenue offsets the deacceleration in sales, to a degree.

I/O Fund

Revenues have outpaced sales and marketing expenses

The last trend that I will highlight that supports a premium multiple is Snowflake’s demonstrated leverage. For instance, Snowflake’s sales & marketing (S&M) expense has declined relative to sales throughout FY2022. Management highlighted that its sales cycle with its customers can be very long, spanning up to three years, and that customer spending usually needs time to fully ramp. Despite the long sales cycle and lag until customers have fully ramped spending, Snowflake’s S&M expense margin has improved throughout FY2022. Trends in S&M expenses continue to demonstrate leverage, highlighting the sustainability of Snowflake’s growth, which is positive.

I/O Fund

Discussion on Snowflake’s premium multiple

We have discussed several reasons why Snowflake is warranted a premium multiple. The company has grown sales over 100% in the current year, and growth is expected to be robust going forward. Furthermore, Snowflake has strong customer metrics, has reported an acceleration in forward-looking metrics along with cash support, and has demonstrated sales leverage despite having an elongated sales cycle.

The market sell-off following Snowflake’s relatively strong results is likely the result of the company’s premium multiple being too high in the current environment. The market is likely simply rerating the multiples it assigns hyper-growth cloud stocks. Looking ahead, Snowflake trades at 30x forward sales, which is similar to other leading cloud platforms such as Datadog (29x), Zscaler (28x) and Cloudflare (33x). However, Snowflake is expected to report strong growth for the foreseeable future and its sales multiple based on FY2024 sales expectations is 19x, which is slightly below the peer median of 21x.

While there is uncertainty related to the cadence of Snowflake’s growth, management has provided a long-term framework that they expect to grow at a 36% CAGR through FY2029 and reach $10 billion in annual sales with 15% free cash flow margins. This guide should be discounted but does provide the Street with a baseline on how to model the long-term growth of the company. The market pays a premium for companies that it can easily model. It is also noteworthy that Snowflake is already guiding for 15% free cash flow margins in FY2023, well ahead of its FY2029 guide.

While Snowflake’s valuation has been volatile in FY2022, the key metrics outlined above support a premium multiple. The company trades in line with its peers and starts to trade at a discount the further you expand your time horizon. We believe that Snowflake remains a premier company with a strong product and improving financials.

Conclusion

Snowflake reported strong results, but there were a couple of small blemishes that impacted near-term growth. Long-term, the story remains intact and forward-looking metrics suggest that growth will remain robust going forward. The company is also expected to be profitable on an adjusted basis next year, cash flows are positive and the growth in cash flows is being driven by sustainable trends (and not just stock-based compensation).

The recent volatility in the company’s shares is likely due to its premium multiple coupled with a slight deacceleration in near-term growth. However, if management can continue to execute, then there is an upside to its valuation over the long term. Forward-looking metrics such as RPO, RPO bookings, upfront cash receipts, and enterprise customer strength (coupled with rising NRR), highlight the strong position of Snowflake.

Be the first to comment