Snowflake Data Cloud da-kuk/E+ via Getty Images

First, we’ll do a deep dive into Snowflake and evaluate whether or not it looks like a good investment.

Then, we’ll explore whether there may be a better option for playing the explosive opportunity that is cloud data.

Snowflake

“Data cloud” has become an esoteric buzzword, but it was first coined by Snowflake.

Data is being mass migrated to the cloud rather than being stored locally. In the cloud, it can be stored, managed, integrated, shared and analyzed.

This is a key evolution in data management and I cannot overstate how much of a seismic shift this really is. Therein lies the investment opportunity.

Historically data has been fragmented and stored locally in silos where it often becomes trapped behind software-defined perimeters, systems and applications. This means that it is not always easily accessible and this severely curtails the utility of that data.

In the past, people have used different software applications to manage different data sets and sharing has been difficult. Sure, it was always possible to use an API to pull data from one system into another, but that is like sucking data through a straw with all sorts of other issues including latency and costs. Alternatively, it was possible to do some heavy lifting by way of file transfer protocols, but that comes with governance problems around security and privacy, not to mention the need to surrender custody of the data.

Snowflake is now able to facilitate data sharing via the cloud with little or no friction. It understands data relationships and most importantly it is able to unlock a great deal of value from a company’s data.

We now have the concept of the ‘time value of data’. Essentially, data often has its highest value when it is fresh. Think about investing in the stock market – you want to know where shares prices are now, not where they were an hour ago or yesterday. And so, with all data, as it ages its value decays.

Snowflake enables the data owner to unlock all of that value.

To that end, Snowflake offers a number of data services including Snowflake Marketplace. This enables data owners to make their data available to others (which they may choose to do altruistically or in order to monetize that data).

For example, Starschema, a data services technology company, utilized Snowflake during the Covid pandemic. The team created a robust epidemiological data set and made it available, for free, to thousands of companies to help inform better decision-making around responses to the rapidly evolving yet entirely unprecedented pandemic situation.

By utilizing the cloud, different data may be marketed to whoever needs it. The value of the data may be further enhanced by aggregating it with other data sets. Data may be linked horizontally or vertically depending upon need.

So as an auto manufacturer, for example, you know about issues that exist in your own supply chain, but how much visibility do you have over supply chains generally. How useful would it be for decision-making purposes if a company were able to identify bottlenecks impacting the industry more generally or the economy more broadly? In the past you had a flashlight in a dark cave illuminating a tiny part in a narrow beam of light, now with Snowflake the entire cave is illuminated.

This linkage of data in the cloud is graphically demonstrated below and resembles a snowflake. It is known in the computing industry as a snowflake schema and it was the inspiration for the name of the company that we are considering today.

Consider this, if all companies make large volumes of data available to each other, you now have a data networking situation (almost like social networking on Facebook, but this time with valuable big data). Snowflake’s data cloud is that network. The data cloud will paint a detailed picture of what is happening socially and economically at any given time.

Information is king. This in turn creates a ramp to enhance productivity, grow the economy, and that in turn, will result in the creation of more data. That is the fly-wheel that will drive Snowflake in the future.

Of critical importance is that almost every company has valuable data of one kind or another, so Snowflake is democratizing big data. Snowflake now provides the infrastructure to monetize the data whereas in the past this was not easy to achieve or not even possible to achieve.

Every business will evolve to have a tech division (even if that is only a small function of a single person) and this will produce a new revenue stream from data supplied in addition to sometimes itself being a consumer of the big data.

A whole new data industry is opening up which never existed before.

Now consider this, third parties will be able to create tools that utilize the data and then look to sell those tools to the market. Think the Apple App store but a commercial version with industrial data-driven tools. This will all be built on the Snowflake data cloud infrastructure and it will facilitate the sale of those apps. A whole new software industry will evolve around the data cloud.

Snowflake has an opportunity of becoming ubiquitous because of its unique offering. A company has achieved ubiquity in my mind when customers say “I need it. You don’t have to sell it to me. I know what it is, what it does and how it adds value.” This is what excites me about Snowflake.

Microsoft was a beneficiary of ubiquity with its Windows and Office products. Google was a beneficiary of ubiquity with its search offering. Same with Amazon for e-commerce, eBay for online auctions and Facebook for social media.

Snowflake is now part of every Cloud Data Warehousing (CDW) evaluation, alongside offerings from AWS (Redshift), Azure (Synapse), Google (BigQuery), HPE (GreenLake) and a select few others.

Snowflake started life as an AWS customer but was concurrently a competitor of AWS RedShift which was launched in 2013 by Amazon. This is a strange situation which an investor may be concerned about. After all, when a company owes its existence to the infrastructure of a major competitor that appears to be a vulnerability.

However, there is nothing to fear in this regard. Snowflake has mitigated this risk by evolving to also run on Microsoft Azure and the Google Cloud Platform. Consider that prior to its initial public offering, Snowflake disclosed that it had committed to spending $1.2 billion through July 2025 on AWS cloud infrastructure services. AWS wants and needs customers like that. This gives Snowflake a great deal of power in this relationship, and indeed with both Microsoft and Google who will be competing for its business.

While Redshift and Snowflake were fiercely competitive back in 2015, Amazon has in recent years taken a more pragmatic view in an effort to cement its relationship with Snowflake for fear of losing its business to Microsoft and Google. AWS now sees its relationship with Snowflake as one of its strategic allies. It seeks to provide differentiated, best-of-a-kind solutions for mutual customers.

As a result of this shrewd change of approach on the part of Amazon, Snowflake deeply invested in technical integrations with AWS including integrations with AWS Lambda (a serverless event-driven compute service), AWS AI for data analytics (AIDA), Amazon SageMaker (a machine learning service) and AWS PrivateLink (allowing customers to privately access AWS services without using public IPs).

The latter was key to Snowflake selling into the enterprise segment of the market, so it can be seen that AWS and Snowflake have a symbiotic relationship. Both feed off the success of the other. Combined they are stronger than the sum of their parts.

In fact, Snowflake was the only partner of AWS at the launch of SageMaker Canvas (a visual, no-code, machine learning tool that allows businesses without machine learning expertise to generate predictions).

The relationship is becoming stronger still. AWS and Snowflake signed a strategic collaboration agreement in mid-2020, with both companies increasing their investments in partner sales, marketing and alliance teams globally. Now Snowflake is a key partner, if not the largest strategic partner, of AWS. In fact, AWS and Snowflake actively co-sell each other’s services.

Snowflake operates on a consumption-based sales model and since cooperating with AWS to jointly serve the same customer base, consumption rates have accelerated. Similarly, if Snowflake wins a cloud data contract and has AWS as the underlying cloud service provider, AWS receives a benefit from the consumption of Snowflake in addition to the data consumption of the customer. It’s a win/win scenario.

It reminds me of the parable of the long spoons. In hell, there are angry hungry people around a large table in the center of which there is the most wonderful food in a pot. Each person has arms that are very long straight spoons. Each person is able to scoop-up the food with the spoon, but due to the length of the spoon, they are unable to place the food into their mouth. This is torturous and results in unimaginable suffering. By contrast, in heaven, there are people around a table with the same long spoons for arms and a pot of wonderful food in the middle. Here they have learned to feed each other. They are very happy and no one is hungry.

AWS and Snowflake have learned to feed each other and both are happier and more successful as a result.

Snowflake’s revenue model is consumption-based and thus harder to predict than a subscription-based SaaS business. However, the service is incredibly sticky and switching costs act as a barrier to change. Accordingly, while contractually less certain, the model does produce high levels of recurring revenue.

Financial year 2022 ended with impressive net revenue retention rates and beats on top-line growth, operating margin, and GAAP earnings per share estimates. It reported fourth-quarter revenue of $384 million, an increase of 102% on a year earlier. This followed an extraordinarily strong third quarter (sequential growth was up 15%) which indicates that this is no blip, but a permanent upward trend. GAAP losses per share were $0.43 but this was largely due to its platform optimization rollout in the quarter, something that will improve warehousing scheduling, software, and hardware. Long story short, the future is looking very bright.

Any business is only as good as its leadership team. To that end, it is important to provide commentary on the man in charge of Snowflake.

In May 2019, Frank Slootman (pictured below), the retired former CEO of ServiceNow, joined Snowflake as its CEO and Michael Scarpelli, the former CFO of ServiceNow joined the company as CFO. This is a proven team.

Frank Slootman, Snowflake Inc.

Frank Slootman at the helm is reassuring because he is a no-nonsense CEO with a track record of procuring strong corporate results. He is level-headed and entirely pragmatic in the way that he runs the business. Slootman surrounds himself only with competent people and if anyone fails to make the grade then they are out. When he landed at the company it was made clear to the board that there would be a purge of any dead-wood and this process was completed within his first 90 days.

However, I must caveat my appraisal of Slootman with a word on the remuneration culture at Snowflake. Slootman received a compensation package that includes 13.7 million stock options exercisable at $8.88 per share which, over the four-year term of his contract, when the shares were trading at $400, was equivalent to $1.2 billion per year of service. This means he would make around $100 million per month, over $23 million per week, $4.6 million per day, and $577,000 per hour.

Remember that Snowflake is still not a profitable company! What are they thinking?

Without paying stock-based compensation of $605m in financial year 2022, Snowflake would have had an income statement loss of only -$75m rather than -$680m.

Many tech companies argue that stock-based compensation is necessary to attract the right people and that if it were not offered then the company would struggle to compete.

Honestly, I struggle to comprehend how it is that shareholders fall for this kind of nonsense. This is nothing more than a wealth transfer from shareholders to the senior executives. Stock-based compensation is by far the most abused aspect of US corporate finance today. In my mind, it is tantamount to market abuse because it could never happen in a private company. Regulators need to introduce safeguarding measures to protect the interests of shareholders because most are blissfully unaware that their hard-earned capital is being transferred into the pockets of greedy executives.

For me there are two types of CEO:

-

There are the CEOs that have a long-term connection to the company, have a moral compass and do everything in their power to align their interests with those of their shareholders. Warren Buffett is the perfect example, he has led Berkshire since 1965, pays himself a mere $100,000 salary and the rest of his wealth is created when his shares in Berkshire Hathaway, that were not gifted to him by way of SBC but paid for with his own money, perform well.

-

Then there are the CEOs that are short term and who seek to enrich themselves at any cost even if it is not in the best interests of shareholders. I fear that Slootman, having accepted such an outrageous four-year contract and remuneration package, falls into the latter category.

Having said all of that, Slootman is a straight-shooter and tells it like it is. This is far preferable to the approach adopted by most tech CEOs who follow the philosophy of “fake it until you make it”. With Slootman you know exactly where you stand. To that end, despite strong numbers being announced in the 2022 year-end reports, the company presented a more conservative outlook than the market was expecting.

This brings me to the issue of valuation. There is no doubt that the business is sound with very robust foundations. But even the best company at the wrong price is a bad investment. Is Snowflake good value as an investment?

Snowflake Valuation

Snowflake is not yet profitable and so it is impossible to value the business based on earnings.

The stock trades at 13x book, but this multiple is less relevant because the business is heavily invested in developing its own intangible assets which are not capitalized under accounting rules, thereby distorting all metrics against book value. On the same basis the return on equity number, when the business moves into the black, will be exaggerated to the upside. So, let’s ignore book multiples.

The sales multiple is more difficult to ignore. It is eye-wateringly high. Put it this way, at 54x revenue, if the company had no operating costs, no capital expenditure, no funding costs and no taxes to pay it would still return an investor less than 2% annually (1.85% to be precise). With all of its costs factored into the equation an investor’s earnings yield will be significantly less. Although not yet profitable, the important thing to note is that when a company is capitalized at 54x sales the earnings yield can never be higher than 1.85%.

That doesn’t meet the hurdle rate of any intelligent investor.

All of this means that one of two things need to happen in order to bring that sales multiple down to an acceptable level for an investor. Either the sales numbers need to rocket higher or else the price needs to adjust lower.

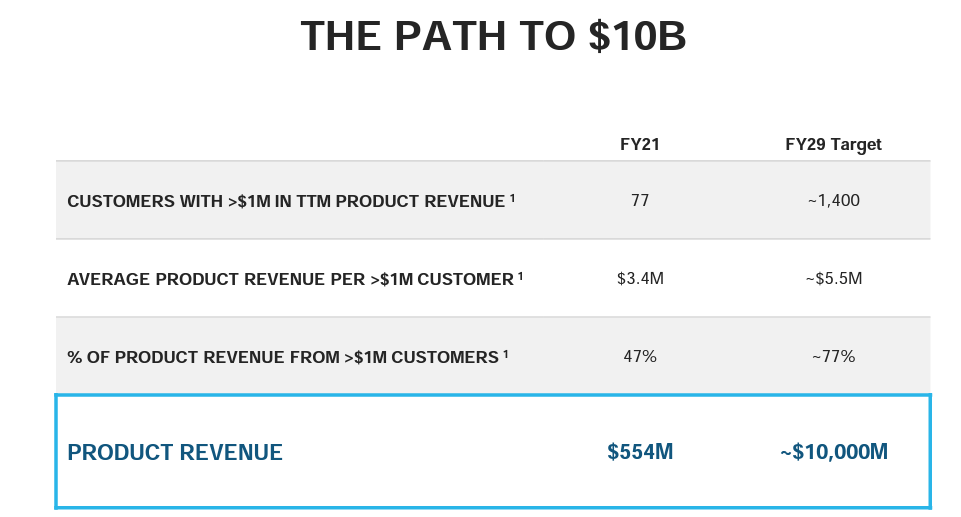

We know what the sales growth looks like because Snowflake has given long-term guidance. As articulated at its investor day presentation in June 2021, Snowflake targets product revenue of about $10bn by financial year 2029 ($1.2bn in 2022). This would be an impressive 35.4% CAGR.

Snowflake Inc.

However, today’s share price implies a growth rate of more than 100% CAGR (as I shall go on to explain below). So, either the market value assumed the company has understated its growth projections by a multiple of three – something that I have never seen in my decades of investing, or else the market has overpriced a new exciting company – something that I see very often. Occam’s Razor would suggest that the most probable explanation is the correct one.

Let me leave you with this lesson from history. We can all agree that Amazon is a great company. The excitement that it created around its IPO was similar to that of Snowflake. Amazon’s IPO price was $18 in 1997. It shot up to $105 by 1999 on the back of over-exuberance in the market, then it collapsed to under $6 in 2001. It took a full decade (2009) before it re-touched $100 again.

Amazon at the back end of the 1990s looks a lot like Snowflake today. Finding a great company is only a part of the success formula. Buying it at the right price is the key ingredient that so many get wrong.

In its 24th August 2021 North America Equity Research note, JPMorgan stated “We expect Snowflake’s rare combination of high growth at a large scale to continue… The path to $10B in revenue with a 15%+ FCF margin should remain in focus, in our view, as the opportunity continues to develop.”

So analysts believe that Snowflake’s 2029 target revenue is achievable, although it is far from being a home-run.

Snowflake bases the projections around achieving 1,400 customers each producing revenue of over $1M (there were 77 such customers in 2021). It targets 77% of product revenue coming from such customers by 2029 (47% in 2021).

These are ambitious targets. Perfectly achievable, but unlikely to have been understated by a factor of three.

The surprise in its guidance was that Snowflake targets 10% in operating margin at the $10 billion revenue scale which looks low for a tech service provider (Apple and Google both consistently managed 26% net margins for the past decade). Perhaps this offers a clue to the costs associated with large-data warehousing and processing which will prevent Snowflake from achieving the kind of operating leverage enjoyed by other tech companies. If so, it will impact its valuation.

With operating margins of 10%, where will net margins be? Perhaps 6.5% – 7.0% (these numbers are consistent with companies such as Hewlett Packard Enterprises, which is more mature than Snowflake and also in the data cloud space – more on this below).

So let’s project forward to 2028. Snowflake has achieved all of its targets. At 7% net margin on $10bn revenue its net earnings are $700m. Now consider that it would have been growing at an average of 35.4% per annum for 7 years and that the rate of growth always slows with scale (it achieved 100% this year), so let us generously assume that by 2028 it is growing at about 25% a year to achieve that average. On that basis, depending upon the exuberance of the market in 2028 it may reasonably be trading on an earnings multiple in the range of 25x to 35x. That would imply a market capitalization in the range of $17.5bn to $24.5bn in 2028. Today it trades on a market cap of $67.3bn.

These numbers don’t stack up. Today’s market cap, and by extension the share price, is way too high.

The speculators amongst us will argue that if the share price doubles then who cares about fundamentals, and they will blindly keep throwing money at the company. I would argue that if fundamentals are not right then except for the Ponzi effect, whereby each wave of speculators fuels the gains of the last wave, what will drive the price higher?

If you have never read the book “Expectations Investing” published by Columbia Business School and written by Mauboussin and Rappaport, then I commend it to you. It encourages investors to ask what business expectations are priced into a security and are they realistic. In the case of Snowflake, I think that we have answered that question in the negative.

The problem is that Snowflake is a great company but that it is currently at the wrong price. A good company at the wrong price makes for a bad investment (for more on this see my commentary on Microsoft in this Seeking Alpha article: Time To Pivot).

CEO Slootman seems to reach the same conclusion as me.

The stock sky-rocketed post IPO and increased 175% on its first day of trading before ending its first week 100% higher than the IPO price. I have already written about the candor of Slootman. When questioned about this price action and asked if he felt that he had left too much money on the table by not launching the shares at a higher price, he responded:

“We need to live with our investors for a very long period of time, so we try to sign up people that can hold multi billion-dollar positions, people that don’t chase momentum up or down, and people that want to sign up for the mission for five or ten years. That’s a very different crowd from the people you saw on [IPO day] that were chasing this thing up. They were buying, you know, at any price. There was zero discipline.”

Irrational exuberance amongst the speculative crowd, many of whom have no idea how to price a corporate entity, has pushed the share price well beyond its intrinsic value. That the share price subsequently continued its crazy rally to $400 is mind-boggling and speaks to the madness of the market in recent years (think GameStop and AMC).

A month ago at the beginning of March 2022, the price dropped back to $166 which I would suggest is far closer to fair value.

The pendulum will continue to oscillate back and forth for a while until the share price finds its true equilibrium.

At today’s price of $235, implying a market capitalization of $67bn, it is still overpriced.

Look at this from another perspective. If you buy shares today with the company valued at $67.3bn, and if you were looking for a risk-adjusted return of 10% per annum (remember that inflation is over 8% today, interest rates are set to climb fast with the fed signposting at least 2.75% by next year and the current equity risk premium is circa 5.37%, so 10% return is not an unreasonable target for an equity investor) then you would need Snowflake to have a market capitalization of $131bn in financial year 2029. This is the same year that Snowflake is targeting $10bn in revenue which, at an operating margin of 10% implies a net margin of not more than about 7% and so a $131bn market cap would require it to be trading at 187x earnings.

Really? How likely is any of this? Remember that investing is all about calculated risk-adjusted returns. The odds do not look stacked in favor of the investor.

Even if the company exceeded its own guidance and achieved a mind-blowing constant 100% annual compounded growth, it would still take another 3 years for the company to grow into today’s share price!

In conclusion, I like the investment story for Snowflake and, save for its unpalatable profligacy in terms of remuneration, I would consider buying the stock if and when it reached an attractive price. We are a long way from that level now. Accordingly, I would like to throw out some alternative investment ideas for you to consider, the last of which is in my humble opinion the jewel in the crown.

Alternative Data Cloud Investment Ideas

Two very interesting alternative investment ideas for playing the data cloud, if you can’t get comfortable with Snowflake, are:

- Hewlett Packard Enterprise

- Micro Focus International

Hewlett Packard Enterprise

If you buy into the data cloud concept, but can’t justify paying today’s share price for Snowflake (or perhaps you wish not to invest in a company that is so profligate in relation to stock-based compensation and executive remuneration), then there are other options.

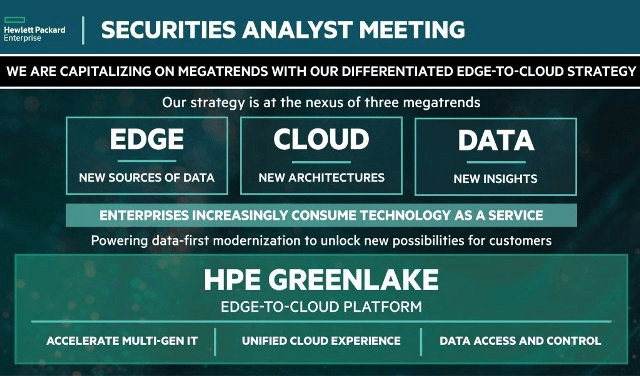

Hewlett Packard Enterprise (HPE) has a data cloud offering named GreenLake which is in direct competition with public cloud data warehouses such as Snowflake and Databricks (due to IPO later this year).

It should be noted that HPE is not a newcomer to cloud data. The GreenLake platform has over 1,200 customers and has contracted more than $5.2bn of business. This arguably puts it ahead of Snowflake in the data cloud space.

It is not a pure play investment in the data cloud space. If you want pure exposure to the data cloud then this is arguably not for you. But if you want to hedge your bets with a company that will reap the benefits of the data cloud but with a diversified range of products and services that will enable you to avoid concentration risk then it is worth considering.

HPE is a company that is both profitable and cash flow positive. It has revenues of $27bn (Snowflake targets $10bn by 2029). Its stock-based compensation only amounts to 10% of its bottom line earnings which again is far more palatable than Snowflake’s profligacy. It only trades at 0.8x sales (compared to 54x for Snowflake), which on a net margin excluding exceptional items of around 6% provides an investor with an earnings yield of 7.5%. It also pays a 3% dividend for anyone interested in income stocks (compared to no dividend at Snowflake).

Hewlett Packard Enterprise

HPE is pushing into high-growth software markets including unified analytics and data protection. This is part of the accelerated approach of HPE to transition to a cloud services company.

Antonio Neri, HPE president and CEO, said:

“The $100 billion unified analytics and data market is ripe for disruption, as customers seek a hybrid solution for enterprise datasets on-premises and at the edge… HPE provides customers with an unparalleled platform to protect, secure, and capitalize on the full value of their data, from edge to cloud.”

Neri recruited VMware executive Fidelma Russo as CTO and effective GreenLake head. So the team is good.

HPE offers a range of ancillary services under the Ezmeral branding including an orchestrated Kubernetes app modernization platform, unified analytics and machine learning. More particularly, in order to match the Snowflake Marketplace, HPE has its Ezmeral marketplace.

In short, HPE offers a compelling choice to customers wishing to harness the power of the cloud data. It also offers an interesting investment opportunity as an alternative to Snowflake.

Micro Focus International

There is an even more interesting alternative. HPE spun off HP Enterprise Software back in 2017 and sold it to Micro Focus International a British company dual listed in both London and New York (MFGP)(London: MCRO).

Today HPE and Micro Focus have an alliance and together offer a suite of services to customers.

Micro Focus stands to be a major beneficiary of the evolution of the data cloud.

You may never have heard of Micro Focus but it is one of the world’s largest enterprise software providers. It has 40,000 customers worldwide and so no concentration risk there. Its customers are also high-quality names, including 98 of the Fortune 100.

Now get this, in 2021 it landed large new contracts from both Amazon (AMZN) and Snowflake (NYSE:SNOW). So Micro Focus not only derives business revenue from its strategic partner HPE GreenLake, but also from Snowflake and AWS which is particularly significant (more on this later).

As Snowflake, HPE and AWS scale up cloud data, Micro Focus wins on all counts.

I can sense that you are probably becoming very interested at this point and want to learn more about Micro Focus.

In essence, it delivers trusted and proven mission-critical software that keeps the digital world running.

With over 1,800 patents issued and 900 pending, Micro Focus is one of the most innovative companies on the planet. Its extensive patent portfolio highlights Micro Focus’ ingenuity and ever-evolving technology. It is committed to creating new and better solutions that help its customers thrive.

When compared with other software companies (SAP, Adobe, Microsoft, Salesforce, and the like), the Micro Focus patent portfolio stands in the top 8. That is a huge competitive advantage providing a large runway of opportunity ahead.

Patents include encryption, artificial intelligence, IT security and digital language solutions, and solutions that ease the path of data migration from local storage to the cloud (Micro Focus is assisting AWS in this regard).

The breadth of Micro Focus’ patent portfolio demonstrates three important things:

-

Its commitment to continually evolving its product set to help its customers thrive.

-

Long-term vision (it takes two to four years to get a patent granted).

-

Its strength and viability. Customers and investors can count on it being around for the long term – and that’s something that no tech start-up can claim!

The best thing about Micro Focus is that its shares are currently offered at a bargain price, due primarily to issues that arose in relation to the integration of the two businesses following its acquisition of HP Software in 2017. This led to the resignation of CEO, Chris Hsu, and executive Chairman, Kevin Loosemore. It also resulted in major restructuring costs which negatively impacted the share price for a couple of years.

The good news is that the restructuring is now all but complete but the share price has not yet adjusted to reflect that.

Better still, as a part of the restructuring Micro Focus conducted a strategic review. It consolidated costs and 60 overhead locations were reduced to 5 global and regional centers. The company, therefore, emerges leaner and stronger than before.

Part of Micro Focus’ three-year plan was to transition more software products into a Software-as-a-Service (SaaS) model to have more predictable revenue. That strategy is paying dividends but will take a while to appear beneficial in its financial reports due to the difference in the timing of revenue recognition. Therefore, investors today should be prepared to show patience and to wait for this improved strategy to pay off.

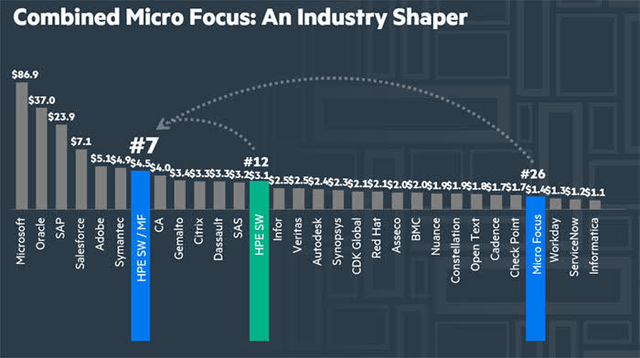

Micro Focus, combined with HP Software, created one of the world’s largest pure-play software companies – essentially combining the #26 with the #12 to create the #7 as the diagram below demonstrates.

In 2017, at the time of the acquisition, these two businesses had a combined enterprise value in excess of $16.7 billion USD. This was close to a 50/50 split based on the acquisition terms. Yet today their combined enterprise value, trading as Micro Focus International, is only $5.9 billion. Said differently, for an investor today, you would be getting two formidable companies for less than the price of one of them back in 2017.

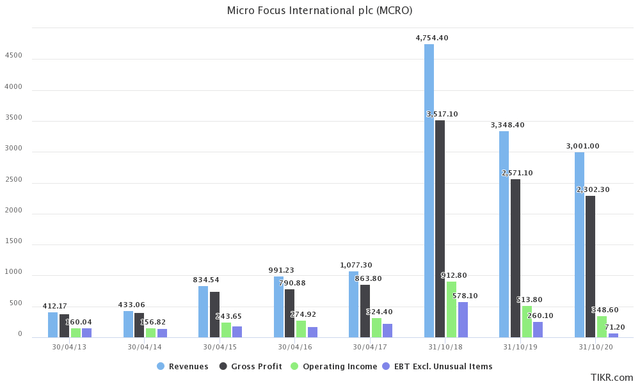

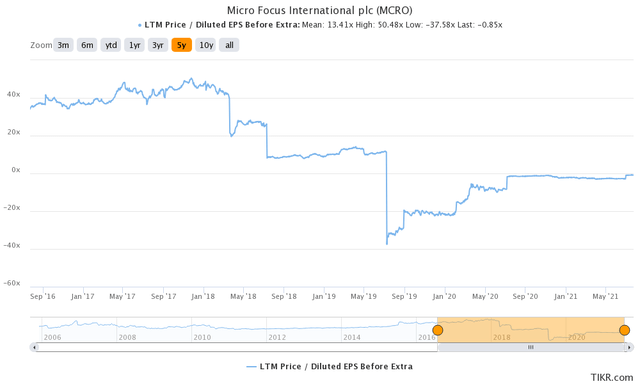

The chart below demonstrates that for Micro Focus the post-merger topline expanded by almost 5x from $1bn to almost $5bn. Since then it has fallen back to $3bn, but still well ahead of where it was in 2017. So sales multiples are much improved.

TIKR

The chart also demonstrates that restructuring costs associated with the integration of the HPE businesses have taken their toll on margins. Although topline revenue in 2020 was 3x where it was in 2017, operating income was flat and, due to the debt expansion of the business, financing costs have eroded Earnings Before Tax which are now 66% lower than where they were in 2017.

Restructuring costs are behind us and as debt is paid down the financing costs will reduce also. Margins will improve markedly from here.

At the time of the merger, the gross margin was 80% and it is still at a very respectable 76%.

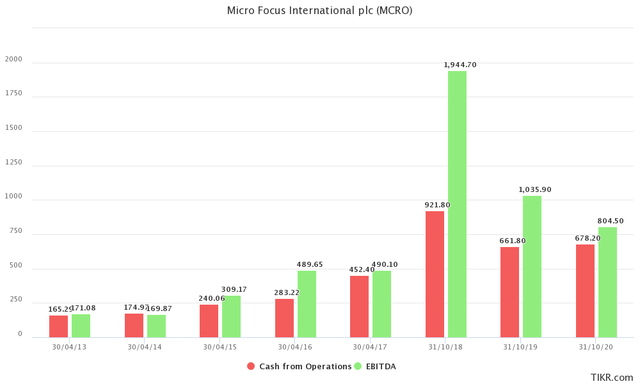

Although net earnings have been depressed by restructuring costs, much of which is non-cash based write-downs (heavy amortization and depreciation of assets), free cash flow and EBITDA are well ahead of where they were in 2017. Restructuring is now all but complete and so the future is looking very bright.

TIKR

Better cash flows will enable the company to pay down its debt relatively quickly and, if this happens, financing costs will reduce dramatically thereby amplifying earnings.

The not so good news relates to irrational executive decisions around allocation of capital:

-

Micro Focus has resumed dividend payments having suspended the dividend in 2020 during the pandemic. Paying down debt would be a far better use of capital than paying out dividends at this stage of the turnaround.

-

Similarly, the company has been repurchasing its own stock which is also odd. On the one hand, it indicates that the company believes that the shares are of good value at the current level, but why allocate capital to share repurchases instead of using it to repay debt? What they are doing amounts to a debt for equity swap (choosing to keep debt on the balance sheet while reducing equity through repurchases).

If net margins return to mid-20s within the next couple of years and if the topline stabilizes, then we are looking at net earnings of circa $600m. The chart below demonstrates that prior to the HPE integration issues Micro Focus was averaging a valuation at 40x earnings. Let us be conservative and pull that back to 25x. $600m earnings at 25x multiple suggest a market cap of $15 billion or almost 300% of today’s valuation. That’s a nice investment return over the coming years.

Now consider that if Micro Focus is able to increase revenue back to 2018 levels of almost $5bn and if the market ascribed a multiple of 40x earnings as it had prior to 2018, now you have a $40 billion market cap which is 800% higher than today.

Goldman Sachs has upgraded Micro Focus stock, rating the shares a “buy” and nearly doubling its price target to £6.50 GBP (+65% on where the shares are trading at the time of writing, circa £4.00 GBP).

In its note, Goldman described Micro Focus as a value stock trading for less than 10 times projected 2022 free cash flow and predicted that if current trends of investors backing off of high-flying growth stocks continue, and there is a “rotation to value” Micro Focus shares could benefit from that.

I believe that Goldman is right that there are attractions here. Micro Focus shares actually look like a pretty good bargain already today.

At the current valuation level, there is also a great deal of potential for Micro Focus International to become a takeover target.

Consider this, on 3 March 2021, the Micro Focus signed a strategic commercial agreement with AWS to accelerate the modernization of mainframe applications and workloads of large public and private enterprises to the AWS Cloud. As a part of that deal, Amazon has subscribed for up to 15.9 million of Micro Focus shares at £4.466 GBP a share, the vesting of which will depend on the level of software revenues generated by AWS for Micro Focus. This means that Amazon may soon have a 4%+ stake in Micro Focus and it will be driving revenues in order to reach the requisite threshold.

Chief executive Stephen Murdoch said the Amazon deal offered the potential to drive new customer adoption and growth for an extended period. It will certainly be a meaningful contributor to the group’s revenue ambitions.

The question in my mind is this – if Amazon has already negotiated a deal that will see it acquire over 4% of the Micro Focus stock, then if Amazon witnesses the value that Micro Focus International brings to AWS why wouldn’t it simply acquire the entire company? It is certainly complementary to the AWS service offering and of a size that would make it easy for Amazon to swallow.

This stock shows an asymmetric skew to the upside which is what every investor ought to look for and it will be a huge beneficiary of the movement of data to the cloud.

With AWS, HPE and Snowflake as customers, and at a very attractive valuation, Micro Focus International could be the smart play in the data cloud area.

Conclusion

Snowflake is without doubt an innovative company with a great future ahead of it. However, it operates in an industry amongst some strong competitors. To that end, it should not be viewed as the next Amazon, eBay, Microsoft or Facebook. Those companies all grew strongly on the back of having a de-facto monopoly in their field and a far wider moat that Snowflake can ever hope for. Another distinction is the operating profit margin. If Snowflake is only targeting 10% then there is a chance that it will come in lower than that. Either way, other fast-growth tech companies have enjoyed the benefit of operating margins in excess of 25% which has acted as a spring board for share price growth. Snowflake won’t have that valuation boost. Additionally, as mentioned, an investor needs to be wary of any company that drives a wedge between the interests of the senior management and that of the shareholders. The remuneration policy at Snowflake is obscene. Other companies guilty of this kind of behaviour include Palantir and Twitter. I have no idea why the US tech sector behaves in this way. One thing is for sure, the companies that adopt this kind of distasteful behaviour always underperform so caveat emptor! Finally, Snowflake is vastly overpriced at the moment. The sensible thing for an investor to do in these circumstances is to keep the company on a watch list. At some point, an opportunity will inevitably arise when the risk/reward profile is sufficiently attractive to open a position. The time is not now.

Hewlett Packard Enterprises is an interesting alternative to Snowflake. Its valuation is far more reasonable meaning that share price growth will not face the headwind of multiple contraction. Its data cloud business already has contracted revenue 5x that of Snowflake’s topline in the most recent reporting year and its customer base is large and impressive. HPE also has the benefit of revenue streams from other segments outside of the data cloud which offers an investor a more diversified opportunity with less concentration risk.

The jewel in the crown of this group of companies is lesser known Micro Focus International. It has Snowflake, HPE and AWS as customers which means that as they successfully grow their cloud presence Micro Focus will benefit. AWS has seen the value in the Micro Focus business and has structured the option to take a 4% stake (perhaps with a view to a complete acquisition at some point). Goldman Sachs believes that it is worth at least 60% more than its current share price. My humble opinion, based on the calculations above, is that in the course of the next few years it will be trading up at over 300% of its current price. It is now leaner and stronger than ever having acquired and integrated the Hewlett Packard Software (HPS) business, yet its market valuation is now lower than either its business or the HPS were prior to the 2017 acquisition. It has a vast portfolio of very valuable patents which provide it with a great moat and much future value. In short, there is a very favourable asymmetric skew to the upside on this stock such that the downside risk is tiny and the upside potential enormous. This is exactly the kind of opportunity every great investor looks for.

Food for thought. Good luck with your investing!

Be the first to comment