Diy13/iStock via Getty Images

Thesis

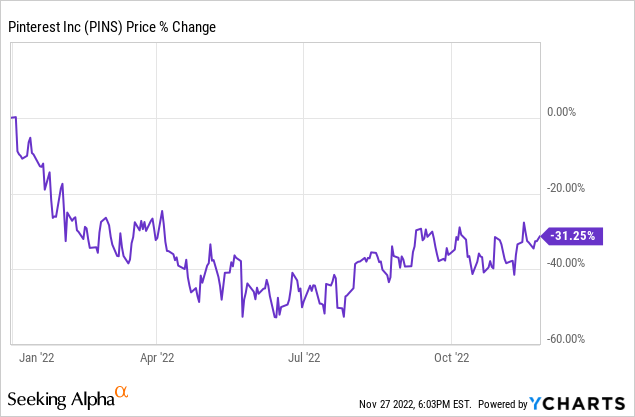

In 2022, the deterioration of the global macroeconomic situation and the slowdown in the growth rate of the global advertising market had a strong negative impact on Snap (NYSE:SNAP) and Pinterest (NYSE:PINS). Companies around the world are cutting back on marketing spending, which is essential for social media’s revenue growth. The struggle for customers in the face of growing competition and recession is becoming increasingly difficult. However, these companies have a different approach to their expansion.

Recession upon us

Given that the tight monetary policy of the Fed has a delayed effect, we can say that in 2023 we will see a slowdown in economic activity, which in turn will mark a recession that will last several quarters. According to a model built by Bloomberg economists, the probability of a recession in the US in 12 months has reached 100%.

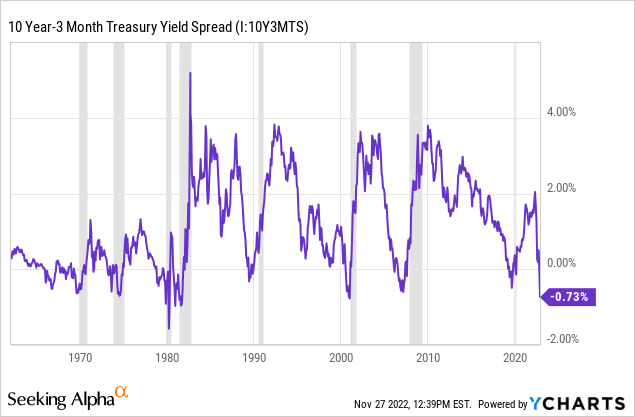

Several signs are foreshadowing the inevitability of this event. The most notable one is the inversion between three-month and 10-year interest rates, which is at its highest level since December 2000.

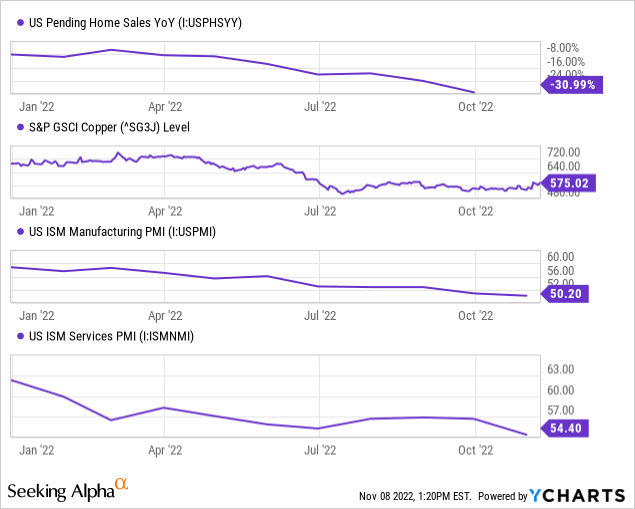

Some signs indicate that we are about to enter a phase of economic decline. US pending home sales are shrinking rapidly this year. Copper, an indicator of a healthy economy, is down almost 20% YTD. Both manufacturing and Services PMI are near the 50 mark.

This allows us to consider a recession as a baseline scenario for 2023. Of course, the online advertising market will feel the pain. Social media ad spending is forecast to grow only 5.2% in 2023 vs. 11.5% in 2022, according to WARC. It’s the lowest growth forecast WARC has ever issued for social media.

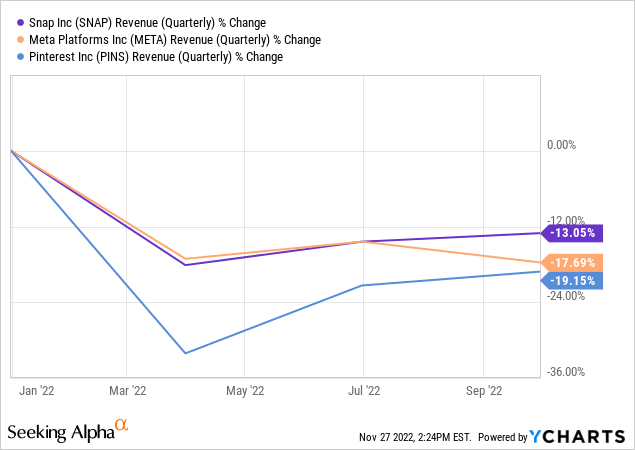

In fact, the market has already begun to slow down. Meta Platforms (META), Pinterest (PINS), and Snap (SNAP) have all seen their revenue falling QoQ for a whole year, just as user growth.

Snap’s case

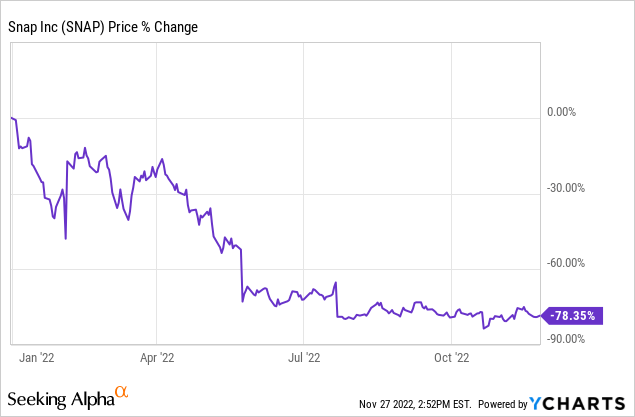

Snap has had a terrible year so far as the active user growth decreased massively and the guidance disappointed investors. Snap is losing ground.

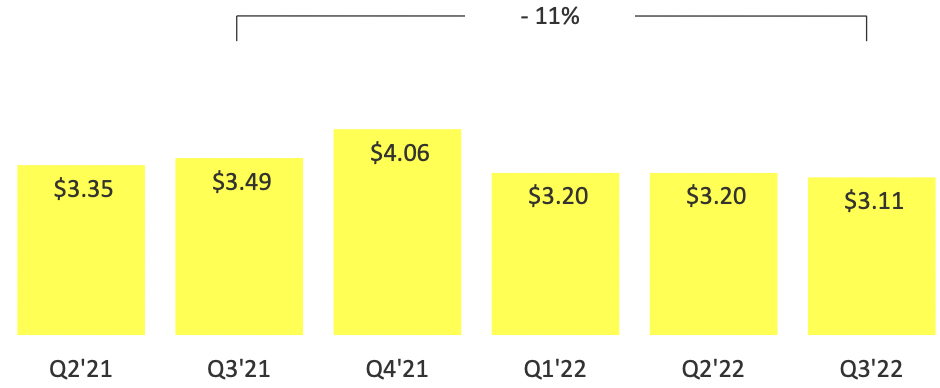

The Q3 2022 report just confirmed that Snap is struggling due to the slowdown in the ad market as the ARPU decreased 11% YoY, however, the company still saw an increase of DAU.

Snap Q3 presentation

As expected, the company began to implement initiatives to reduce operating costs. 20% of the workforce was laid off back in August, thus, in Q3, the number of full-time employees decreased to 5,706 compared to 6,446 in Q2. This will definitely have an impact on revenue in 2023.

The market is betting that the current problems Snap is facing will have a long-term effect.

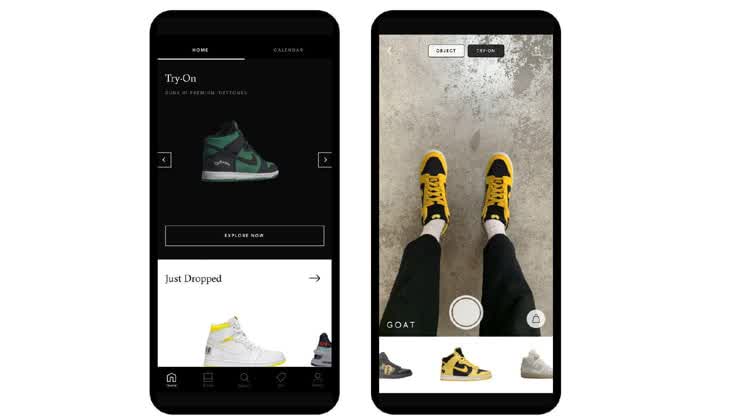

It is worth noting here that Snap has a good position in the online advertising market. Snap has reached a new level in terms of advertising, its methods are very diverse and unique: from standard 10-second videos to full-fledged AR models that allow users to try on a new pair of sneakers with the help of a camera.

apparelresources

AR development is one of the key ones. According to Statista, there are >1 billion mobile AR active users worldwide. Snap has partnerships with recognized fashion brands like Gucci, Adidas, and Dior. The company is ahead of its competitors with its technological developments.

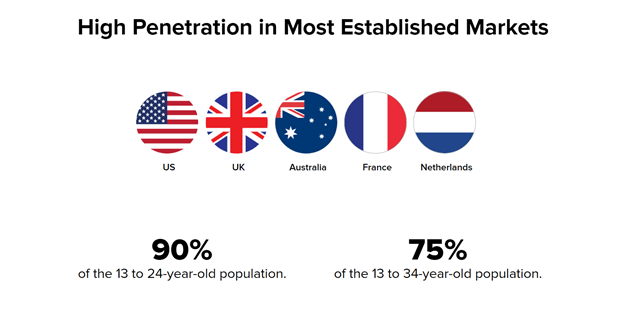

Snap’s main strength is its young audience that, according to a CreditCards.com poll, makes way more impulsive purchases. Snap allows advertisers to target younger audiences specifically. Over 75% of the population aged 13-34 and over 90% of the population aged 13-24 are active Snapchat users.

Snap presentation

It is also worth noting that the views of Stories have decreased and are now at the pre-COVID level. Snap’s CEO notes that this is due to the increase in views of other types of content, like Spotlight and Discover, and this fact in itself should not cause concern. However, this could be a signal that Snap is starting to lose out to competitive apps like TikTok.

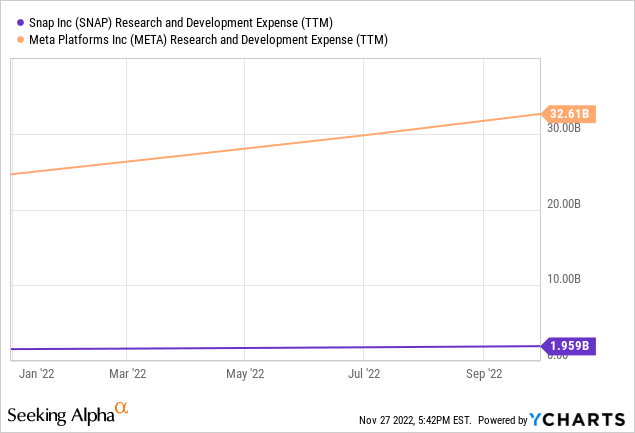

Concerning competition, there are a lot of risks. Meta is the main concern as it owns the first and the fourth most popular social networks: Facebook with over 2.9 billion MAU and Instagram with over 1.4 billion MAU. Facebook’s quarterly ARPU is more than three times larger than Snap’s ($9.41 vs $3.11 respectively) and only can and threatens mainly in terms of the battle for advertisers. At the same time, Instagram can do much more damage to its smallest peer. Its audience is young too: 70% of all users are 13-34 years old. The social network has Instagram Reels, which is a huge competitor to Spotlight and its Stories are the most popular among all peers (used by 500 million users every day). Instagram, like Snap, has AR technologies that are actively used by creators. So far, they are more for entertainment purposes and not as strongly integrated into the social network. However, Meta spends just a crazy amount of money on R&D purposes and could eventually replace Snapchat as the “cool app” among young people.

In general, Snap has great technologies and a business approach but doesn’t offer advertisers unique opportunities that cannot be refused. As such, I think Snap will suffer more than its competitors if digital marketing spending is drastically reduced.

Pinterest’s case

Pinterest, at the same time, has had a much better 2022 as the company is coping with a deteriorating macro environment judging by the ability to keep the quarterly revenue growth above 8% YoY.

Pinterest, unlike Snap, has a more stable advertising business. Pinterest is actively developing its own ecosystem, creating new features and convenient features for users in the application. It has a unique online advertising business model and therefore has advantages over other platforms. Pinterest’s user-friendly business model encourages retailers to actively upload entire catalogs rather than just individual products to the platform, turning the social network into an e-commerce platform of sorts. Marketers actively use the platform to advertise goods and services for a specific target audience, and such advertising looks unobtrusive because users themselves scroll through the feed in search of the right products or ideas.

Pinterest has a strategic partnership with Shopify that it is actively expanding. Thanks to that, retailers can create their business accounts on the social network, and users can add a tag to the merchant’s website. According to Cowen, 48% of US social media users go to Pinterest to find or buy products. That’s three times more than the next closest competitor—Facebook—at 14% of users.

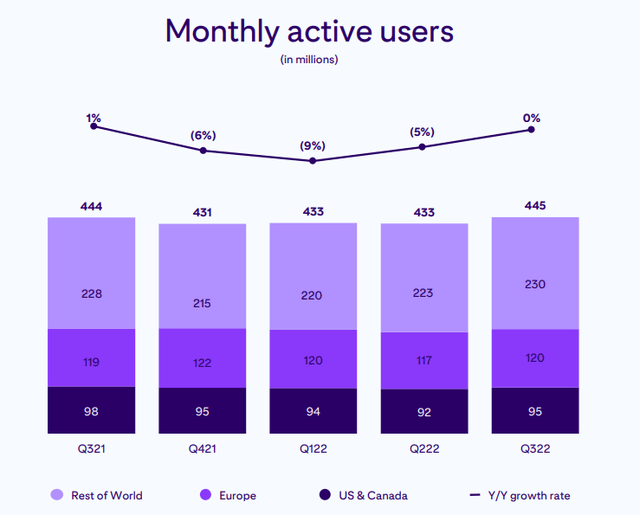

At the same time, Pinterest’s MAU stayed flat YoY, while Snap added more users during that period. However, Pinterest managed to increase its ARPU by 11%, while Snap saw a decrease of 11%.

Valuation

Pinterest looks more expensive than Snap as its forward P/S and EV/S multiples are 50+% higher.

Investors clearly see Pinterest as a much more sustainable business.

Conclusion

In conclusion, it looks like there is no better buy here. Sure, Pinterest is slightly better protected from industry issues, but its valuation is much higher.

I can only say that social networks are going through difficult post-COVID times, and now not every company will be able to maintain double-digit growth rates in the future.

Both PINS and SNAP are a Hold.

Be the first to comment