monsitj

Investment Thesis

Snap-on’s (NYSE:SNA) sales benefited from the healthy demand in the end-market as the volumes in Q1 FY22 improved. To support the strong demand in the end-market the company plans to expand its hand tools plant in Milwaukee. There are a variety of drive trains present in the market, such as the internal combustion engine, plug-in electric, and full electric, which gives Snap-on the opportunity to grow its revenue by introducing new tools to the market that solve the technicians’ and repair shop owners’ problems. As the vehicles get more complex, the shop owners rely on companies like Snap-on for repair assistance, and Snap-on provides service and repair information to its customers. The company’s margin prospects also look good and as the commodity prices stabilize, I believe the company’s margins should start improving. Additionally, the company’s Rapid Continuous Improvement (RCI) should support the margin growth of the company.

SNA Q2 Earnings

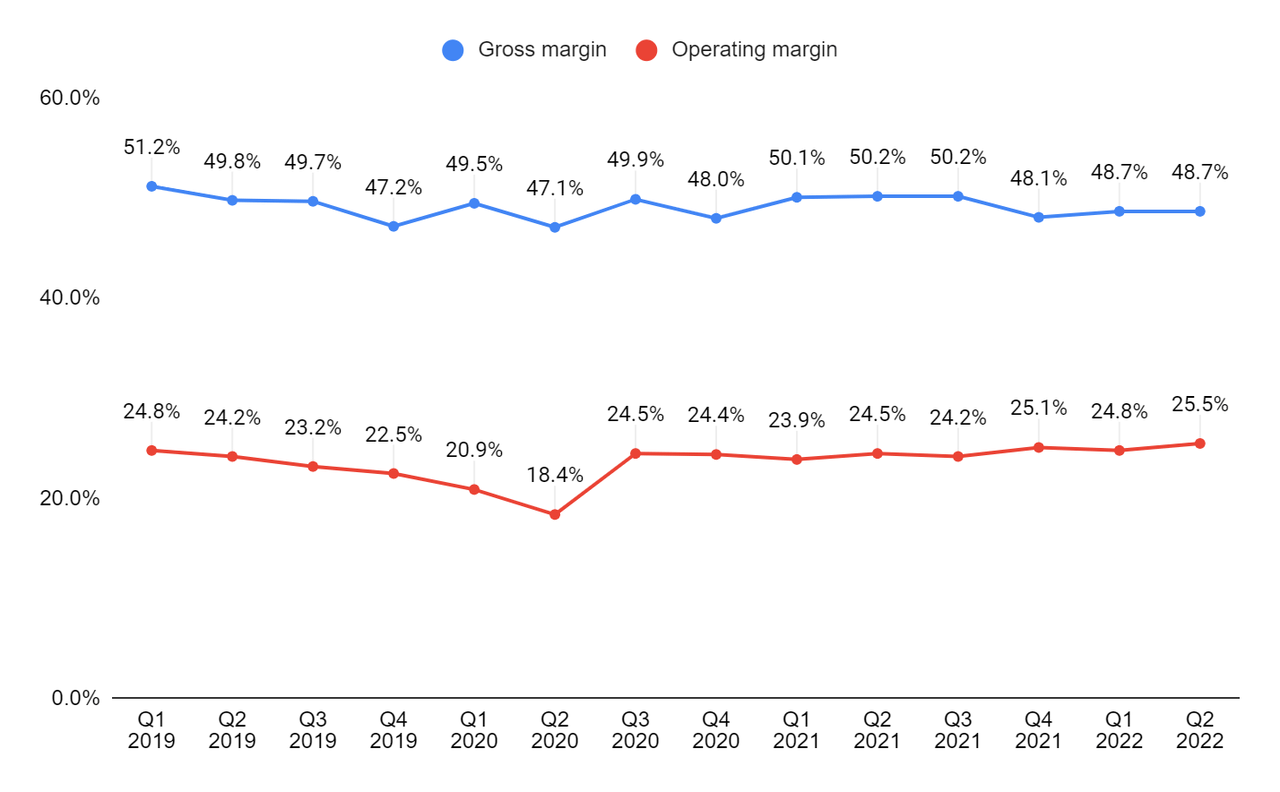

Snap-on Inc. recently reported its second quarter FY22 financial results that were better than expected. The net sales in the quarter grew 5.1% Y/Y to $1.14 bn (vs. the consensus estimate of $1.1 bn). The diluted EPS in the quarter was up 13.6% Y/Y to $4.27 (vs. the consensus estimate of $3.97). The sales in the quarter reflect 8.4% organic growth, partially offset by $32.4 mn of unfavourable foreign currency translation. The organic sales growth resulted from high single-digit organic growth across the company’s segments. The gross margin in the quarter declined 150 bps Y/Y to 48.7% due to higher material and other costs, partially offset by increased sales volume and pricing actions. However, the operating margin improved 100 bps Y/Y to 25.5% due to savings from the Rapid Continuous Improvement initiative, and lower costs associated with stock-based expenses, resulting in 13.6% Y/Y growth in the diluted EPS during the quarter.

Revenue growth prospects

The Auto-repair market remained positive in the last quarter, with key indicators such as spending on vehicle maintenance and repairs and mechanic wages showing a positive trend in the quarter. In addition, the demand for new and used cars remained strong. To offset the inflationary environment, the company has been increasing prices, however, the majority of the sales contribution came from volume growth compared to the price increases.

These factors led to high single-digit organic sales growth in Q2 FY22 across the business portfolio. The Commercial & Industrial (C&I) segment revenue grew 2.5% Y/Y to $359.1 mn reflecting 7.6% organic growth, partially offset by $16.7 mn of unfavourable currency translation. The organic growth was primarily due to the double-digit sales growth in the European-based hand tools business and Asia Pacific operations and mid-single-digit growth in the Critical Industries (CI). The solid gains in general industry and international aviation businesses more than offset the lower sales from the military businesses as we predicted in our previous article. Despite the headwinds in the C&I segment’s international operations, the company grew its sales in the quarter. The C&I segment’s international business was the most impacted in the quarter due to the 2-month lockdown in Shanghai city. Shanghai is a significant C&I business centre and a key transportation hub for the company’s factories in China. With lockdown curbs easing in China, revenue growth in international business should improve in the back half of the year.

The sales in the Snap-on Tools Group increased 7.5% Y/Y to 520.6 mn. The organic sales grew double-digits in the U.S. business across all the product lines with robust sales of tool storage, while international operations grew low single-digit. Tool storage sales were up double digits in the quarter. The new offerings in the Snap-on Tools Group, such as the new Long Nose Slip Joint Pliers, are already making a difference in the segment sales. Globally, Snap-on has more than 4300 franchises, and the company’s franchise health metric indicates a positive trend ahead. For the past eight quarters, the Tools Group’s sales have been above the pre-pandemic levels, and given the demand in the market and the new offerings from the company, this should drive the further growth of the Tools Group. The company also plans to expand its hand tool plant in Milwaukee to roll out more products.

The Repair Systems & Information (RS&I) segment sales were up 4.6% Y/Y to $416.8 mn, reflecting 7% organic growth, partially offset by $9.2 mn of unfavourable foreign currency translation. The organic growth comprises a double-digit increase in sales of under-car equipment, with the collision business being the star player and low single-digit growth in the sales of diagnostic and repair information products to independent shop owners and managers. The activity with the OEM dealerships was essentially flat. Looking forward, the RS&I segment has great opportunities, and the company is fortifying its way forward by launching new products like the Hoffman 609 Aligner, designed specifically for independent general repair shops with limited space. The equipment business has been growing in double-digits for the past few quarters, with the Hoffman 609 Aligner being the largest of that product mix.

Looking forward, I believe the presence of a variety of drivetrains such as internal combustion engines, hybrids, plug-in electric, and full-electric in the market and the increasing automation and vehicle complexity gives Snap-on opportunity to sell its new and innovative products to its customers. Customers rely on repair information and shop management software to fix their vehicles efficiently. The company is also moving away from selling titles (basically providing updates on software every six months) and pivoting to a subscription business, which should help the company’s revenue.

Margins

The gross margin of the C&I segment declined 220 bps Y/Y primarily due to higher material and other input costs, partially offset by higher sales volume and savings from the segment’s RCI initiatives. Gross margin in the Snap-on Tools Group declined 80 bps Y/Y due to higher material and other costs and 10 bps of unfavourable foreign currency effects, partially offset by higher sales volume and pricing actions. The RS&I segment’s gross margin declined 150 bps Y/Y due to higher input costs and mix shift towards lower gross margin businesses, partially offset by pricing actions, 50 bps from favourable foreign currency effects, and savings from RCI initiatives. The interesting thing is despite the Y/Y decline in all three segments, gross margins improved sequentially in two (C&I and Snap-on Tools) out of the three segments resulting in a flattish gross margin for the whole company sequentially. So, the pricing action seems to be taking hold and we can see gross margin improvement as the input prices stabilises.

The operating margin of the C&I segment declined 140 bps Y/Y to 14.4% in Q2 22, whereas it improved in the Snap-on Tools Group segment and the RS&I segments by 250 bps and 120 bps Y/Y to 23.9% and 23%, respectively. This helped the company post operating margin improvement both sequentially as well as year over year.

Snap-on’s gross margin and operating margin (Company data, GS Analytics Research)

Looking forward, the company buys most of its semiconductor chips and commodities such as different grades of steel from the spot market, and the prices of steel have been coming down since June 2022. So, things are getting a little better. I believe that as these costs stabilize and the company continues to implement its decade-old RCI initiative, which focuses on improving productivity and efficiency, the margins of the company should improve in 2H22 and beyond.

Valuation & Conclusion

The stock is currently trading at 13.18x FY22 consensus EPS estimate of $16.26 and 12.84x FY23 consensus EPS estimate of $16.68, which is slightly lower than its average five-year forward P/E of 14.43x. The company’s sales growth should benefit from the transition in the automotive segment from internal combustion engines to electric vehicles. Snap-On has been developing new products along with its customers to meet the current demand in the end market. The margins of the company should also improve as commodity prices stabilize going forward. Since I am optimistic about the company’s margins and earnings growth prospects and valuations are also attractive, I believe it is a good buy at the current levels.

Be the first to comment