Ethan Miller/Getty Images News

Yes, You Heard It Right: A P/E of 3

Smith & Wesson Brands, Inc. (NASDAQ:SWBI) stock was down as much as (10%) in after-hours trading after releasing Q1 FY ’23 results, which saw revenues plunge nearly (70%) as the company lapped a particularly strong Q1 FY ’22. While shares are still down after-hours, they have recovered some of their early losses.

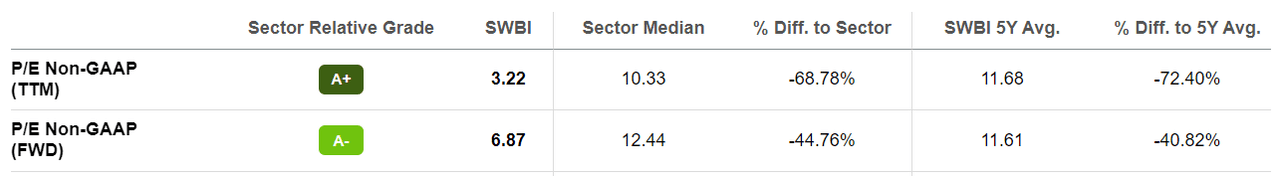

Overall, before today’s release, shares were down more than (25%) year-to-date (“YTD”), leaving the company with a trailing twelve months (“TTM”) non-GAAP P/E of 3.2.

Figure 1: SWBI Non-GAAP P/E Valuation (Seeking Alpha)

On that basis, and when compared to its 5-year average non-GAAP P/E of 11.7 as per Figure 1, SWBI looks enticingly cheap.

But, of course, one ratio doesn’t tell a complete story. Accordingly, if we dig deeper, do downtrodden SWBI shares represent an attractive entry point for investors right now?

An Expectedly Lousy Q1 Came In Lousier, But Context, Context, Context…

Management expected a soft Q1 given normalizing firearms demand after the surge that accompanied 2020 and 2021. However, results still came in far below estimates.

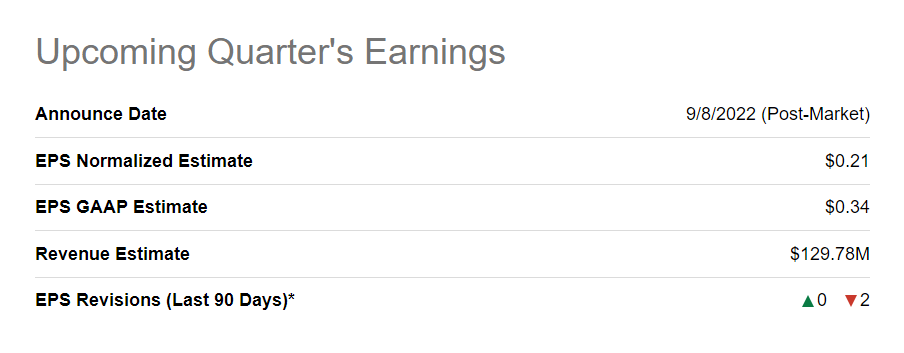

Figure 2: SWBI Q1 FY ’23 Earnings Estimates (Seeking Alpha)

As with anything, however, it helps to add some context around Q1 results, leveraging management’s comments from the earnings call.

-

Q1 FY ’23 net sales of $84.4M missed the consensus estimate of $129.8M by $45.4M, or (35%) of the estimate. Further, sales results reflected a ~(69%) decline versus the prior quarter’s net sales of $274.6M. Although, as already mentioned, demand was particularly strong in 2021.

-

GAAP EPS of $0.07/diluted share missed the consensus estimate of $0.34 by $0.27, or (79%) of the estimate. Total GAAP net income of $3.3M in the quarter compared with $77.1M, or $1.57 per diluted share, in Q1 FY ’22.

-

Gross margin in Q1 FY ’23 was 37.3% versus 47.3% in the comparable period. Management noted that gross margin “…was well below the 47.3% realized in the prior year comparable quarter, but equal to the first quarter of fiscal 2020 in spite of lower sales…[and] excluding relocation costs, however, gross margin would have been 38.8%, 1.5 percentage points better than in 2020 with approximately 12% less revenue.” Yet, understandably, gross margin in Q1 FY ’23 was impacted by the absorption of fixed costs in spite of lower production volume.

-

($4.4M) in negative free cash flow during Q1 FY ’23. Management explained that “…[they] expect negative free cash for at least the next quarter as [they] continue to invest in the relocation [of the business to Tennessee], but [they will] generate ample cash throughout the remainder of the year to meet [the] annual cash generation target of $75 million.”

Investors would have preferred a different set of Q1 FY ’23 results, obviously. But, it’s worth pointing out that SWBI still managed to eke out a GAAP profit in spite of:

1. An overall environment of soft demand with “…the industry [navigating] through the inflection point from the largest [firearms] surge in history.”

2. A high level of distributor inventory heading into the quarter, exacerbating an already soft market.

3. Relocation costs associated with the company’s move to Tennessee.

An Attractive Entry Point for a Trade

Despite a challenging Q1 FY ’23, management offered a couple key points during the earnings call to suggest the remainder of the year should be stronger.

1. The typical seasonality of the firearms business should bolster results in Q2 FY ’23 and Q3 FY ’23 as the fall and winter seasons are usually busiest.

2. The business has largely worked through built-up channel inventory. As a result, management “…[believes] that the inventory correction…is now behind us…[and] since the end of the first quarter, order rates have also rebounded.”

On these points, SWBI would be expected to put up a better top-line performance over the next couple quarters. Although, nothing is guaranteed by the volatility of the firearms market. However, as I argued recently in another article on Sturm, Ruger & Company, Inc. (RGR), it’s possible that cooling inflation and an out-performance by Democrats in the November elections could also drive industry sales higher over the next few months. Overall then, I’d argue that SWBI investors have some good reasons to feel bullish heading into the end of CY ’22 and the beginning of CY ’23 with management confident “…in [their] ability to comfortably maintain…published full year targets for cash generation of $75 million, cash on hand of $100 million, gross margins of 32% to 42% and EBITDAS at 20% to 30% of revenue.”

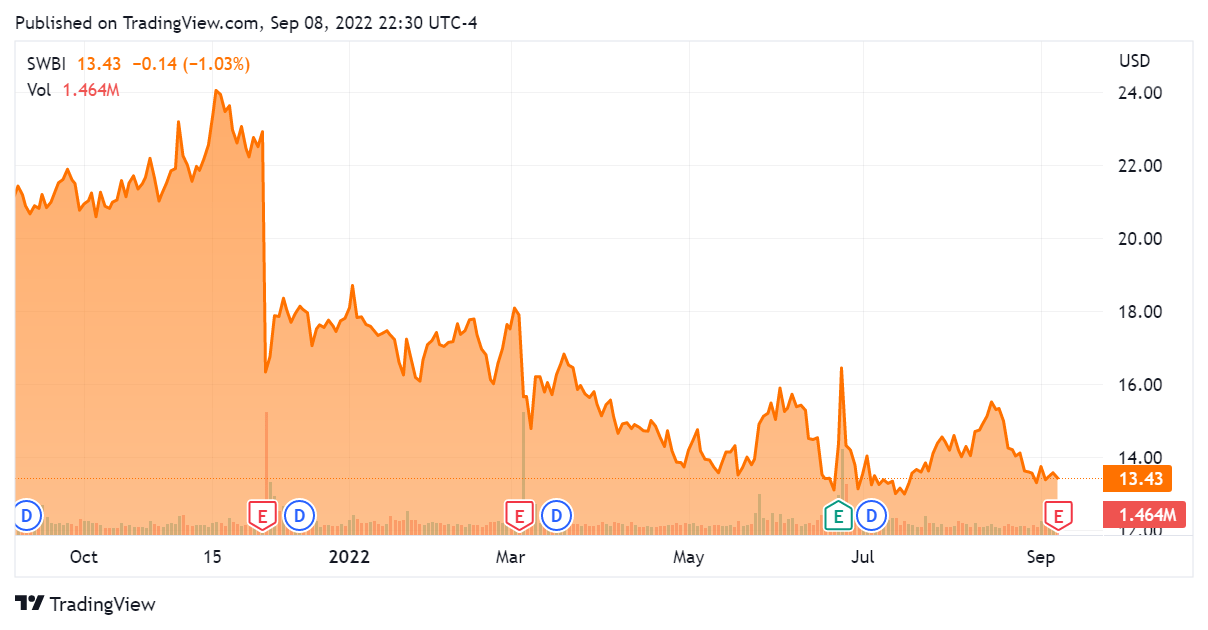

The stock’s close price of $13.43 Thursday is (45%) below the 52-week high of $24.26, with the dividend of $0.40 representing a nearly 3% yield on the (current) share price.

Figure 3: SWBI 12-Month Stock Price Performance (Seeking Alpha)

As mentioned, SWBI still posted a GAAP profit despite all their headwinds in Q1, and looks set to benefit from some reasonably strong tailwinds moving into Q2 FY ’23 and Q3 FY ’23. From my perspective, the current share price looks like a nice entry point to pick up some shares to hang on to for a couple quarters, betting on the stock recovering in Q2 and Q3 for the reasons mentioned above. Even if shares just get back to where they were trading mid-August, ~$15.50, that would still represent a 15% gain above today’s closing price.

More On Ratios and Parking Some Money

As (at least) one Seeking Alpha reader noted after SWBI’s earnings results today, the “sell-off seems overdone”. And, coming back to the company’s valuation and utilizing data from Yahoo Finance, SWBI shares do look like a bit of a bargain compared to, for example, RGR, with the former sporting P/S (“TTM”) and P/B (“MRQ”) multiples of 0.74 and 1.70, respectively, and the latter offering investors analogous multiples of 1.42 and 2.38. More strikingly, SWBI’s current EV/S ratio is just 0.62.

With a preferred investment style of staying long, I admittedly find that difficult to do with firearms manufacturers due to the vicissitudes of the industry. However, as I have done with RGR shares in the past and present, I think SWBI is worth a look for those investors who are willing to consider the stock as a trade and don’t mind parking some of their money for a couple quarters as shares (ideally) rebound with expected top-line strength in Q2 and Q3.

Be the first to comment