Chaay_Tee/iStock via Getty Images

This is our third article this year for Seeking Alpha on business development companies (“BDCs”). SLR Investment Corp. (NASDAQ:SLRC) might be a potential opportunity, but we are skittish following the release of its Q2 ’22 financial report two weeks ago. SLRC shares moved up almost a dollar since then and seem to have momentum again.

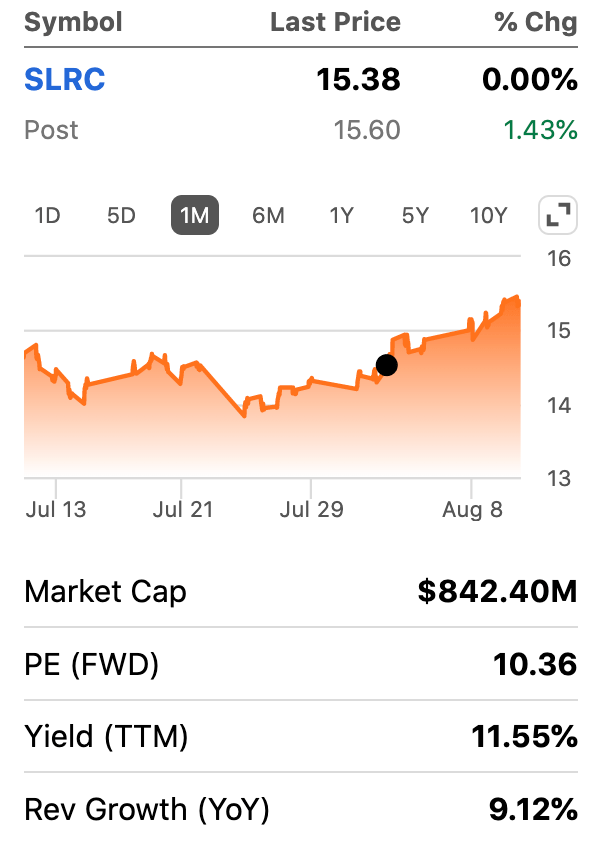

Price Chart SLRC (seekingalpha.com)

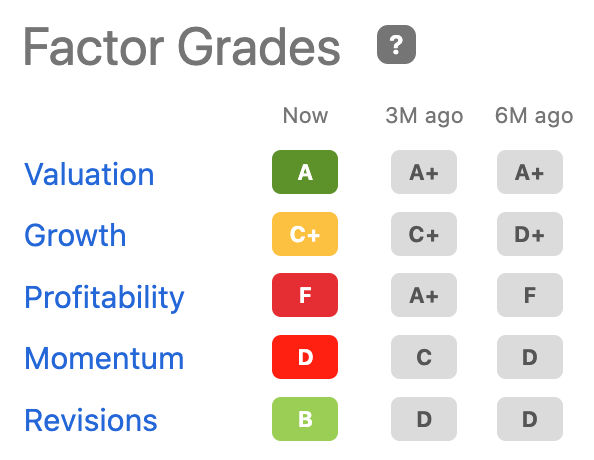

Seeking Alpha’s Quant Rating for all three BDCs, SLR, Goldman Sachs BDC (GSBD), and Capital Southwest (CSWC), are a hold, tiptoeing into the buy-side of the rating. CSWC shares are up ~$2 per share since early June. GSBD shares are up ~$1 since our article. The tone of our articles was positive about the other two companies because they are profitable. We are less bullish about SLRC because it sports weak Factor Grades and “hold” recommendations from S A authors, Wall Street analysts, and the S A Quant Rating:

Factor Grades (seekingalpha.com)

Snapshot

SLR Investment Corp. specializes in making secured and unsecured lending investments across a diversified field of industries and for multiple purposes. Investments are between $5 million and $100 million. The fund invests in companies with revenues between $50 million and $1 billion and EBITDA between $15 million and $100 million. It makes senior secured loans, and mezzanine loans, and accepts equity securities. SLR Investment sometimes makes investments in thinly traded public companies. The fund makes non-control equity investments.

SLRC shares are not volatile. Their Beta rates at 0.32, well below one for market movements. We don’t anticipate any events that will fortuitously move the share price. The average price target we expect will meander between $15 and $17 over the next 12 months. Shares are overvalued and are riding the market uptick. The share price might slip to $13 per historical multiples, past returns, growth, and forecasts.

A recent major announcement by the company is it revised its intent “to make monthly distributions to stockholders instead of quarterly distributions.” This announcement follows a merger with SLR Senior Investment Corp this past April. The combined company has assets of ~$2.6B and about $1.1B total net assets. Essentially, the merger was to streamline investment opportunities, cut operating expenses, and heighten synergies.

Investment Highlights

SLR Investment’s net investment income for Q2 ’22 is reportedly 37 cents per share equal to last year. It beat estimates for the straight fourth quarter that this time forecast EPS at $0.34. SLR Investment also beat revenue estimates. We expect the EPS for Q3 will be the same or a penny higher, as the economy improves. SLRC shares are down +20% for the year and +28% over the past five years. The benefit to retail value investors, like with similar BDC stocks, lies in the dividend (TTM) yield at 11.55%. The P/E ratio is 73.24. Short interest is nil.

The company holds a $2.7B investment portfolio that includes ~780 companies. It made $274.8M in investments in Q2. Net investment income was $20.3M. Since the merger, we forecast an annual earnings growth of 140%. Revenue at the close of the first week in August is touching $200M for the year; earnings are $86.5M.

Two Warnings

The company took a one-off loss of $58.4M that directly lowered financial results and drove the stock down to a 52-week low of $13.75. Last year, the profit margin peaked at 58.4%; the last report had it at 3.7%.

The company’s net debt-to-equity ratio is a high 61% from about 33%. Operating cash flow is negative, and EBIT does not cover interest payments.

On the bright side, the average manager’s tenure is over 14 years. These seasoned professionals hold a healthy 2.5% stake in the company. Private companies own less than 4% of the shares while institutions own only 40%. The remainder, 53% to 54%, are held by the public. The CEO and founder upped his holdings by 214%.

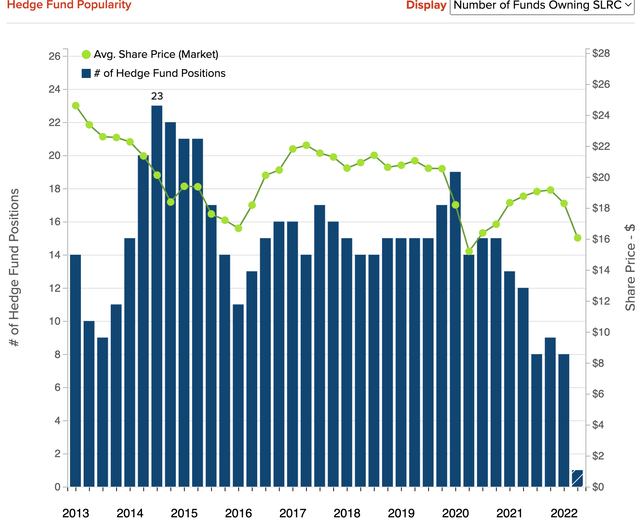

In the last quarter, hedge funds increased their holdings by 272.5K shares but there are no beamish portents suggesting this will be a trend in 2022.

Hedge Funds in SLRC (insidermonkey.com)

Better Don’t Commit

We believe the downsides and uncertainties facing SLR Investment leave us flummoxed and unable to do more than recommend holding shares. The dividend yield is good, but other BDCs are more solid and profitable. Time may turn this around. This company has weaker financial strength and profitability than others. We doubt significant growth is in the cards. The merger sparked momentum, but debt can be overwhelming. The next earnings report date is November 3, 2022. For now, better don’t commit.

Be the first to comment