DNY59

SLM Corporation (NASDAQ:SLM), also known as Sallie Mae, faces adverse economic conditions. Revenues and margins remain hammered amidst higher interests and provisions. Despite this, the company shows promise as financials remain sound and adequate. It can sustain the business while paying dividends and borrowings in a rugged market. Also, student loans continue to play an integral role in education. It remains lucrative by being a permanent partner of many private institutions. Meanwhile, the stock price downtrend remains prominent but does not appear cheap.

Company Performance

With skyrocketing prices and interest rates, financial institutions face more risks. SLM Corporation is not exempt from the unfavorable impact of these market changes. Inflation affects the capacity to afford many essential goods and services, including education. Consumers face higher borrowing costs, which may affect company performance. Likewise, SLM faces higher interest on borrowings and deposits.

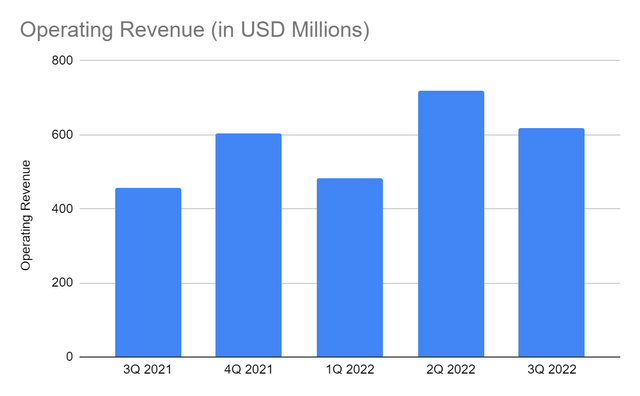

The 3Q 2022 operating revenue of Sallie Mae was $617 million, a 35% year-over-year growth. A lot of factors contributed to humongous development in the recent quarter. Seasonality was one of the primary driving forces. The first trimester in college begins during summer, so student loans are more of a staple every 3Q. There is increased demand for SLM’s services, leading to higher fees. Interest rates also drove revenue growth. Since it offers student loans and credit cards, it benefited from basis-point increments. Higher interest rates mean higher borrowing costs and, in turn, higher interest income.

Operating Revenue (MarketWatch)

Prudent portfolio diversification also helped speed up revenue growth. In general, inflation lowers the valuation of various investments. Yet, SLM kept investment risks at bay. Some investments did not realize higher returns, such as mortgage-backed securities. That’s logical. But the vast majority of investments are government-backed securities and inflation-linked treasuries. So there was an added protection that made the earning assets more interest-sensitive. Investment income tripled in the recent quarter.

But the main reason behind this massive growth was the SLM’s decision to sell its billion dollars of loans. Given this, it achieved the goal of selling $3 billion in loans at enticing premiums. It helped SLM synergize revenue streams and normalize the impact of interest rates. It also pushed the company to focus on core revenue components and capture more demand. It was a timely move since 3Q was the peak season.

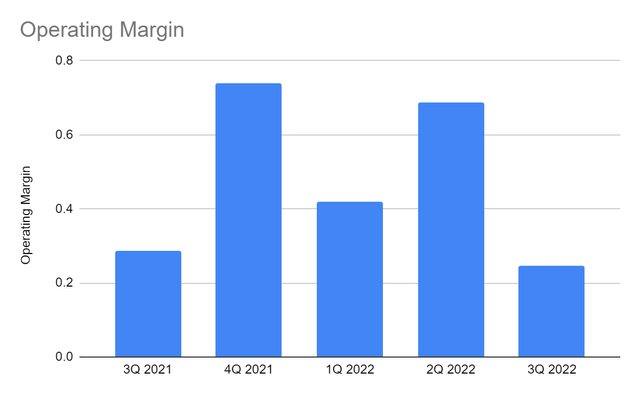

However, higher inflation and interest rates also led to higher operating expenses. Interest expense rose by 70% in only a year, driven by deposits. Fortunately, it kept borrowings low, so the impact of interest rates remained manageable. Non-interest expenses were also relatively stable. Overall, the company maintained efficient asset management to stay viable. But the impact of unfavorable market conditions offset revenue growth. The operating margin was 25% compared to 29% in 3Q 2021. Nevertheless, viability could tell about the capacity to withstand external changes.

Operating Margin (MarketWatch)

Market Risks, Opportunities, And Core Competencies

SLM Corporation has always been a private education staple. For over 50 years, it was able to extend financial help to millions of students. Along with this, SLM has flourished and withstood numerous economic downturns. It continued to expand access to higher education through M&As and partnerships.

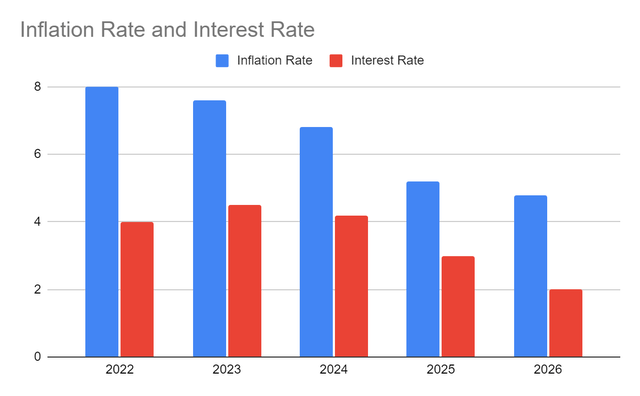

However, SLM must not be too complacent with being a household staple. Inflation remains intense, although there has been a continued lull recently. Meanwhile, interest rates are yet to reach their maximum level. While higher interest rates mean higher interest fees, potential defaults pose more risks. It also leads to higher interest on borrowings and deposits. Its most recent performance already showed it. Expenses offset revenue growth and led to lower margins.

Inflation Rate And Interest Rate (Barron’s And Author Estimation)

Despite this, SLM is here to stay. I expect it to rebound once interest rates become more stable. Also, the recent sale of credit card loans will allow SLM to focus on student loans and investments. Prudent portfolio diversification may also help with SLM’s rebound. It may withstand macroeconomic disruptions and remain viable despite lower margins. It may take more time since the next peak season will be in summer.

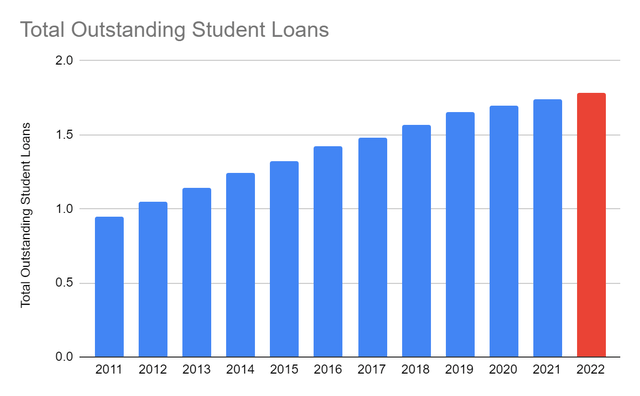

Moreover, student loans have always been essential to US households. They comprise about 10% of the total household loans. The percentage is already more than twice as much as it was during the Great Recession. It shows increased demand for student loans over the past decade. As of this year, about 25-30% of post-secondary enrollment belongs to private institutions. It has been stable in the last two years despite the massive changes in the US economy.

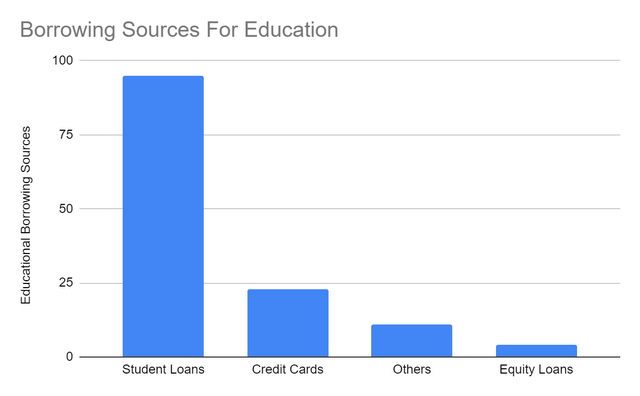

Over the years, the total outstanding student loans have risen from $959 million to $1.7 billion. It can be attributed to a more stable economy and increased borrowing capacity. In 2021, the value reached $1.74 billion. In 2022, it rose again, regardless of the skyrocketing interest rates. This quarter, student loans may increase further as interest rate hikes intensify. Student loans remain the primary source of funds for education. In a study, 95% of households rely on student loans to fund their education. It proves that student loans will remain an integral part of private education in the US. In turn, SLM may remain a durable student loan provider and weather the stormy market.

Total Outstanding Student Loans (Bankrate)

Borrowing Sources For Education (Education Data Initiative)

SLM has solid and intact fundamentals. Its stellar Balance Sheet shows SLM can sustain its capacity and cover borrowings. It remains a conservative company with a loan-to-deposit ratio of 90%. It has 10% reserves to preserve liquidity in case of student loan defaults. Also, loan provisions increased from $1.17 billion to $1.19 billion or 0.59% of the total loans. While it can hammer revenue growth further, it is still a wise move to protect its positioning.

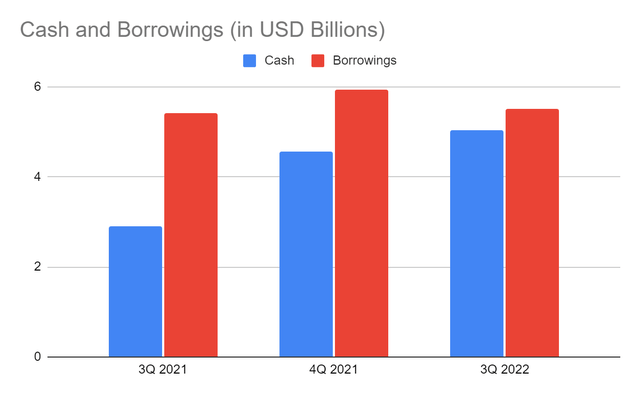

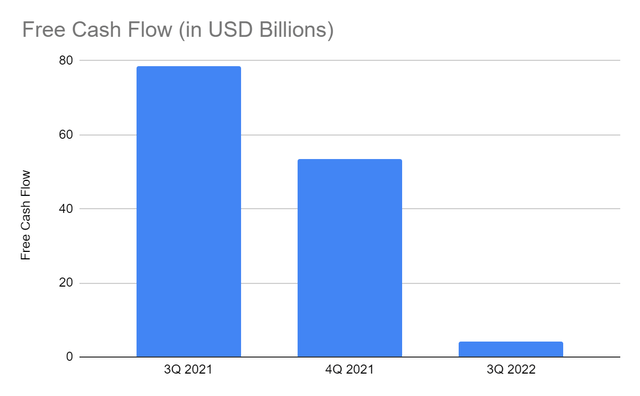

Moreover, its cash and cash equivalents are $5.04 billion. It is almost twice as much as the value in 3Q 2021. We can attribute it to the prudent sale of loans that generated billions of proceeds. Prudent portfolio diversification that led to impressive yields also raised cash levels. Meanwhile, borrowings are stable at $5.52 billion, so Net Debt/EBITDA is less than 1x. It also generates enough income, given its ROAA of 3% and ROAE of 42%. SLM’s cash inflows can confirm it. Its FFO remains stable at over $200 billion. Although provisions lowered income, the actual cash transactions remained high. Cash Flow from operations is way lower than in comparative quarters. It was mainly driven by the increased receivables, particularly accrued interests. Overall, SLM maintains impressive liquidity.

Cash And Cash Equivalents And Borrowings (MarketWatch)

Stock Price Assessment

The stock price of SLM Corporation has been slightly rebounding after its dip in the last year. It has a sideways six-month pattern, although the downtrend is still more prominent. At $16.8, it is 12% lower than the starting price. Even so, it remains elevated compared to pre-pandemic levels. It can be reasonable due to substantial growth in revenues and income in 2019-2021. But we must also consider the impact of share buybacks. Today, it has a price-earnings multiple of 5.4x. If we multiply it by the expected earnings, the target price will be $13.4-13.9. With that, there may be a 17-19% decrease in stock price.

Despite this, SLM is a secure company with consistent dividend payments. With an annualized value of $0.44, the dividend yield is 2.67%. It is more than twice the S&P 400 and NASDAQ averages of 1.21% and 1.25%. So for every $1, investors realize $0.0267. A dividend cut has a very low probability since the Dividend Payout Ratio is only 38%. Dividends are still well-covered. But investors must be careful since it has already reduced its common shares by 42%. SLM returned their capital which can lead to more dividends. Share buybacks can also preserve stock prices. It can be the driving force behind the stock price rebound despite the hammered income. It appears to adhere to the target stock price using the price-earnings multiple. To assess the stock price better, we will use the DCF Model.

FCFF $243,000,000

Cash $5,021,000,000

Borrowings $5,520,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 250,196,830

Stock Price $16.8

Derived Value $15.36

The derived value confirms our supposition that the stock price is not cheap. There may be a 9% downside in the next 12-18 months. Investors must wait for a better entry point or look for better alternatives.

Bottomline

SLM Corporation has stable revenues but with hammered margins and sluggish near-term growth prospects. But it maintains solid fundamentals, as shown by its stellar Balance Sheet. It may also bounce back once the economy becomes more manageable. It is still possible, especially since it increases its focus on student loans. However, it may take time since interest rate hikes do not indicate a lull anytime soon.

With regard to investor value, dividends have attractive yields. But there is more to investor value than dividends. The stock price appears overvalued, so investors must wait for a better entry point. After assessing the fundamentals and stock price, SLM Corporation is a hold.

Be the first to comment