KENGKAT

Semiconductors have come a long way from the pandemic boom, riding the massive growth of cloud expansion and client PC growth. Nevertheless, it’s clear there’s a slowdown occurring – look no further than Intel (INTC), Nvidia (NVDA), and AMD (AMD). This brings us to Skyworks Solutions (NASDAQ:SWKS) and its FQ4 report after the bell on Thursday. It’s primarily delivering revenue from mobile but expanding into industrial and automotive, mainly through its partial Silicon Labs acquisition. Is this enough to buck the trend of expected declining mobile sales, or will the company dip into negative revenue growth for the next quarter or two and play into the hands of the market’s worst fears?

First, are declining mobile sales a real issue, and will they affect the rest of Skyworks’ calendar year? According to an IDC study from September, worldwide phone units shipped will be down 8.5% in 2022 compared to 2021.

The worldwide mobile phone market will reach 1,515.3 million units shipped in 2022, down 8.5% from the 1,655.5 million units shipped in 2021. From there, total mobile phone shipments will grow to 1,623.1 million units worldwide by 2026, resulting in a CAGR of -0.4% for 2021–2026.

What’s also alarming is the world won’t reach the 2021 1.655B units shipped number until after 2026. That’s quite a prolonged contraction, but it’s also up for adjustment, much like this year’s original forecast, as it had unit sales down only 1.5% in March.

But if I focus on smartphone trends from IDC’s study, it has a more complex trend playing out. After expecting smartphone sales to be up 1.6% earlier in 2022, IDC has revised it down to negative 3.5% growth.

…shipments of smartphones will decline 3.5% to 1.31 billion units in 2022…IDC has significantly reduced its forecast for 2022 from the previous projection of 1.6% growth. However, IDC expects this to be a short term set back as the market rebounds to achieve a five-year compound annual growth rate…of 1.9% through 2026.

All in all, it’s hard to take any study seriously when it can be off by such a wide margin in just half a year.

However, it’s clear the smartphone segment doesn’t have the glorious growth it’s had over the last decade.

At the same time, it doesn’t take into account the high-end smartphone market’s unit sales specifically, which is where the money is and where Skyworks benefits. Since Apple (AAPL) is its largest supplier, it may buck the trend a bit as Apple’s iPhone sales are on track to be level with 2021.

Level is better than down, but even with Skyworks’ overreliance on Apple as a customer – 55% of revenue as of FQ3 (see FQ3’s transcript) – it may support its revenue in the near term as Samsung (OTCPK:SSNLF)(OTCPK:SSNNF) is the only other 10%+ customer. At 12%, 73% of its revenue is directly tied to top-tier smartphone customers. I’d keep an eye on how much reliance the company sees in FQ4 on these two customers.

Now this could keep the company’s revenues afloat in the near term. But is that enough?

On the last earnings call, CEO Liam Griffin gave some decent insight into the company’s remaining revenue, which is on a $2B run rate annually.

Fueling our momentum going into the second half of the calendar year, with our customer count doubling year-over-year in a broad markets portfolio on pace for $2 billion in annualized revenue, our business is more diverse than ever.

On $5.47B in FY22, theoretically, 36.5% of revenue is diversified into “broad markets,” which is likely defined as anything outside of mobile. Using an annual average of 53% for Apple brings this year’s Apple revenue to $2.9B, leaving 10.4% for Samsung, or $570M in revenue.

Therefore, if the “momentum” Griffin mentioned continues, it may (partially) offset a mobile slowdown.

Which is a good segue into FY23 revenue and, more specifically, FQ1.

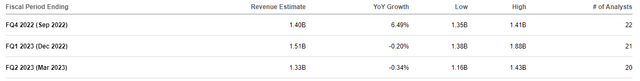

Analysts are estimating guidance for the coming quarter of -0.20% growth.

It wouldn’t take many wins during the quarter in the broad market portfolio during to push the company’s guidance to positive revenue growth. And right now, the difference between negative and positive growth is at the center of the market’s attention (after interest rates, of course).

But mobile seasonality may be more pronounced this year as the holiday season may be an even higher peak in the smartphone industry relative to the other quarters. Furthermore, customer inventory is playing a much more significant role, pushing component vendors to ship far fewer components for the same end demand. This is no more obvious than Qualcomm’s (QCOM) report issued Wednesday after the close, which provided guidance well short of consensus, blaming inventory draw-down at its customers (read: Apple, among others).

This is the game of give and take for Skyworks and its ability to diversify customers and end markets.

I’ll be closely listening to the company’s diversification efforts on the call, especially what it has to say about it as it progresses into the new fiscal year. The company must continue to march down this path, as mobile handsets are not the growth story they once were. This is especially true when an economic uncertainty factor is added, causing clients to wind down inventory built up for insulation from pandemic-related supply chain issues.

I wouldn’t be surprised to hear the same inventory correction lines nearly every other semiconductor has harped from Skyworks’ management. This is why diversification is all the more important. The key is Skyworks has been working toward this for the last few years, with the pinnacle coming with its July 2021 closing of its Silicon Labs deal. The company has gotten a decent head start on this, and a $2B annual run rate of “diversified” revenue will need to kick into high gear to buck the retail weakness trend.

Be the first to comment