Boarding1Now/iStock Editorial via Getty Images

Besides significant pent-up demand that airlines expect to outpace cost growth, another reality that airlines are engaged in a big battle for pilots to fly their schedules. The main victims of that reality are airlines that simply cannot offer attractive salaries and terms. Those include ultra low-cost carriers where the low-cost element is not just embedded into the service but also into the crew costs as one can reasonably expect and regional airlines as flying a smaller aircraft translates into smaller pay. In this report, I have a look at how SkyWest Airlines (NASDAQ:SKYW) is managing this headwind.

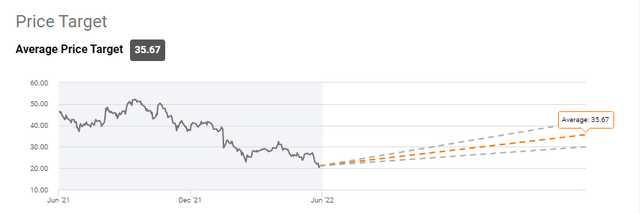

Wall Street Analysts Are Upbeat On SkyWest

SkyWest Airlines price target consensus (Seeking Alpha)

With labor shortages putting significant pressure on the schedule of the regional airlines, it might be worth to look what Wall Street Analysts are expecting for SkyWest in terms of share price trajectory. The average price target is $35.67 indicating 66.7% upside. I think that is upside that anyone would sign for at this point. However, Seeking Alpha Quant tools show that the rating from analysts has flipped from Buy to Hold, which might be the result of labor pressures expected to persist.

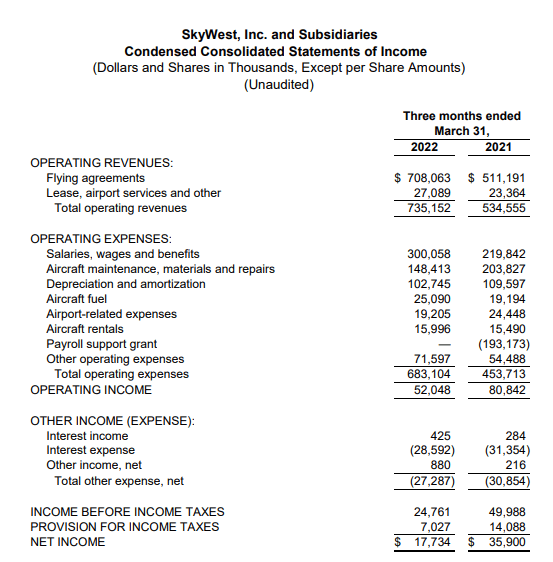

SkyWest Earnings Positively Surprise

SkyWest Airlines Q1 2022 earnings (SkyWest Airlines)

SkyWest Airlines’ first quarter earnings came in above analyst expectations with earnings per share being $0.35 whereas $0.03 was expected on revenues that were $35.2 million higher than expected. So, nothing to complain about the results. Looking at revenues, we see a 35 YoY increase which doesn’t quite compare favorably to airline revenues for mainline carriers which more than doubled. There are two reasons for that. The first one is that the recovery of air travel was always expected to go from smaller aircraft to bigger aircraft, so regional airlines operate smaller aircraft and therefore were a step ahead in the recovery trajectory providing a higher comparison basis. Additionally, that recovery is being held back by pilot shortages.

Operating costs went from $453.7 million to $683.1 million, offsetting the topline growth. The result is an operating income of $52 million compared to $80.84 million last year. However, we should adjust earnings for the Payroll Support Grant which would show an improvement from a $112.3 million loss to a $52 million profit which is an appreciable turnaround amidst higher fuel prices.

SkyWest Navigates A Tough Environment

SkyWest Airlines is the biggest regional airline in the world, but that doesn’t put it in a superior position when considering the full airline industry. For the second quarter no outlook has been provided, but the regional airline expects to be profitable this year rather than breaking even as expected earlier. One thing that SkyWest Airlines has going for it which should shield some of its business from shortages is its long-term leases. On how SkyWest Airlines is going to tackle the pilot shortage issue, detail was lacking.

The airline talked about optimizing the training footprint but that’s rather vague compared to comments Southwest Airlines for instance provided on their training environment. SkyWest Airlines was realistic in the sense that the airline has a pipeline of first officers in place that could convert to captains, but the airline simply is time constrained on executing on those conversions in time in order to not affect the schedule. So, the schedule has been affected and the regional carrier was looking for permission to drop 29 destinations from its schedule. This request was denied.

Is it all that bad? Yes, and no. During the pandemic a lot of pilots chose an early retirement and the pilot supply doesn’t cover the demand for pilots. Additionally, SkyWest Airlines is essentially a funnel for the bigger airlines. Pilots make their hours at SkyWest Airlines and then continue their careers at other carriers and those carriers can offer more attractive pay. That’s just the nature of the regional business really. The big question is whether SkyWest Airlines will actually follow suit and increase pay like American Airlines recently did. So, I feel SkyWest Airlines should do something if it doesn’t want to see its own pipeline dry up.

There has been some progress. Whereas United Airlines said 150 of its United Express regional jets parked during its first quarter earnings call, that number seems to have reduced to 92. Part of that fleet is operated by SkyWest, so there’s progress in putting aircraft in service.

Conclusion

SkyWest Airlines first quarter results looked good and exceeded expectations. While Wall Street analysts expect further upside, the pilot shortage is putting a damper on how much the regional carrier can benefit from pent-up demand and SkyWest Airlines pilots are high in demand while American Airlines regional jets pilots recently saw their pay being hiked. So, SkyWest Airlines in my view has to follow suit in order not to exacerbate the shortage.

Overall, the pilot shortage limits the potential of regional airlines but also pushes them closer to the Scope Clause limiting the number of seats on the aircraft operated to 76 seats. So, the current shortage will not just transform pay but also transform the fleet over the longer term and might even transform the size of regional airlines.

To alleviate the pilot shortage, SkyWest could opt to operate CRJ-200s under Part 135 which would allow the airline to use pilots with fewer than the 1,500 hours normally required.

Be the first to comment