hallojulie

The Macro Economy Is Moving Favorably for Gold as Protection Against Fears of a Sharp Contraction In The U.S. Economy

The U.S. Federal Reserve’s tightening interest rate policy continues to bear fruit in line with its goal of bringing inflation back to the 2% target that would ensure price stability and a productive economy. After this hawkish monetary policy, the inflation rate stood at 7.1% in November, a significant drop of 60 basis points since October.

Investors now expect negative consequences for the U.S. economy in the form of a decline in gross domestic product [GDP] and a deterioration in employment levels. Although the U.S. Federal Reserve is trying to calm markets by forecasting a slight slowdown in the U.S. economy in 2023, fears of a sharp contraction in the GDP linger.

Fears grew after the U.S. Federal Reserve said at its press briefing last week that it expects the unemployment rate to worsen to 4.6% by the end of next year, from 3.7% in November 2022, in a bid to curb inflation. This is because, according to the Sahm rule, a model used by the U.S. Federal Reserve for economic recession warnings, an unemployment rate of 4.6% would mean a significant economic downturn for the USA.

Against the strong headwind of market fears, certain investment solutions designed to protect the value of assets in investors’ portfolios are, therefore, back in vogue.

The most popular of these investment solutions is gold, and demand for hedging is likely to pick up again as the price per ounce traded via Gold Futures – February 2023 (GCG3) has been on an upward trend since Federal Reserve Chair Jerome Powell’s press conference.

Take Advantage of Skeena Resources Limited’s Higher Volatility Versus Gold

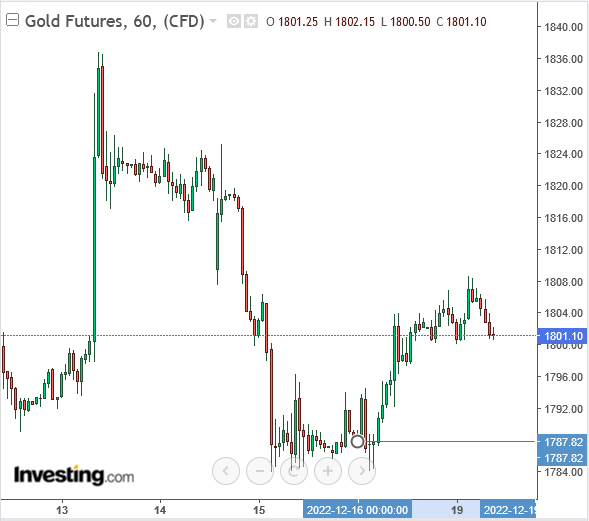

Gold prices rose from $1,787.82 an ounce on Dec. 16 to as high as $1,801.10 an ounce as of this writing, according to Investing.com’s chart

Source: Investing.com

Gold prices are likely to continue to rise as fears of a dramatic contraction in GDP linger in financial markets, driven by what appear to be quite important factors.

Investors on North American exchanges should take the opportunity to profit from the rise in gold prices by trading North American-listed gold stocks, as the shares of these publicly traded companies are typically more volatile than the commodity itself.

So, when the price of gold goes up, shares of gold stocks increase much faster, giving investors an amazing instrument to profit heavily from the metal’s price appreciation.

One of these gold stocks could be Skeena Resources Limited (NYSE:SKE) (SKE, TSX:SKE:CA).

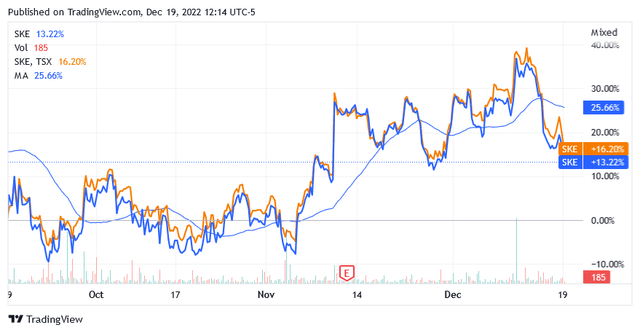

As the chart below shows, Skeena Resources Limited’s shares, which are positively correlated with changes in the gold futures price, also appear to be much more volatile than the metal, showing high potential for impressive upside moves as gold prices rise.

Assuming that the daily change in the share price of Skeena Resources Limited is the result of a linear equation using Gold Futures – February 2023 (GCG3) as an input variable, the average daily return on Skeena shares is nearly twice that of gold futures based on the last 12 trading months.

Skeena Resources Limited Share Price Development

Skeena Resources Limited shares are traded on the New York Stock Exchange under the symbol SKE at a price of $5.38 per unit, for a market capitalization of $389.45 million and a 52-week range of $4.10 to $13.39, at the time of writing this article.

Shares of Skeena Resources Limited are also traded on the Canadian Stock Exchange under the symbol SKE:CA at a price of CA$7.03 per unit for a market capitalization of CA$556.15 million and a 52-week range of CA$5.64 to CA$17.11.

The chart for the last 12 months shows that SKE stock has fallen sharply in both markets. Since the end of September, however, there has been a positive trend in the development of the share price. This development does not take place regularly, but through strong fluctuations, which are typical for stocks that follow the price of commodities.

Regarding the current cycle, the price seems to indicate the formation of a new minimum that can be used to open or increase a position in this stock with the possibility of profiting from later increases.

Skeena Resources Limited in The Gold and Silver Industry

Skeena Resources Limited, headquartered in Vancouver, Canada, is a company engaged in the exploration and development of precious metal properties in Canada.

Skeena Resources is currently attempting to resume gold and silver production at a property called the Eskay Creek Mine. This property was once used to produce the two rare earth metals for the benefit of the former operator and the communities in the Tahltan Territory. This location is in the Golden Triangle, an area of northwestern British Columbia known for precious metals mining and exploration opportunities.

The Eskay Creek gold mine covers approximately 6,151 hectares acres and consists of eight mineral claims, two surface claims and several unpatented mining claims.

Last September, Skeena Resources released a feasibility study for the Eskay Creek mine. This is a highly technical document that briefly describes what the future production of precious metals will mean in terms of economic returns for the company, shareholders, and the local community, as well as accurate geolocation data of metal projects, mineralogical and metallurgical aspects.

From an economic perspective, Skeena Resources Limited plans to resume production of gold and silver, but primarily yellow metal, and recover through an open pit mine approximately 3.85 million gold equivalent ounces from nearly 30 million tonnes of mineral, averaging 4 grams of equivalent gold per ton of mineral.

Production is expressed in gold equivalent as mining activities will attempt to mine gold (approximately 2.87 million ounces) and silver (approximately 75.5 million ounces).

Of course, production will continue throughout the life of the mine, which the feasibility study document estimates at 9 years. This means that Skeena Resources Limited is aiming to excavate no less than 352,000 gold equivalent ounces per year at a total cost of $652 per ounce.

The cost item is all-inclusive in the sense that, in addition to expenses more closely related to mining activity, it also includes taxes payable to local government agencies for the exploitation of the land, as well as various costs associated with property maintenance and exploration and general & administrative expenses. So, $652 per ounce is a very rough estimate and could vary significantly from actual costs once the mine is operational.

In Skeena Resources’ Eskay Creek Mine Project, The Rationale for Good Entry Points in The Stock

If higher gold prices help Skeena Resources shares rally, the feasibility study could instead provide the rationale for the bottoms that investors need for their profit-taking strategy near cyclical highs.

The Eskay Creek Mine Project is as ambitious as it is risky. The significant risk of falling short of expectations creates headwinds for new cycle bottoms in an up-trending stock price.

The project has a net internal rate of return [IRR] of 50%, while investors typically consider a project with an IRR of 30-35% to be highly profitable. In addition, the Eskay Creek Gold Mine has a net present value [NPV] of CA$1.4 billion (approximately US$1.02 billion at current exchange rates) and a payback of only one year.

Here, all these estimates are based on prices of $1,700 per ounce of gold and $19 per ounce of silver, which are anything but conservative.

Especially as far as the yellow metal is concerned as it has averaged $1,610 an ounce over the last 5 years and $1,440 an ounce over the last 10 years. Given these significantly lower prices, the calculations could therefore result in a project with less attractive economic numbers.

Capital is required to move into the operational implementation phase, which should be no less than $435 million just to bring the mine back online.

Then the capital will be needed to ensure the continuation of exploration activities throughout the life of the mine and those that will become necessary to meet the costs associated with mine closure and reclamation work. In total, about $665 million will be needed to fund the entire project.

To raise this money, it will be possible to resort to loans, but since the cost of borrowing increases due to the fight against inflation, the company will have to postpone the implementation of the project or resort to issuing new shares.

Based on an average share price of about $5.5 calculated over the last 30 trading days, the company should be issuing 120 to 121 million shares, bringing the total number of outstanding shares to nearly 200 million. This means that Eskay Creek Gold Mine’s NPV will be $5.1 per share instead of the current $13.5 per share.

Additionally, at this stage of the business, Skeena Resources Limited can be viewed as a growth stock trying to transition from the role of discoverer and appraiser of metals projects to a small producer of gold equivalent ounces.

Therefore, as with growth stocks, the following principle must be applied to the Eskay Creek Gold Mine. Since growth stocks are valued by discounting future cash flows, the market will hardly be unfazed by an NPV calculated using a 5% discount factor, as rising interest rates mean that Eskay Creek Gold Mine could be worth much less than specified in the feasibility study.

Conclusion

The feasibility study thus reveals aspects that could cause downward pressures on the share price. The bottoms of the cycle allow investors to take a position or add shares more conveniently, increasing the potential for a strong return if profit-taking occurs near the cycle highs.

The bullish trend in gold prices should instead be the catalyst, favoring the recovery in Skeena stock prices and the start of a new cycle, of course as long as economic conditions remain supportive for the precious metal. Since the stock tends to grow faster than the commodity, rallies should generally provide interesting profit-taking opportunities.

It will also be possible to profit from cycles by implementing risky trading techniques based on short selling, but these are put into practice by more experienced traders.

Be the first to comment