David Becker

Investment Thesis

Over the past year, Skechers (NYSE:SKX) has made extremely important investments in distribution centers in China, India, Canada, and South America. With the launch of these DCs, the shoe manufacturer will be able to reduce the delivery time of goods to retail and wholesale buyers, which can improve asset turnover. In the last six months alone, the company has launched about 10 e-commerce sites and increased the share of DTC to 39% compared to 29% in 2021. Skechers is well-positioned to achieve its revenue target of $10 billion by 2026. Despite investors’ concerns about inventories and their impact on margins, most of them will likely be sold at the usual price.

The company with the most protected product with inflation remains unnoticed by investors. While the industry average P/E is 12.24, SKX has a P/E score of 7.48. Given the potential drivers for revenue and margin growth, as well as the current comparable valuation, we rate SKX as a Buy.

Company Profile

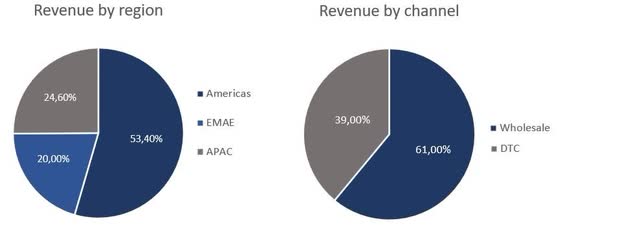

Skechers USA Inc. is an American company that develops and sells men’s, women’s, and children’s shoes under the brands Skechers USA, Skechers Sport, Active, Walk, Run, and many others. Sales are carried out both wholesale in the USA and abroad, and through 1404 own and 3054 partner stores. The revenue structure is as follows:

Investors’ Concerns

On October 25, Skechers released its third quarterly report, after which the shares fell by 9.5%. Earnings were $0.55 per share, below the street consensus of $0.16, while revenue beat expectations to $1.88 billion versus the consensus of $1.80 billion. Gross margin decreased by 280 basis points to 47.1%. Management’s expectations for the final quarter are also below consensus, with revenue of $1.73 -1.78 billion (5.3-8.4% YoY) versus $1.81 billion, and earnings per share of $0.30 – 0.40 versus $0.52.

This decrease in revenue and profit is due to a shortage of containers and restrictions in China, during the quarter about 10% of stores in this country were closed. Despite the decreased activity in China and a 19% drop in revenue, the Asia Pacific region showed growth of 7%, mainly due to the Indian market.

Inventory’s balance sheet grew by 45% to $1.78 billion, as did most retail companies. Management attributed this increase to late deliveries and sharply increased port capacity, while it is expected that stocks will be sold at full price.

“We do feel very good about the inventory. As we noted, it all arrived within the last couple of months. And so it is good inventory that we fully expect to be able to sell through at regular prices. We don’t have any real concerns about that” – John Vandemore, CFO

In the short term, margins will continue to be under pressure due to the supply chain and restrictions in China. However, the prospects remain favorable, as Skechers has a strong competitive positioning.

Brand And Positioning

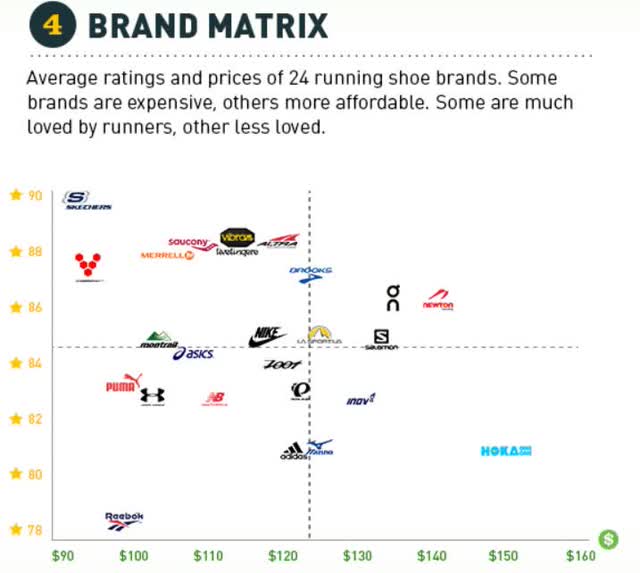

Skechers is the very brand that will not appear in the news headlines, and its advertising will not occupy the largest sign in the mall. The company’s products are more about comfort and durability than design or popularity. SKX does not need to sign contracts with Cristiano Ronaldo or Kanye West to be in demand. Buyers love Skechers because for a little money they get high-quality shoes that they will wear for years.

According to a Runrepeat study, Skechers shoes have the highest customer rating, at the lowest price relative to competitors.

During the period of inflation and cost reduction among consumers, Skechers is in a more advantageous position compared to Nike (NKE), New Balance, adidas (OTCQX:ADDYY) and other brands. The Skechers audience is less likely to save on shoes than the buyers of competitors. At the moment, the average buyer is more likely to refuse to purchase specialized and branded shoes produced by competitors, but not from Skechers. These shoes have a casual orientation and they are cheaper, so the probability of a significant decrease in demand seems unlikely.

For example, according to the results of Q3, revenue in EMAE increased by 48% YoY, although inflationary pressure is strongest in this region, compared with APAC and Americas. For comparison, Nike’s revenue in this region has grown by only 0.8%, adidas by 8.8%, and VF Corp. decreased by 4%. Despite macroeconomic obstacles, the company continues to increase revenue, due to its more inflation-resistant products.

Another argument in favor of strong positioning is effective marketing. Like other sportswear firms, Skechers spends about 7% of its revenue on advertising. However, SKX earns $13.5 of revenue per advertising dollar, while Nike and Adidas have this figure of $12.2 and $8.1, respectively.

Growth Strategy

Since the company is represented in more than 170 countries, logistics and supply chain occupy a very important place in business. At the moment, Skechers is experiencing problems in North America and China, since it does not have enough production capacity in the first region, and China is temporarily paralyzed by the zero-COVID policy. As part of a long-term project, a distribution center is currently being built in Vancouver, with the help of which the delivery of products to Canada, the USA and Mexico will accelerate.

India is also a key market for a shoe manufacturer. A new distribution center in Mumbai will help to establish logistics in the region. Deliveries from DCs in Mumbai and Vancouver are scheduled to begin in mid-2023. The management also announced a new stage of construction of the center in China, completion of work is expected in 2024. These investments are part of a long-term project to expand capacity in key regions. There is also a reconstruction of the center in Colombia and the DC in Panama is being updated.

These distribution centers will not solve the current supply chain problems, however, faster delivery of products in key markets will help increase the brand’s presence.

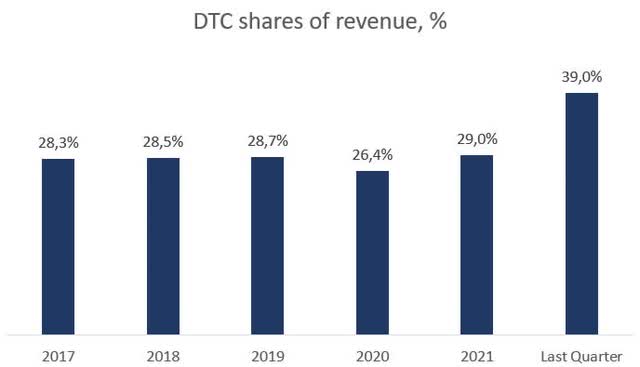

Management also invests in e-commerce [DTC], over the past six months, e-commerce sites have been launched in Belgium, the Czech Republic, Hungary, Italy, the Netherlands, Poland, Switzerland, Portugal and Japan. By the end, it is planned to launch two more sites in Europe and two in South Africa. By the end of the year, the Skechers Plus loyalty program is expected to be deployed in the UK, Germany, Spain and Canada.

These investments are already bearing fruit, the share of Direct-to-Consumer in the last quarterly report was 39%, against 29% at the end of 2021. For comparison, over the past 12 months, the share of e-commerce at Nike was 45.9%, and at VF Corp 45.2%, which tells us about the potential for Skechers.

This segment is extremely important for Skechers because its gross margin is higher than Domestic and International Wholesale. In the last quarterly report, the gross margin for the channel was 66.4%, compared to 36.3% for wholesale.

Over the past year, the company has invested a lot of money in expanding and improving its business. Skechers can become an even more efficient and profitable company by concentrating on the DTC channel. While the new distribution centers will improve logistics and expand the brand’s presence in all regions.

SKX Stock Valuation

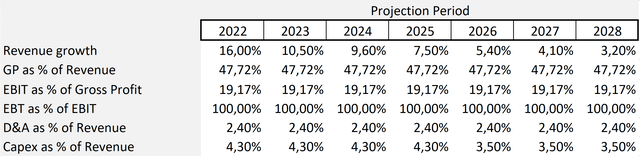

The DCF model is built on several assumptions. We expect revenue in the fourth quarter to be $1.725 billion, in line with the lower bound of management’s forecast, and revenue for the year will grow by 16% year-over-year to $7.289 billion. Next, we expect revenue to reach $10 billion by 2026, in line with management’s expectations.

The projected gross margin is 47.7% – the average for 5 years. This is a fairly conservative forecast, since it does not take into account the growth of the share of DTC sales. The operating margin is also predicted based on a five-year average of 9.1% (EBIT as % of Gross Profit – 19.17%).

CapEx and DD&A expenses will remain at 4.3% and 2.4%, respectively, as the average for the last 5 years until the end of the forecast period. The terminal growth rate is 2%. Our assumptions are presented below:

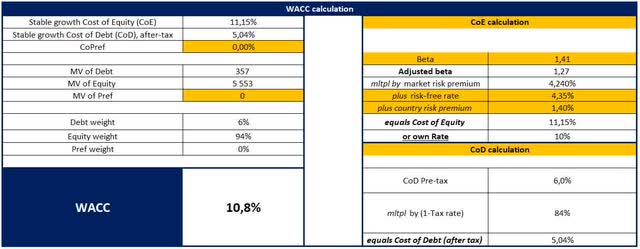

With the cost of equity equal to 11.15%, the Weighted Average Cost of Capital [WACC] is 10.8%.

With a Terminal EV/EBITDA of 5.68x, our model projects a fair market value of $7.8 billion, or $50 per share. The upside potential we see is about 27%.

You can see the model here.

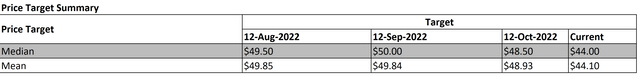

The minimum price target from investment banks set by Cowen is $31 per share (-21.6% downside potential). In turn, Morgan Stanley estimates SKX at $54 (36.5% upside potential). According to the Wall Street consensus, the company’s fair market value is $44.1, which implies 11.45% upside potential.

Since the beginning of the year, the S&P 500 index has declined by 19%, while SKX shares have fallen by 30%, and even by 40% from the historical peak. Nevertheless, after COVID, the company significantly improved its financial results, and its net margin demonstrated the best period in its history. Nevertheless, investors continue to ignore Skechers amid general pessimism in the stock market and the consumer industry in particular.

| SKX | NKE | ADDYY | VFC | DECK | |

| Market cap | $5.51B | $144.1B | $23.7B | $10.5B | $8.7B |

| EV/Salsa | 0.99x | 3.32x | 1.32x | 1.54x | 2.65x |

| EV/EBITDA | 10.17x | 22.09x | 13.28x | 10.59x | 14.92x |

| P/E TTM | 8.87x | 30.16x | 20.96x | 30.65x | 20.96x |

Conclusion

Over the past two years, Skechers has made important investments that will lay the foundation for further growth. The largest distribution center in California was reconstructed, two centers are planned to be launched in Vancouver and Mumbai by mid-2023, and DC construction in China is expected to be completed. Through these centers, the company will strengthen its position in these markets, both for consumers and wholesalers. Over the past 12 months, with the launch of new websites, Skechers has been able to increase its DTC channel share from 29% in 2021 to 34%. The shoemaker is trading at a substantial discount to industry averages and peers. According to our valuation, the upside to fair value is 27%. We are bullish on the SKX.

Be the first to comment