gorodenkoff/iStock via Getty Images

Money can buy you a fine dog, but only love can make him wag his tail.” – Kinky Friedman

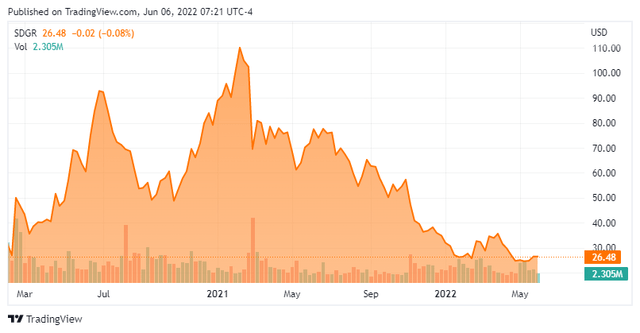

Today, we take our first in-depth look at a somewhat unique concern in both the software and drug discovery space. Thanks to the downturn in the market over the past six months, the shares now find themselves in ‘Busted IPO‘ territory. A full analysis follows below.

Company Overview:

Schrodinger Inc. (NASDAQ:SDGR) is headquartered in New York City. The firm’s physics-based software platform enables discovery of novel molecules for drug development and materials applications. The company operates in two segments, Software and Drug Discovery.

The software business provides its software for drug discovery in the life sciences industry, as well as to customers in materials science industries. The discovery side has several compounds in development, both standalone as part of collaborative efforts. The stock currently trades for just over $26.00 a share and enjoys a market capitalization of just south of $2 billion.

May Company Presentation

The company’s software platform enables discovery of first-class molecules for materials application and drug development. This process allows clients to develop new products at a lower and at an improved success rate. Schrodinger continues to update computational algorithms to more accurately map important properties of molecules.

May Company Presentation

The second part of the company’s business revolves around its drug discovery program. The company partners with a variety of drug companies like Bristol-Myers Squibb (BMY) to develop new drug candidates.

May Company Presentation

The company also has its own wholly owned internal pipeline of early stage assets. These are very early stage efforts. Right now, this part of the business provides about 20% of overall revenues, but this percentage will increase over time as this part of Schrodinger is growing much faster than the software side.

May Company Presentation

First Quarter Results:

On May 4th, Schrodinger reported first quarter numbers. The company had a GAAP loss of 48 cents a share as revenues rose over 50% from 1Q2021 to nearly $48.7 million. Both top and bottom line numbers nicely beat expectations. Software sales, where growth is more consistent and predictable, was up 26% to $33.1 million during the quarter.

May Company Presentation

On the press release that accompanied earnings numbers, leadership provided the following guidance for FY2022.

- Total revenue expected to range from $161 million to $181 million, representing 17 percent to 31 percent growth over 2021 vs. $172.25M consensus.

- Total software revenue expected to range from $126 million to $136 million, representing 11 percent to 20 percent growth over 2021.

- Total drug discovery revenue expected to range from $35 million to $45 million, representing 42 to 82 percent growth over 2021.

Analyst Commentary & Balance Sheet:

Since late February, five analyst firms including Citigroup and Jefferies have reissued Buy or Outperform ratings on SDGR. Two contained minor downward price target revisions. Price targets proffered range from $55 to $88 a share. One month ago, Morgan Stanley maintained its Hold rating and $34 price target on SDGR.

There has been no insider activity in this stock so far in 2022. Approximately nine percent of the outstanding float in SDGR is short. The company ended the first quarter with approximately $525 million of cash and marketable securities on its balance sheet.

Verdict:

The current analyst consensus has Schrodinger losing just over two bucks a share in FY2022 as revenues advance more than 25% to some $175 million. Analysts are modeling 60% revenue growth in FY2023, although estimates are in a somewhat wide range (roughly $250 million to $260 million).

May Company Presentation

The problem with trying to place a value on Schrodinger is the company has more moving parts than the typical small cap biotech/biopharma firm I typically look at. First of all there is the software division that currently is providing consistent growth and revenues and is more akin to a tech company than a biotech firm.

Then we have numerous partnered drug candidates, mostly early stage and the internal pipeline that is smaller and very early stage. Drug discovery revenue is growing faster than the software side, but off a smaller base. This is harder to model as milestone payments make up a good portion of this revenue, and are likely to be ‘lumpy‘.

The company’s balance sheet seems to be in good shape. Schrodinger would appear to be well-funded with over $500 million in cash and marketable securities given its net loss was approximately $100 million in FY2021. Leadership noted on its last conference call that ‘we have sufficient runway to fund our operations for the foreseeable future, including advancing our wholly-owned programs into clinical studies‘.

The shares probably merit a small ‘watch item‘ for now as this seems an intriguing story with lots of potential depending on how its pipeline develops. This is also a concern we will probably revisit in late 2022 or early 2023 to see how Schrodinger is progressing.

It’s not the size of the dog in the fight, it’s the size of the fight in the dog.” – Mark Twain

Be the first to comment