Thomas Barwick/DigitalVision via Getty Images

Introduction:

Six Flags Entertainment Corporation (NYSE:SIX) has been beaten up since its highs back in March of this year. This can be attributed to the general market downturn and fear of impending recession. Six Flags did not fare well in the last recession, going bankrupt, which might be why Six Flags is trading at a discount to peers. Six Flags’ current valuation is 11.54 times LTM free cash flow or FCF or 9.5 times normalized FCF. This represents a distressed value, which I believe is the market getting ahead of itself. Six Flags has a number of positive things going for it, including years of profitability, attendance numbers that have yet to recover to pre-coronavirus highs, and a new CEO with a great plan for the future.

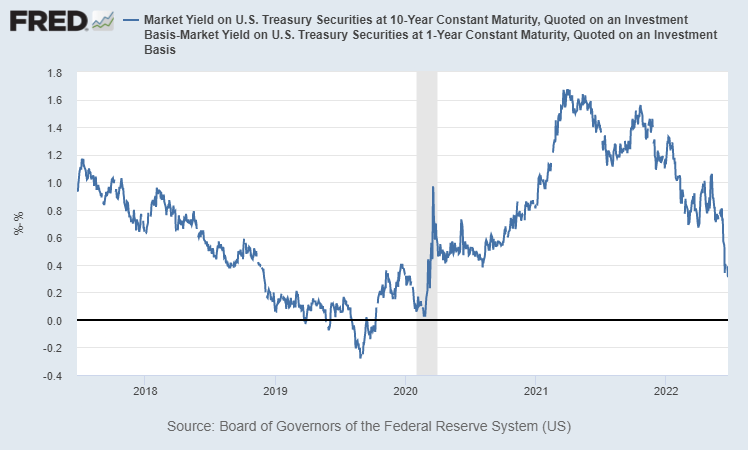

Recession Fears

Fear of a recession is widespread and I’m beginning to believe it is coming myself. The 10-year/1-year yield curve which is my preferred recession indicator is beginning to fall drastically, and if it hits negative territory, I’ll officially call it a recession.

Six Flags’ depressed valuation and hammered stock price can be explained by this. There is a perception that theme parks are levered plays on consumer spending, and in the previous recession, Six Flags went bankrupt.

These recession fears for Six Flags I feel are overblown. During the last recession in 2008-2011, Six Flags had been unprofitable and mismanaged for years beforehand, and so bankruptcy was inevitable. This time around, Six Flags has been profitable since its restructuring back in 2011. Since 2016, and excluding 2020, Six flags has made a combined $976m in profit, compared to a combined 1.1B loss in the years preceding 2010. This gives a much better chance for debtors to roll over Six Flags’ debt come the next recession.

|

Previous Cycle’s Six Flags Net Income (In Millions) |

||||||

|

Year |

2010 |

2009 |

2008 |

2007 |

2006 |

2005 |

|

Net Income |

$(875.56) |

$(229.16) |

$(134.93) |

$(275.12) |

$(327.58) |

$(-132.9) |

Source: Table created by author data collected from company 10-Ks.

|

Last Five Years of Six Flags Net Income (In Millions) |

||||||

|

Year |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

|

Net Income |

$129.92 |

$(423.380) |

$179.065 |

$276.00 |

$273.82 |

$118.30 |

Source: Table created by author data collected from company 10-Ks.

The second item is that theme parks are not as levered to consumer spending as someone would think. Even in the last recession back in ’08, attendance for Six Flags was only down 8%. If we look at Cedar Fair (FUN), another theme park operator, they experienced a similarly small loss in attendance. The drops in attendance are probably more than they would have been because of the swine flu that was going on at the time.

The fact that revenue doesn’t drop that much during a recession is due to the fact that parkgoers who live nearby will still go to the parks, while tourists who have to travel long distances are the ones most affected by a recession. Per the CEO, Six Flags is more dependent on nearby parkgoers than tourists for revenue.

In conclusion, the likelihood of a recession is increasing every day. Six Flags should be able to weather this storm and come out stronger with the new strategy the CEO is pushing the business towards.

New Path Forward

I traveled to Six Flags back in December of 2021, and my experience was not great. This was caused by overcrowding in the park. My wait for New Texas Giant was over 3 hours. Next was that the food I paid an arm and a leg for wasn’t really that good. The experience, though negative, is a positive, as there is much to improve at the park.

Six Flags appointed a new CEO in Q4 of 2021 with a plan to improve the park experience in exactly the right way. This includes reducing wait times for rides and improving the food options. This will be done by increasing the admission price, getting rid of heavy discounting, digital screens throughout the parks that display current wait times, and franchising well-known brands to the park such as Starbucks (SBUX) and Fatburger (FAT).

The fact that the parks are overcrowded means that prices aren’t high enough. When I went back in December, admission was only $15, which seemed crazy low, especially compared to Disneyland (DIS), which is over $100. So, taking the price higher seems like exactly the right strategy. My intuition is that demand elasticity will prove to be very inelastic for Six Flags. Another point is that per capita spending in Six Flags parks was a lot lower than competitors, with the nearest one being 18% higher. This ensures me that there is room for price hikes.

|

Per Capita Park Spend in 2021 |

|

|

Companies |

Per Capita Spending on Parks |

|

Six Flags |

$52.40 |

|

Cedar Fair |

$62.03 |

|

SeaWorld (SEAS) |

$74.43 |

|

Vail Resorts (MTN) |

$72.49 |

Source: Table created by author data collected from company 10-Ks.

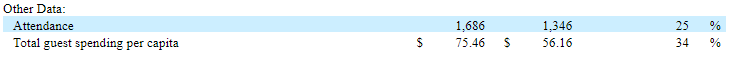

Even though attendance will most likely fall from pre-coronavirus highs, there is still a reopening tailwind that can push up attendance or even stop it from failing even with the price hikes. This is because attendance has yet to recover to pre-coronavirus levels. In 2019, attendance was 32.811 million, while in 2021 attendance was only 27.693 million. This is actually already playing out, as in Q1 2022 attendance was up 25% even while guest spending per capita was up 34% mostly due to the pricing.

Six Flags 2022 Q1 Quarterly

This new strategy will reduce attendance in the coming years, but revenue and profits will still increase, as prices should rise faster than attendance will drop.

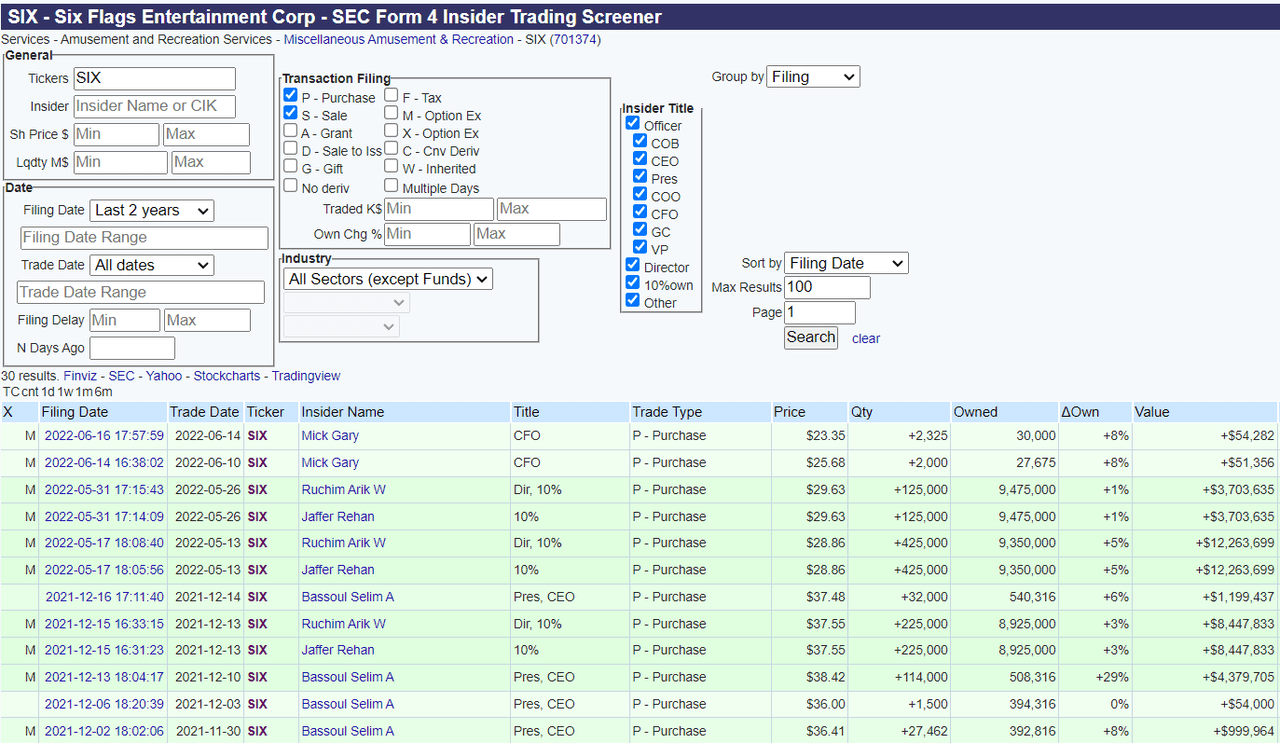

Insiders

New CEO Selim Bassoul has really impressed me so far. In his first conference call on Q4 2021, he went into great detail on his study of the parks and clearly laid out the future of Six Flags. He showed passion and a great understanding of the business. This makes me believe he is the perfect match.

Insiders have been buying up stock at around these levels. This means that they think, along with me, that the company is undervalued at current prices. The largest purchases came from Ruchim Arik W and Jaffer Rehan, both 10% owners of the company, in the upper 20s back in May. Minor purchases in June came from CFO Mick Gary. The CFO is especially interesting due to the fact he is probably the most knowledgeable person in the company when it comes to the financial position

OpenInsider

The excellent quality of the CEO and the insider purchases from large shareholders and the CFO give me confidence that the share price is undervalued and should do well from here.

Risks

The main risks I see for Six Flags going forward are a large amount of debt on their balance sheet, potential margin squeeze, and execution risk in the new CEO’s plan.

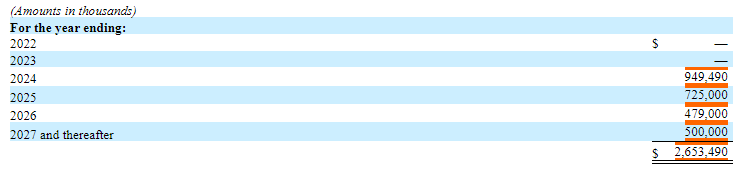

Debt

Six Flags has a lot of debt, around $2.6B. Compare this to free cash flow of 170-300mm. This creates quite a large FCF/Debt ratio. This large debt load creates risk around if they can maintain steady cash flows and if they’ll be able to refinance their debt.

Another concern is the rising rate environment. Six Flags’ debt maturities are not far off. In 2024, Six Flags has $1B of debt coming due. This will need to be refinanced at most likely higher rates. This could reduce net income when the time comes.

The new CEO listed as priority number 2 to reduce the debt load. This should help to mitigate this risk going forward. Not to mention Six Flags’ consistent profitability.

Six Flags 2021 10-K

Execution

The second risk is the execution of the new strategy the CEO is pursuing. The new CEO, Selim Bassoul, was previously CEO of Middleby Corporation for 18 years, where he was very successful. However, he is still new to Six Flags, so he still has a lot to prove. In his new plan, the main risk is the price hikes. This could result in a backlash from consumers.

Margin Squeeze

Inflation is everywhere and will definitely affect Six Flags. Six Flags and theme park operators, in general, are very capital-intensive businesses due to the fact that they always need to create new exciting attractions. Not to mention theme parks employ lots of minimum-wage labor. Inflation increases the costs of both their new investments and wages, bringing about lower margins and lower returns on investment. The new CEO has announced lower capex spend going forward, along with automating security and back-of-kitchen operations, which should help to alleviate these pressures.

Valuation

Compared to peers, Six Flags is quite cheap. I used a normalized FCF multiple, which I define as a 3-year average FCF excluding 2020 due to coronavirus. Six Flags sits at 9.5 times normalized FCF compared to the second-lowest peer Cedar Fair at 16.5 times normalized FCF. Pre-coronavirus profitability was even higher for Six Flags, so the valuation could be even lower on an LTM basis.

|

Company |

Normalized FCF Multiple |

|

Six Flags |

9.5 |

|

Seaworld |

18 |

|

Cedar Fair |

16.5 |

|

Vail Resorts |

23 |

Source: Table created by author data collected from company 10-Ks

I also calculated an expected return for Six Flags.

|

Worst Case |

Base Case |

||

|

Current Price |

$22.85 |

Current Price |

$22.85 |

|

Rev Per Share 22 |

19.76 |

Rev Per Share 22 |

19.76 |

|

5 Year Rev CAGR |

-2% |

5 Year Rev CAGR |

2% |

|

5 YR FCF PM |

8% |

5 YR FCF PM |

15% |

|

FCF Multiple |

8 |

FCF Multiple |

16 |

|

FCF Per Share |

1.58 |

FCF Per Share |

$3.2 |

|

Future Price |

$12.6 |

Future Price |

$51.2 |

|

Expected Return |

-11% |

Expected Return |

18% |

Base Case

In the Base Case, I use 2022 projected sales from Seeking Alpha of $1.7B as my starting place. I assume that in 2023 Six flags will suffer an 8% sales drop due to the recession, then a quick rebound in 2024 and 3% growth after that. This translates to a 2% expected CAGR for sales growth going forward. I assume that Six Flags will reach their per-coronavirus margins of 15%. And I assume Six Flags will receive a pre-coronavirus multiple of 16 times.

From the current price, this translates to an 18% 5-year CAGR. Not to mention this does not include any buybacks or dividends. If shareholder yield were to return to pre-coronavirus levels, shareholder yield (buyback yield + dividend yield) would be 13%. This would juice the returns even more. However, I’m uncertain when this will return, so I did not include it in my assumptions.

Worst Case

The worst-case represents what may happen given a recession. I assume a 12% sales drop from this year’s projected sales, which is a -2% CAGR over 5 years. Also, I assume lower margins of 8% due to sales leverage and a multiple of 8, which is a distressed multiple. From this, I get a price of $12.6, a share which is a lot lower than the current price. From the current price, there is still potential for a lot of downside. However, recessions are impossible to predict let alone the stock price. So, given the base case, shares seem attractive. Also, it’s unlikely a recession will last 5 years, which is my forecast horizon.

Conclusion

Six Flags is at a very attractive price currently, with my expected return of 18% CAGR over five years and the potential for more once shareholder yield comes back to pre-coronavirus levels. I think Six Flags should make it out of the recession this time without bankruptcy and prosper due to the new CEO’s strategy. However, the risks of margins being squeezed, execution, and the debt should be watched.

Be the first to comment