AvigatorPhotographer Sinopec Shanghai logo (Sinopec Shanghai home page)

Investment thesis

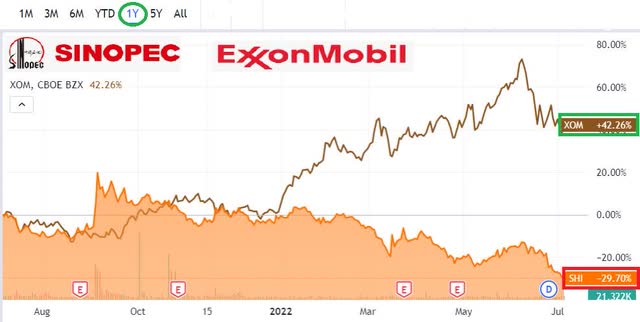

Sometimes we can see big divergences in share price developments for some companies that operate in the same industry. There is most likely a reason for this divergence but it is worth asking why there is such a large difference.

Sinopec Shanghai versus ExxonMobil share price (SA)

Sinopec Shanghai Petrochemical Company Limited (NYSE:SHI) has a market capitalization of just USD 11.4 billion, although it is a part of the whole Sinopec group which has a market capitalization in excess of USD 62 billion

Exxon Mobil (XOM), on the other hand, is a company with a USD 362 billion market capitalization.

However, is Sinopec Shanghai Petrochemical offering investors good value at this moment?

That is what we want to find out

Background

Sinopec Shanghai Petrochemical Co., Ltd. is one of the major refining-chemical integrated petrochemical companies in China.

It became the first international listed company in China, with its shares listed on the Shanghai Stock Exchange, the Stock Exchange of Hong Kong, and the New York Stock Exchange. In 2013, the Company completed the reform of equity separation.

Their listed shares on the NYSE are ADSs where 1 share represents 100 Class H shares on the Shanghai Stock exchange. There is a total of 10.82 billion shares outstanding in SHI.

The company has a primary crude oil processing capacity of 16 million tons per year. Products are gasoline, diesel, jet fuel, chemicals such as synthetic fibers, resins, and plastics.

SHI 1 year share price development (SA)

Financial Performance

As their interim report will come out only around 27 August, we will look at their 2021 Full Year financial report which came out on 27 April 2022.

Revenue increased from RMB 61.5 billion in 2020 to RMB 75.9 billion in 2021

Net profit after taxes improved from RMB 0.66 billion to RMB 2.08 billion in 2021.

EPS was RMB 0.102 in 2021, which translates to USD 2.91 per ADS as there are 100 shares in one ADS. Based on the present price of USD 16.31 it gives us a very reasonable 12-month trailing P/E of 5.6

In comparison, XOM also has an attractive estimated EPS of USD 7.35 as an average from 21 analysts.

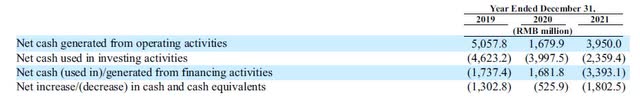

More importantly than earnings or profit is the ability to generate free cash flow When we look at this we can see that the cash generated from operating activities more than doubled last year. However, when we take into account the cash used in investing and financing activities we do get a decrease in cash of RMB 1.8 billion.

Net cash generation of Sinopec Shanghai (Sinopec Shanghai 2021 Annual Results)

But we do need to look at this in view of their strong balance sheet, as the negative cash flow after investing and finance activities is well covered by the balance sheet.

It sometimes frustrates me when I hear people comment that Chinese companies are burdened with a lot of debt, as this is not true. Such biases are based on ignorance. Many, especially the ones controlled by the government, have no debt at all.

With regards to the balance sheet of SHI, it is as solid as it can get.

As of the end of 2021, they held time deposits in banks worth RMB 5.58 billion and cash on hand of RMB 5.11 billion. Their total borrowings were just RMB 0.7 billion

This resulted in equity of RMB 10.8 billion in share capital and as much as RMB 19.42 billion held in reserves in the accounts.

Valuation

How should we value the business?

I would not want to base it on the share price in comparison to the value of the net asset value per share.

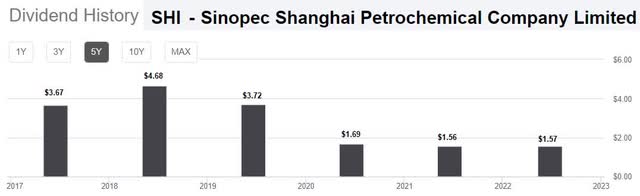

We can look at what we as investors get paid in dividends to judge the present value of future earnings to us as shareholders. Here is how the dividend has been over the last years.

Sinopec Shanghai – dividend history (SA)

The yield of more than 9% is attractive, but the problem with the dividend is that SHI’s dividend is not stable. It dropped from USD 4.68 in 2018 to just USD 1.69 in just two years. That is a 64% drop.

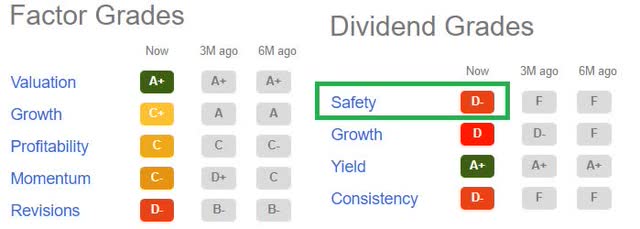

Sinopec Shanghai – low dividend safety (SA)

We see that it gets good grades in terms of value, but a D- in terms of dividend safety.

As such it is hard to judge what owners will receive year in and year out over a period of the next few years.

Business development

Most supermajors like XOM and especially Shell (SHEL) are transforming their business towards a less carbon-intense industry in the future. This costs money and will most likely result in a somewhat lower return on invested capital.

To the best of my knowledge, SHI has not produced any ESG report, or as they call it a corporate social responsibility report, since March of 2021 for the year 2020.

In this report, they simply said they will follow the Chinese government’s policy on peak carbon dioxide emission by 2030 and carbon neutrality by 2060 as a goal. In the meantime, they keep burning mostly coal to provide the energy they require. In 2020 they burned 7.2 million tons of coal equivalent with a total carbon emission of 11 million tons.

Concrete plans are in place to improve their carbon footprint through energy consumption revamp and substitution, such as replacing some of the coal used with natural gas. It remains to be seen how far they will go and at what costs.

Risks to the thesis

My main concern with SHI is whether they have the ability to truly pass on the increased cost of raw materials, such as crude oil and any other inflationary expenses.

SHI imports as much as 95% of its crude oil to manufacture its products. Last year this cost them RMB 43.2 billion, which accounted for 58.12% of their annual cost of sales

They do admit that they sometimes fail to pass on these increased costs to their customers and that they are dependent on government regulations. It restricts the prices they can obtain from certain of their fuel products such as gasoline, diesel and jet fuel, and LPG. Last year 47% of their sales came from such products that were subject to price controls.

The balance, fortunately, comes from the chemical side of the business which does not face such restrictions.

Conclusion

When the war in Ukraine started, most of the western world imposed a trade embargo on the importation of oil from Russia. Not gas, as they desperately need that in Europe. This caused Russia to discount sales of crude oil for those that gladly take it. China is one such country.

According to an article published end of May by Bloomberg, this discount was as much as 30%

That rebate comes out to roughly USD 35 per barrel so it is substantial, even if they have to ship it further which does add some costs.

This is a competitive advantage for those Chinese refineries that can use their crude.

In terms of gasoline prices, China recorded on 4th July a price equivalent of USD 5.50 per gallon. From what I see in the news about gasoline prices in the U.S., I draw conclusions that gasoline cannot be too heavily subsidized in China.

It will be interesting to see in August how SHI has performed in the first half of this year with all these important factors.

At the moment, it looks fair that there is a large divergence in price between the likes of XOM and SHI. One could perhaps argue that the difference is higher than it ought to be and as such there could potentially be more upside to SHI than it is to XOM at this moment.

Nevertheless, I will take a Hold stance as there is too much uncertainty around what kind of profit margins they can achieve and if they would change their dividend policy to a more stable dividend smoothening out some of the volatility in the commodity sector.

Be the first to comment