RiverNorthPhotography/iStock Unreleased via Getty Images

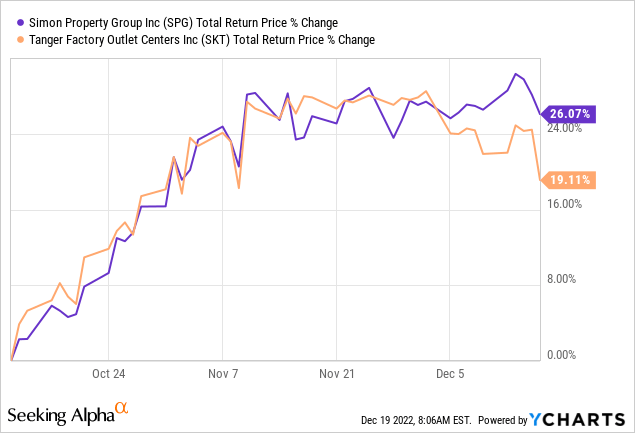

When we last covered Tanger Factory Outlets Inc. (NYSE:SKT) we acknowledged that the key metrics had improved and the REIT’s 10% dividend hike would put bears on the defensive. Nonetheless, we saw this an inferior play relative to Simon Property Group Inc. (NYSE:SPG) which we felt was the better play on retail space. How did that work out? Well, SKT continued higher as investors were thrilled with getting a fatter dividend, but those that went with SPG definitely did not regret the decision.

We examine the recent results and key metrics to tell you why we are doubling down on this relative performance train for 2023.

Q3-2022

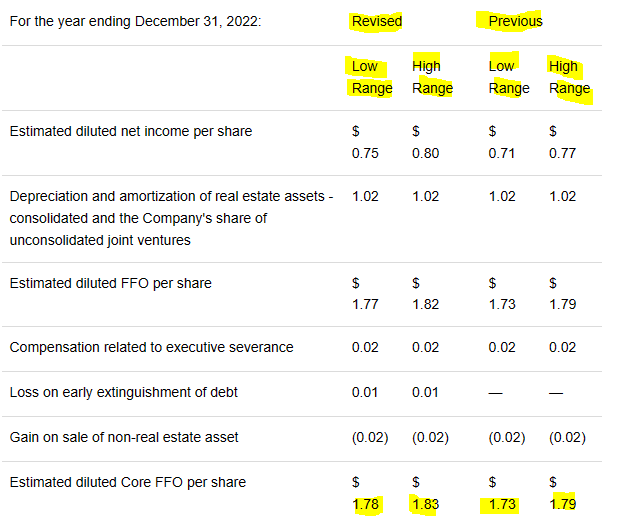

For both retail REITs, the third quarter results were exceptionally strong. Tanger’s prime boast was the increase in occupancy to 96.5% from 94.4% in 2021. Simon matched that growth in occupancy which moved to 94.5% at the end of Q3-2022 compared to 92.8% in Q3-2021, for an increase of 1.7%. Both REITs raised their guidance for the year. SKT’s beat saw them move up core funds from operations (FFO) range by about 3%.

Tanger Q3-2022 Press Release

Simon’s guidance raise was less impressive but still respectable at 1.5%. The REIT now expects FFO to be within a range of $11.83 to $11.88/share. While Tanger had raised its dividend from 20 to 22 cents a share earlier in the year, Simon delivered its third consecutive dividend hike, which took the quarterly amount to $1.80 per share.

On the surface it appears that both REITs could do no wrong and an investor could happily trek with either. After all, a small price outperformance over two months is not necessarily indicative of much beyond a random walk. While both REITs have done well so far, we think the reasons for owning Simon over Tanger have actually become more compelling today than they were a little while back. We go over those four reasons and rate both the stocks.

1) It Is All About Sales

One key difference in the press releases was how underlying retail sales shaped up for the two REITs. See if you can spot it. Here is Tanger talking about Q3 results.

Average tenant sales productivity remained nearly flat at $446 per square foot for the twelve months ended September 30, 2022 compared to $448 per square foot for the twelve months ended September 30, 2021, a decrease of 0.4% for both the total portfolio and on a same center basis

Source: Tanger Q3-2022 Press Release

Followed by Simon.

We reported another record in the third quarter of $749 per square foot for the malls and outlets, which was an increase of 14% year-over-year. Mills ended up at $677 per square foot, a 15% increase. TRG was $1,080 per foot, 25% increase. Our occupancy cost is at 12%, which is a level not seen since early 2015.

Source: Simon Q3-2022 Conference Call Transcript

The bear argument has always been one of malls going obsolete. While flat sales in a highly inflationary environment is a weak counterargument from Tanger, Simon really knocks the bear case out. An extension of this is that if you cannot grow sales (Tanger tenants) in the tailwinds of such a strong retail environment, what is going to happen in the next recession?

2) Weighted Average Debt Maturity & Credit Ratings

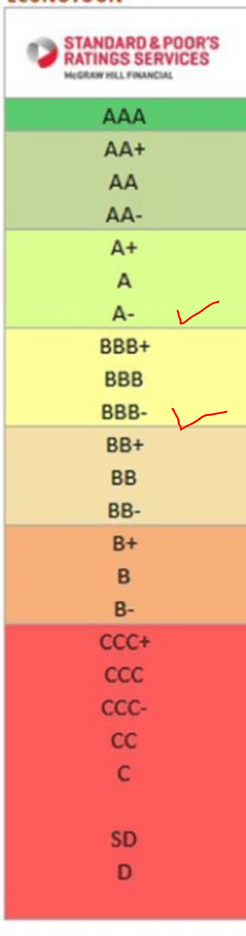

While both Simon and Tanger have excellent interest coverage levels, Simon again gets an edge by having a weighted average debt maturity of 6.8 years. Tanger’s identical number came in at 5.0 years at the end of Q3-2022. while neither number is concerning, the higher one is obviously better to navigate challenges. Simon being rated A- by S&P is also a huge edge over BBB- for Tanger.

S&P

3) Better Dividend

Dividends are the key reason to invest in REITs and Simon has worked hard to reward shareholders in that area. The current dividend yield is now 6.2% for Simon versus 4.83% for Tanger. Both REITs are paying a relatively low percentage of their FFO and have plenty of coverage for their dividends. Nonetheless, Simon is the one that is rewarding its shareholders in a better manner today.

4) Simon Is Cheaper

On a simple FFO multiple level, Simon trades 9.5X forward FFO versus 10X for Tanger. This may seem like splitting hairs, but adds weight to the rest of our thesis. Simon is the superior end product here and should trade at least three multiples higher than Tanger, all other things being equal.

Verdict

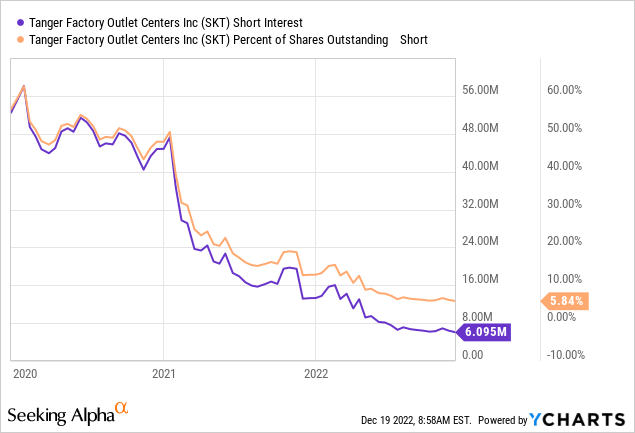

One final piece of the puzzle here is that it was extremely dangerous to Short Tanger in the past. Short interest was at a mammoth 60% at one point.

The bears have now given up and gone home. Hence a paired trade makes more sense now, with little possibility of a short squeeze on the Tanger front. We think a Long Simon/Short Tanger strategy should do well in 2023. We rate Simon a Hold and Tanger a Sell.

A Quick Update On Those Preferred Shares

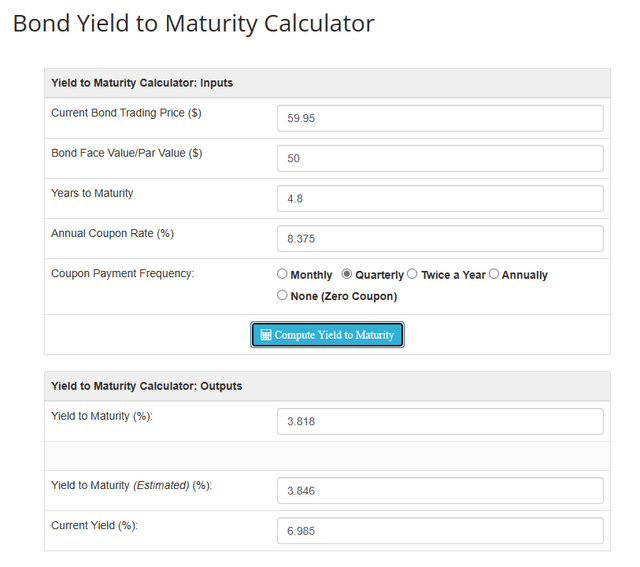

Simon has preferred shares listed Simon Property Group, Inc. PFD J 8.375% (SPG.PJ). These are callable in October 2027. We have been warning about the most horrific risk-reward on these shares since January 2021 (see Distortions Created By Yield Chasing). Over the last two years, those shares have delivered total returns of negative 6% (inclusive of those fat dividends) and investors did well to avoid those return-free coupons. The current yield to maturity has improved modestly.

DQDYJ

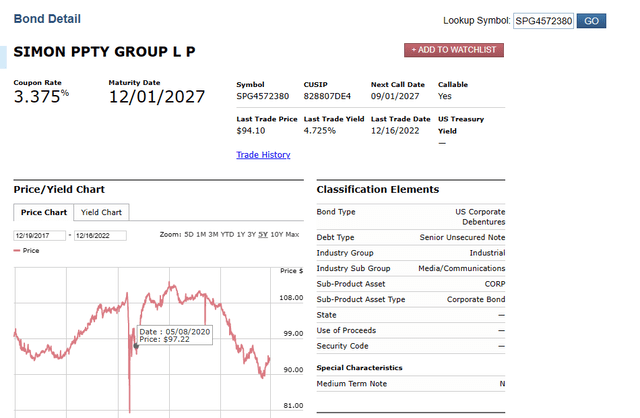

The preferred shares still look like a waste of time considering they provide less yield to maturity than comparable Simon bonds.

FINRA

We think investors should avoid the preferred shares and defer to the bonds.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment