IGphotography

Simon Property Group (NYSE:SPG) cannot catch a break. After making it through the pandemic more or less in one piece, the company is now facing the risks of inflation and recession. While investors are justifiably hard pressed to call mall REITs a growth industry, the valuation has finally come to a point in which the reward outweighs the risk. With a strong balance sheet, near-term financial risk remains conservative at worst. While the stock is not yet presenting “home run” potential, the 7% dividend yield is attractive.

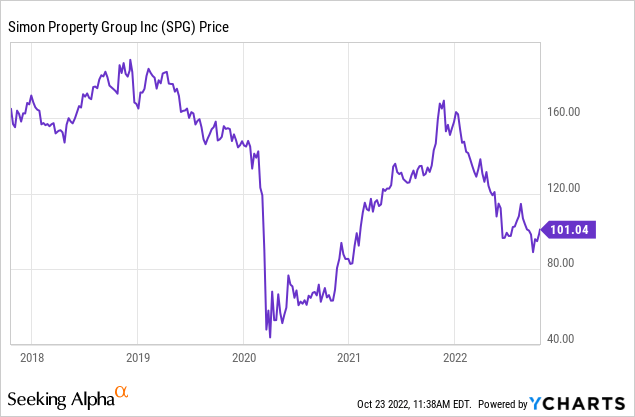

Simon Property Stock Price

SPG had just finally broke through to pre-pandemic levels before the broader market turbulence hit the stock.

I last covered the stock in March where I recommended avoiding the stock on account of changing financial disclosure. I was previously bearish the stock here and here with good results. The stock is not quite trading at pandemic lows (the stock traded in the $40’s briefly), but rent collection isn’t under question right now. I have been waiting for the risk-reward to turn positive, which I believe has finally happened courtesy of the 7% yield.

SPG Stock Key Metrics

The latest quarter saw continued recovery from the pandemic, with funds from operations (‘FFO’) growing 1.4% to $2.96 per share on a comparable basis. Portfolio NOI increased by 4.6%.

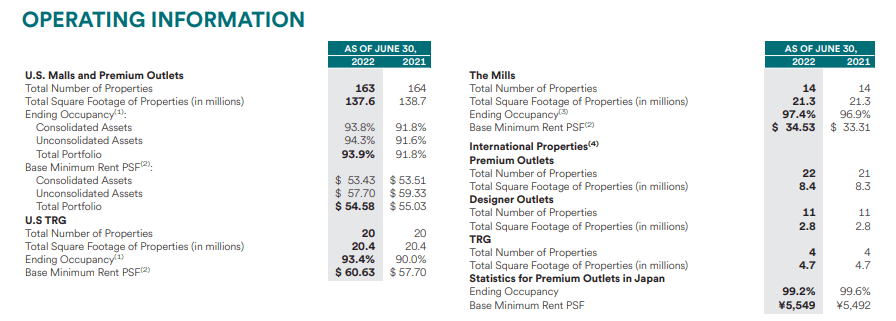

Occupancy was 93.9% versus 91.8% in the prior year – it hovered just above 94% before the pandemic.

On the conference call, management noted the retailer sales reached $746 psf, with the previously acquired Taubman properties being a highlight at $1,068 psf.

Yet in spite of the rising occupancy rates and strong tenant sales, base minimum rent declined to $54.58 psf with most of the weakness seen in JV properties.

2022 Q2 Supplemental

I suspect that the weakness can likely be attributed to poor leasing spreads. An analyst had asked about leasing spreads on the call (because the company no longer disclosed this metric) to which CEO Simon merely replied that they are “moving in the right direction.”

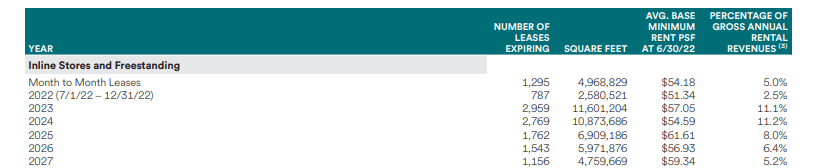

The next few years will be a critical test for the company as a large number of leases will be expiring.

2022 Q2 Supplemental

Perhaps investors were fine giving the company the benefit of the doubt over the past 2 years, with a potential explanation being that the company needed to bolster occupancy rates before being able to exert pricing power. But now that occupancy rates are just around 94%, it would be concerning if leasing spread strength did not return or if average base minimum rents did not begin growing again. Remember, these leases typically carry annual lease escalators in the 2% to 3% range (these are class A properties), making the declines in base rent particularly troubling. Yes, many leases were switched to percentage rents, but those likely will be pressured in an inflationary environment.

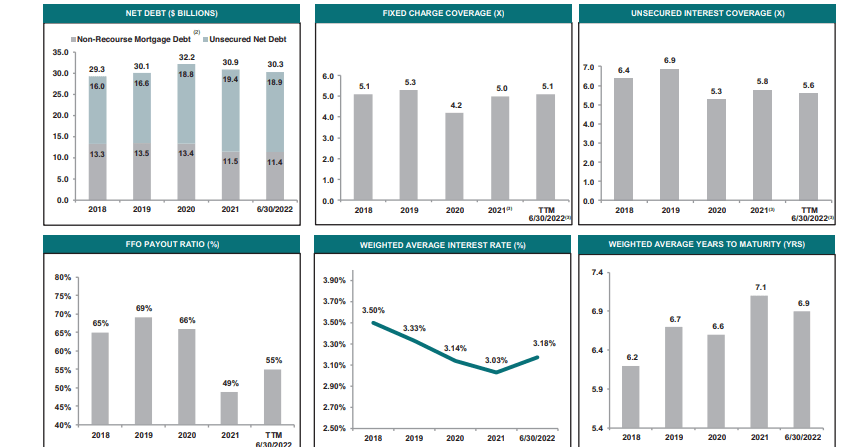

SPG maintains a strong balance sheet with conservative leverage and high liquidity.

2022 Q2 Supplemental

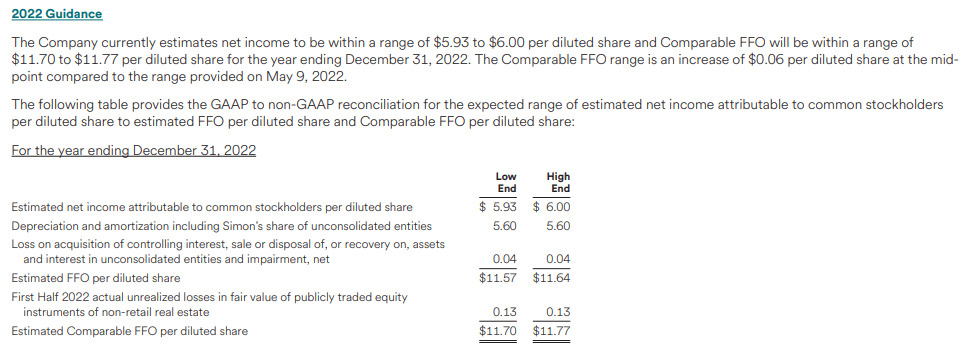

The company is back to pre-pandemic beat-and-raise habits, increasing guidance slightly to $11.77 in FFO per share.

2022 Q2 Supplemental

Is SPG Stock A Buy, Sell, or Hold?

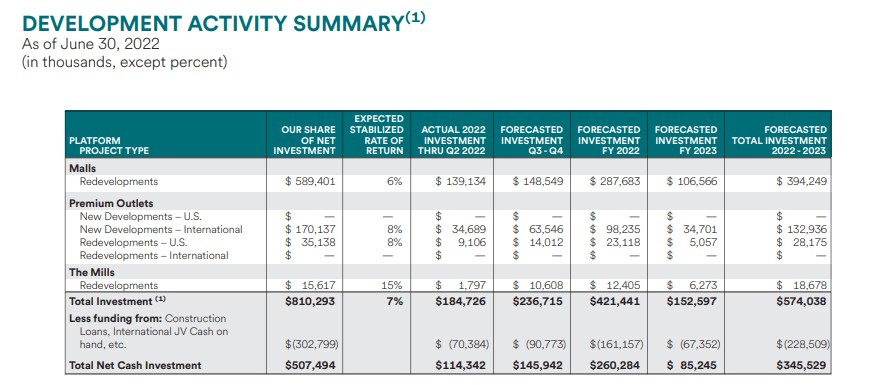

At recent prices, the stock trades at 8.5x FFO and more critically, at a 7% dividend yield. The company is repurchasing stock, having spent $144 million in the latest quarter. At the moment, I am skeptical that share repurchases are the best use of capital. SPG has greatly scaled back its growth development ambitions – it previously spent well over $1 billion annually.

2022 Q2 Supplemental

These growth projects did more than generate solid ROI. These projects involved tearing down vacant anchor boxes (like Sears) and replacing them with restaurants, small stores, and housing. I always held the view that these projects helped to counteract the secular headwinds from e-commerce. But management is now apparently preferring share repurchases to growth projects. I cannot help but hold fear that management is failing to invest aggressively enough to avoid long term e-commerce pressures. In my view, the company should be investing as aggressively as possible in growth projects – even if the ROI is lower than simply repurchasing shares. The shortfall in immediate ROI would be more than made up for by the increased strength for the rest of the property. E-commerce growth may have slowed for now, but that is mainly due to tough pandemic comps and the long-term trend remains intact.

But again, the stock trades cheaply. The strong balance sheet and lack of immediate negative catalysts make the 7% yield look “money-good.” I can see this company growing at a 1% to 3% clip between retained cash flows and an eventual return to pricing power. Perhaps the stock can trade up to a 6% yield, giving this the potential to deliver double-digit annual returns from here.

The weak macro-environment remains an obvious risk for the stock, but one could make the argument that the pandemic helped to pull forward many years of retail bankruptcies. Maybe the current slate of retailers is stronger than ever and well prepared to meet the challenge. Yet sentiment is likely to remain negative for anything retail-based and that may hold back multiple expansion. There is not yet clear evidence that malls haven’t been permanently impaired by the pandemic, as average base minimum rents continue to decline. The strong balance sheet is only strong if growth can return – even slightly – but I expect credit downgrades if it becomes clear that this is a business in secular decline. The leverage ratio is not too concerning at the moment – the company can likely pay off debt gradually at least for many years. But in such an event, I wouldn’t be surprised if the stock sold off to as low as 5x FFO, as most of cash flows would need to go to paying down debt. My buy rating is dependent on the company seeing ongoing strength in financial metrics over the next several quarters – I’ll be watching this one closely as the high yield isn’t without risks.

Be the first to comment