tamaya

Simon Property Group, Inc. (NYSE:SPG) – the world’s largest publicly traded mall real estate investment trust (“REIT”) – has one of the highest quality retail real estate portfolios and one of the strongest balance sheets (A- credit rating from S&P) in the sector.

SPG just reported Q3 results. In this article, we will share three important takeaways from the Q3 report and also provide our outlook on the stock.

#1. Simon Property Group’s Fundamentals Continue To Surge Higher

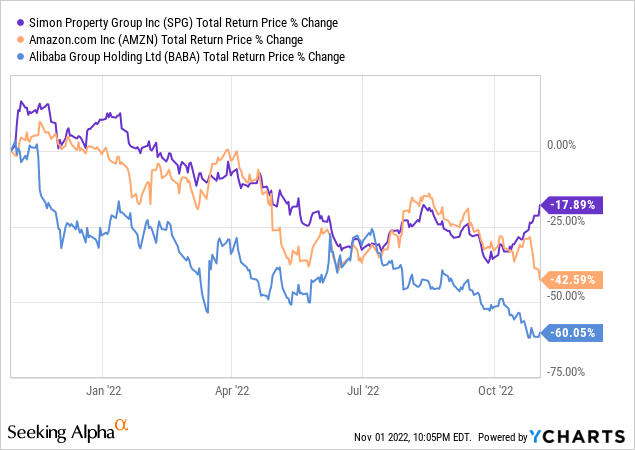

Despite the widely accepted perspective in recent years that “malls are dead” at the hands of e-commerce giants like Amazon (AMZN) and Alibaba (BABA), in 2022 SPG is the one experiencing the rebound while AMZN and BABA are putting up disappointing numbers and seeing their stock prices plummet at a much more dramatic rate than SPG’s has:

Part of this is simply due to the fact that the economy has re-opened – perhaps faster than the market and even AMZN expected – and consumers have resumed their former shopping habits at a rate that was not entirely expected. As a result, AMZN overbuilt and got hammered by rising fuel costs (while BABA has had enormous challenges at the hands of the Chinese Communist Party) and now their growth projections moving forward are disappointing.

In contrast, SPG’s redevelopment projects continue to roll out, delivering attractive returns on investment for SPG alongside its shrewd investments in distressed retail tenants. Despite raging inflation likely taking a bite out of consumer buying power and increasing warnings of a severe recession hitting the United States, SPG continues to see its fundamentals get better and better with each passing quarter.

For example SPG’s FFO per share has increased each quarter so far this year, going from $2.78 in Q1 to $2.97 in Q3. This was largely fueled by solid portfolio NOI growth of 3.2% year-over-year in Q3 while occupancy increased to 94.5%, up 170 basis points year-over-year and 60 basis points sequentially. Base minimum rent per square foot also continued to increase, rising 1.7% year-over-year and 0.40% sequentially.

On top of that, SPG’s balance sheet remains in excellent shape as it managed to refinance 16 property mortgages during the first three quarters of the year at an average interest rate of 4.78%, which is very reasonable given that the 30-year single family home mortgage interest rate recently crossed above 7%. The company has a whopping $8.6 billion in total liquidity (13.8% of its total enterprise value) with fixed charge coverage of over five times, giving it very substantial flexibility to handle any challenges that may come its way while supporting its hefty and growing dividend payout to shareholders.

CEO David Simon emphasized this robust strength on the earnings call, stating:

For nearly 30 years as a public company, like many companies and industries, we have dealt with significant shifts within our industry. In our case we embrace new challenges, and are better operators and more thoughtful and astute capital allocators. Many have tried to kill off physical retail real estate and in particular enclosed malls.

And I need not remind you, when physical retail was closed in COVID, all the naysayers saying that physical retail was gone forever. However, brick and mortar is strong – brick and mortar retail are strong and e-commerce is flat lining. And importantly, over this period of time, we have paid out $39 billion in dividends to shareholders, as we have become stronger and more profitable.

And why do I bring this up constantly? Well, because hopefully this will put an end to the so called negative mall narrative as you can’t pay those dividends without a strong underlying business.

#2. Strong Dividend Growth Momentum

As a result of this stellar performance, SPG hiked its dividend for the second quarter in a row and for the sixth time in its past seven quarters, this time by 2.9% sequentially, representing a whopping 9.1% year-over-year increase. When combined with its 6.3% forward dividend yield, SPG is one of the best-looking dividend growth stocks in the market today.

Analysts expect SPG to generate $12.16 in FFO per share in 2023, which should provide strong dividend coverage and facilitate further robust dividend growth next year. In fact, analysts remain very bullish on SPG’s dividend growth outlook, forecasting 6.9% dividend growth for 2023 and a 7.1% dividend per share CAGR through 2025, despite the increasing expectations of an impending recession. This speaks very highly of the REIT’s assets, business model resiliency, stellar balance sheet, and substantial dividend coverage (expected to be over 1.7x in 2022).

It will be hard to find a more attractive combination of high dividend yield and strong dividend growth in the REIT sector today.

#3. Value Proposition

SPG looks attractively priced based on virtually every metric. First and foremost, SPG is buying back stock, reflecting its view that its equity is undervalued:

Since May, we have purchased 1.8 million shares of our common stock at an average price of $98.57 per share.

Its P/AFFO ratio is 9.99x compared to its five year average of 12.76x, its P/FFO ratio is 9.44x compared to its five year average of 11.54x, and its price to NAV ratio is 0.83x. Meanwhile its dividend yield is 6.29% compared to its five-year average of 5.89%. Given its solid dividend growth profile and strong momentum in its fundamentals, the stock looks quite cheap.

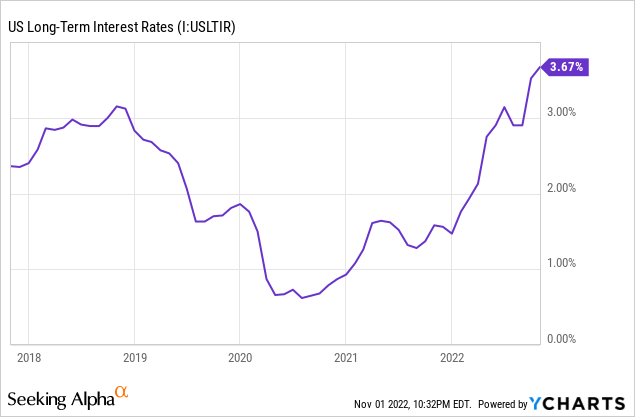

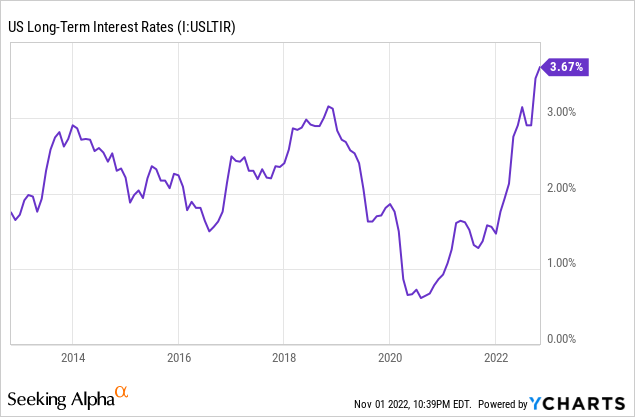

That said, there are some metrics that imply SPG is much closer to fairly valued. For example, its EV/EBITDA ratio is actually above its five-year average (16.51x vs 16.39x) and its price to NAV ratio – while considered discounted at 0.83x – is actually slightly higher than its five-year average of 0.82x. Furthermore, the mall sector is almost entirely illiquid today, especially with interest rates at such high levels, so if it were to liquidate a large portion of its portfolio, it would likely have to take a meaningful discount to the estimates factored into calculating its current NAV. Furthermore, while its P/AFFO, P/FFO, and Dividend Yield all appear attractive on a relative basis, it’s important to take into account that SPG’s FFO per share growth rate is expected to slow from a 13.5% CAGR over the past two years to just a 1.5% CAGR through 2025. Furthermore, interest rates are at a higher level than they have ever been over the past five years with further increases expected in the near future

As a result, SPG may not really be that cheap after all.

Investor Takeaway

Overall, it was another very strong, perhaps even outstanding, quarter for SPG. The fundamentals continue to improve, the balance sheet is an absolute fortress, the dividend and cash flow per share continue to grow at a very attractive pace, and the REIT is even buying back shares, something that’s virtually unheard of among retail REITs these days.

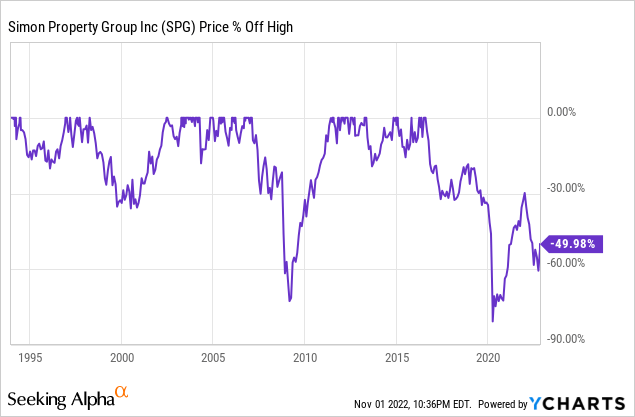

On top of that, SPG remains attractively priced according to the P/FFO, P/AFFO, and dividend yield metrics and its share price remains well below all-time highs, indicating significant upside:

On top of that, some would say that its five-year valuation multiple averages understate SPG’s true value given that its valuation was beaten down over that entire period, especially during the COVID-19 crash. This is true as its 10-year mean valuation multiples are meaningfully higher and it is very undervalued based on those metrics.

On the flip side of the argument, SPG looks fairly valued based on its EV/EBITDA and P/NAV ratios, especially when taking into account that interest rates are rising and are already at levels not seen for over a decade:

While we’re not ready to label SPG a Strong Buy due to valuation and recession reservations, we do think SPG warrants a Buy given its sector-leading balance sheet, management team, and business fundamentals. Furthermore, we think it will weather a recession pretty well. As the CEO said during the earnings call:

What gives me unbelievable confidence going into the next few years is, the realization that what we have been saying is don’t underestimate physical retail…And so — even though if we may slow down next year or even into the holiday season I don’t think the growth from our existing business is going to slow down because the demand for new deals and space is there…

I said to you on the last call, the lower income consumer has tightened their belt and we do have a few brands that are affected by that. But even with that said, we have an unbelievable return on investment after tax from the earnings that those businesses throw off. And we’re also making investments in those businesses.

With a near 7% forward dividend yield and a similar expected dividend per share CAGR through 2025, SPG is worth adding to an income-oriented portfolio.

Be the first to comment