eric1513/iStock via Getty Images

What You May Have Missed

The FTX (FTTS-USD) collapse has been a major headline crypto-related news for the past few weeks. One of the biggest centralized exchanges (CEX) implosions seen in the crypto industry’s history. FTX was a centralized cryptocurrency exchange founded by Sam Bankman-Fried (also popularly known by the initials SBF) in 2019. During its prime, FTX was ranked the third largest crypto exchange in terms of trade volume.

There have been many claims and stories about the root cause of the FTX fiasco. In the wake of the FTX collapse, the crypto community has shown its information-digging prowess while regulators and legislators have been seeking answers. Based on the popular demand of the crypto community, some existing CEX has begun publishing their digital asset holdings via proof-of-work reserves.

The FTX implosion has affected several crypto-based firms that have cited exposure to FTX and Alameda Research, FTX’s trading arm. Crypto lending platform BlockFi halted withdrawals as a result of its FTX exposure and has since filed for chapter 11 bankruptcy. Genesis Trading, Celsius Network (CEL-USD), and Galois Capital are among the firms that have been affected by the FTX collapse.

Silvergate Bank (NYSE:SI) is one of the financial institutions at the core of the on-ramp and off-ramp of fiat on most US-based crypto exchanges. As the FTX contagion continues to spread, Silvergate Bank has become a part of the contagion. Silvergate’s share price has fallen by over 40% in one month, as a reaction to the FUD generated over its links with FTX.

The FTX Contagion Spreads to Silvergate Bank

In the wake of the FTX debacle in early November, a statement regarding Silvergate FTX exposure was released by Silvergate. In the statement, Alan Lane, Chief Executive Officer of Silvergate, said:

In light of recent developments, I want to provide an update on Silvergate’s exposure to FTX. As of September 30, 2022, Silvergate’s total deposits from all digital asset customers totaled $11.9 billion, of which FTX represented less than 10%. Silvergate has no outstanding loans to nor investments in FTX, and FTX is not a custodian for Silvergate’s bitcoin-collateralized SEN Leverage loans. To be clear, our relationship with FTX is limited to deposits.

Source: Alan Lane

A group of US lawmakers, led by Senator Elizabeth Warren, has asked Silvergate to release its full records of FTX transactions; this will give closure into the potential role Silvergate Bank played in the collapse of the crypto exchange and into how Silvergate is connected to FTX. Silvergate has until December 19 to comply with the lawmakers’ request.

Your bank’s involvement in the transfer of FTX customer funds to Alameda reveals what appears to be an egregious failure of your bank’s responsibility to monitor for and report suspicious financial activity carried out by its clients,

Source: Senator Elizabeth Warren

In the wake of the FTX collapse, Lane has issued a statement. In the statement, Lane said Silvergate takes risk management and compliance very seriously and also claims extensive due diligence on FTX and Alameda Research was conducted.

It has been a very difficult few weeks for the digital asset industry, as we have all come to terms with the apparent misuse of customer assets and other lapses of judgment by FTX and Alameda Research. There has also been plenty of speculation – and misinformation – being spread by short sellers and other opportunists trying to capitalize on market uncertainty,

Source: Alan Lane

Will FTX Impact Silvergate?

In the statement by Lane, he reiterated that while it has been a turbulent time in the digital asset industry, customers’ deposits at Silvergate are, and have always been, safely held.

In addition to the cash we carry on our balance sheet, our entire investment securities portfolio can be pledged for borrowings at the Federal Home Loan Bank, other financial institutions, and the Federal Reserve Discount Window – and can ultimately be sold should we need to generate liquidity to satisfy customer withdrawal request,

Source: Alan Lane

Silvergate shares have continued to drop amidst the FTX debacle. The stock price dropped by about 14% on Tuesday, December 14, reaching a two-year low and closing at $18.73 on New York Stock Exchange (NYSE). The Stock price has fallen by 90% year to date (YTD).

In the latest developments in the FTX debacle, ex-CEO of the fallen crypto exchange Sam Bankman-Fried has been arrested by the authorities in the Bahamas, where he has been based, following formal notification by US authorities to the Bahamian government that criminal charges have been filed against Sam Bankman-Fried. A hearing by the U.S. House Committee on Financial Services was held on Tuesday, December 13, in which FTX post-collapse CEO John Ray III provided testimony.

Sam Bankman-Fried has been denied bail in the Bahamas and will remain in custody until February 8, 2023, when he will appear in court.

Technical Analysis

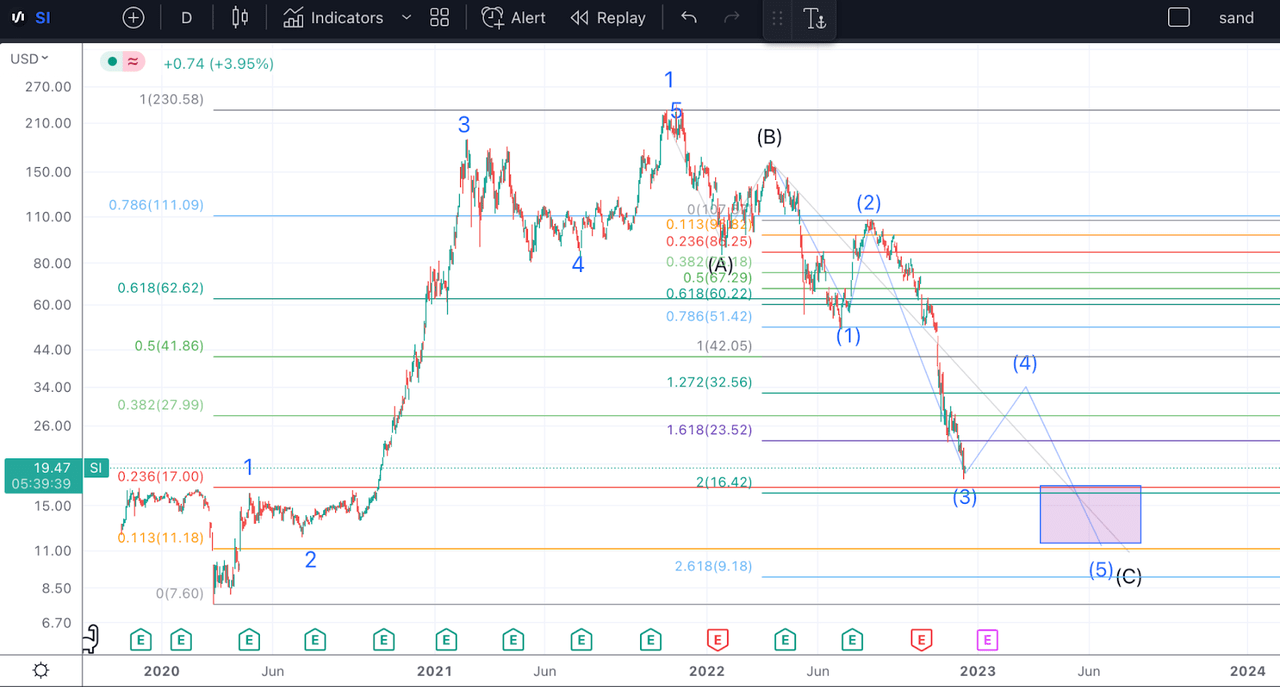

With the recent drop in price, the technical picture doesn’t look great for SI, but we are still within an acceptable range for a retracement.

Price Analysis (Author’s work)

We did break below the 61.8% retracement of wave 1, so the next key fib level is the 76.5% retracement, followed by the ultimate resistance level, the 88.7% retracement.

Now, if we consider this a five-wave move to finish off a C wave, as labeled above, then the Fibonacci extensions project us into the $10 area. Wave 3 has almost hit the 2 extension at $16.42, so wave 5 could reach the next key fib level of 2.618.

I might consider entering a trade if SI reaches this level, but investors must be wary that this is a high-risk/reward trade.

Closing Remarks

The FTX collapse has sent shockwaves through the crypto market. SI, Grayscale (OTC:GBTC) and now even Binance (BNB-USD), which is seeing huge withdrawals from its exchange, have all been negatively impacted. Fear and uncertainty can cause much trouble, even for legitimate businesses like Silvergate.

Be the first to comment