cobalt/iStock via Getty Images

Introduction

Signet Jewelers (NYSE:SIG) is one of the largest bridal and diamond jewelry sellers in the world. The company has undergone a restructuring process to become a high-performing omnichannel seller by optimizing its store footprint and increasing its online retail presence. While the restructuring for the most part has finished, the business has seen a slurry of economic ups and downs, with the pandemic shutdown, pandemic rebound, and now high inflation. For these reasons, it is a bit hard to truly gauge the effects of the restructuring process, but a few key metrics like same-store sales and e-commerce growth have been promising. At around 6x earnings, I am holding my position with strong short and long-term headwinds, as some tailwinds also abound.

Financial History & Restructuring

Signet has had a rather variable journey of results over the past five years due to the restructuring the company has gone through. Over the past five years, Signet has divested and acquired some business units to focus on better brick-and-mortar and online sales. The company has made key acquisitions, like R2Net and Blue Nile, while closing/relocating stores to maximize foot traffic. Now with the restructure coming to its end, Signet has reduced low foot traffic stores (many in dying malls) and seen high online sales growth, helping the business become an omnichannel diamond seller.

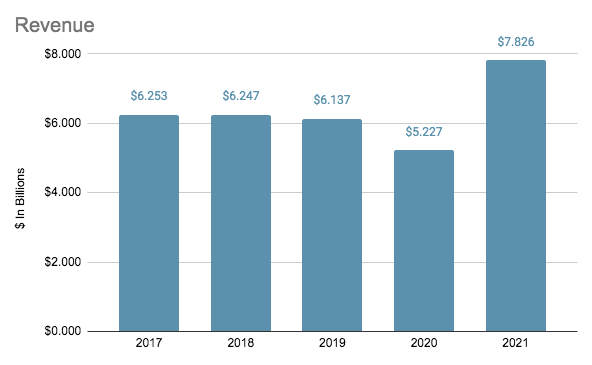

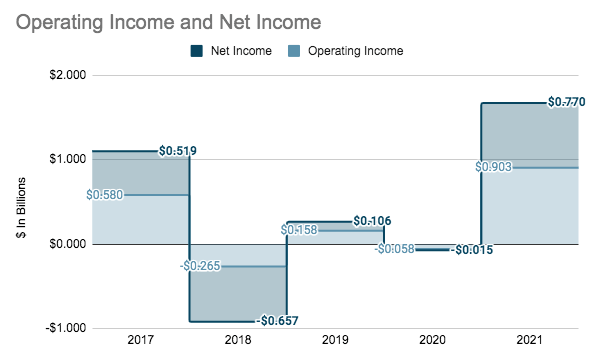

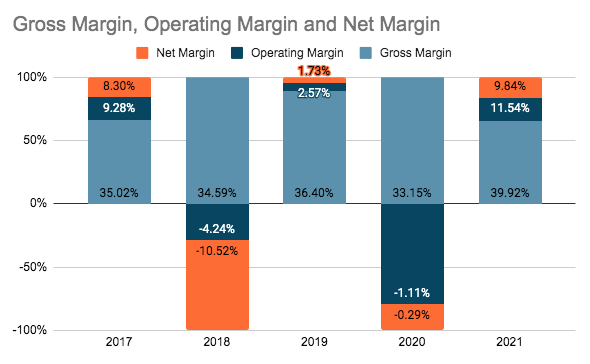

Signet Jewelers Revenue (SEC.gov) Signet Jewelers Operating & Net Income (SEC.gov) Signet Jewelers Margins (SEC.gov)

Looking at the revenue, Signet was seeing stable sales of around $6.25 billion a year until the pandemic hit. The COVID-19 pandemic caused the company to close many stores from mid-2019 to early 2020. The results of this action were felt across the board. But after the pandemic, Signet has seen an incredible rebound. In 2021 the business saw a revenue pop of 49.7%. This was in part due to the purchase of Diamonds Direct, as well as government stimulus and a very strong American consumer base.

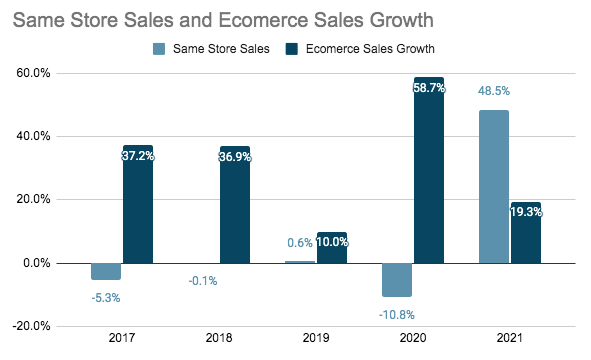

Signet Jewelers Same Store Sales & E-commerce Growth (SEC.gov) Signet Jewelers Same Store Sales & Ecommerce Growth (SEC.gov)

With the restructuring of the past years focused on becoming omnichannel and improving e-commerce and brick-and-mortar, it is key to check these metrics. E-commerce sales growth for the company has been stellar, with no year seeing lower than 10% growth. I believe e-commerce will be the most important revenue driver in the future as online retail has become the norm. Same-store sales have been just alright. The small changes in 2018 and 2019 are good to see and don’t show anything negative. The 10% decline in 2020 was attributable to the pandemic closures, while the 48.5% increase in 2021 is due to the strong economic factors pandemic. Overall, the same-store sales numbers don’t worry or excite me with the variety of abnormal economic influences at play. It does seem that Signet has done a good job at becoming omnichannel though, with stable same-store sales and great e-commerce growth.

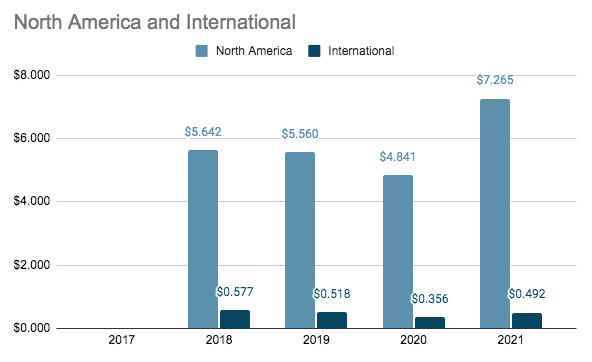

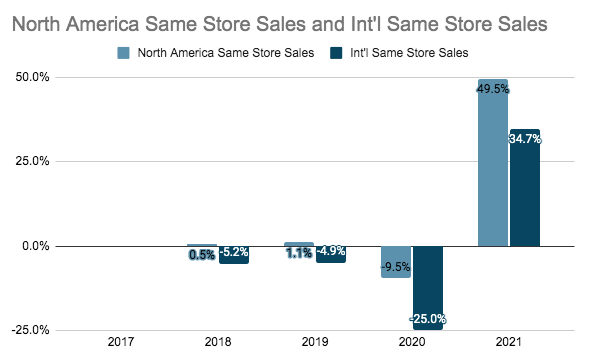

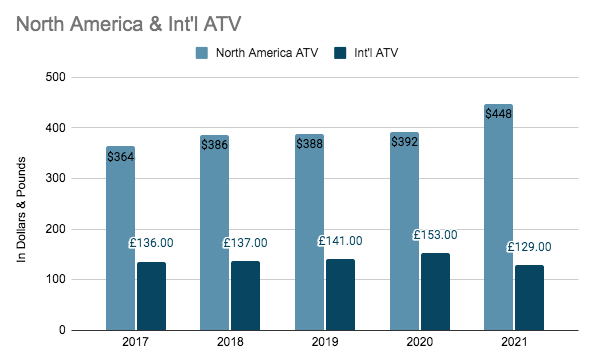

Signet Jewelers Revenue By Segment (SEC.gov) Signet Jewelers Same Store Sales By Segment (SEC.gov) Signet Jewelers Average Transaction Value By Segment (SEC.gov)

Diving deeper into each segment shows that most of the success has come from North America. Since the reorganization of the segments into North America & International, North America revenue has grown at a clip of 6.52% per year. The revenue trends match the overall business with revenue stability in 2018 and 2019, a dip in 2020, then a large jump in 2021. The North American same-store sale has followed suit too. The ATV, on the other hand, has grown each year by a rate of 4.24%. As for the International segment, revenue has seen a downtrend, declining at a rate of 3.91% per year. Same-store sales for International have been bad until 2021. On top of this, International ATV have been everywhere. Overall, some work needs to be done with the International segment, but the strength of North America can carry the business forward for now.

This Year So Far

In the first six months of 2022, Signet has seen poor comparable results from the prior year. Revenue has increased by 3.3% so far, primarily due to the purchase of luxury bridal company Diamonds Direct. The North America segment saw revenue growth of 1.8% from this acquisition, while International revenue grew 17.8% from the reopening of all United Kingdom stores in April 2021. Same-store sales were poor for the business down 3% so far, with North America down 4.8% and International up +35.2%. ATV for both segments increased by 15.1% and 4.8%. E-commerce sales were down by 11.41% for the half year.

Operating and net income was down by 12.3% and 82.9% each for the period. Most of the decline was from a $191 million litigation charge attributable to the purchase of Diamonds Direct. Adjusted out, the operating income would only be down by 4.1%. To end the half year. Signet posted an EPS of $0.90 and made another key acquisition of Blue Nile, another popular online retailer. This purchase will help reboot online sales, which have dipped to 17% of total sales.

These results so far have been alright, considering last year’s results were bumped up by government stimulus, a strong consumer, and continued store reopenings. With that being said there was pressure this year from a weakening consumer due to high inflation. This will be a downward lag for the company for the foreseeable future.

Balance Sheet

Signet has a great balance sheet to withstand these pressures. The company has a current and quick ratio of 1.77x and 0.63x, showing solid liquidity and the ability to pay off current obligations. The business also doesn’t have too high of a debt load after all these acquisitions. The debt-to-equity is just 3.03x, which is very manageable with a times interest earned of 48x. Altogether, if the inflationary environment worsens and consumers become weaker, I think Signet can withstand the downturn.

Valuation

As of writing, Signet trades around the $65 price point. At this level, the company trades at a 5.9x P/E using the 2022 EPS estimate of $10.94. Signet also trades at a P/BV of 2.36x and has a dividend yield of 1.25%. It seems the business is fairly valued for the upside of the restructuring and the downside of the inflationary environment.

Conclusion

Overall, I think the restructuring Signet has gone through over the past few years has been successful. Whether it be divesting the credit portfolio, closing nonperforming stores, or making key acquisitions, Signet has become the omnichannel source for bridal and diamond jewelry. As a current stockholder, it will continue to be important to watch the metrics, not only for the rest of the year but for the next few years to test the restructure results. At around 6x earnings, I am staying in a hold position for the foreseeable future, as I think there are both strong long-term upsides, but also inflationary headwinds in the short term.

Be the first to comment