Olemedia

Sigma Lithium Corporation (NASDAQ:SGML) recently reported a new valuation of its Grota do Cirilo Project, which is more than $5 billion. The market capitalization stands at close to $2-$2.6 billion, and management reports almost no debt. Under my own discounted cash flow (“DCF”) model, without taking into consideration the Phase 3 of the project, the implied valuation should be close to $40-$41 per share, or $4 billion. In my view, as Sigma Lithium conducts more exploratory work, and measures a bit more of its proven reserves of lithium, many market participants will likely have a look at the project. Finally, with the first revenue appearing around 2022 and 2023, I believe that the demand for the stock will increase soon.

Sigma Lithium

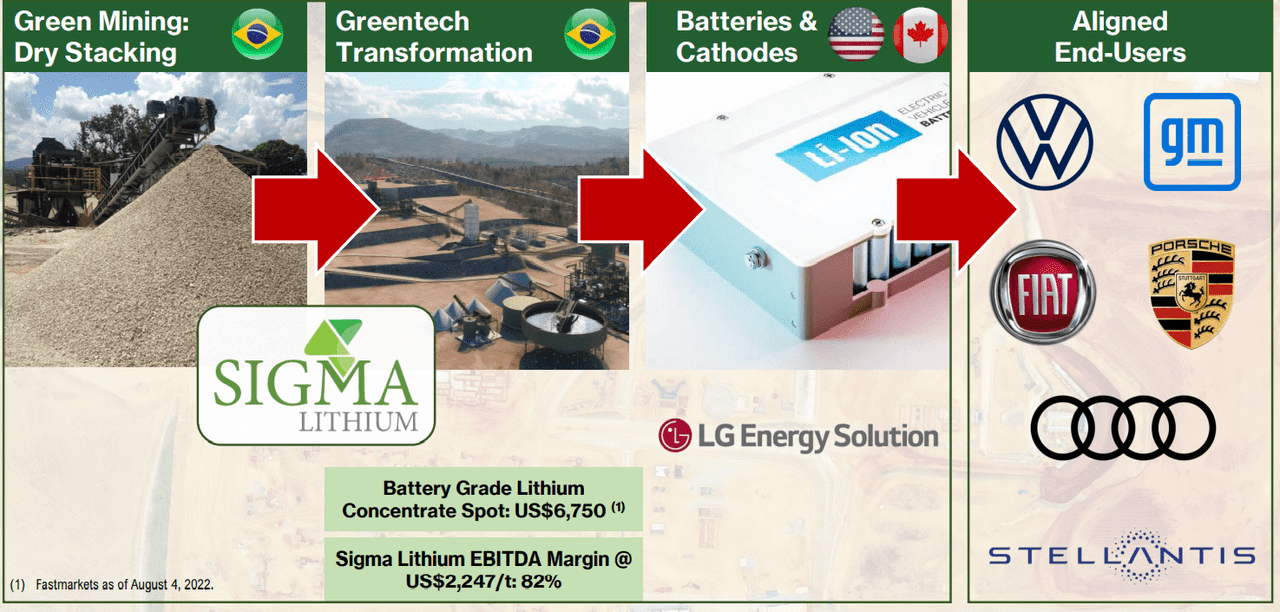

Sigma Lithium runs Grota do Cirilo Project in Brazil, a vertically integrated operation expecting to produce high purity 5.5-6% battery grade lithium concentrate.

Considering the increase in the demand for lithium-ion battery supply chain for electric vehicles and the size of Sigma’s lithium mineralization, many media outlets out there made optimistic comments about the company’s flagship project.

August Presentation

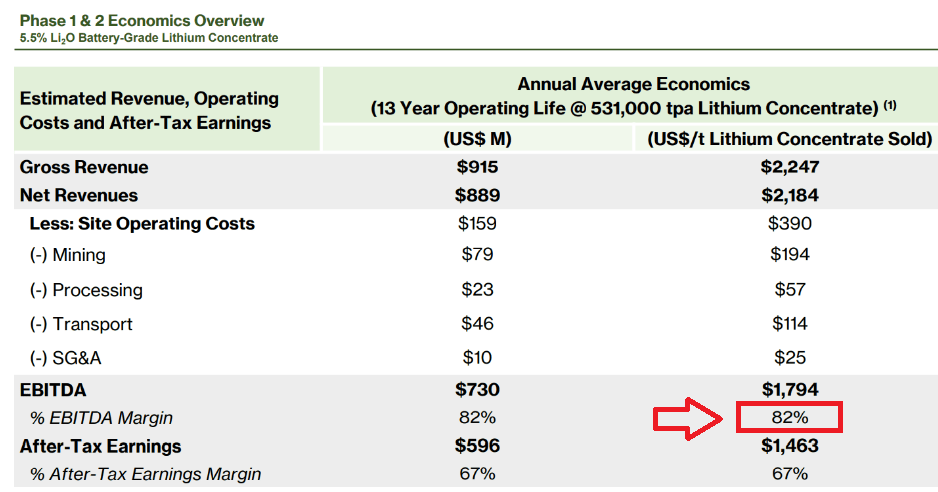

If we go a bit further into Sigma Lithium’s numbers, the project appears to be quite profitable. With the battery grade lithium concentrate price at $6.75, the company’s EBITDA margin with a price of $2.24 per ton would stand at 82%, which is quite impressive.

August Presentation

August Presentation

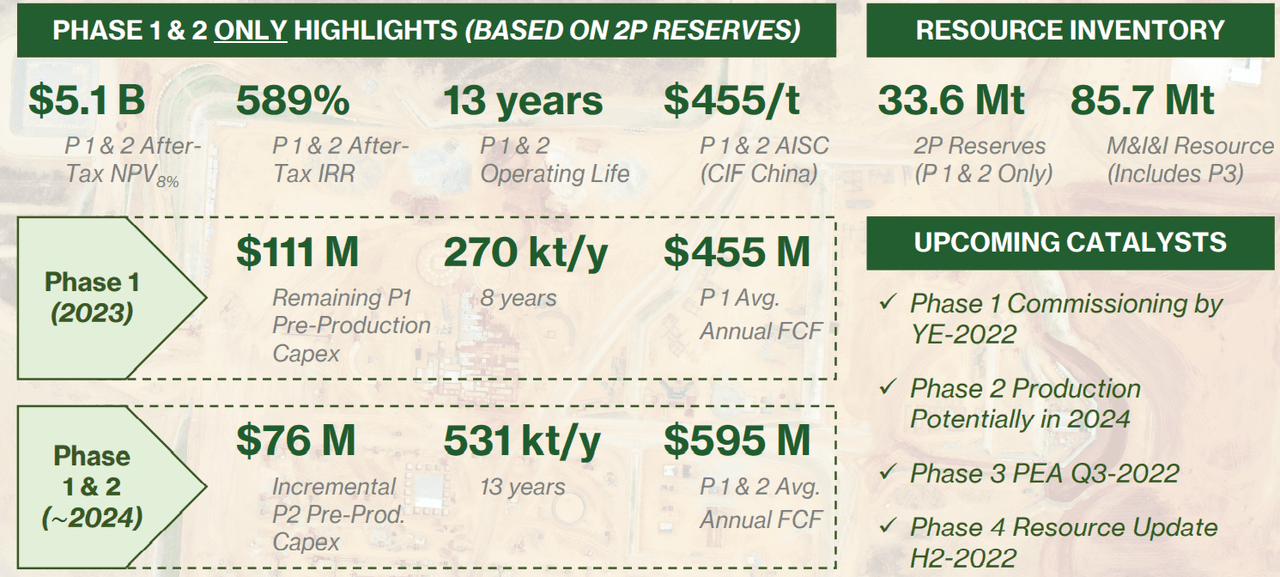

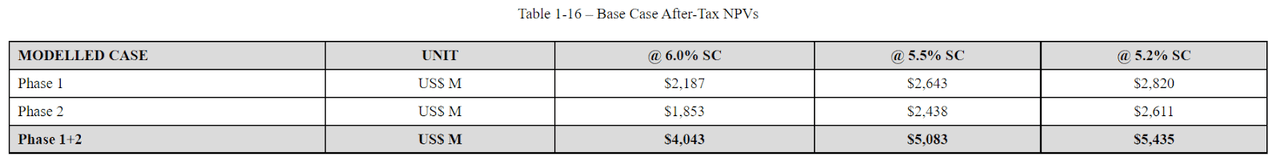

A recent estimate of the project’s valuation including the two phases of the project and 13 years of operating life result in free cash flow of $455 million in 2023 and $595 million in 2024. The net present value would stand at $5.1 billion.

August Presentation

August Presentation

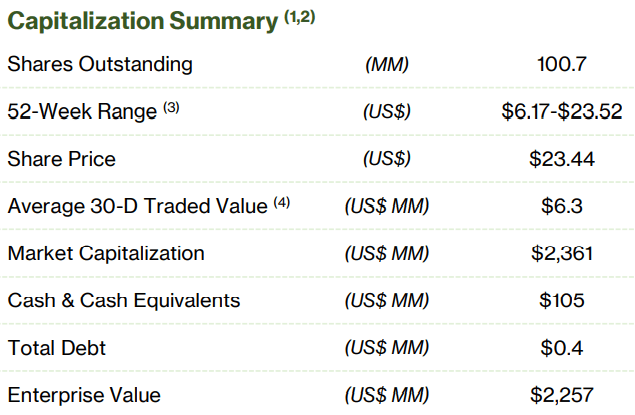

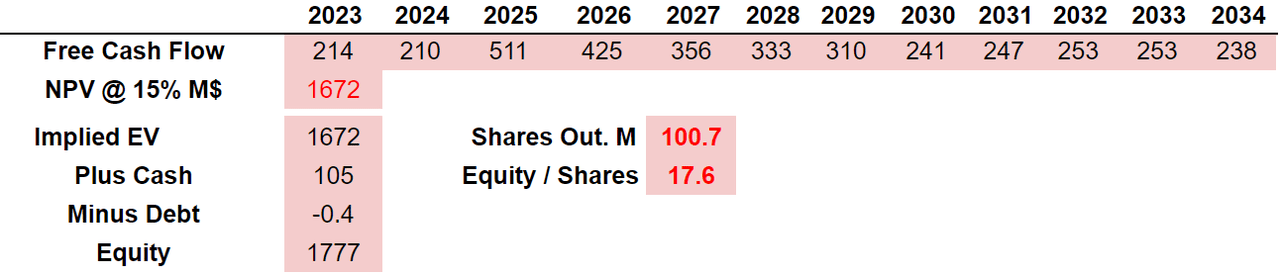

Sigma Lithium’s market capitalization stands between $2 billion and $2.6 billion, so I believe that there is significant upside potential in the market capitalization. Keep in mind that Sigma reports almost no debt and $105 million in cash. With 100.7 million shares outstanding, the NPV at 8% discount stands at $5.1 billion, close to $51 per share. These figures interested me so much that I decided to run my own financial model.

August Presentation

My Conservative Assumptions Lead To A Fair Price Of $40-$41 Per Share

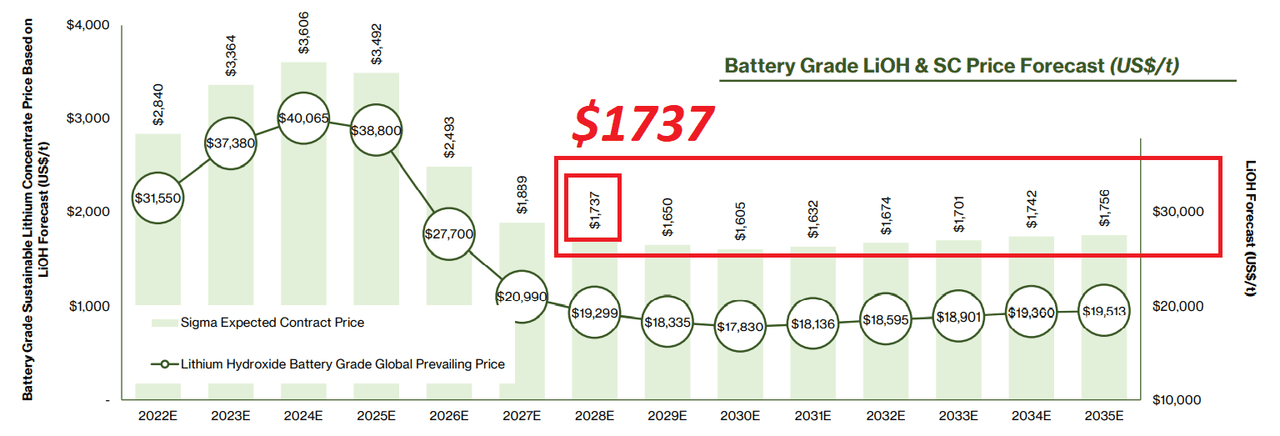

The company expects to sign agreements to sell concentrate at $2.8k in 2023 and even $3.6k in 2024. I tried to be conservative as possible, so I used a constant price of $1737.

August Presentation

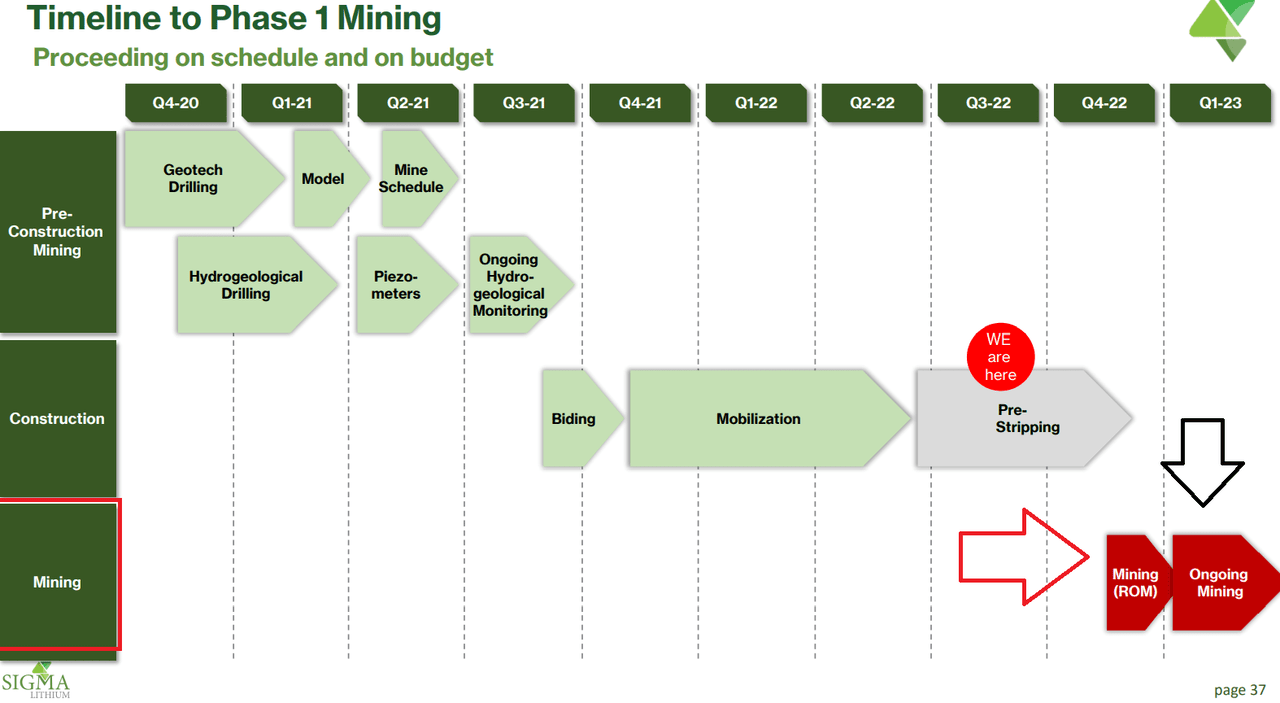

I invite investors to read the feasibility study, which includes substantial information about the company’s production expectations. The price of lithium concentrate increased significantly since the reports were issued. However, there is plenty of information valuable for the valuation of the mineral deposits. In the last feasibility studies, the company talked about more than 1.6 million dry tonnes of ore per year for a mine life of 12 years.

The extraction plan in the feasibility study assumes development of one open pit and construction of a process plant to process 1,680,000 dry tonnes of ore per year for a mine life of 12 years and eight months. Source: GROTA DO CIRILO LITHIUM PROJECT

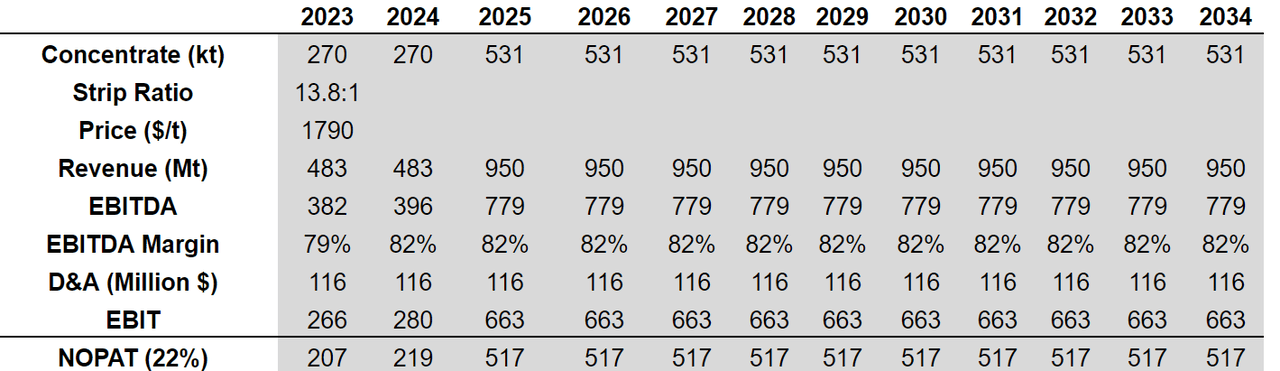

Under my previous assumptions, I also included 270 kt of concentrate in 2023 and 2024, which is related to Phase 1. From 2025, at Phase 2, I believe that the company will be able to deliver 531 kt of concentrate. Using an ultraconservative price of $1790 per ton, revenue would trend north from $483 million in 2023 to $779 million in 2034. If we also assume an EBITDA margin around 82%, the company’s NOPAT would most likely be close to $517 million.

Author’s Work

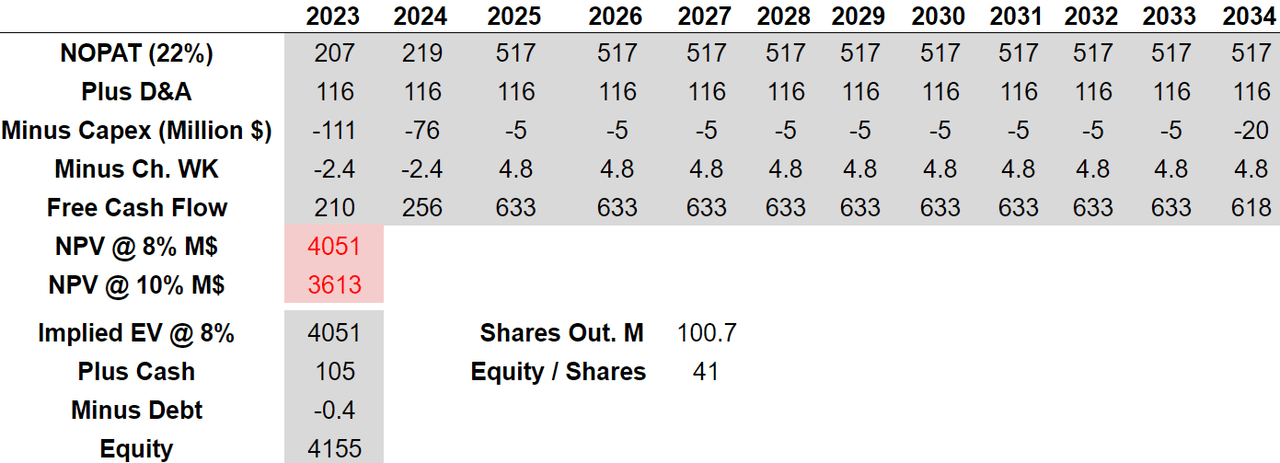

If we add back D&A, and deduce changes in working capital, the free cash flow would range from $210 million in 2023 to close to $633 million from 2025 to 2033. With a discount of 8%, the net present value would be $4.05 billion, and with a discount of 10%, the net present value would be $3.6 billion. Finally, with a discount of 8%, the implied enterprise value would be close to $4 billion. I added cash worth $105 million, and subtracted debt to obtain the equity valuation. The implied fair value would be close to $40-$41 per share.

Author’s Work

I believe that I am considerably more conservative than the company. In a recent technical report, with information from the Phase 1 and Phase 2, Sigma Lithium obtained a net present value of close to $5 billion.

August Technical Report

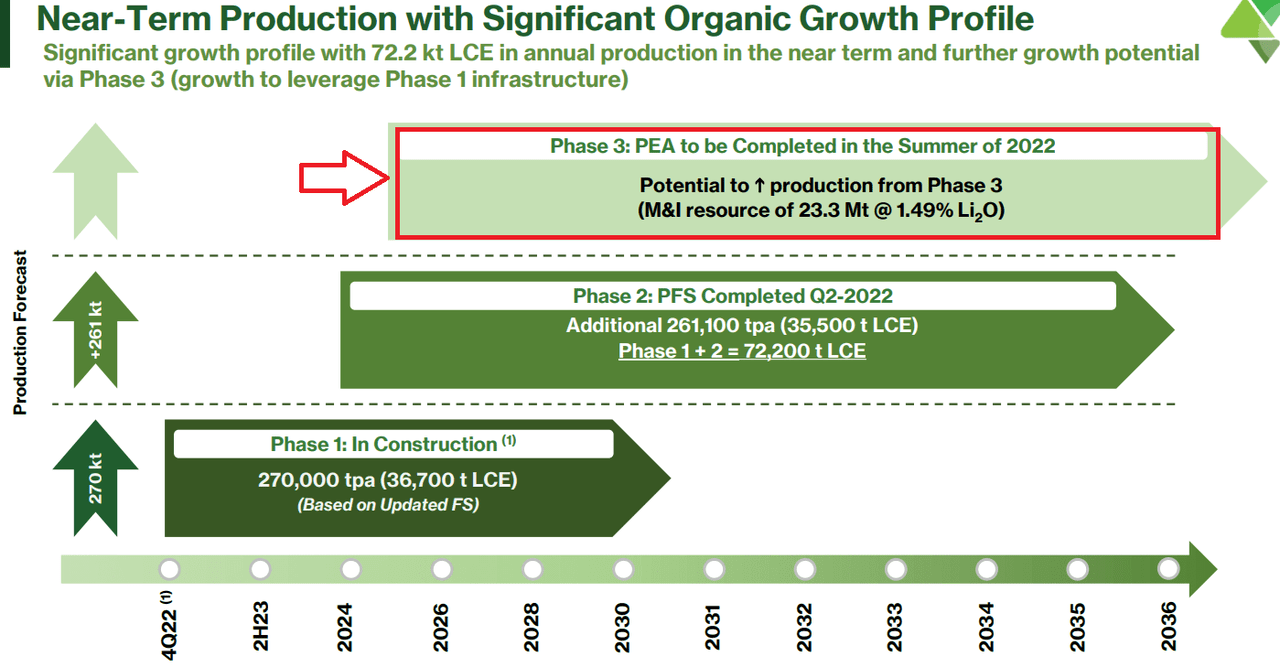

Finally, let’s notice that management is expecting to have three phases. I only included the production expected for Phase 1 and Phase 2. In the future feasibility studies, the company may deliver more detailed information about its plans for Phase 3, which may increase the expectations for future sales growth. As a result, the stock price would likely increase as revenue expectations would increase.

August Presentation

In this regard, let’s say that in a separate technical report, the company noted a 50% increase in the total mineral reserves thanks to the new Phase 3. I don’t believe that the current market price does include this new information:

Sigma Lithium reports that it has filed a technical report titled Grota do Cirilo Lithium Project Araçuaí and Itinga Regions, Minas Gerais, Brazil, Phase 3 Mineral Resource Estimate supporting its news release dated June 22, 2022, announcing the approximate 50% increase to the total National Instrument 43-101 (“NI 43-101”) mineral resource estimate at its 100% owned Grota do Cirilo Project. Source: SEC

Detrimental Conditions And Several Risks Would Lead To A Valuation Of $17.3 Per Share

Under this case scenario, I would depict what I consider a detrimental outcome. First, Sigma Lithium may not find the total amount of minerals expected. Keep in mind that many of the free cash flow projections used indicated and non-measured reserves. It means that geologists may have not properly assessed the amount of lithium. As a result, future production may be lower than expected. The company discussed these risks in a recent report:

The Company’s business strategy depends in large part on developing the Project into a commercially viable mining operation. Whether a mineral deposit will be commercially viable depends on numerous factors, including: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; commodity prices, which are highly volatile. Source: Management Discussion, And Analysis

The company may also have trouble with supply chain issues. Lack of machinery to drill, explore, or produce minerals could delay production, which would lead to less revenue growth. As a result, the implied NPV of the project would be lower than expected, and the fair price would decline.

Let me also point out that the company’s flagship project is in Brazil, where voters will likely elect a new president in a few months. The new administration could change relevant laws that may affect Sigma Lithium project. If the company has to invest more in environmental research, or modify its mining plans, future production may be lower. As a result, I believe that the market price could decline.

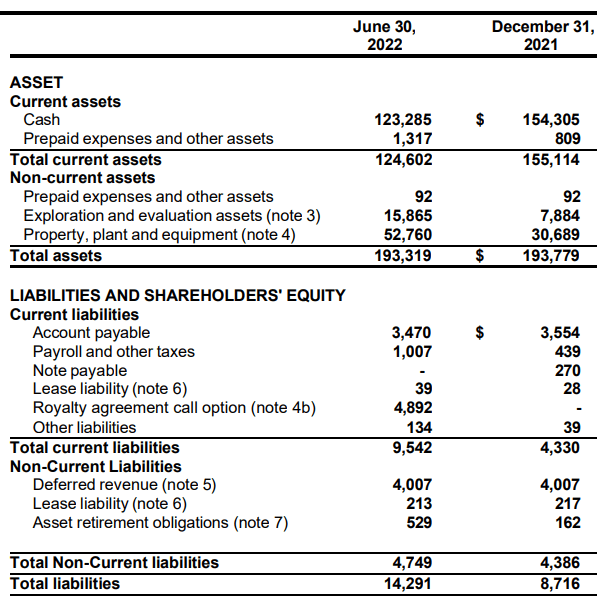

Finally, I believe that the company may need additional financing for future capital expenditures. Right now, the balance sheet reports cash in hand equal to CAD123 million. However, I believe that future capital expenditures necessary could be larger than $187 million. Without sufficient financing or due to higher cost of equity, the net present value would be lower than expected.

Q2 2022

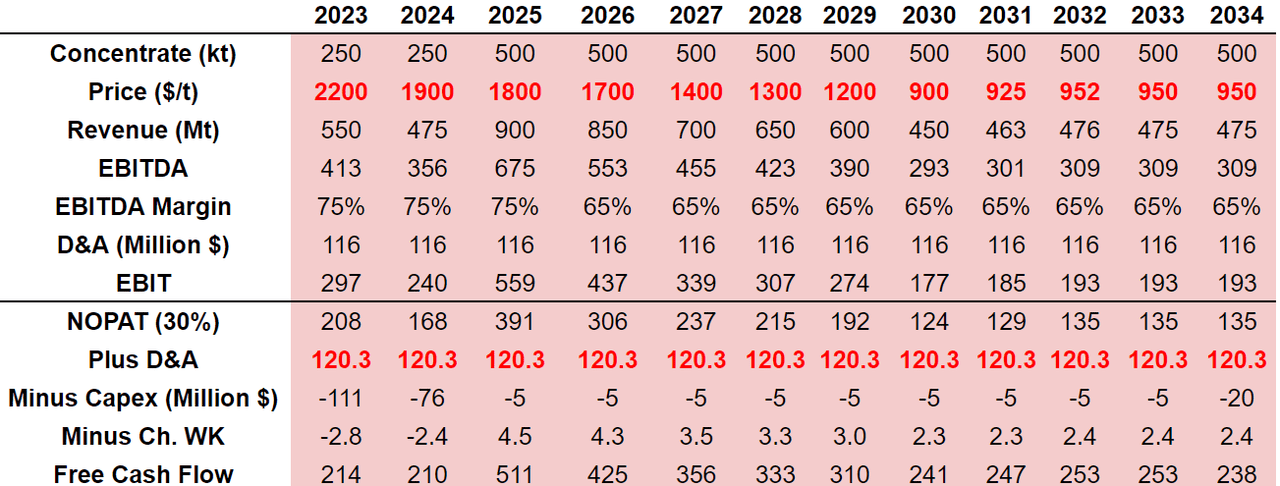

I tried to assess a more detrimental case scenario with production of 250 kt of concentrate in 2023 and 2024, and 500 kt from 2025 to 2034. I also assumed that the price of concentrate would fall from $2200 per ton in 2023 to $950 per ton in 2034. Also, with a declining EBITDA margin around 75% and 65%, I obtained a non-operating profit after tax close to $135 million in 2034.

Author’s Work

If we add back D&A to the NOPAT, and subtract changes in working capital and capex, the free cash flow would range from $214 million to $238 million. With a discount of 15%, the implied valuation would stand at close to $1.7 billion. Finally, the equity per share would be close to $17.3 per share.

Author’s Work

Conclusion

I believe that many analysts didn’t have enough time to have a look at Sigma Lithium. The shares appear quite undervalued. Even with the recent valuation of $5 billion given by the company, or my net present value of $4 billion, Sigma’s market capitalization appears too low at $2-$2.6 billion. In my view, as more investors have a look at the feasibility reports that may include Phase 3, more investors may grab shares. Besides, if the company measures a bit more its reserves, and generates more market awareness, the stock price will likely trend north. Finally, in my view, as the company starts to report the first revenue in 2023 or 2024, the demand for the stock will likely increase.

Be the first to comment