Mikhail Shapovalov/iStock via Getty Images

A Quick Take On Sidus Space

Sidus Space, Inc. (NASDAQ:SIDU) went public in December 2021, raising approximately $15 million in gross proceeds from an IPO priced at $5.00 per share.

The firm provides a range of satellite-related services to companies seeking access to space-based operations.

My outlook on SIDU for the near term is on Hold, although the stock is subject to strong uptrends on news headlines, so is worth putting on a watchlist.

Sidus Space Overview & Market

Sidus Space is a space-as-a-service company that designs, manufactures, launches, and collects data from commercial satellites. Their services consist of satellite manufacturing, precision manufacturing, Low Earth Orbit microsatellites, Launch & Support Services, space-based data services & analytics, and satellite deployment, among other capabilities.

The firm is headed by CEO, Carol Craig, who has a MS in Electrical and Computer Engineering, and previously founded Craig Technologies Aerospace Solutions.

According to a 2022 market research report by Research and Markets, the market for space launch services (as a proxy for all space services) was an estimated $11.3 billion in 2021 and is forecast to reach $26.6 billion by 2027.

This represents a forecasted strong CAGR of 15.32% from 2021 to 2027.

The main drivers for this expected growth are the increasing adoption of satellites for information and communication purposes by a growing variety of private entities and public agencies.

Also, a transition toward smaller satellite sizes over traditional satellites due to the miniaturization of capabilities will contribute to market demand growth.

Major competitive or other industry participants include:

-

Airbus

-

Antrix Corporation

-

Arianespace

-

China Great Wall Industry

-

Mitsubishi Heavy Industries

-

Northrop Grumman

-

S7 Airlines

-

Safran S.A.

-

SpaceX

-

The Boeing Company

-

Others

Sidus’ Recent Financial Performance

-

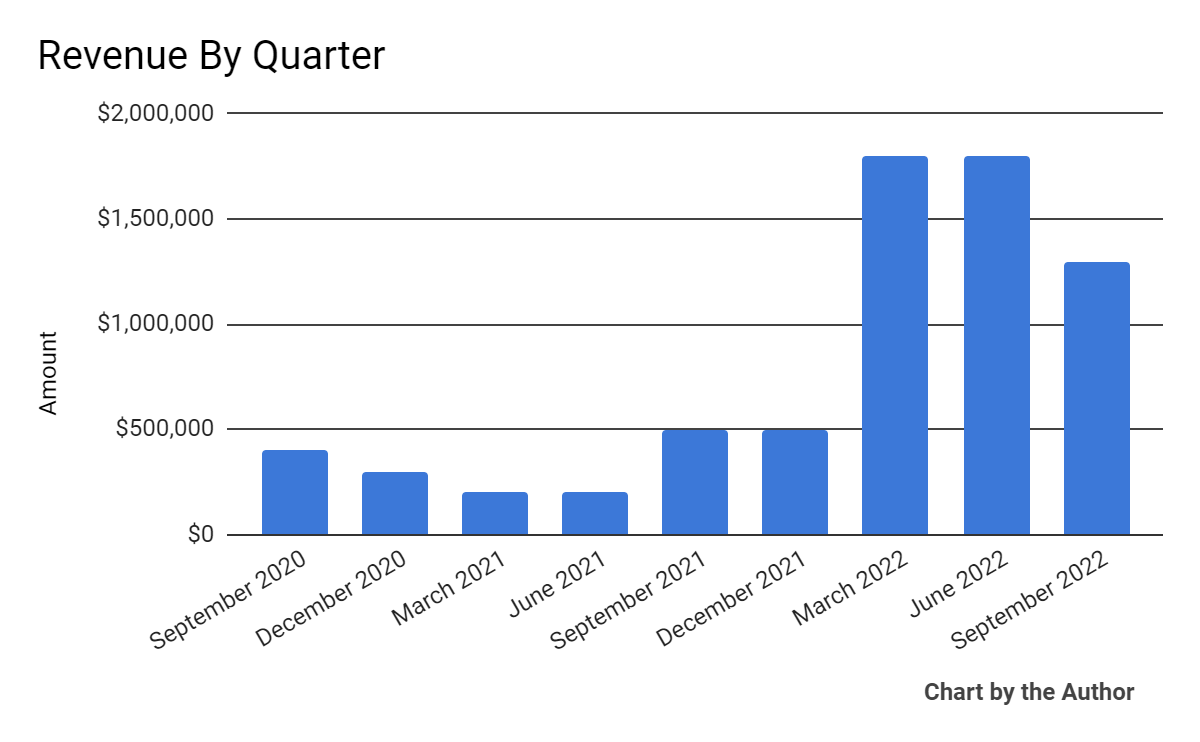

Total revenue by quarter has risen in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

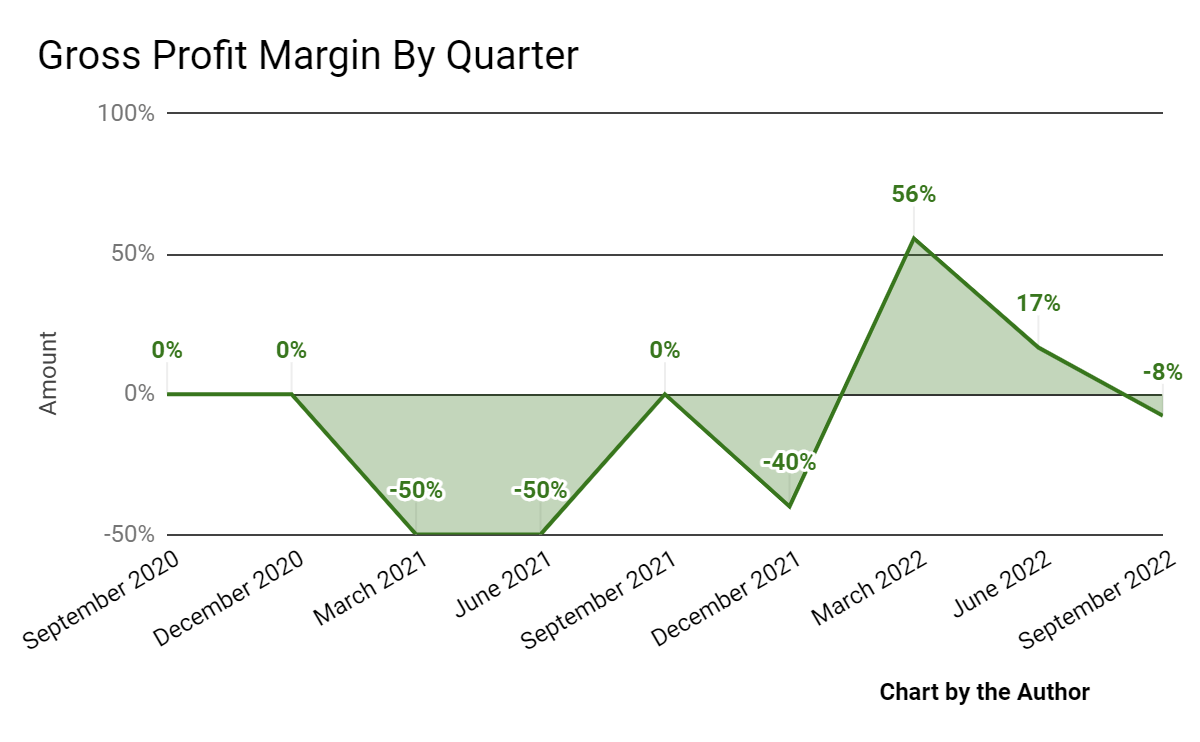

Gross profit margin by quarter has fluctuated substantially, as the chart shows here:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

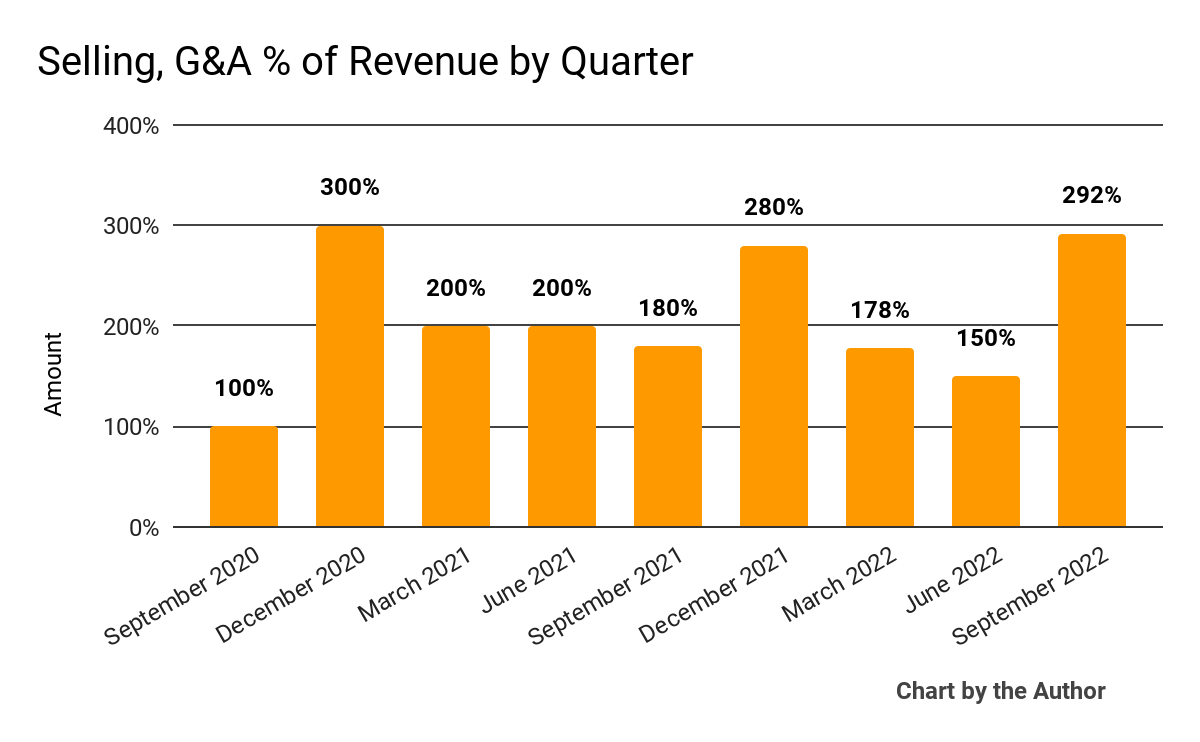

Selling, G&A expenses as a percentage of total revenue by quarter have remained high and well above total revenue:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

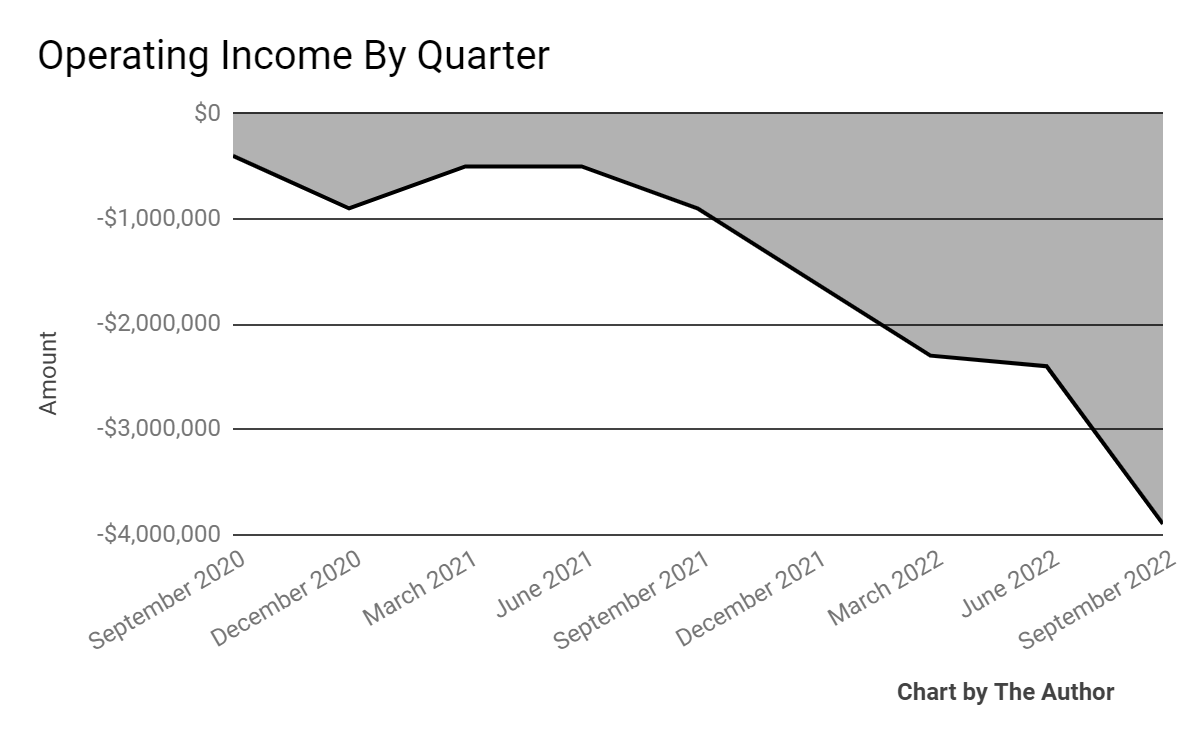

Operating losses by quarter have worsened sharply in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

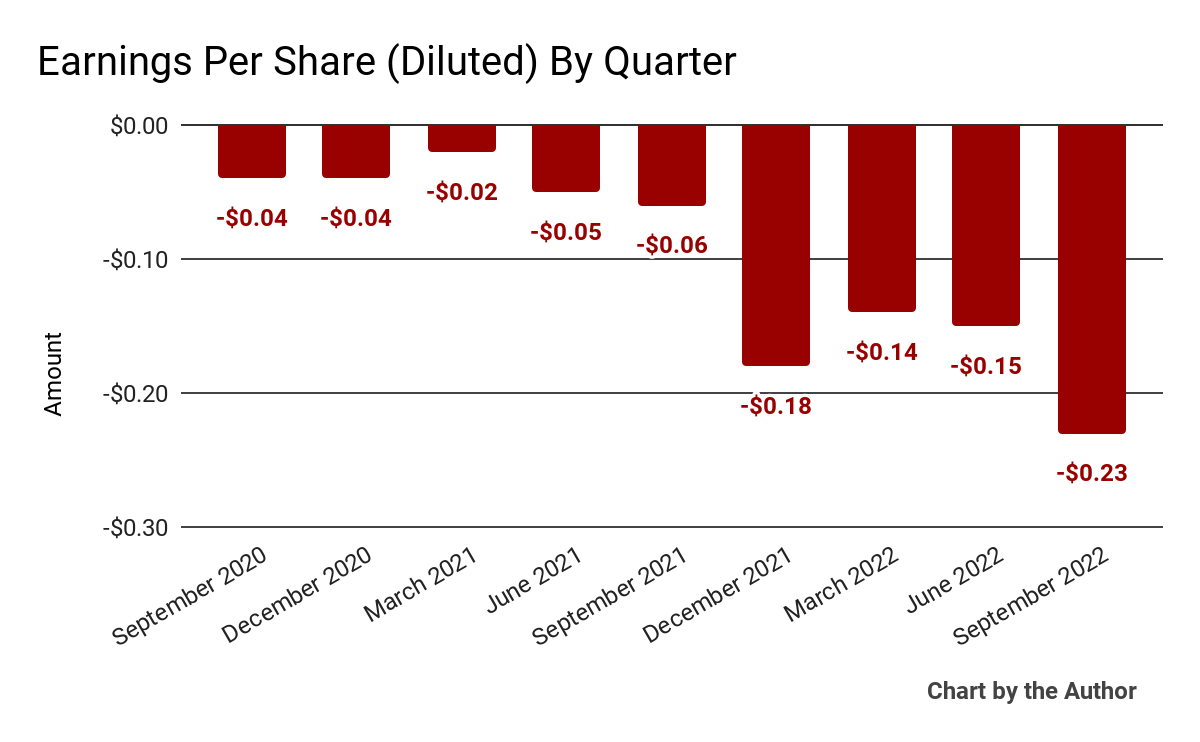

Earnings per share (Diluted) have also deteriorated further into negative territory:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

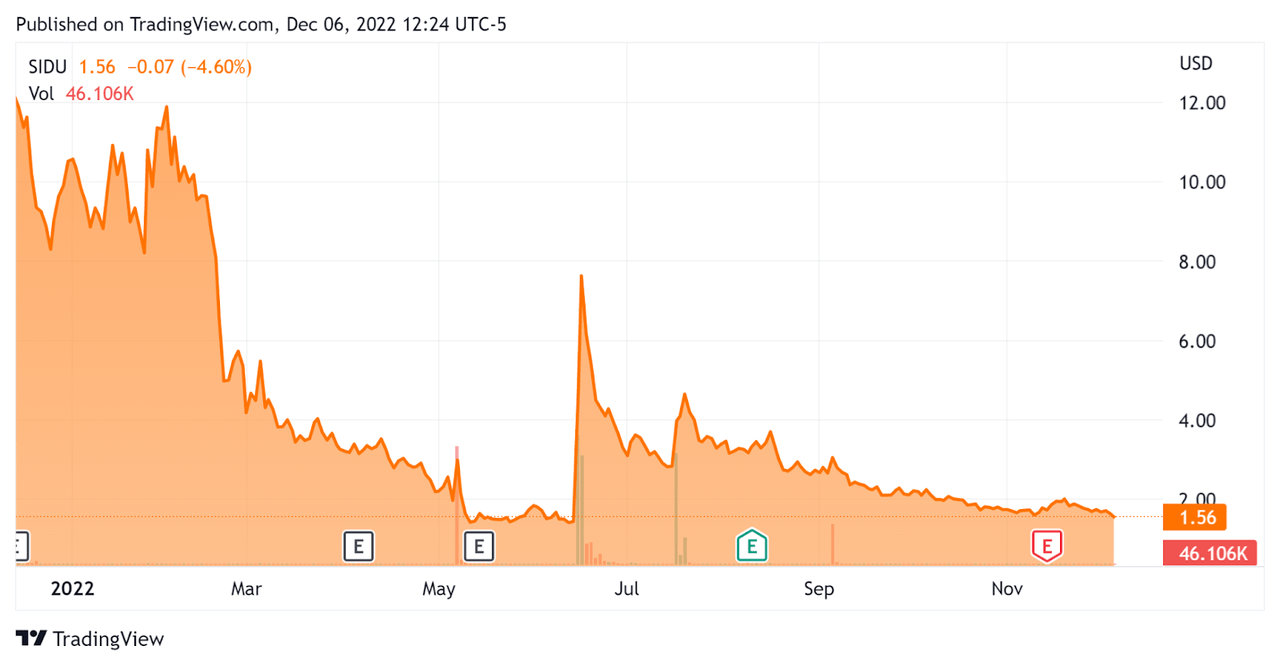

Since its IPO, SIDU’s stock price has fallen 87.2% vs. the U.S. S&P 500 Index’s drop of around 14%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Sidus Space

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

4.8 |

|

Revenue Growth Rate |

375.6% |

|

Net Income Margin |

-203.0% |

|

GAAP EBITDA % |

-179.0% |

|

Market Capitalization |

$29,330,000 |

|

Enterprise Value |

$26,340,000 |

|

Operating Cash Flow |

-$11,790,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.70 |

(Source – Seeking Alpha)

Commentary On Sidus Space

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the company’s current primary source of revenue is from manufacturing space and defense hardware.

In the near future, management believes its revenue mix will shift to include more incremental revenue from payloads, technology integration on its microsatellites, and data and analytics subscriptions.

The company seeks to diversify its revenue model by serving customers across the space industry, with a focus on private customers and subcontractor opportunities.

It is developing proprietary, partially 3D printed satellites, with approvals from the ITU, and management believes it has the necessary components and technology partners in place for launch in 2023.

Its LizzieSat satellite, with its multi-mission constellation, will offer remote sensing, data collection, and propulsion capabilities. In the past quarter, the company has obtained multiple launch agreements, including with SpaceX and several technology and data partnerships.

As to its financial results, topline revenue rose 160% year-over-year from a tiny base.

Gross profit margin turned negative while SG&A costs as a percentage of total revenue rose sharply to very high multiples of revenue.

As a result, operating losses worsened, as did negative earnings per share.

For the balance sheet, the firm finished the quarter with $4.4 million in cash and equivalents and $1.1 million in long-term debt.

Over the trailing twelve months, free cash used was $13.4 million, of which capital expenditures accounted for $1.6 million in cash use.

Looking ahead, the firm is seeking to move beyond hardware manufacturing to launching its LizzieSat constellation plan, with the potential for more predictable and steady revenue growth.

Earlier in 2022, the stock spiked on news of a subcontract win for a NASA contract and also on deals to launch its LizzieSat satellites.

However, in the wake of these headline announcements, the stock has reverted to nearly its 52-week low, so there hasn’t been any staying power for the stock.

While management is making progress on various fronts and topline revenue growth is promising, SIDU is still a tiny company losing, producing increasing operating losses, and using cash in a rising cost of capital environment.

My outlook on SIDU for the near term is Neutral, although the stock is subject to strong uptrends on news headlines, so is worth putting on a watchlist.

Be the first to comment