Nordroden

Sell-side ratings aren’t always reliable; however, they influence the financial markets and; thus, they need to be considered. Deutsche Bank (DB) recently downgraded Sibanye Stillwater (NYSE:SBSW) from buy to hold based on “continued operational underperformance of U.S. Platinum, Palladium, and Gold”. We assessed Deutsche’s vantage point and discovered features that explain, substantiate, and counteract the rhetoric.

Based on our analysis, Sibanye’s risks remain abundant, and we reiterate our hold rating on the stock.

Let’s Start With The Positives

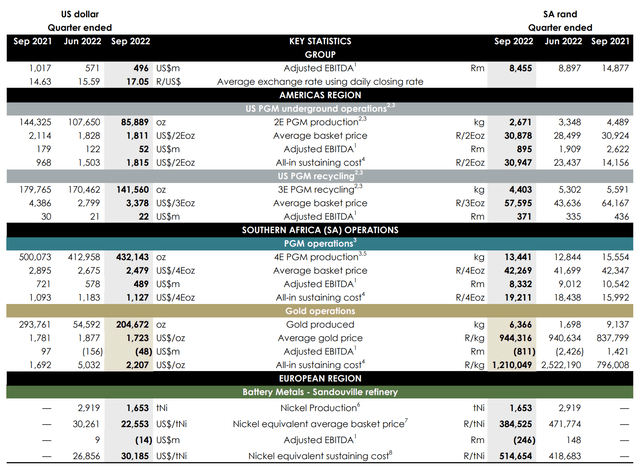

Although Sibanye Stillwater recently suffered a drop in production, many of the causes can be backed out as they’re considered non-core items. The firm’s latest earnings report revealed a 14% year-over-year drop in South African PGM (Platinum Group Metals) production and a 30% decline in regional gold production. Furthermore, the company’s U.S. PGM operations slumped by 40% year-over-year amid the flooding of its Stillwater mine in Montana.

Sibanye expects full-year production to end up at the lower end of its 445K to 460K oz guidance. In addition, all-in-sustaining costs are anticipated to settle between $1,435 to $2,380/oz.

Third Quarter Results (Sibanye-Stillwater)

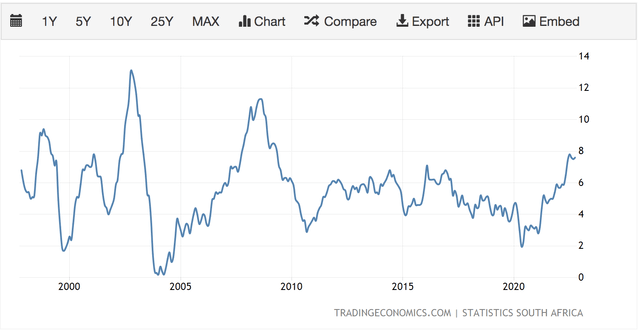

As previously mentioned, the company experienced severe misfortunes in 2022 with the flooding of its PGM operations in the United States. Moreover, the mining house dealt with challenging labor wage disputes, which saw its gold mines stand still for a prolonged period. In our opinion, the flood in Montana that affected Sibanye’s PGM operations can be backed out of the company’s long-term earnings trajectory (which has proliferated significantly in recent years) as it’s a natural disaster and not a long-term operational defect. Furthermore, wage disputes in South Africa were a systemic phenomenon amid multi-year high inflation. We believe the nation’s/company’s wage disputes will likely find calm in the coming years if global inflation tapers.

South Africa Inflation Rate (Trading Economics)

Another factor to consider is the company’s likely appeal to renewable energy investors. Sibanye has aligned itself with foreign renewable energy projects that could de-risk the company’s business model and re-ignite growth as it asserts itself in the renewable energy sphere. Notable moves to consider are the company’s 30.29% share of Keliber to gain access to lithium mining operations, which could initiate in 2024. Furthermore, Sibanye recently acquired Sandouville from Eramet SA to roll out vertically integrated processes that could bolster the firm’s Nickel portfolio.

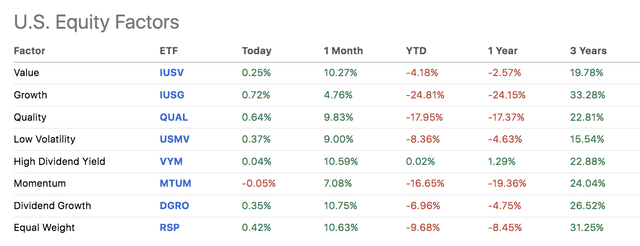

Furthermore, Sibanye Stillwater provides a sumptuous dividend yield of 7.91%, aligning it with the current market zeitgeist. Factor analysis suggests that investors currently favor high-dividend stocks, which isn’t surprising given that we are in the midst of a risk-off market. Although not worth considering in isolation, Sibanye’s dividend properties could spark demand among factor-driven investors.

Potential Challenges

Jurisdictional

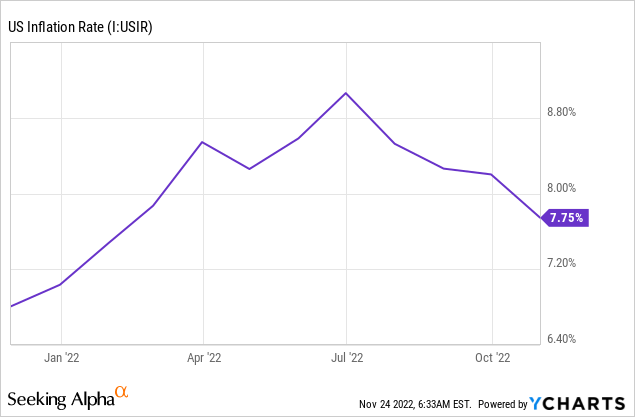

As previously mentioned, we don’t believe Sibanye’s U.S. operations are risky. The flood in Montana is an abnormal event, and rising input costs will likely settle once inflation stabilizes.

However, the company’s South African operations are faced with severe turbulence. From an energy vantage point, the nation’s primary producer Eskom is in tatters, which has slowed industrial production considerably during the past year.

According to Sibanye’s CEO, Neal Froneman:

“Severe load-shedding imposed by Eskom during September necessitated the curtailment of concentrator capacity across the South African PGM operations, impacting processed output and sales for the quarter,”.

From an anecdotal vantage point, Eskom’s situation isn’t improving, as mismanagement of funds and material theft are serious concerns. Moreover, Eskom generates approximately 95% of the nation’s power, and the government seems reluctant to allow private market competition.

Furthermore, South Africa is faced with numerous other infrastructure challenges. Abolishment of railways is a severe issue in South Africa, with much of it being funded and executed by local ‘kingpins’. For example, Transnet recently called its sixth force majeure in 18 months amid disastrous floods, strikes, fires, cyberattacks, and riots.

Parsimoniously speaking, poor infrastructure maintenance and mismanagement could severely damage Sibanye Stillwater’s export activities.

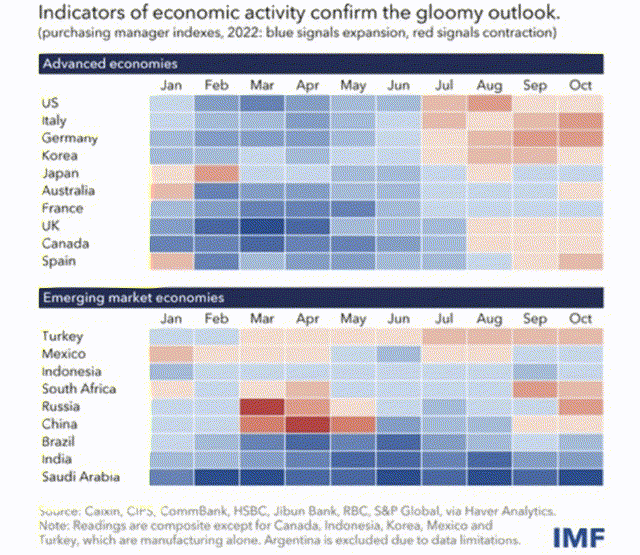

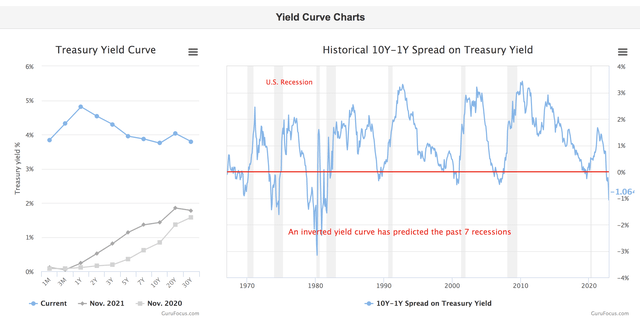

The yield curve and Sibanye’s historical financials corroborate the argument. The yield curve is inverted, suggesting future interest rates will need to recede significantly to amplify a struggling economy. The yield curve isn’t settled law; however, it’s a useful indicator of future economic policy.

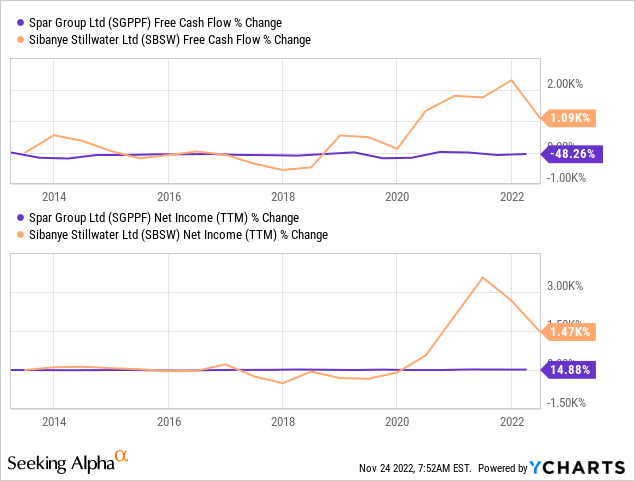

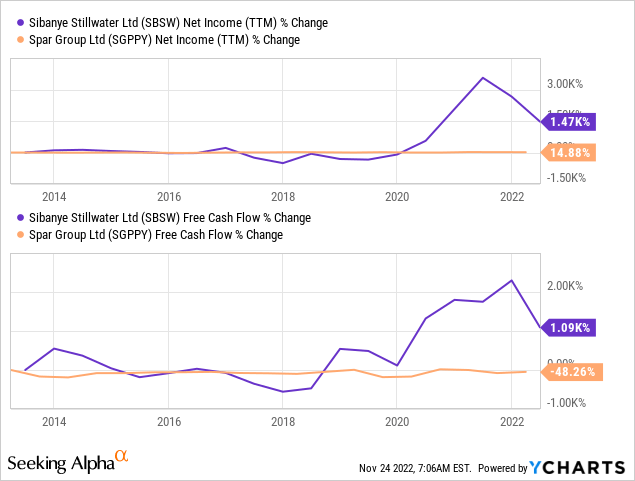

As previously mentioned, Sibanye’s financials display the cyclical nature of the business and mining in general. I compared the company’s free cash flow and net income to Spar Group’s (A South African consumer staples company) (OTCPK:SGPPF) below to illustrate the fact.

Managerial

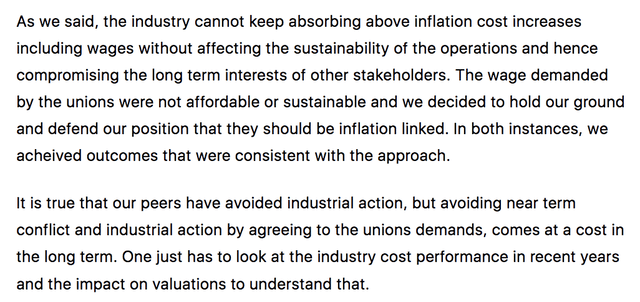

Lastly, I’d like to point out a few managerial concerns. Sibanye’s investor relations Vice President, James Wellsted, recently commented on one of our previous articles, pointing out that Sibanye did what was best for the business by not raising wages above inflation.

Words of James Wellsted (Pearl Gray Equity and Research)

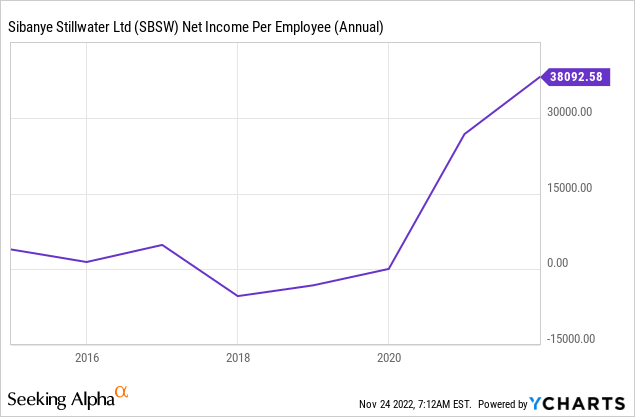

Although I partially concur with James, opportunity cost needs to be assessed. Before striking mid-year operational misfortunes, Sibanye hosted an extremely high net income per employee figure, allowing it to settle any wage disputes. In my opinion, drawing hard lines regarding abnormal wage disputes will result in opportunity costs, such as the temporary closure of mines and employee dissatisfaction, which isn’t worth it, especially if wage disputes are related to inflation, as inflation is cyclical.

In our opinion, this illustrates managerial inefficiency and highlights concerns.

Concluding Thoughts

Based on our analysis, Sibanye’s production could recover after suffering a tumultuous period, which saw its U.S. PGM operations dented. In addition, the company’s South African operations have underperformed due to systemic wage disputes.

Despite a possible production recovery, Sibanye is faced with potential demand destruction from a waning global economy and supply-side issues derived from the decay of South African infrastructure. Moreover, the company’s cyclical exposure could be a headwind in today’s market as the yield curve’s inversion and factor analysis indicate a risk-off environment.

Be the first to comment