Alvaro Sanchez/iStock via Getty Images

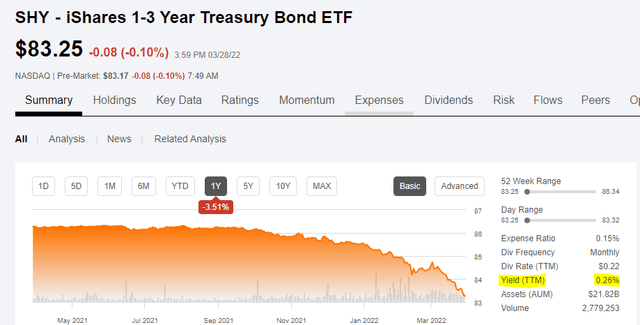

While we have not been fans of iShares 1-3 Year Treasury Bond ETF (NASDAQ:NASDAQ:SHY), we softened our stance the last time we wrote about it. It was still far from being a “buy” for us, but it had punished its ardent investors enough that the silver lining was becoming visible, albeit faintly. We still preferred another ETF with a lower duration risk along with a couple of preferred issues. Our conclusion stated that:

SHY yield has improved significantly since we last covered it. We like NEAR a bit more here as the duration risk is lower. Neither offer a great yield but at this point at least the chances of losing money are far lower. We like the idea of taking selective credit risk where the market is paying us far more to do so. BEVFF and AFIN related securities offer that in this market.

Source: Cash Parking Choices: A Look At SHY And Alternatives

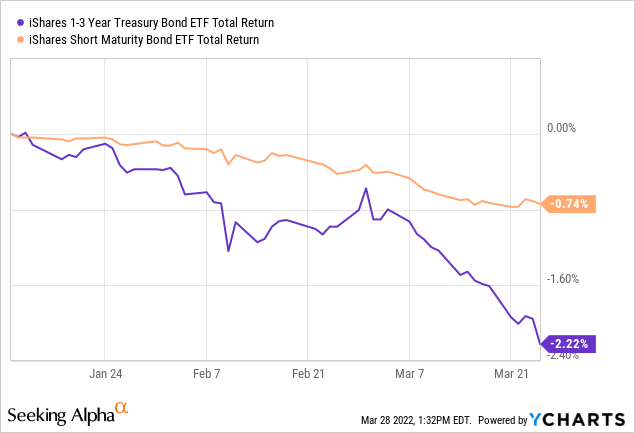

BlackRock Short Maturity Bond ETF (NEAR) too lost money during this time frame but it did a relative solid to its investors by losing less then SHY.

Its shorter duration makes its more resilient to the interest rate blows than SHY as expected.

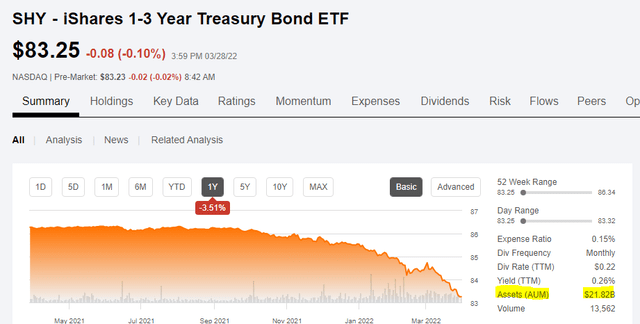

SHY’s investors got no respite during this time. Let’s review this one again today and talk about the $22 billion question. To buy or not to buy?

SHY Assets Highlighted (Seeking Alpha)

Current Allocations & Characteristics

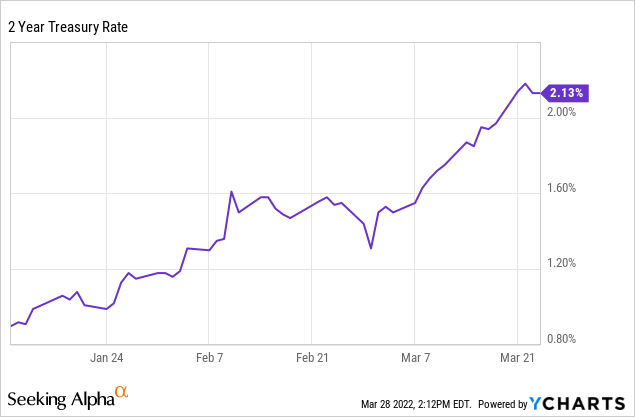

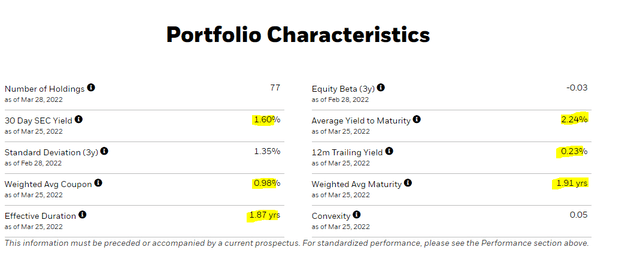

SHY being a passive ETF pretty much runs where the market goes and there is generally zero thought put into the what or why. On last check it held 77 different treasury securities with a weighted average maturity of close to two years.

SHY Characteristics (iShares)

The effective duration was similar as well and came in at 1.87 years. Investors might be peeved at the distributions over the last 12 months and they have definitely not been much to write home about. But fortunately, that 0.23% is the past, even though most websites still have to show the yield based on that.

SHY Chart (Seeking Alpha)

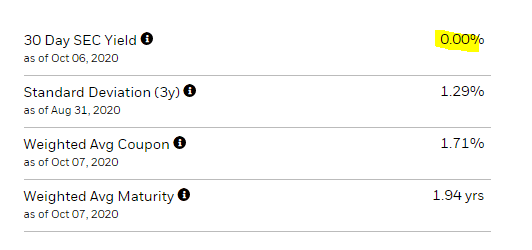

The true forward yield today is the 30 day SEC yield and that gets us up to 1.6%. While not exactly peaches and butterflies, it is a vast improvement from what we have seen in the past. Here, we are not even referring to the 0.23% trailing yield. In the past SHY has literally yielded 0.00%.

SHY Yield In The Past (iShares October 6, 2020)

So you are now getting a decent bang for your buck and parking cash is not so painful as before.

Could You Do Better?

There are a lot of alternatives to SHY, but in each case you take a different kind of risk and get a different kind of reward. For example, we recommended Diversified Royalty Corporation’s (OTCPK:BEVFF) convertible debentures maturing in less than one year as a solid alternative to “cash”. With a 5.25% yield on par, and a company firing on all cylinders, we felt that this bond maturing in 15 months was worth it. It worked out perfectly as the company kept paying its interest and you got a far better deal than losing money in SHY. One fly in the ointment was that BEVFF, panicked by the rapid rise in rates, placed new convertible debentures at 6.00% and intends to call this one. So while you got paid, you did not get paid as long as we would like. The new bonds obviously don’t make sense as “cash”.

One issue we highlighted for our subscribers was Global Medical REIT Inc. 7.50% CUM PFD A (GMRE.PA). This was effectively trading under par when we issued the alert. Global Medical REIT Inc. (GMRE) is a very fast growing medical office REIT that we have covered before. The firm has no need for preferred shares costing 7.5% and we give this a 99% probability of being redeemed in September 2022. While the price today for GMRE.PA is higher than what it was when we issued the alert, it still is a far better bet than SHY considering the total dividends of $1.41 that will be paid till redemption.

Verdict

SHY now pays you to park cash and fixed income in general is becoming more attractive. After having an extremely bearish stance on bonds for 2021, we are starting to see some better opportunities and recently bumped up fixed income to 2.5% of our portfolio. Keep in mind though, that we expect the Fed to unleash the most aggressive tightening if the S&P 500 stays elevated. SHY offers too little for parking cash but we still think it outperforms the broader equity indices from here. So it is now a legitimate investment, albeit with little reward.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment