JasonDoiy

Intel (NASDAQ:INTC) is currently offering a high-dividend yield that seems to be of interest for income investors, but its dividend sustainability is not great and the dividend cut risk should not be overlooked.

Background

As I’ve discussed in previous articles, Intel continues to struggle due to weak fundamentals within the semiconductor industry and its shares have declined considerably in recent months, but most of its fundamental woes seem to be priced-in and some upside potential exists if its turnaround plan goes well over the next couple of years.

However, Intel’s risk-reward proposition was not attractive yet from an upside potential perspective, particularly for growth investors that usually wait to buy stocks with considerable upside potential over the long term. On the other hand, Intel may now be interesting for a different type of investor, namely income investors that look for ‘safe’ income over the medium to long term, plus some upside potential.

Therefore, in this article I analyze in more detail Intel’s dividend prospects over the next few years, to see if it is currently a good income pick or not.

Intel’s Dividend History

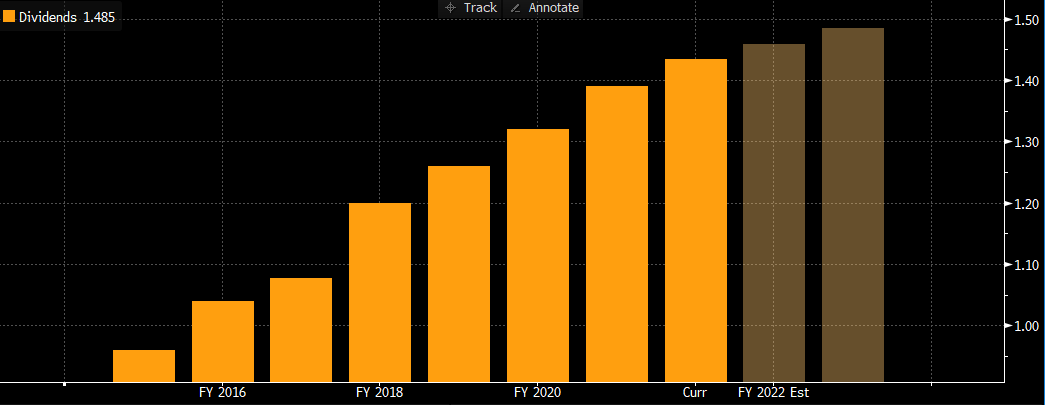

Intel has a very good dividend history, considering that its dividend has a growing trend over the past few years. Indeed, its annual dividend increased from $1.06 per share in 2016, to $1.39 per share last year. This means that Intel’s dividend increased at an average growth rate of 6% per year during this period, which is acceptable for a large company like Intel.

Dividend history (Bloomberg)

Intel increased its quarterly dividend at the beginning of 2022, to $0.365 per share, which means that related to 2022 earnings, Intel’s annual dividend will increase to $1.46, an increase of 5% from the previous year. While Intel’s dividend has been on a growing trend in the recent past, its share price has been going in the opposite direction, leading to a much higher dividend yield than usual for a technology company.

Indeed, at its current share price, Intel offers a dividend yield of about 5.6%, making it a high-dividend yielder. This is quite unusual in the technology sector, and can be a great opportunity for income investors to receive a relatively high and recurring income stream, or can be a sign that the market expects dividend cuts ahead as the company’s fundamentals have deteriorated rapidly in the past few years.

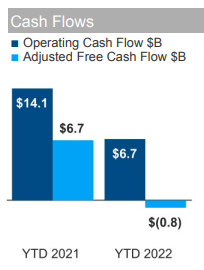

As I’ve discussed in a previous article, Intel’s struggles aren’t easy to turn around and recent earnings were quite poor, plus the company turned to losses in the last quarter raising further questions about its dividend sustainability. Indeed, its operating income was a loss of $700 million in Q2, and its free cash flow was negative in the first six months of 2022, not boding well for its dividend prospects.

Cash flow (Intel)

Dividend Sustainability

To analyze Intel’s dividend sustainability I look into a few metrics, including earnings, cash flow, and its balance sheet position. Based on earnings, Intel’s historical dividend payout ratio has been somewhat low, which is a good sign for its dividend sustainability. Over the past six years, its average dividend payout ratio was 35%, but this declined to about 27% over the past four years, showing that its dividend has been well covered by earnings in recent years.

The problem is that Intel’s earnings collapsed during the most recent quarters due to several issues, which the company attributed to a weaker macroeconomic environment, supply disruptions, high inventory, and ultimately competitive pressures.

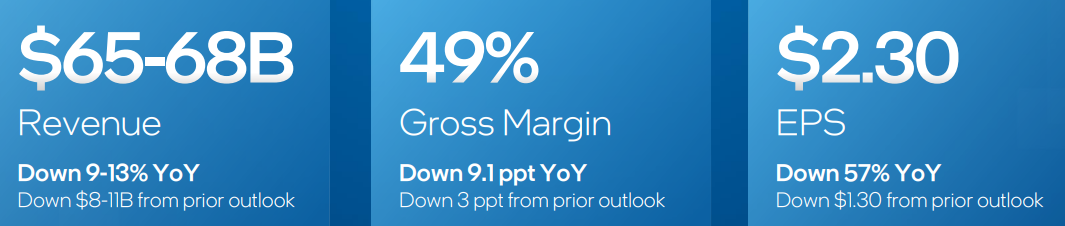

Its revised guidance is for EPS to be $2.30 in 2022, which means that its dividend payout ratio should increase to about 63% this year. While this is still an acceptable payout ratio, it is a worrisome trend and a big increase from its history, being a warning sign for investors.

Guidance (2022) (Intel)

According to analysts’ estimates, Intel’s net income and EPS are expected to drop further next year to $2.03, while a significant recovery is only expected by 2025 to $2.84. This means that, assuming a flat dividend, Intel’s dividend payout ratio should be close to 70% over the next two years, which is still acceptable, but doesn’t leave much room for error if the company’s earnings don’t recover, as currently expected, in the coming quarters. By 2025, its dividend payout ratio is expected to be 51%, which is a much more comfortable ratio to consider the company’s dividend sustainable over the long term.

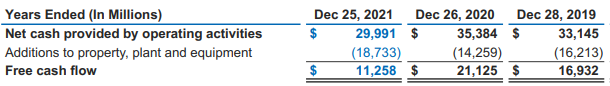

Regarding cash flows, Intel has a good cash flow generation, which has historically been more than enough to finance its capital expenditure and dividend distributions, as shown in the next table. Intel’s dividend distributions have amounted to $5.5-5.6 billion per year, over the past three years, while its free cash flow has been much higher than that, which means that historically its dividend has been well covered by cash flows.

Free cash flow (Intel)

However, this profile also changed in the past couple of quarters, has cash flow from operating activities amounted to $6.7 billion during the first six months of 2022, which were not enough to finance capex of $11.8 billion and dividends of $3 billion. This means that Intel’s free cash flow, excluding other items such as divestitures and sale of equity investments, was negative by some $8 billion in the first semester of 2022.

For the full year, Intel’s free cash flow is expected to be negative by some $3.4 billion, while in 2023 should be negative by about $1.5 billion and turn positive again by 2024 to $3.2 billion. Therefore, Intel’s dividend distributions are not expected to be covered by organic cash flow during the next three years, not boding well for its sustainability.

This is explained by Intel’s declining operating margins, given that its net profit margin is expected to reach a bottom of 11% in 2023, compared to 26.6% reported in 2021, and also high capex spending during the next few years. Intel is investing significantly in capex to build new factories, but this takes some time to build and equip and they are only expected to be operational by 2024/2025, thus representing a burden for free cash flow generation during the next two to three years. Only by 2025, Intel’s annual free cash flow generation is expected to cover again the company’s dividend distributions.

While Intel is not expected to generate enough cash flow to cover its dividend distribution in the coming years, this doesn’t necessarily mean that is has to cut its dividend. The company can finance this dividend, and even potentially increase it, through debt issuance.

Intel has a good credit rating (A+ by S&P) and should have easy access to credit markets, even though at higher costs than compared to the past few years, both from higher interest rates and its own credit spread. This means that to finance its dividend through increased debt, Intel’s income statement will be hurt by higher interest costs, being another headwind for earnings growth.

Nevertheless, Intel has a strong balance sheet given that its net debt amounted to less than $8 billion at the end of last quarter, while its EBITDA in 2021 was $32 billion. However, due to lower revenue and gross margin, its EBITDA is expected to be around $21.5 billion this year, which means that Intel currently has a net debt-to-EBITDA ratio of only 0.4x.

This is a very low credit leverage ratio and Intel can increase its indebtedness to finance its dividend payments over the next few years. Assuming that Intel wants to maintain a credit rating of single A, an appropriate leverage ratio would be less than 1x. This means that, considering current estimates that EBITDA will recover to $23.7 billion in 2023 and $29 billion by 2029, Intel could increase its net debt position by some $21 billion over the next three years.

Therefore, assuming flat annual dividend distributions of $5.6 billion during 2022-24, Intel would need to raise $18 billion in debt to finance a flat dividend during this period, and would end 2024 with a net debt-to-EBITDA ratio of around 0.9x.

I think this is an acceptable leverage ratio for Intel, unless its fundamentals continue to weaken and earnings don’t recover as expected over the next couple of years, in that case its increased debt levels and weaker operating trends would certainly lead to a credit rating downgrade.

Conclusion

While Intel can maintain its dividend unchanged in the near future, this is not really supported by the company’s business prospects, especially from a cash flow and balance sheet perspective. Intel will need to raise significant amounts of debt and execute well on its turnaround plan. Plus, if an economic recession hits harder than expected in the next few months and the company’s earnings don’t recover, then its dividend is not sustainable in my opinion.

While this depends more on macroeconomic developments rather than the company’s actions, I think that Intel’s management should be more conservative and maintain a strong credit rating, thus a dividend cut can be considered to be a significant risk, and Intel is therefore a company to avoid for income investors as I think its current high-dividend yield may be cut in half or even more over the next couple of years.

Be the first to comment