Joey Ingelhart/iStock via Getty Images

It’s been a little over three months since I last wrote about The Greenbrier Companies, Inc. (NYSE:GBX), and in that time, the shares have returned about 1.3% against a loss of ~4.4% for the S&P 500. I thought I’d check on the name again to see if it’s worth buying the shares. Of course, I’ll make that determination by looking at the updated financial history here, and by looking at the stock itself as a thing distinct from the underlying business. In addition, I suggested selling puts earlier, and I absolutely can’t wait to brag/write about how that trade has gone.

Welcome to the “thesis statement” portion of the article, dear readers. It’s here that I lay out my argument in broad strokes so you won’t have to wade through the whole article. I do this as a way to save you time, and because I’m absolutely obsessed with trying to find new and innovative ways to make your lives better. So I think the most recent financial results are generally good with a few dark spots. The problem is the valuation. The shares are not cheap, especially in the context of a risk-free rate of 2.9%. For that reason, I can’t recommend buying at the current levels. Thankfully, though, the options market is offering a decent price for the December put with a strike of $35. The returns on these may not be as high as they are on the stock, but they are much better risk-adjusted returns in my view.

Financial Snapshot

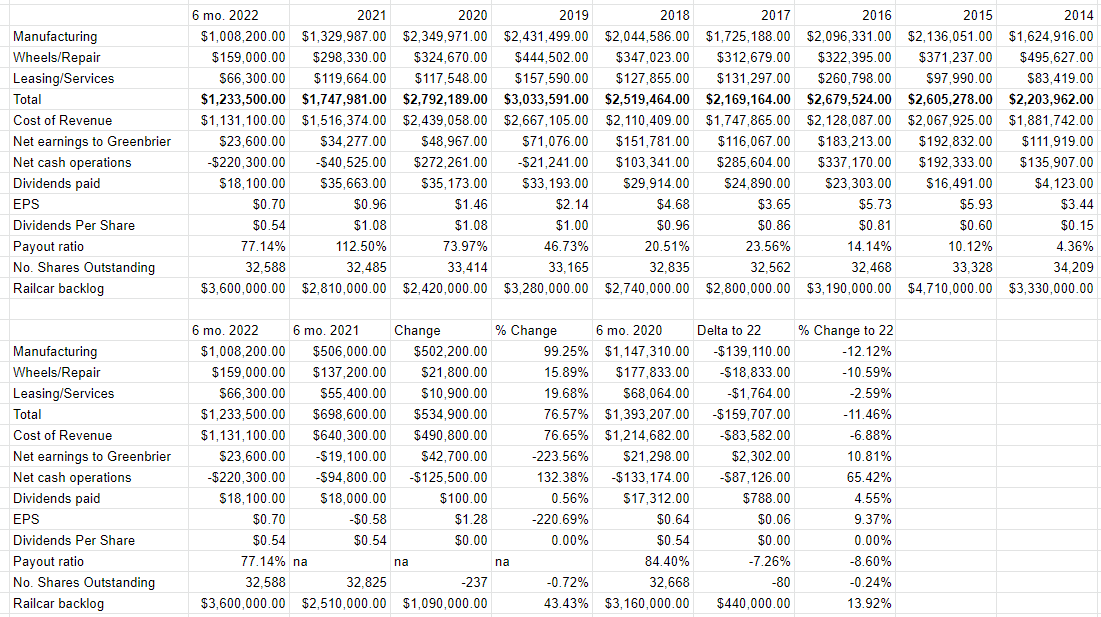

The first half of FY 2022 has been quite good in many ways in my estimation. Specifically, sales were up a whopping 76.5% from the year-ago period. Additionally, net earnings to Greenbrier swung from a loss of $19.1 million last year to a positive $23.6 million this year. Cash from operations deteriorated significantly because the company sold a great deal more on credit, and because they bought a great deal more inventory. None of this warrants much concern in my view.

When we expand our horizons a bit and compare the most recent six months to the period in FY 2020, things look less good in my view. Sales in the most recent period were actually 11.5% lower than they were the same time in FY 2020. In spite of that net earnings were higher in 2022 than they were in 2020.

Finally, I think it’s worth noting that the backlog has expanded by about 43%, offering us yet another data point to suggest that the demand for railcars is ticking up. All of this suggests to me that this is a worthwhile buy at the right price.

Greenbrier Financials (Greenbrier Investor Relations)

The Stock

As my regular readers know, I consider the stock and the business to be distinct from each other. The business is pretty easy to understand. It takes a set of inputs, adds value to them, and then sells them (hopefully) for a profit. The stock, on the other hand, is a mercurial measure of the mood of the crowd on a moment-by-moment basis. The stock’s price changes reflect changing perceptions about the long-term future of the company it supposedly represents, and these perceptions change very quickly. This is why I treat the two as distinct.

In case you’re not fully convinced, I’ll belabour the point by looking at Greenbrier stock itself to hopefully demonstrate the point. The company released quarterly results on April 6th, and if an investor bought the stock the next day, they’re up about 4.3%. If they waited a week, they’re down about 2.2%. Not enough happened at the firm to warrant a 6.5% swing in performance in a week, so the variance in returns came down entirely to the price paid. The person who bought shares cheaper did better. This is why I try, though don’t always manage, to buy shares cheaply.

My regular victims know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship between price and some measures of economic value, like earnings, free cash flow, and the like.

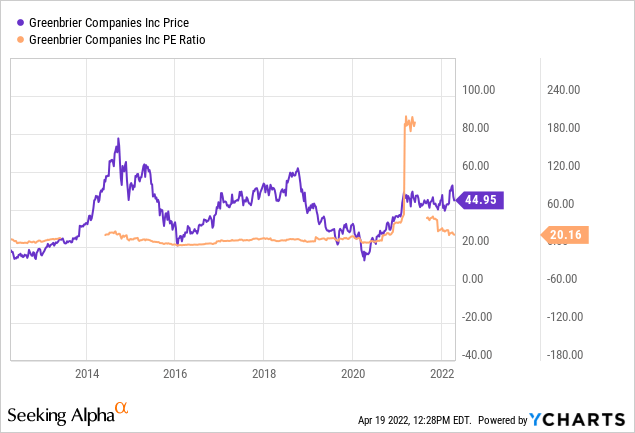

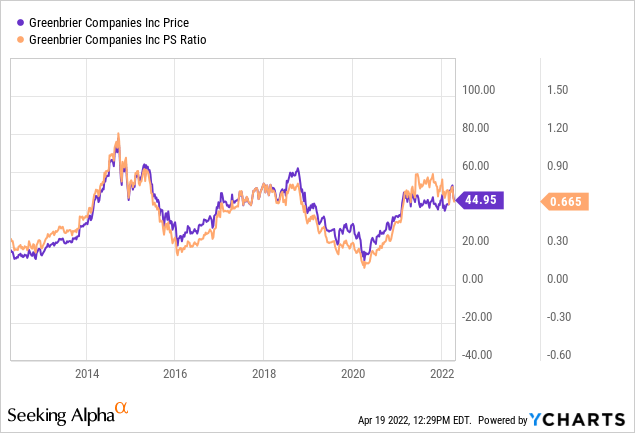

In my previous article on this name, I became nervous because the PE had hit a level of about 50, and the price to sales ratio came in near a multi-year high of 0.9. Now, the PE has fallen to about 20, and the price to sales is down to 0.67.

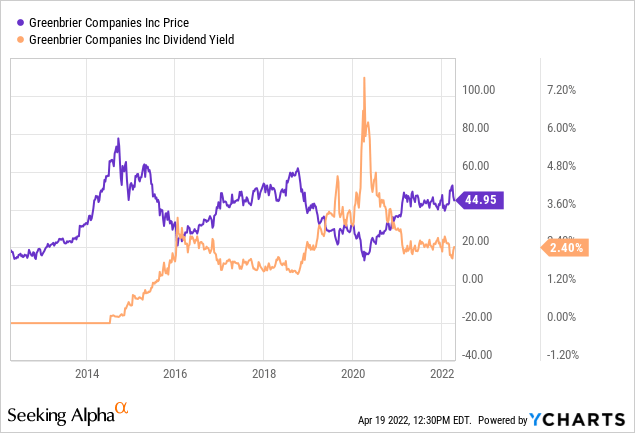

While shares are relatively less expensive than they were, investors are receiving a dividend yield that is actually pretty high by historical standards, per the following:

In addition to looking at the relationship between price and value, I like to try to understand what the market seems to be “assuming” about the future of a given company. As my regular reader-victims know, In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can isolate the “g” (growth) variable in a standard finance formula in order to work out what is currently assumed about long-term growth, holding other variables like price and book value and earnings forecasts constant. Applying this approach to Greenbrier at the moment suggests that the market is forecasting a long-term (i.e., perpetual) growth rate of ~14% here. This is wildly optimistic in my view, and given all of the above, I can’t recommend buying at current prices.

Options Update

Just because I don’t want to buy at current prices, doesn’t’ mean I see no value here. For instance, in my previous missive on Greenbrier, I suggested selling the June Greenbrier puts with a strike of $35. I considered this a winning trade because the outcome would be great regardless. Either I’d collect a nice premium, or the shares would be “put” to me at a very good price. I sold 10 of these for $0.95 each, and I’m exceedingly happy to report that these are now priced at $0.20-$0.35, so I’d say that trade’s working out swimmingly so far.

I like to try to repeat success when I can, and so I’m actually going to sell December Greenbrier puts with a strike of $35, which are currently bid at $2.00. Selling these will mean that I’m exposed to both June and December puts, which is more aggressive than I usually get, but I really like the premium-strike price combination. If the shares fall 21%, I’ll be obliged to buy, but will do so at a dividend yield just north of 3%. If the shares don’t fall 21%, I’ll pocket a very nice premium. This is why I characterise these as “win-win” trades.

It’s that time again. Welcome to the point in the article where I get to indulge in my semi-sadistic tendency to spoil people’s moods by pointing out that the phrase “win-win” is really just a bit of rhetoric. This trade, like all others, comes with risk. I consider the risks associated with these instruments to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. So, dear reader, only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

Also, understand that put options are generally less liquid than stocks. That means that if you need to exit a position in a pinch, there’s a good chance that you will take a relatively large loss, given the large gap between bid and ask prices. Thus, I would urge you to treat most options as though they were of the European variety, meaning that they can’t be traded until expiration.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on the upside. To use this trade as an example, let’s assume that the stock price of Greenbrier shoots to at least $60 per share as another writer suggests might happen. Obviously, in that happy circumstance, my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upsides in the stock price, though. So, short put returns are capped by the premium received. This is emotionally painful for some more hopeful souls. Thankfully for me, my expectations have been so diminished by a life of trading that this isn’t really an emotional hardship for me.

Secondly, it can be emotionally painful when the shares crash below your strike price. This has happened to me more than a few times over the years. While it always works out well because my strike prices are usually “screaming buys”, it is emotionally painful in the short term. The fact is that it’s not fun when the stock crashes well below the strike price. So, I can make a reasonable argument that Greenbrier would be a steal at a net price of $33, but if the shares drop to $25, for instance, that will take an emotional toll, at least in the short run. I think people who sell puts should be aware of these emotional risks before selling.

If you understand these risks and can tolerate them, I would recommend that you sell puts in lieu of buying shares. The return may be lower, but in my experience, this game isn’t about trying to capture maximum returns. It’s about trying to capture maximum risk-adjusted returns, and a deep out of the money put is a far less risky proposition than the stock in my view.

Conclusion

Although the shares of Greenbrier are less expensive now than they were when I last reviewed the stock, they’re not cheap enough to consider in my view. Thankfully, the options market is offering a nice premium on deep out of the money puts, so I think that’s a better way to “play” this name. The returns on these may not be as great, but the risk-adjusted returns are far higher in my view. If you’re comfortable with selling puts, I’d recommend this or a similar trade. If you’re not, I’d hold off and wait for shares to fall to a more reasonable level before buying. I would consider $40 to be a reasonable price here.

Be the first to comment