Nina Shatirishvili/iStock via Getty Images

It’s been just under 17 months since I wrote my cautious note on Wynn Resorts (NASDAQ:WYNN), and in that time, the shares have lost about 15% of their value against a gain of ~26.5% for the S&P. Now, those who know me best suspect that this is going to trigger more tedious bragging, and they would be right to assume that. The problem, from my point of view, is that you selfish readers don’t want to read my undiluted self congratulation. I need to offer you something more, so I suppose I’ll do that for you. You’re welcome. Not all heroes wear capes. As a quiet voice in my head yammers something about “pride goeth before the fall” or similar nonsense, I’ll try to work out whether it makes sense to buy at current levels. After all, a stock trading at $72.75 is definitionally less risky than the same stock trading at $86.50. I’ll decide on what I think is the wisest course of action by looking at the latest financial history here, and by looking at the stock as a thing distinct from the underlying business. My regular victims also know that I am a fan of selling put options, so prepare for a section on the risk reducing, yield enhancing potential of these things.

If you’re a new member of my audience, the novelty may not have worn off yet. If you’ve been around for a while, though, I understand if you just want to read my arguments and move on. I get it. My writing can be “a bit much.” For that reason, I offer up a thesis statement paragraph, where I give you people the “gist” of my argument, so you won’t have to wade through 2,000+ of my words. I think Wynn is turning around nicely, and I really like the fact that the capital structure has improved dramatically. Further, I think the company has sufficient cash to meet its contractual commitments to late 2023. The problem for me is that the stock is not objectively cheap at current levels, so I must continue to recommend avoiding the shares. Just because I don’t want to buy the stock at current prices doesn’t mean there’s nothing to do, though. The options market is offering very generous premia for deep out of the money put options, so I recommend selling those. In particular, the January 2023 puts with a strike of $55 are bid at $4.60 at the moment. Receiving a yield of 8.45% ($4.60/$55) is very attractive in my estimation, and I think it’s the smartest trade here. If you’re comfortable selling put options, I recommend this or a similar trade. If you’re not, I recommend holding off a little while longer before buying. That’s the essence of my argument. So, if you read on, that’s on you. I don’t want to read any moaning in the comments section about my tiresome bragging or the fact that I spell correctly.

Financial Snapshot

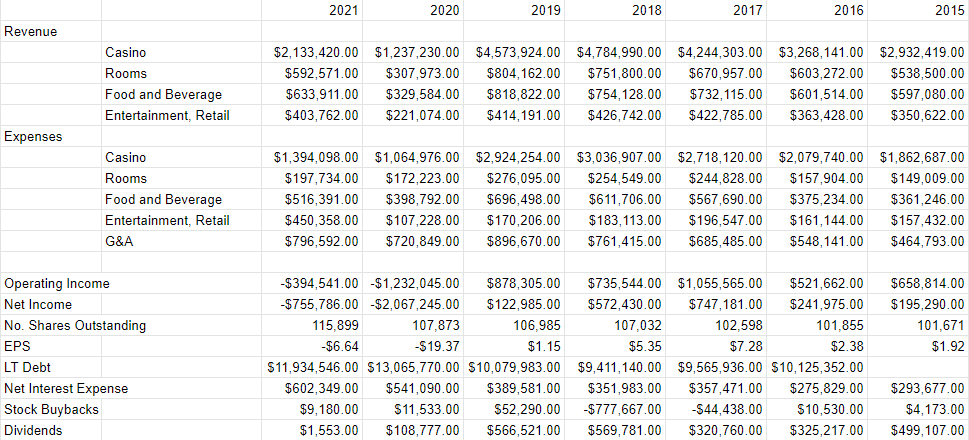

Although the company is not yet “out of the woods”, things improved massively in 2021, relative to 2020. Revenue was up a massive 79.5% in 2021 relative to the previous year, and “rooms” and “food and beverage” were standouts, each up slightly over 92% from the year ago period. “Casino” revenue increased by 72.5%, and “entertainment, retail” was up by 82.6%, so these, too, performed exceedingly well.

When we cast our eyes back to the period before the pandemic, things look less rosy as we should expect. Specifically, total revenues were ~$2.85 billion lower in 2021 than they were in 2019. “Casino” revenues, in particular, are noteworthy, as they’re down about 53% from the pre-pandemic period. Additionally, the company has witnessed some dilution, with share count up by about 7.5% in 2021 relative to 2020.

It’s not all nasty sharp pointy teeth at Wynn Resorts, though. I like the fact that the company managed to clean up the capital structure quite well during the year. Specifically, long term debt declined by $1.13 billion from the year ago period. Long term debt is still higher now than at any point during the pre-pandemic era, but I’m very glad to see that it’s moving in the right direction.

Finally, I don’t think we should expect to see the return of a dividend anytime soon for a few reasons. I hope that doesn’t come as a shock. The company last paid an annual dividend in 2019, a time when they were generating cash from operations of $901 million, as opposed to 2021’s CFO of -$223 million. In 2019, they also generated net income of $123 million, against a net income loss of $756 million in 2021. In my view, things have to improve dramatically from current levels for the company to consider sending out dividend cheques to people. For my part, I would prefer the company paid down debt before paying a dividend anyway.

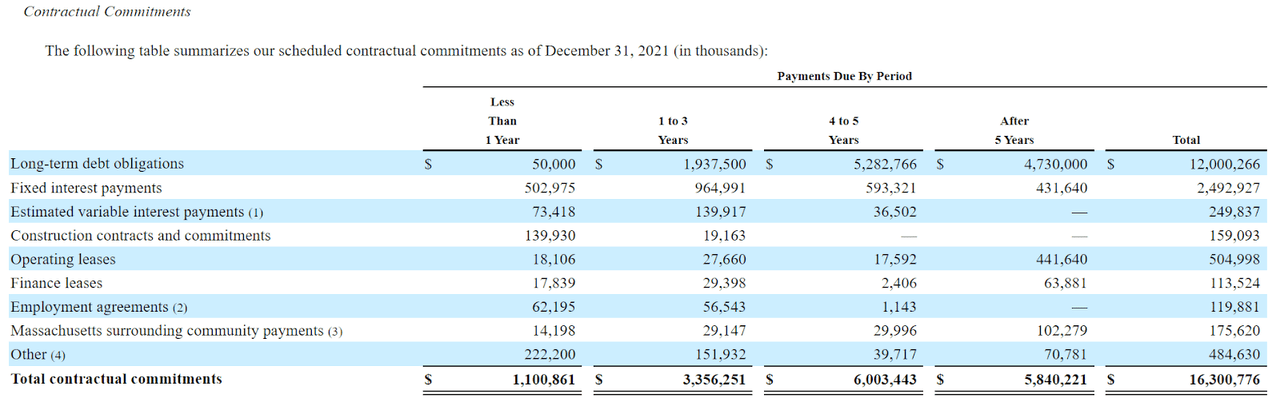

Additionally, the contractual commitments schedule’s pretty intense over the next few years, per the following plucked from page 52 of the latest 10-K

Wynn Resorts Contractual Obligations (Wynn Resorts 2021 10-K)

The company is on the hook for $1.1 billion this year, and an average of $1.678 billion in each of 2023, and 2024.

Against these obligations, the company has ~$2.522 billion in cash as of the latest 10-K, so I don’t expect the company will need to return to debt or equity markets this year, but unless things improve very quickly this year and next, the company will need to draw down credit lines, or sell more shares in 2023 or 2024 in my estimation. This eliminates any hope of a dividend in my view.

All of this written, I think the company is improving dramatically, and I think it’s reasonable to assume that the good times will return again. For that reason, I’d be comfortable buying the shares at the right price.

Wynn Resorts Financials (Wynn Resorts investor relations)

The Stock

My regulars know that I’ve disqualified some very profitable companies from consideration by yammering on about “at the right price.” I insist on never overpaying for a stock, because I think when you overpay for a stock, the probability of capital loss skyrockets. This discipline has kept me from participating on some very profitable trades, but it’s also stopped me from making disastrous investments like Wynn Resorts would have been nearly a year and a half ago. I’m willing to make this trade because I think losses are more painful than identical sized gains are pleasurable. Mathematically, if you lose 50% in year one, you need to make 100% in year two just to get back to the starting line. So, my former colleagues on Bay Street (Canada’s smaller, deeply insecure version of Wall Street) used to call me “granny” because of my squeamishness about overpaying. That nickname is one of the least bad I’ve had, so I’ll wear it as a badge of honour. The point is, though, that I try to avoid overpaying for a stock.

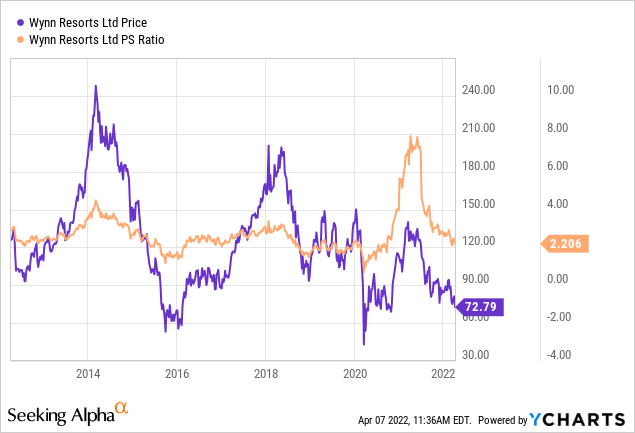

My regulars know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous article on this name, I blanched at the price to sales ratio of ~3. The stock is now about 27% cheaper per the following:

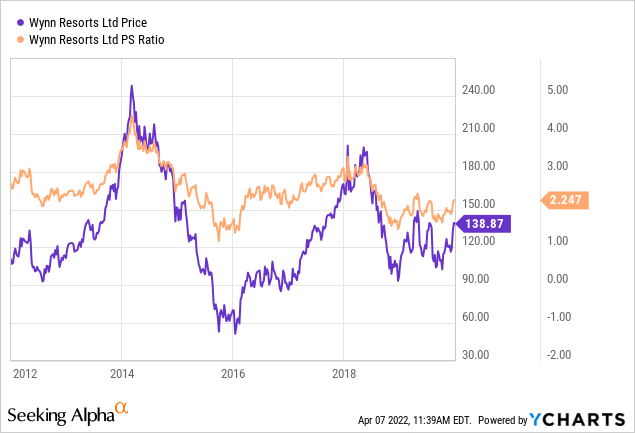

I thought it would be helpful to strip out the spike in the ratio during the pandemic, so feast your eyes on the typical price to sales ratio between 2012 and Jan 1, 2020. It seems that the current ratio is somewhere between “typical” and “relatively cheap”, which I like a great deal.

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to Wynn Resorts at the moment suggests the market is assuming that this company will grow at about 3.57% over the long term. This is neither optimistic, nor pessimistic in my view. I’d suggest that the shares are currently neither cheap nor expensive. Given that I’m such a timid beast, I’ll not buy at current prices, though the shares are getting quite a bit closer to a “buy” price for me.

Options as an Alternative

If you read my stuff regularly, you know that I’m a fan of selling deep out of the money put options on companies that I like at strike prices that I like. In case you’ve forgotten because I haven’t mentioned it for three minutes, I consider these to be “win-win” trades. If the stock remains above the strike price, I earn the premium, which is never a hardship. If the stock falls in price, I’ll be obliged to buy, but will do so at a price that I’ve already determined to be acceptable. With that in mind, I’m a fan of selling some put options on Wynn at the moment.

In terms of specifics. I’m recommending selling the January 2023 Wynn puts with a strike of $55. These are currently bid at $4.65, which I consider to be a very decent yield for nine months of, uh, let’s call it “work.” If the shares remain above $55 until the third Friday of next January, I’ll throw this premium onto the pile. If the shares fall another 25% from current levels, I’ll be obliged to buy, but will do so at a price to sales of ~1.5 times, which is very near a multi year low. Since I’m comfortable with either outcome, I consider this to be a “win-win” trade.

All that said, in case you’re the sort of person who takes the word of a stranger on the internet unquestioningly, I have a moral obligation to rein you in a little bit by writing about risk. After all, it’s all well and good for me to characterize these things as “win-win” trades as I frequently do, but everything comes with some measure of risk, and short puts are no exception. I’m starting to divide the risks here between the economic and the emotional. Let’s review these in turn.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. For instance, I would never have sold puts on this stock when I last wrote about them because the premium on offer for the reasonable strike price of $55 were too thin. Had I written puts with a strike of $85, for example, I may have picked up a few dollars in premium, but I’d be sitting on a fairly massive loss on the stock thus “put” to me. So, rule one is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

The two other risks associated with my short-put strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that the market really likes what’s happening at Wynn, and the shares jump to $120 this year. The short put only offers you the option premium. The return from the short put may be lower risk, but it’s certainly limited, and that can be emotionally painful for many.

Secondly, I can say from many years of painful experience that it can be emotionally painful when the shares crash below your strike price. While these trades have worked out well in the medium to long terms, largely because my strike prices are usually “screaming buys”, it is emotionally painful in the short term. So, I can make a reasonable argument that Wynn shares are a bargain at $55, but if they drop to $45 because of a market meltdown, for instance, that will take an emotional toll. I think people who sell puts should be aware of these emotional risks before selling.

I’ll conclude this rather long, drawn out, ponderous discussion of risks by looking again at the specifics of the trade I’m recommending. If Wynn Resorts doesn’t drop by a quarter over the next several months, I’ll add the premium to other short puts I’ve written and move on. If the shares fall in price, I’ll be obliged to buy, but will do so at a price that represents great value in my estimation. All outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” I know. It’s weird of me to end a discussion of short put risks by writing about how these reduce risk. If this is the first “weird” thing you’ve noticed in this article, I’d suggest you give it another read.

Conclusion

I think Wynn Resorts has improved dramatically, and I think the good times will continue for the rest of 2022 and beyond. My problem is that the shares are still not quite cheap enough for me to pull the trigger. Thankfully the options market offers an opportunity to make a nice 8.45% yield right now ($4.60/$55) to take on the obligation to buy these shares at the historical equivalent of a “screaming buy.” If you’re comfortable selling put options, I would recommend this or a similar trade. If you’re not, I think it prudent to wait a bit longer for price to fall to match value.

Be the first to comment