MasaoTaira

REIT Rankings: Shopping Centers

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on October 17th.

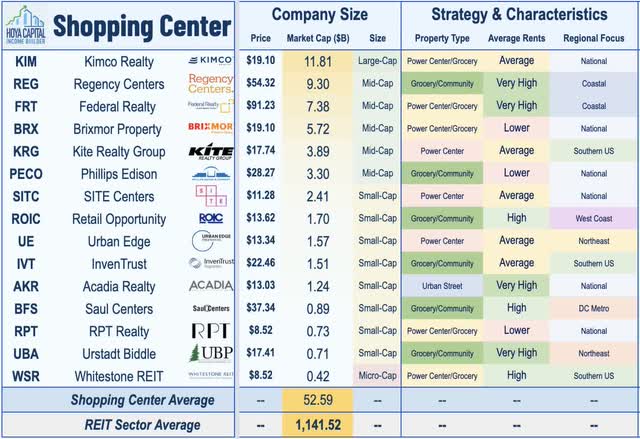

Shopping Center REITs are one of the better-performing property sectors this year – outpacing their mall REIT peers – as impressive earnings results and record-low store closings have offset looming recession concerns. While the enclosed regional mall format faces a choppy road to recovery, the versatility and larger footprint of the strip center format have been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid “distribution centers” in last-mile delivery networks. In the Hoya Capital Shopping Center REIT Index, we track the 15 largest open-air shopping center REITs, which account for roughly $50 billion in market value.

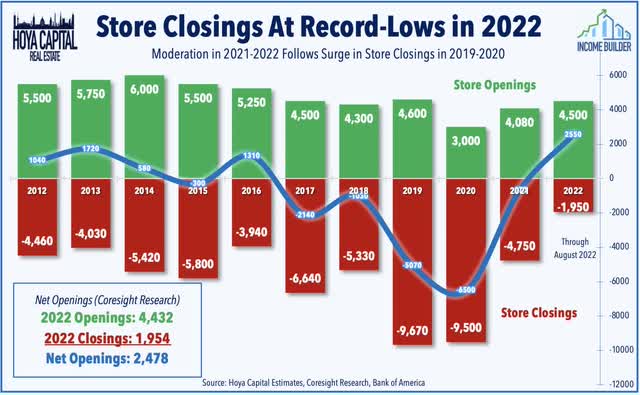

Critically, after a surge in store closings during the pandemic, the number of store openings has outpaced closings by nearly 2x since early 2021, according to Coresight Research, with particular strength in larger-format strip centers. After surging to around 10,000 in both 2019 and 2020, just 5,000 retail stores shut down in 2021 while 2022 is currently on pace for the lowest level of store closings on record with a total net store openings on pace to be over 2,500. Importantly, we believe that this slowed the pace of store closings – particularly in the strip center format – goes beyond the near-term pandemic-related trends and is indicative of a sustained retailer focus on highly efficient and well-located large-format space which can serve as hybrid showroom and distribution centers.

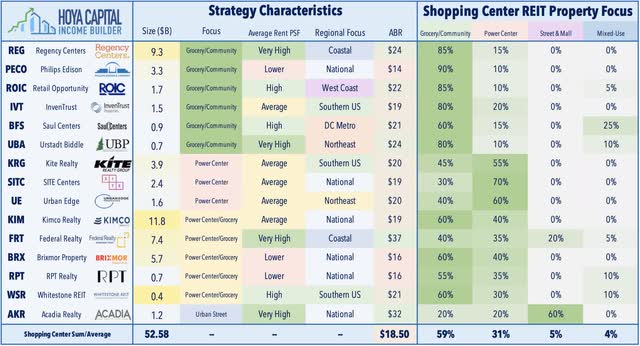

The proposed merger between supermarket chain Kroger (KR) – the second-largest grocery chain and Albertsons (ACI) – the fourth-largest grocery chain should have a minimal impact on these REITs outside of Kimco Realty (KIM), which has a strategic investment of nearly 40 million shares in Albertsons. KIM announced last week that it raised $300 million in a partial sale of 11.5M of shares and expects to pay a special dividend. Grocery-anchored centers have historically commanded premium valuations relative to power centers and REITs with a heavier balance of grocery-anchored centers have generally delivered steadier operating performance throughout the pandemic.

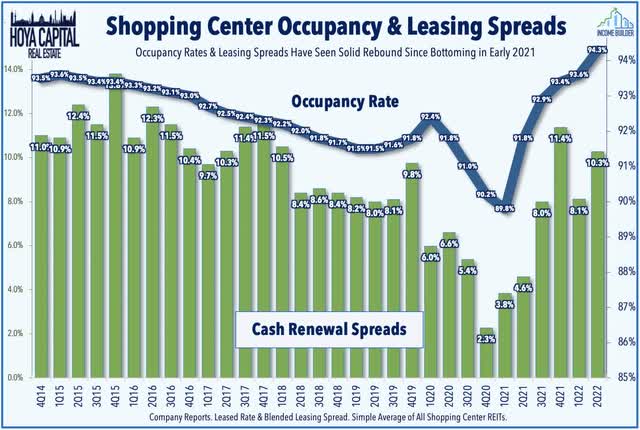

Earnings results across the shopping center REIT sector have been as impressive as any property sector over the past three quarters with fundamentals that are as strong – if not stronger – than before the pandemic with a full recovery in both FFO and NOI now complete. As discussed in our REIT Earnings Recap, recent shopping center REIT earnings results have been impressive even compared to pre-pandemic standards – and occupancy rate trends and leasing spreads have been especially encouraging. Results in the second quarter pushed the average occupancy rate to the highest level since early 2015 at 93.6% while rental rate spreads have exhibited a notable acceleration since bottoming early last year.

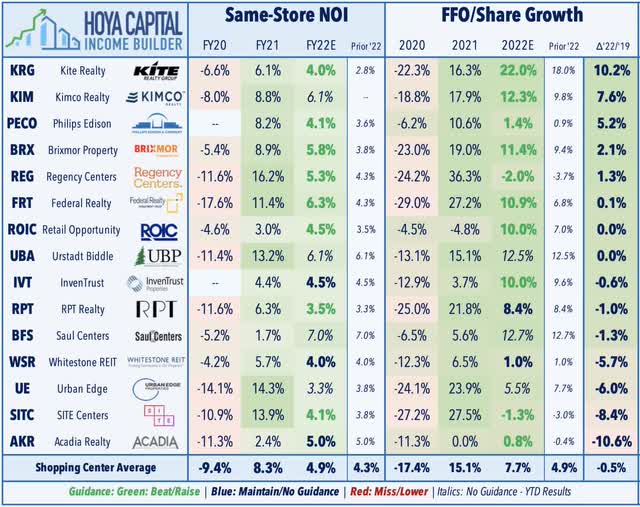

Over the past five REIT earnings seasons beginning with Q2 2021, Shopping Center REITs have delivered the highest total quantity of full-year guidance increases and the positive trend continued in Q2 with ten of twelve REITs that provide guidance raising their full-year FFO outlook. Upside standouts included Kite Realty (KRG), which reported another strong quarter and raised its full-year outlook. Driven by strong leasing activity with 13% blended cash spread, KRG now projects FFO growth of 22.0% this year – up 400 basis points from last quarter – and 10.2% above its pre-pandemic 2019 rate, the strongest in the shopping center REIT sector. Kimco was also a notable standout in Q2 earnings season, boosting its full-year FFO growth outlook to 12.3% – up 250 basis points from its prior outlook. Of note, KIM commented that one of the key drivers is their focus on “last mile locations” which are seeing positive traffic patterns at 101.3% relative to the same period last year.

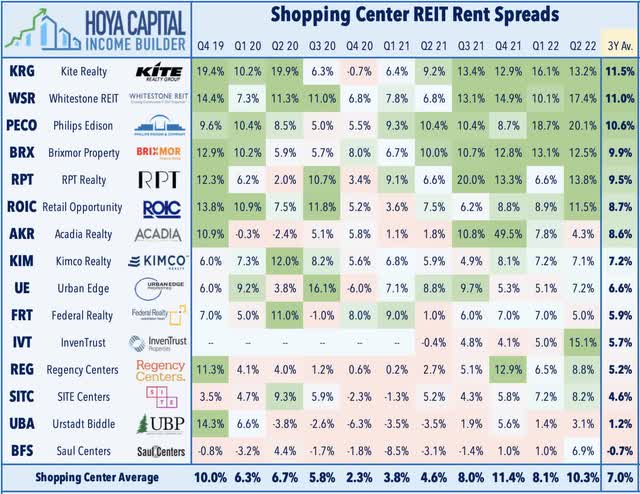

Strong leasing activity has been the positive highlight of the past several quarters and unlike their mall REIT peers, leasing volumes and rental rates have picked up considerably since early 2021. Encouragingly, leasing spreads stayed positive throughout the pandemic and meaningfully accelerated since mid-2021 with blended leasing spreads rising by over 8% for the fourth-straight quarter in Q2. indicating clear signs of pricing power for the first time since the mid-2010s. Notably upside standouts in Q2 on the leasing-front included grocery-focused Phillips Edison (PECO), which reported blended spreads of 20.1% in Q2. SITE Centers (SITC) also reported impressive leasing results with its highest quarterly new leasing volume since early 2017.

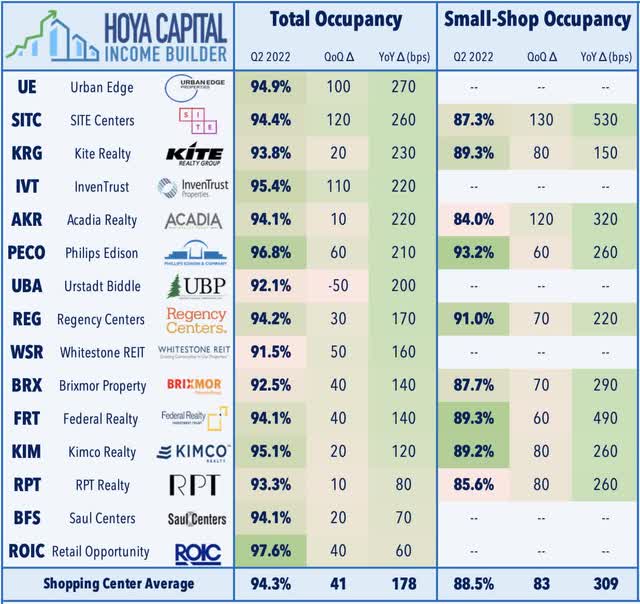

Total leased occupancy rates improved 180 basis points from the prior year and 40 basis points sequentially in Q2 with notable improvement in the quarter from InvenTrust (IVT) and Urban Edge (UE) along with Kite Realty and SITE Centers. Small-shop occupancy improvement has been a key contributor to the earnings beats in recent quarters – a trend that continued in Q2 with a 309 basis point average rise in occupancy. Adding some color to the small-shop trends on its earnings call, Kite Realty noted that its “still seeing a healthy appetite” for small shops despite the macro headwinds and noted that its occupancy is still 320 basis points below the high-level mark prior to the pandemic “which shows a lot of growth yet to come.”

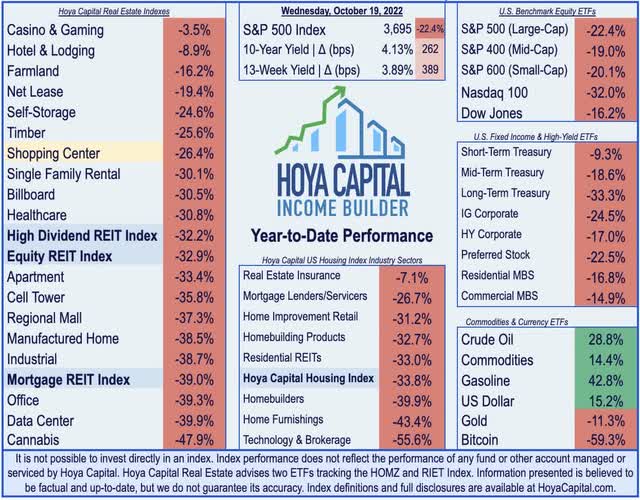

Shopping Center REIT Performance

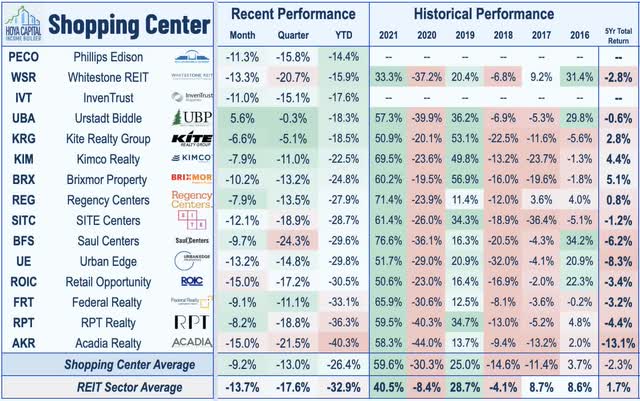

A common theme across the shopping center sector over the past several years, new reasons for caution always seem to emerge just as investors were starting to feel confident in the outlook and mounting recession concerns have kept a lid on the performance in recent months despite the strong earnings results. Shopping Center REITs are still among the stronger-performing sectors so far in 2022 with price returns of -26.4% compared to the 32.9% decline from the Vanguard Real Estate ETF (VNQ) and 22.4% decline from the S&P 500 (SPY).

After plunging more than 50% early in the pandemic, shopping center REITs have been one of the better-performing property sectors since the initial vaccine announcements in mid-November 2020. Shopping center REITs snapped a five-year streak of underperformance in 2021 with total returns of more than 65%, significantly outpacing the 41% total returns from the broad-based Equity REITs Index. Diving deeper into the company-level performance, all fifteen shopping center REITs are in negative territory this year, but upside standouts have included the pair REITs that went public last year – Phillips Edison and InvenTrust – as well as Urstadt Biddle (UBA), which has rallied since launching a sizable stock buyback program last month.

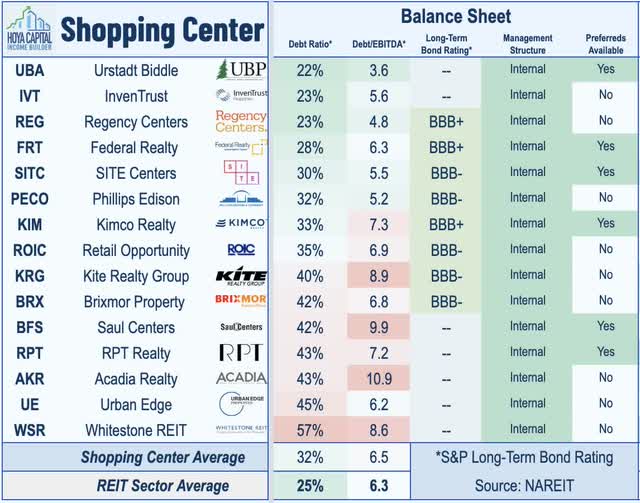

Performance trends since the start of the pandemic closely mirrored balance sheet quality more than any other factor as the eight REITs with investment-grade S&P credit ratings have delivered double-digit outperformance relative to their non-investment-grade peers over this time. Balance sheet metrics – particularly the critical Debt/EV Ratio metric – have improved considerably as share prices have rebounded and all but one REIT – WSR – are now trading with Debt Ratios below 50%, down from 15 REITs at the end of 2020.

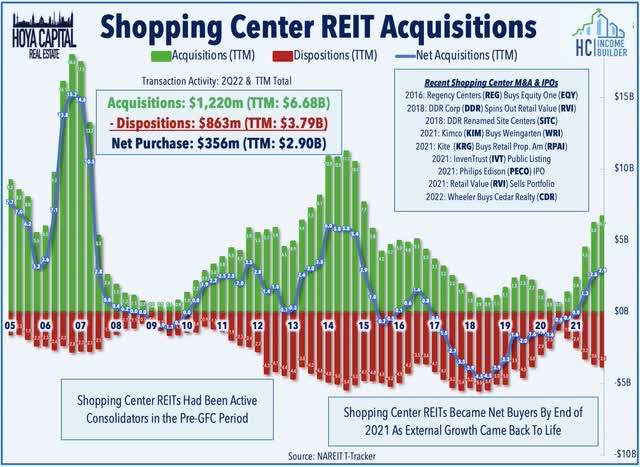

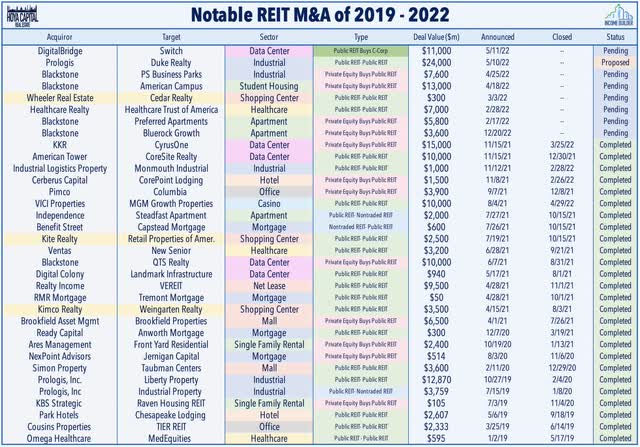

Shopping Center M&A and External Growth

A sharp disconnect had persisted between private market valuations of retail real estate assets and the REIT-implied valuation, forcing retail REITs to be net sellers of assets for nearly a half-decade. The tide turned a bit during the pandemic, however, as shopping center REITs became net buyers for the first time since 2016, acquiring $4.45B in assets during the year while selling $3.14B for a net positive total of $1.31B. Nevertheless, a pair of small-cap REITs that traded at persistent Net Asset Value discounts headed for the exits – recognizing significant shareholder value in the process: Retail Value (RVI) sold the majority of its portfolio in two separate transactions while Cedar Realty sold the majority of its portfolio before being acquired by Wheeler (WHLR).

Before the surge in interest rates over the past six months, the “animal spirits” had come alive across the shopping center REIT sector with several mergers, two new listings, and the highest level of acquisitions since the mid-2010s. Kimco Realty and Weingarten Realty closed on their merger last August while Kite Realty closed on its acquisition of Retail Properties of America last October. Back in March, Cedar Realty was acquired by small-cap diversified REIT Wheeler Real Estate. Two sizable new public REITs have emerged as well, graduating from the “non-traded” REIT ranks: InvenTrust Properties went public through a “Dutch Auction” last October while Phillips Edison went public through an IPO last July.

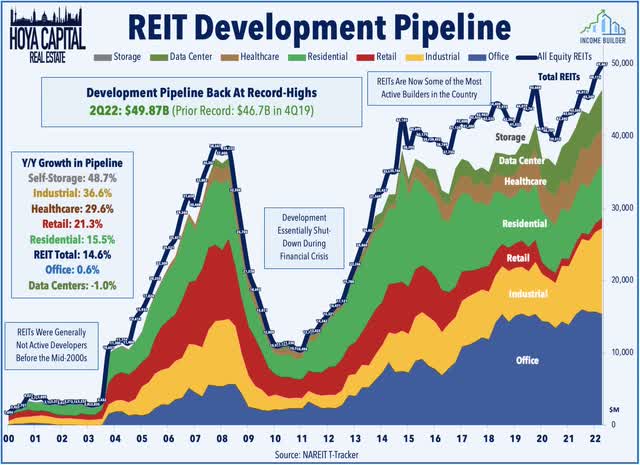

Importantly, after a development boom during the 1990s and early 2000s, a limited amount of new retail space has been created since the Financial Crisis and the retail development pipeline remains almost non-existent, declining another 12.1% in 2021 to its lowest level in nearly 20 years. Despite that, the US still has more retail square footage per capita than any other country in the world, but the gap between total spending and square footage has narrowed rather significantly over the past half-decade. The majority of new retail development by shopping center REITs has been through redevelopment or modest expansions of existing properties with only a handful of complete ground-up construction.

Deeper Dive: Retail Sales & Omnichannel

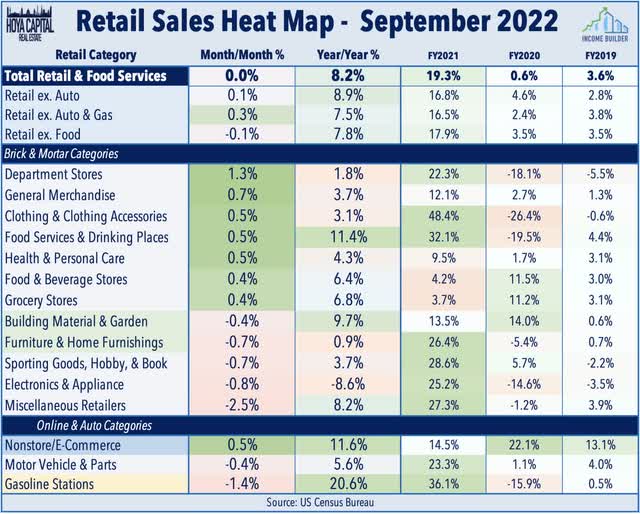

Powered by WWII levels of fiscal stimulus, retail sales set record-after-record throughout 2021 and into early 2022, and while the stimulus-fueled spending spree has certainly moderated over the past several months, retailers are generally far healthier now than they were before the pandemic. Regaining all of the lost ground during the pandemic by early 2021, the strength in retail sales over the past two years has been led by many of the “big box” categories including home improvement, general merchandise, grocery, sporting goods, electronics/appliances, and home furnishings stores. The Census Bureau reported last week that retail sales were still 8.2% higher on a year-over-year basis despite several months of depression-like levels of consumer sentiment.

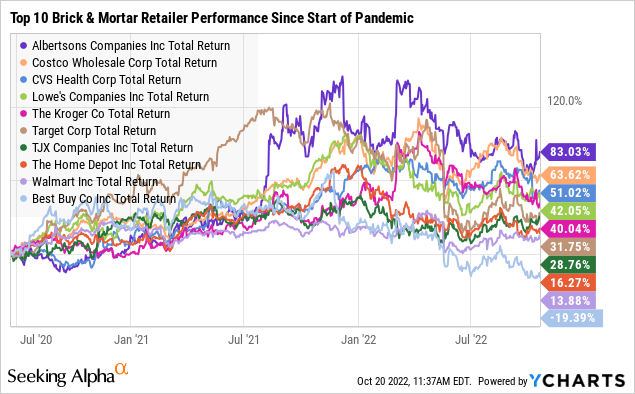

It took a few years, but Big Box retailers have learned to compete effectively in the e-commerce era. Despite their slide in the past month, the ten largest brick-and-mortar retailers have posted average returns of roughly 30% since the start of 2020. While the momentum slowed in 2022 amid inflation challenges and the waning of stimulus, profitability metrics from Home Depot (HD) and Lowe’s (LOW) were historically strong in late 2021 and into early 2022, as were earnings results from many of the largest “big-box” general merchandise retailers including Walmart (WMT), Costco (COST), and Target (TGT). The large publicly traded grocers have also seen renewed strength driven by the pandemic including Albertsons – which has surged more than 80% since its listing in June 2020, and its potential acquirer Kroger – which has gained 40% over this time.

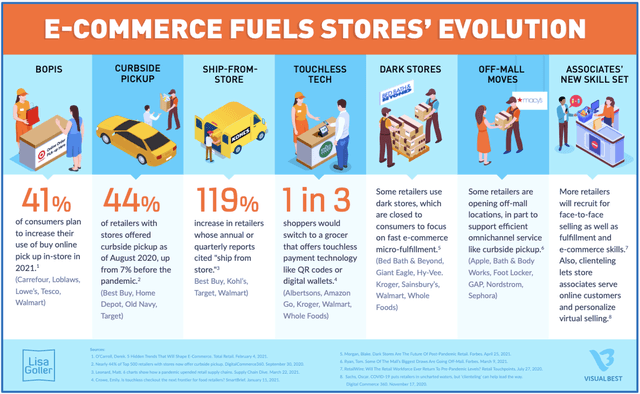

Hoya Capital

The growing usage of alternative (and higher-margin) “delivery” options including in-store pickup, “curbside” pickup, and delivery-from-store have been a tailwind for well-located shopping center REITs. Shopping centers have increasingly become hybrid distribution centers in a decentralized third-party delivery network powering “same-hour” delivery to challenge Amazon’s (AMZN) dominance in ultra-fast delivery. The pandemic significantly accelerated retailers’ investment in their in-store order fulfillment platforms which have evolved from a pure “click and collect” model into a multi-channel “last-mile” delivery network supplemented by delivery platforms like Uber (UBER), Postmates (POSTM), and DoorDash (DASH) as the food delivery model is becoming more ubiquitous across all retail categories.

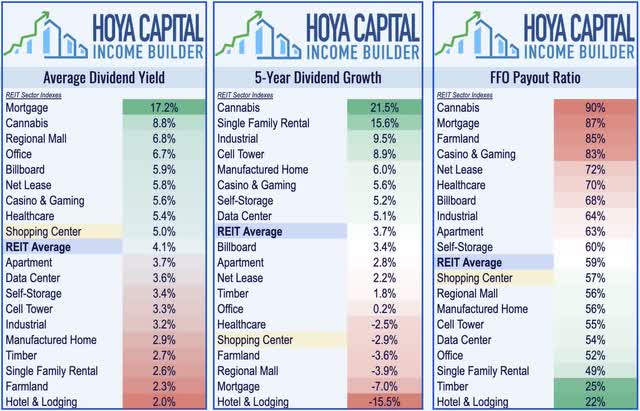

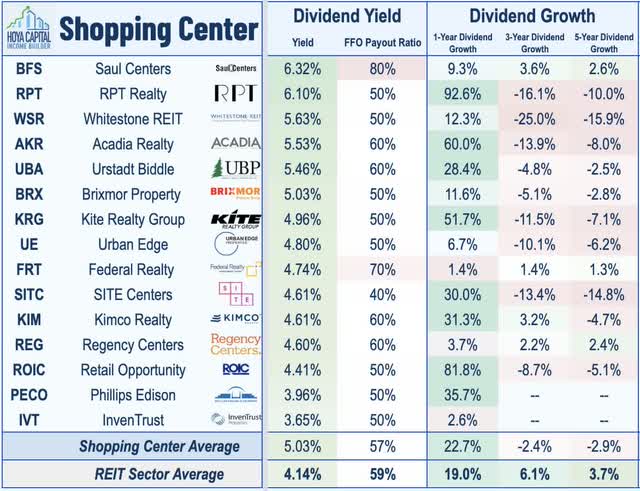

Shopping Center REIT Dividend Yields

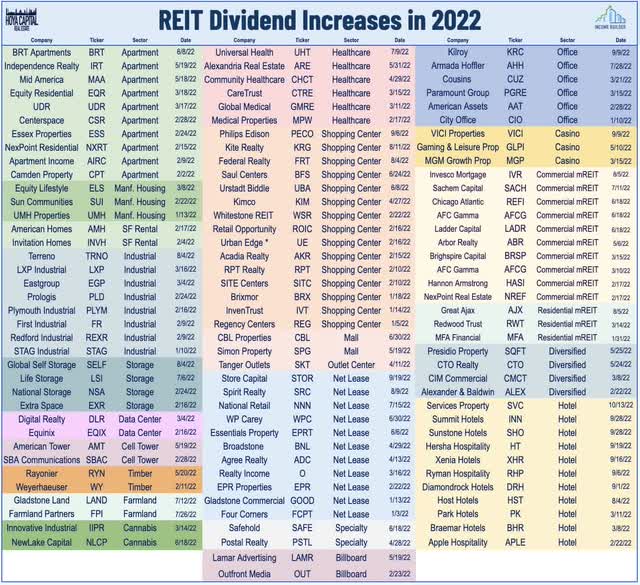

Powered by a wave of fifteen dividend increases this year, shopping center REITs currently pay an average dividend yield of 5.0%, which is well above the market-cap-weighted REIT sector average of 4.1%. Shopping center REITs pay out only about half of their FFO, leaving significant embedded upside potential for dividend growth – and a solid cushion for dividend protection if economic conditions take a turn for the worse.

Diving deeper into the sector, we note that dividend yields range from a sector-high of 6.32% and 6.10% from small-caps Saul Centers (BFS) and RPT Realty (RPT) to a sector-low of 3.65% from InvenTrust. Notably, three REITs in the sector have recorded positive dividend growth over each of the one, three, and five-year time horizons – Regency Centers (REG), Federal Realty (FRT), and Saul Centers. Notably, Federal Realty’s dividend hike this year marked the 55th consecutive year that FRT has raised its dividend – the longest record of consecutive annual dividend increases in the REIT sector.

Key Takeaways: High-Quality At A Discount

For shopping center REITs, the versatility and larger footprint of the strip center format have been a winning formula as retailers have increasingly utilized their brick-and-mortar properties as hybrid “distribution centers” in last-mile delivery networks. After a surge in store closings during the pandemic, the number of store openings has outpaced closings by nearly 2x since early 2021 with particular strength in larger-format strip centers. As a result, shopping center fundamentals are now as strong – if not stronger – than before the pandemic, underscored by a rise in occupancy rates to the highest level since early 2015 while all fifteen REITs in the sector have raised their dividends in each of the past two years – one of just three property sectors that can make that claim. High-quality strip centers remain one of our favorite “value-oriented” property sectors given their ’embedded’ dividend growth potential and solid positioning for a variety of economic scenarios.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment