Sean Gallup

Article Thesis

Shopify Inc. (NYSE:SHOP) has seen its shares rebound from the recent lows. Its business growth outlook is far from bad, although Shopify will not continue to deliver the outsized growth seen during the pandemic. As a long-duration asset, Shopify will likely be volatile going forward, as market expectations about inflation and interest rates continue to move up and down. Overall, I do not believe that Shopify is a buy at current valuations.

What Happened?

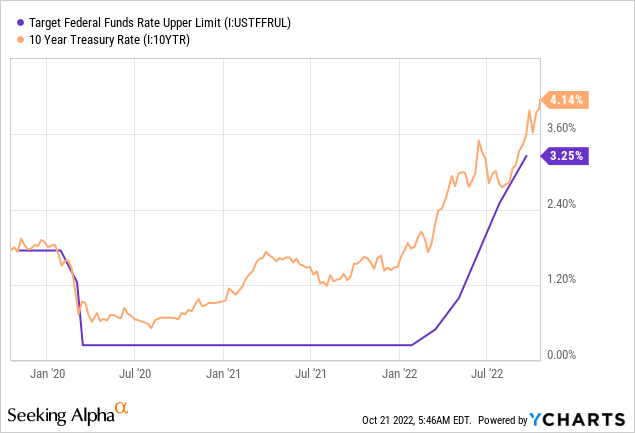

Shopify Inc. has been a pretty bad performer in 2022 overall. Its shares declined from well above $100 per share to just $30, while the performance versus Shopify’s 52-week high is even worse, with shares down 83% since then. There are two main reasons for that. First, Shopify has seen its business growth slow down, which isn’t too surprising, as the pandemic-driven e-commerce tailwinds had to wane eventually. Possibly even more important, however, is the change in the value of money so far this year:

In an environment of ultra-low interest rates, such as in 2020 and 2021, when the Fed kept interest rates near zero and when 10-year treasuries yielded less than 1% for some time, paying very high valuations for growth stocks made at least some sense. I’d say that Shopify’s valuation at its peak was too high even considering the low interest rates, but there was some reason to pay up for future growth. When interest rates are very low, discount rates in DCF models are very low as well. That has an impact on all equities, but the impact is most pronounced for stocks where the vast majority or all future profits will be generated in the distant future. These long-duration assets include many or most growth stocks, especially ones that aren’t profitable yet, but where the market anticipates meaningful profitability in the long run. Shopify is one such stock, where current profits are negligible, but where long-term growth tailwinds such as the megatrend of climbing e-commerce sales are bound to make the company more profitable over time.

When interest rates rise and discount rates in DCF models rise as well, the value of these long-duration assets slumps, which is a key factor for Shopify’s weak performance in 2022. Shopify’s business growth wasn’t bad so far this year, as the company has grown its H1 revenue by around 20% versus the previous year’s period. But slowing growth (revenue growth was north of 70% in H1 2021) combined with a big increase in interest rates has made Shopify’s shares slump.

Shopify is, however, not trading at its lows any longer. Versus its 52-week low, Shopify has climbed by 25% in the very recent past, with a pronounced upward move over the last week. That coincides with a rising share price for many other long-duration assets – the ARK Innovation ETF (ARKK), for example, is also up over the last week. This was driven by some easing worries about the direction of rates going forward. Intervention by the Bank of England, for example, made yields on Gilts decline and stopped the recent hefty run-up these yields had experienced. The market has started to anticipate that rates might rise less in the next couple of months versus what had been feared last week. This, in turn, means that discount rates in DCF models could climb less than feared, which is, all else equal, positive for growth stocks such as Shopify.

There was also some other recent positive news. Consumer spending in the US has remained very healthy, more so than what one might expect, considering the pressures in areas such as energy and electricity. Consumers increased their spending by 0.4% in September, in line with the increase one month earlier, and north of what was expected. Bank of America (BAC) reports that consumer payments among its clients grew by a hefty 10% year over year, and consumer confidence was up in both August and September. While consumer sentiment is not great in absolute terms, it is improving, and rising consumer spending overall is good for all kinds of retailers and retail-related companies such as Shopify. With the market being forward-looking, an upward trend line in consumer sentiment points to an improving macro environment for Shopify and other retail-exposed companies. It is, of course, possible that consumer sentiment trends reverse, but at least for now, it looks like the worst has been passed and that things are looking up, which helped Shopify recover some of its losses in the very recent past.

Shopify’s Outlook

In the long run, sentiment won’t be the most important factor for Shopify’s stock. Instead, the company’s ability to grow its business and to improve its profitability is what will be the deciding factors for SHOP stock.

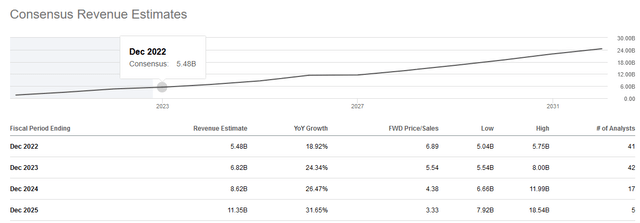

Looking at the next couple of years, this is what Wall Street is expecting when it comes to SHOP’s revenues:

This year’s growth will be very solid in absolute terms, at a little less than 20%, but below the past growth rate and also below what is forecasted for the coming years. This can be explained by a very tough comparison versus 2021, when the pandemic had a large beneficial impact on online shopping. But as comparables become easier, SHOP should see its topline growth improve over time, while easing recession worries in the coming years also should help SHOP. Of course, the underlying business growth outlook also benefits from the macro trend of growing e-commerce sales, as this means that Shopify’s addressable market will expand further and further. Amazon (AMZN) is both a threat and an opportunity. On one hand, AMZN is trying to move onto SHOP’s turf, e.g. by offering “Buy with Prime” for third-party websites. On the other hand, there are consumers that aren’t happy with how Amazon is operating and that are looking for ways to spend money online without being exposed to Amazon, which offers opportunities for companies such as Shopify.

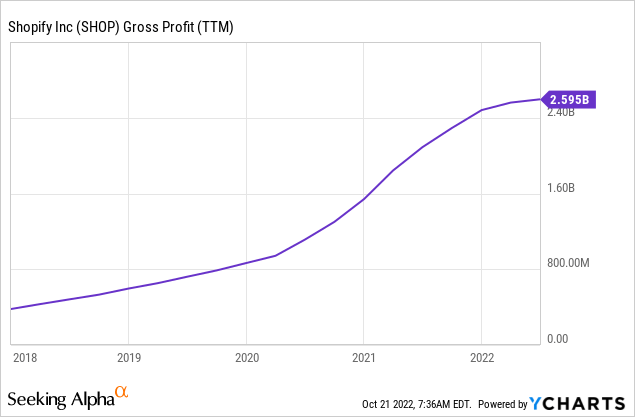

Ongoing revenue growth is good (and very likely going forward, I believe), but without improving profitability, it won’t be enough. Looking at Shopify’s profit trajectory over time, we see that gross profits have grown very meaningfully, rising around 6x over the last five years:

That’s good news, as rising gross profits are key for a company when it comes to its ability to grow net profits via improving scale. Ideally, operating expenses grow at a smaller pace, as some expenses are more or less fixed, no matter how much revenue a company generates – e.g., expenses for administration and R&D are not tied closely to a company’s revenues. Over time, as gross profits rise, companies thus become more profitable when they manage to keep their operating costs under control, thus benefitting from operating leverage.

In Shopify’s case, that has unfortunately not worked well in the past, as the company actually became less profitable: In H1 2022, Shopify lost $0.01 per share, while the company had earned $0.42 in the previous year’s first half. Despite higher revenue and higher gross profit, net profit declined, as operating expenses rose faster than revenue and gross profit did. If Shopify were to keep that up, it would never become profitable, essentially making SHOP a very unattractive investment. But I do believe that there is a good chance that the company will turn this unfortunate recent trend around.

Many other tech companies, including large players such as Microsoft (MSFT) and Meta (META), have recently increased their focus on bringing down expenses, e.g. by slowing down their hiring pace and by cancelling non-needed projects while also cutting jobs. Shopify should follow the same model, bringing down its operating expense growth rate. The company has hinted at that happening, stating in the most recent earnings release that, “operating expense growth, excluding one-time items, [will] meaningfully decelerate year over year in the third quarter, and again in the fourth quarter.”

That bodes well for the company’s future profitability, although it will take some time for these trends to play out, which is why profits in H2 will likely still be negligible or non-existent. Still, over the years, with improving scale and tighter cost controls, SHOP could turn into a seriously profitable company as long as management executes well. With SHOP having around $7 billion in cash on its balance sheet, there is very little risk of it running out of cash in the next couple of years, thus there is no immediate need to become profitable.

Valuation And Takeaway

We can’t value SHOP based on net profits, as there are none. Looking at Shopify’s sales multiple, we see that SHOP is valued at around 5.5x this year’s expected sales. That’s not a very high valuation in absolute terms, relative to how other software companies are valued.

But whether that makes for a good investment is dependent on whether SHOP manages to improve its profitability, as expenses had been growing way too fast in recent quarters. According to management, things will improve going forward, but as long as we have not seen this play out, I personally do not want to buy into SHOP. If management executes well and profitability improves, Shopify could be a very solid investment, as the growth potential for its business is attractive in the long run.

Be the first to comment