JHVEPhoto

Introduction

My thesis is that Shopify (NYSE:SHOP) is helping merchants take some of the complexity out of freight, distribution, fulfillment and delivery.

Simplifying Logistics

Using their merchant-centric focus, Shopify is implementing an asset-light approach to help simplify logistics – especially for small and medium sized merchants. Freight, distribution and fulfillment/delivery are key steps and Shopify is making progress across the board. In the 1Q22 call, President Harley Finkelstein noted that supply chain management and fulfillment are challenging for merchants. He said Shopify is creating an end-to-end logistics platform that will simplify the process:

To actually get an order to a buyer, they have to fumble through a maze of freight providers, 3PLs and middle and last-mile carriers. We know merchants trust Shopify to offer simple, reliable, cost-effective solutions to their biggest problems. That’s why we’re creating the world’s most merchant-obsessed, end-to-end software and logistics platform, fully integrated into the Shopify ecosystem. We are simplifying logistics across every stage of a merchant supply chain, from inventory inbounding to inventory distribution across all merchant channels, to fast and affordable D2C order fulfillment and returns.

President Finkelstein went on in the 1Q22 call to announce the acquisition of Deliverr which is accelerating Shopify’s path to an end-to-end merchant supply solution. The 2Q22 presentation explains the ways Shopify is simplifying logistics:

simplifying logistics (2Q22 presentation)

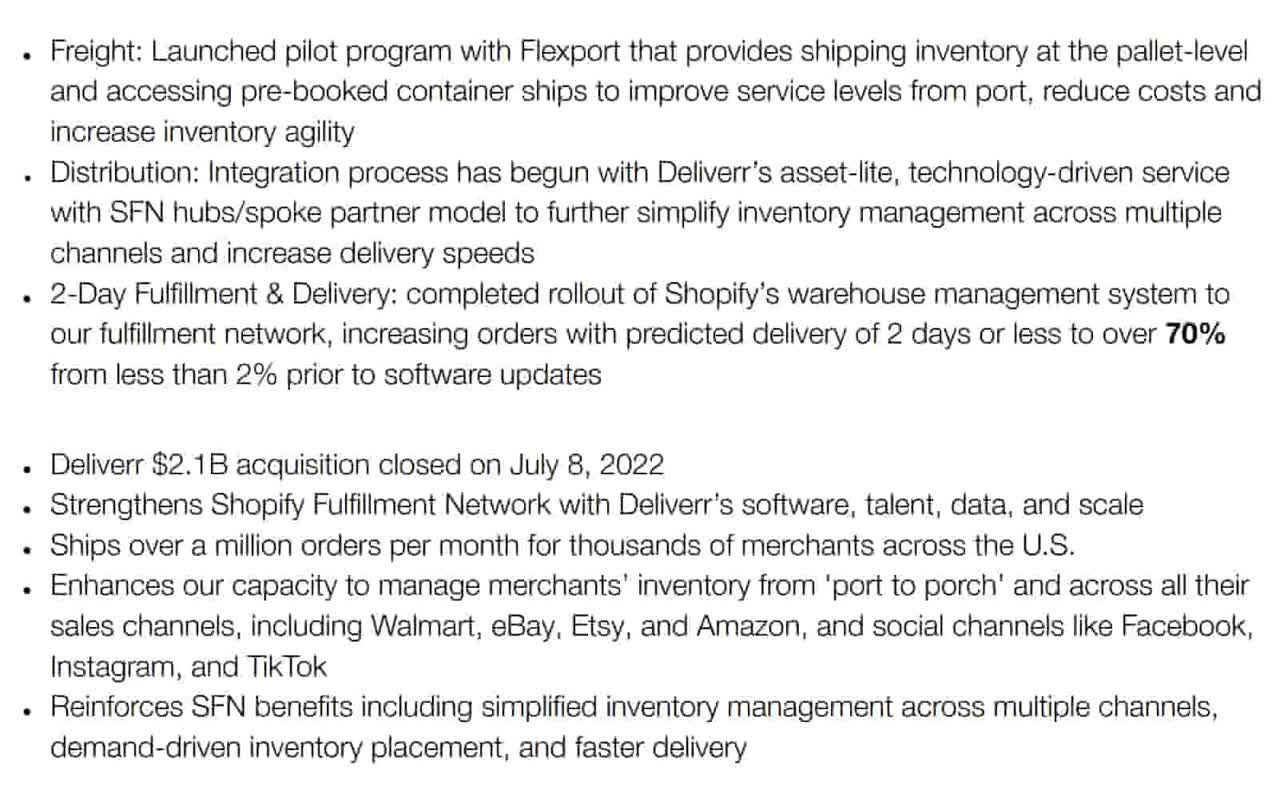

Freight

On the freight side, Shopify has invested in Flexport, a company that helps merchants with inventory inbounding. Dave Clark left a senior management position at Amazon (AMZN) and he’ll soon be the CEO of Flexport starting September 1st. Shopify President Finkelstein breaks down freight in the 2Q22 call, saying merchants need to work with upwards of 10 vendors in a system that is often set up at the container level. Shopify and Flexport have a pilot program together where merchants can ship at the pallet level instead of the container level. Speeds can be up to 50% faster with a lower than average cost per pallet. Flexport is shown as a key part of inventory inbounding in Shopify’s 2Q22 presentation:

flexport (2Q22 presentation)

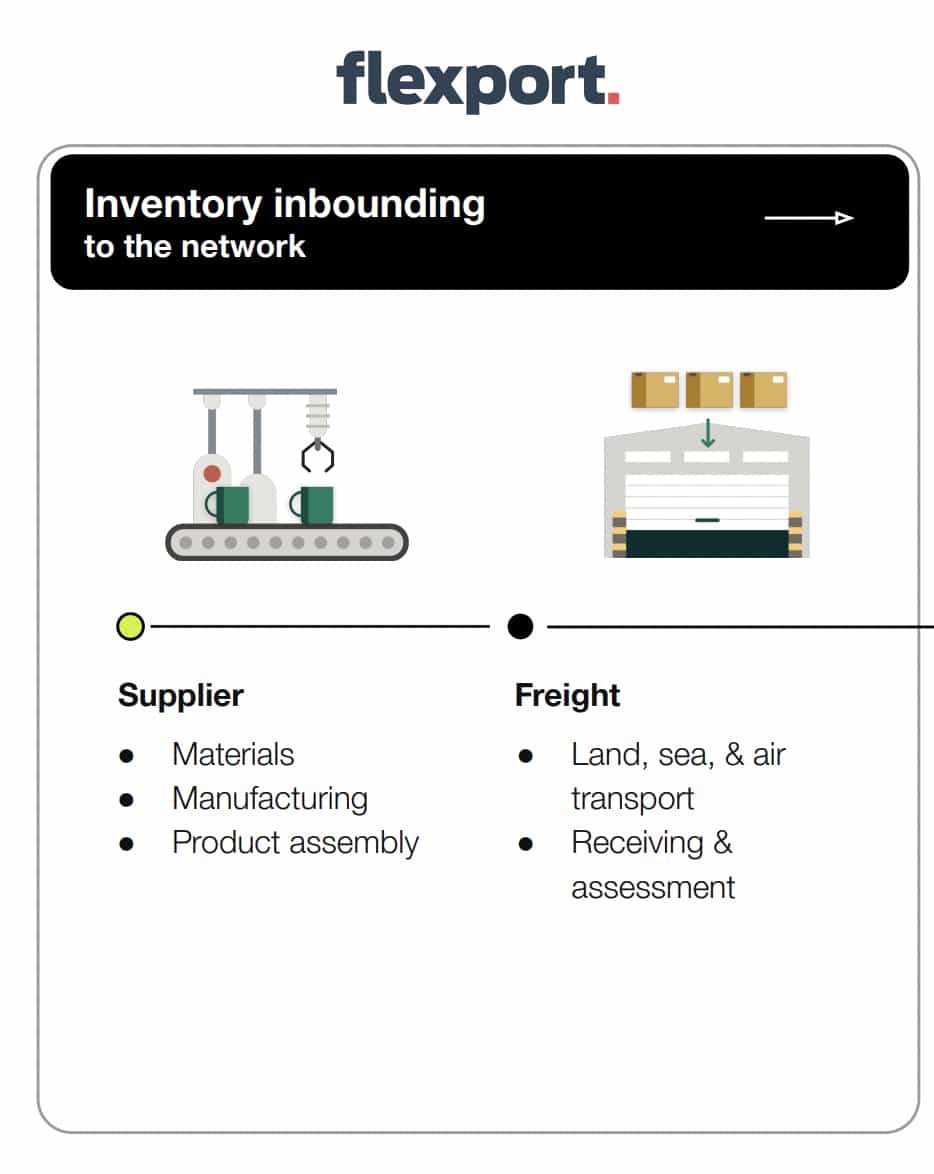

Distribution

President Finkelstein covers distribution in the 2Q22 call. As inventory arrives in port, independent merchants can have a hard time preparing and routing it for distribution across multiple channels. Shopify closed their acquisition of Deliverr in July in order to accelerate the simplification of the distribution process, starting in Atlanta:

The first example of this will be at our Atlanta Hub warehouse. Using software and machine learning, these SFN hubs, leveraging Deliverr’s capabilities, will unpack, scan and inspect all inventory, then compare against metadata in Shopify’s back office to route the goods to a merchants’ various distribution channels as well as forward-position inventory into SFN-spoke direct-to-consumer fulfillment centers based on expected buyer demand. With this software-based approach, Deliverr is helping us expand 2-day delivery across SFN.

At the August Canaccord Growth Conference, Senior Manager Ana Raman explains that Deliverr is acting as an accelerant in various channels such as wholesale and brick-and-mortar:

So Deliverr is really helping to accelerate a roadmap that we already had planned. Now they’re just helping us get there faster. So things like distributing product through channels, so multiple channels. So whether that is B2B wholesale, whether that is brick-and-mortar, whether that is any online channel from marketplaces to social media or the merchant’s online store. With their smart inventory placement, we’re going to be able to really effectively allocate inventory through the channels

The 2Q22 presentation shows how Deliverr helps with distribution:

Deliverr (2Q22 presentation)

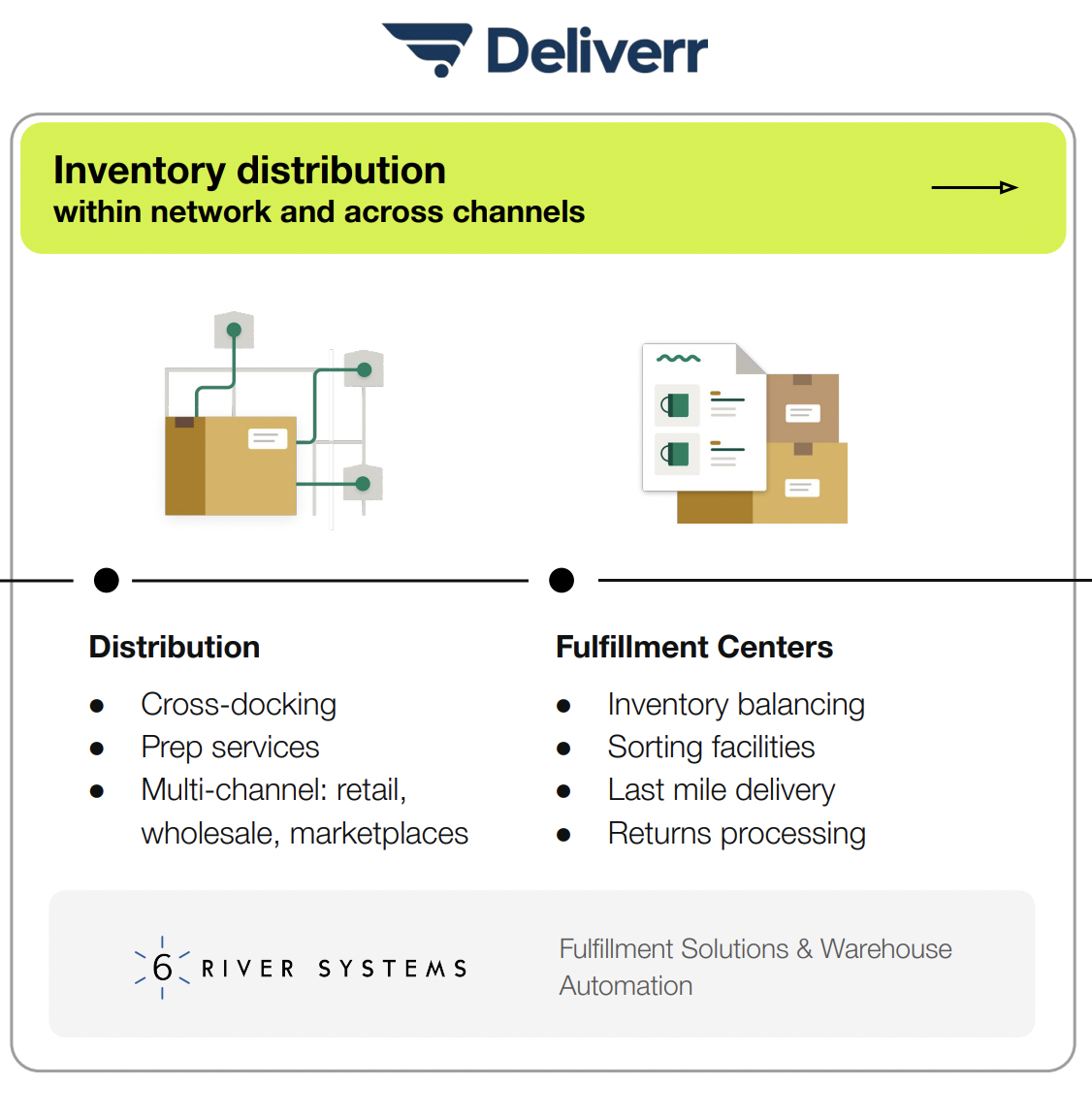

Fulfillment and Delivery

In the 2Q22 call, Shopify President Finkelstein explains that the last step in logistics is 2-day fulfillment and delivery. It is the most critical step and in the past it has been hard for merchants to get this right on their own. The numbers show that conversions increase when merchants can promise a delivery window – even if it is up to 3 or 4 days:

By leveraging Deliverr software in SFN hubs and SFN Spoke partner warehouses all equipped with 6 River Systems technology, we can forward position merchants inventory to support timely fulfillment with a minimal inventory commitment for merchants. We’ve also continued our early access to Shop Promise, which lets merchants offer 2-day delivery promises across online storefronts and channels like Google, Facebook and Instagram. Deliverr data suggests that as Shop Promise reaches scale, many merchants will be able to increase average conversion rates by more than 30%.

The 2Q22 presentation shows that the “Shop Promise” badge helps merchants give customers peace of mind with respect to delivery timelines:

fulfillment (2Q22 presentation)

Buy With Prime

Much of the information on Amazon’s Buy with Prime program emphasizes the fulfillment and delivery step but we’ve seen that freight and distribution are additional considerations with logistics. In the same way that Amazon third-party (“3P”) is one of many sales channels, I believe Buy with Prime will be one of many logistics channels. A July 18th interview from ModernRetail shines some light on what we can expect from Shopify and Amazon in the coming years. Many investors see Amazon’s Buy with Prime offering as a threat but Shopify logistics leader Aaron Brown’s thoughts on the subject are optimistic:

We’re also working with Amazon, every week, right now to integrate the new platform and having super positive discussions. We’re really bullish on the partnership between Amazon and Shopify. The interesting thing with fulfillment is we’re solving for fundamentally different problems. Shopify is trying to provide an end-to-end platform helping a merchant manage their entire supply chain across all channels. One of those channels can be fulfillment by Amazon. If a merchant wants to take all of their inventory in a Shopify SFN cross dock and deploy a quarter of that in FBA, we help them do that. We’re also trying to build a fulfillment solution that’s super integrated into Amazon’s online store, its channels, and very integrated with Shop Promise to help build a really compelling solution. And so we’re really excited about Amazon and the infrastructure they’re creating for independent retailers.

Senior Shopify manager Ana Raman answers a question about how significant a threat Buy with Prime is to SFN at the August Canaccord Growth Conference mentioned earlier. The point is made that it is great for merchants if Amazon is coming over their walled gardens and helping independent merchants. Still, Amazon is customer-focused while Shopify is merchant-focused. Amazon is not as good as Shopify in terms of letting merchants own their buyers, channels, data and brand:

But we also need to think of this holistically in terms of SFN fulfillment being one piece of the much larger commerce puzzle. And because we are fueling the firewheel for – flywheel from different perspectives, whether that is fulfillment, whether that is finding new buyers or helping them manage their business from their back, and the superpower of fulfillment is tied into the network effects into that flywheel. And so that is an area we’re continuing to work on, so that merchants have an end to end commerce experience. We are not just focused on fulfillment. And that is a key area that I hope that investors can take away is that it’s really worthwhile to look at Shopify from a much more holistic, the whole is greater than the sum of its parts perspective.

Valuation

Shopify’s 2021 40-F shows 64.5% of revenue coming from the U.S. and eMarketer shows that in 2021, only 15% of total retail in the U.S. was done online. Shopify will benefit in the coming years as the U.S. increases this percentage to be more like the UK where 28.5% or total retail was online per eMarketer. Commerce keeps moving online in the U.S. and around the world but this doesn’t benefit all companies equally. In the 3Q21 BigCommerce (BIGC) call, CEO Brent Bellm answered a question about the companies they’re displacing. BigCommerce, Shopify and Salesforce (CRM) are all taking customers from on-premise Magento (ADBE) and around 500 other platforms:

And the easy thing to say is Magento is by far the biggest donor platform to us. But in aggregate, they’re probably – I mean, I don’t have the specific figure, they’re probably no more than 20% of the mid-market and above migration, an awful lot of custom sites and then a very long tail. I mean we get sites migrating from every other platform that you can imagine, big, small, old, really old. It’s really all of them. The point is that as you look forward, SaaS is clearly the future for most merchants. There are 3 leading SaaS platforms. You know those 3: it’s us, Shopify and at the high end of the market, Salesforce. And all 3 of us are taking share from the rest of them in addition to competing for net new builds.

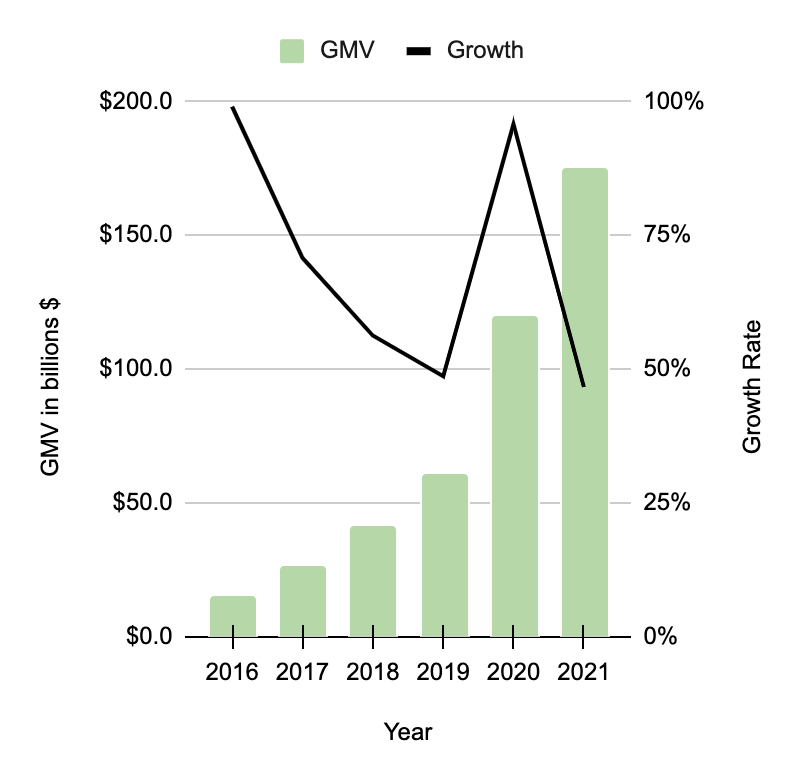

Back in 2016, Shopify’s annual GMV was just $15.4 billion and it grew explosively over the next 5 years to reach $175.4 billion in 2021:

GMV growth (Author’s spreadsheet)

GMV growth has slowed down substantially since the fourth quarter of 2021. 1Q22 GMV was $43.2 billion which was only 16% above what we saw in 1Q21 and 2Q22 GMV was $46.9 billion which was only 11% above what we saw in 2Q21. Much of this slowdown is because of the pull-forward we saw from covid in 2020 and 2021. The 2022 GMV growth rate might end up being single digits but I am optimistic that it will go back to healthy double digits in 2023 – maybe between 20 and 30%.

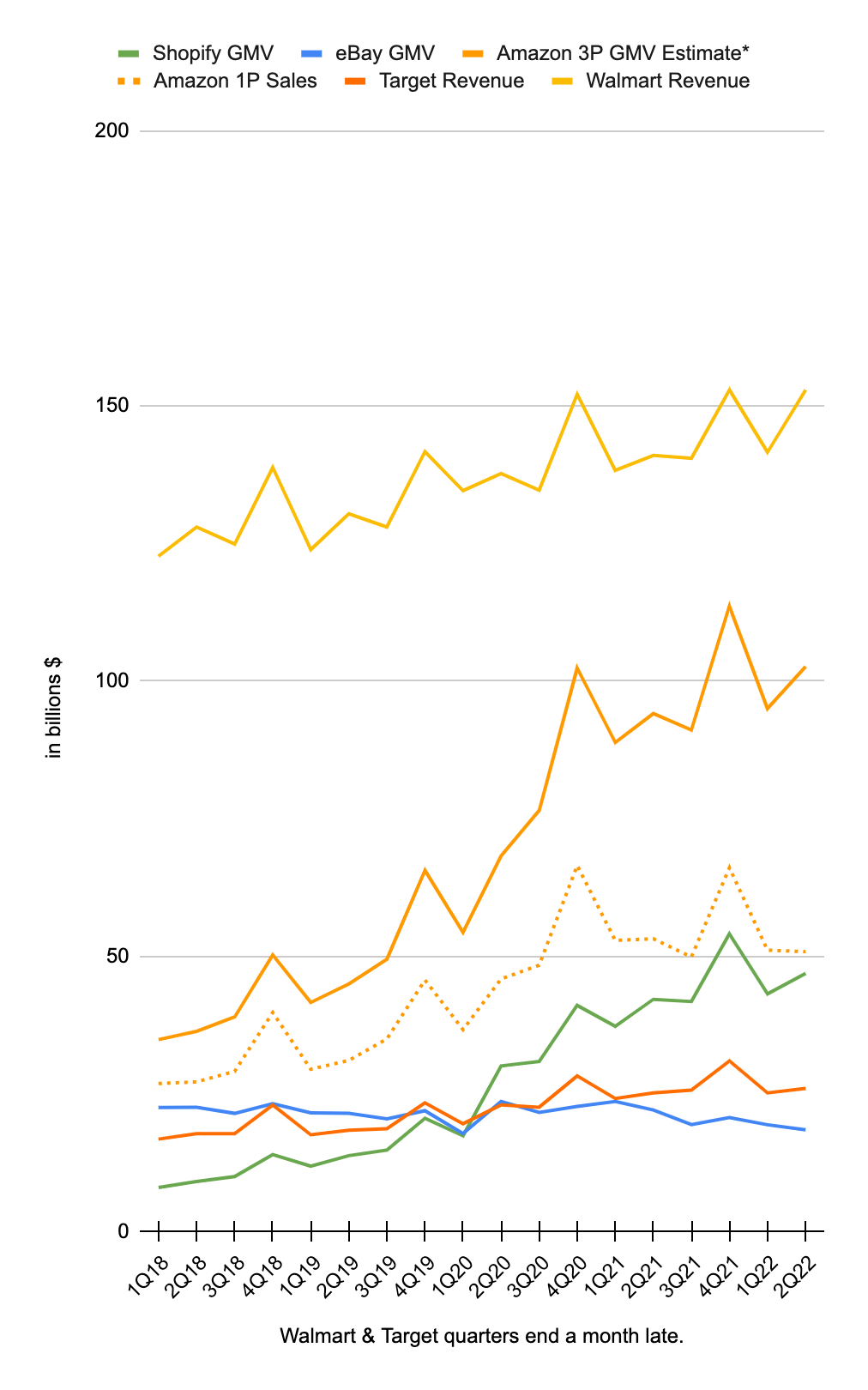

Shopify is more of an operating system than a marketplace or a retailer so it is important to not place too much weight on comparative GMV numbers. There is also overlap; some Shopify merchants use Amazon (AMZN) as a sales channel such that part of the GMV for certain Shopify merchants is counted in Amazon’s 3P numbers. Having said that, it can be helpful to look at the different numbers as long as we keep the scope in perspective. Shopify’s 2nd quarter GMV grew from $9.1 billion in 2018 to $46.9 billion in 2022 for a 4-year CAGR of over 50%. Meanwhile, Amazon’s 3P estimated quarterly GMV grew from a larger base of $36.4 billion in 2018 to $102.7 billion in 2022 for a 4-year CAGR of nearly 30%. Looking ahead, the 4-year CAGR for both of these will be lower because there was significant pull-forward from the covid pandemic. Both companies are making painful adjustments because they underestimated this pull-forward impact:

GMV progress (Author’s spreadsheet)

One can’t help but notice that Shopify is coming close to passing Amazon’s first-party (“1P”) segment in the graph above. Again, I expect the next 2 years for Shopify and Amazon to be more like the period from 1Q18 to 1Q20 than the period from 1Q20 to 1Q22 because of the unique characteristics of the pull-forward we saw with the covid pandemic. No one focuses on fulfillment more than Amazon and their fulfillment offering is part of the reason as to why their 3P segment has experienced so much growth. Part of the reason eBay’s (EBAY) GMV has declined is because they didn’t make significant fulfillment investments years ago when the time was right.

This part of Shopify’s 2022 guidance in the 2Q22 release resonated with me:

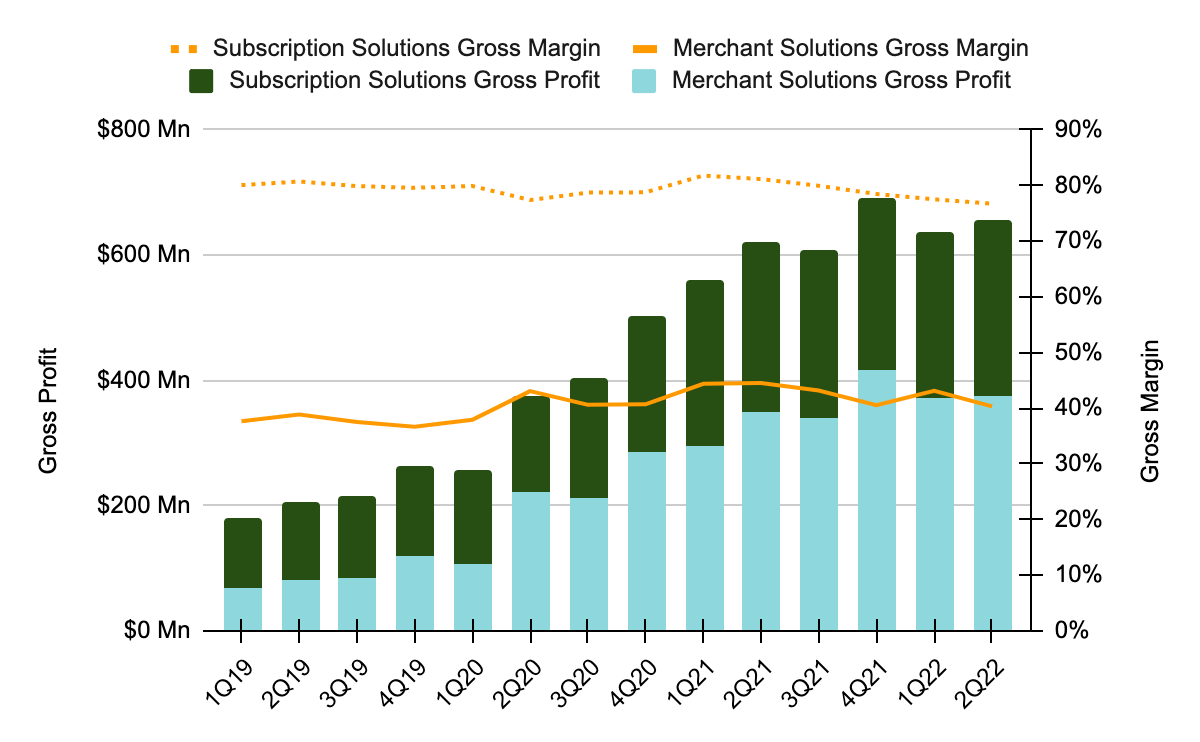

Because of this larger mix of Merchant Solutions contributing to overall revenue and Deliverr, which we expect to be dilutive, gross profit dollar growth will trail revenue growth.

I expect future gross profit growth to be substantial despite the fact that it should lag revenue growth in 2022. We see the gross profit margin for merchant solutions went down to 40% in 2Q22 but gross profit dollars were still up. Quarterly gross profit for merchant solutions was $374 million on revenue of $928.6 million. Gross profit for subscription solutions was $281 million on revenue of $366.4 million:

gross profit (Author’s spreadsheet)

Trailing-twelve-month (“TTM”) gross profit was $1,502 million for merchant solutions and $1,093 million for subscription services. The steady-state operating income economics are obfuscated because gross profits are poured back into investments in operating expense lines. Future growth prospects aren’t as bright as they were half a year ago but I still believe there are immense opportunities. One of the reasons investing is hard is that it is difficult to know what future gross profit numbers will be for merchant solutions. We saw the gross profit number for this segment jump 175% from $81 million in 2Q19 to $223 million in 2Q20. Next it went up 57% to $350 million in 2Q21. Finally, it went up just 7% to $374 million in 2Q22.

I am optimistic that half or more of merchant solutions gross profit dollars could make their way down to operating income if growth investments were paused. One of the reasons for this optimism is due to the fact that much of the merchant solutions gross profit is payment related and BigCommerce CEO Brent Bellm said the following at the December 2020 Raymond James Technology Investors Conference:

Remember, net margin is really important to focus on because credit card interchange is such a big part of cost of goods sold for any payment processing fees. So we’re getting, let’s call it, very 100% profit margin to us. Rev share from these strategic partners and that — and the rev share we get constitutes a very meaningful percentage of the net margin on transactions.

Half of TTM gross profit for merchant solutions comes to $751 million. It is difficult to say what type of multiple this segment deserves in an environment where its gross profit growth has been slowing and interest rates have been going up. We won’t see year-over-year growth of 175% again anytime soon but I also think we can do quite a bit better than the 7% y/y growth we saw in the most recent quarter. Based on tremendous growth possibilities, I think a multiple of 40x to 50x is not out of the question such that this segment alone could be worth $30 to $38 billion.

The TTM gross profit for subscription services is 2/3rds what it is for merchant solutions but I don’t think subscription services is 2/3rds of the valuation because more of the merchant solutions gross profit makes its way to the bottom line in a steady-state environment than the subscription solutions gross profit. Also, subscriptions solutions gross profit growth has been less robust, going up 23% from $124 million in 2Q19 to $152 million in 2Q20. It then went up 78% to $271 million in 2Q21 and then up another 4% to $281 million in 2Q22. Given these considerations, I think the subscription services segment is only worth about half the merchant solutions business, implying a range of $15 to $19 billion.

Today’s market cap is a little about $41 billion based on the August 26th share price of $32.42 and the 1,262,011,665 shares in the 2Q22 release. The enterprise value is less than the market cap seeing as cash and marketable securities outweigh other balance sheet considerations. I think the stock is undervalued, seeing as the market cap is less than my valuation range for the sum of the merchant solutions and subscription solutions businesses.

Be the first to comment