DNY59

In this modern era that’s defined by science, laboratory instruments and other similar instruments that require tremendous precision are unbelievably important to have. One multi-billion dollar company that provides these types of products is Mettler-Toledo International (NYSE:MTD). In recent years, the company has seen its revenue expand nicely and profitability has followed suit. Long term, I fully suspect that the business will continue to expand. And eventually, shareholders will benefit. Having said that, shares do look a bit lofty today, even though they look more or less fairly valued compared to similar firms. Given all of these conditions, I do believe that a ‘hold’ rating on the business is appropriate at this time, reflecting my belief that its returns will likely match the returns of the broader market for the foreseeable future.

A play on precision instruments

As I mentioned already, Mettler-Toledo International has built its business on the production and sale of precision instruments and the provision of related services. The company claims to hold global number one market positions in many of the areas in which they operate. They sell their products to customers in over 140 countries, including 40 countries that they have a direct presence in. Geographically speaking, the company is fairly diverse. 29% of its revenue last year came from Europe while 38% came from North and South America combined. 33% of its revenue, meanwhile, comes from Asia and all other countries in which it operates.

To best understand the company, we really should dig down into the specific products and services that it provides. First and foremost, we have the Laboratory Instruments category. Through this, the company produces and sells a variety of precision laboratory instruments that are used for things like sample preparation, synthesis, material characterization, and inline measurement. Laboratory balances, liquid pipetting solutions, automated laboratory reactors that utilize real-time analytics, pH meters, thermal analysis systems, and more are just some of the examples that the company provides. Last year, 56% of the company’s revenue came from these types of products. This is up from the 52% that came from them in 2019, indicating that this is a good growth area for the firm.

The company also sells products that it refers to as Industrial Instruments. These offerings include industrial weighing instruments and related terminals. Under this umbrella, the company also provides software solutions related to its technologies. This category of products and services, as a whole, are made available to a variety of end customers, ranging from pharmaceutical companies, to chemical companies, to food producers, and more. It also produces metal detection, X-ray, and other related technologies, on top of the automatic identification and data capture solutions that it provides. On the industrial side, the company also provides heavy industrial scales and software that’s associated with them. In 2021, this particular segment accounted for 39% of the company’s revenue. And finally, we have what management calls its Retail Weighing Solutions. Through this unit, the company sells weighing and food labeling solutions that are used for the handling of fresh goods like meats, vegetables, fruits, and more. It also provides networked scales and software and other related technologies. End users for this segment include supermarkets and other food retail businesses. Last year, this particular segment made up 5% of the firm’s revenue.

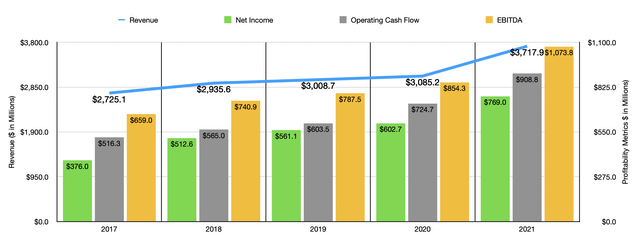

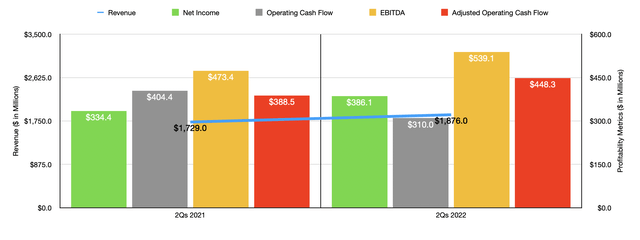

The overall financial track record for the company has been quite impressive. Revenue has risen consistently over the past five years, climbing from $2.73 billion to $3.72 billion. The greatest growth came from 2020 to 2021, when revenue shot up by 20.5%. This surge in revenue was driven by robust customer demand in most of the businesses and regions in which it operates. Growth was particularly strong in China. Of particular appeal has been the digital tools and techniques that the company makes available to its customers. It’s also worth noting that the company did benefit somewhat from the acquisition of PendoTECH, but that only contributed 1% to the company’s sales increase. Growth for the company has continued into the 2022 fiscal year. Sales in the first half of the year totaled $1.88 billion. That represents an increase of 8.5% over the $1.73 billion generated the same time last year. This translates to an increase of roughly 9% year over year. That rise would have been greater at about 12% had it not been for foreign currency translation.

As revenue has risen in recent years, profitability has followed suit. Net income rose from $376 million in 2017 to $769 million last year. Other profitability metrics have followed a similar trajectory. Operating cash flow, for instance, rose from $516.3 million to $908.8 million in the same five-year window. Meanwhile, EBITDA for the company grew from $659 million to $1.07 billion. And justice as was the case with revenue, this increase in profitability has continued into 2022. Due to strong demand for its products and services, net income came in at $386.1 million for the first half of the 2022 fiscal year. That compares favorably to the $334.4 million generated the same time of 2021. This is not to say that every profitability metric fared well. Operating cash flow, as an example, declined, dropping from $404.4 million to $310 million. But if we adjust for changes in working capital, it would have actually risen from $388.5 million to $448.3 million. And over that same timeframe, EBITDA also improved, rising from $473.4 million to $539.1 million.

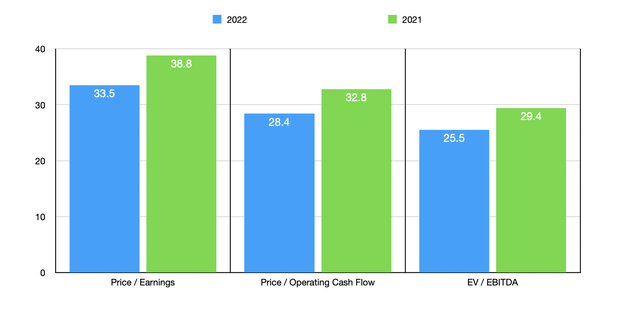

When it comes to the 2022 fiscal year as a whole, management expects revenue growth, on a local currency basis, of between 9% and 10%. Earnings per share, meanwhile, should be between $38.85 and $39.03. Using the midpoint figure here, that should translate to net income of $888.7 million. If we assume that other profitability metrics will rise at the same rate, then we should expect operating cash flow of $1.05 billion and EBITDA of $1.24 billion. Using these figures, we can effectively price the company. On a forward basis, the firm is trading at a price-to-earnings multiple of 33.5. This is down from the 38.8 figure we get using 2021 results. The price to adjusted operating cash flow multiple should drop from 32.8 to 28.4, while the EV to EBITDA multiple should decline from 29.4 to 25.5. As part of my analysis, I did compare the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 27.1 to a high of 77.3. Using the price to operating cash flow approach, the range is between 18.2 and 75.8. In both cases, two of the five companies were cheaper than our prospect. Using the EV to EBITDA approach, instead, we get a range of between 16 and 46.7, with four of the five companies being cheaper than Mettler-Toledo International.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Mettler-Toledo International | 33.5 | 28.4 | 25.5 |

| Illumina (ILMN) | 77.3 | 75.8 | 46.7 |

| West Pharmaceutical Services (WST) | 34.7 | 29.7 | 24.0 |

| Agilent Technologies (A) | 31.3 | 28.1 | 21.6 |

| Waters Corporation (WAT) | 27.1 | 29.9 | 19.9 |

| ICON Public Limited Company (ICLR) | 35.5 | 18.2 | 16.0 |

Takeaway

Fundamentally, Mettler-Toledo International is an excellent business with a bright future ahead for it. The company should continue to expand over the long haul and profits should continue to come in strong. Cash flow is particularly appealing and can be used not only to reward shareholders but to fuel growth further. However, this does not mean that the company makes sense to buy into right now. Although I view the loss of capital as a very low risk when it comes to this enterprise, I do think there is risk of underperformance from a share return perspective. Yes, the company is fairly valued compared to similar firms. But on an absolute basis, it is awfully pricey. Because of this, I’ve decided to rate the business a ‘hold’ for now.

Be the first to comment