Sean Gallup/Getty Images News

Thesis

I believe Shopify (NYSE:SHOP) will be a market beating stock over the next five years because of their excellent leadership, business model, and their ecosystem of commerce. In this article we will cover the current state of the business, the risks and valuation, the execution of leadership, and deep dive into their business model which can be the central operating system for merchants, and why that has me bullish on the future of Shopify stock.

Current State of the Business

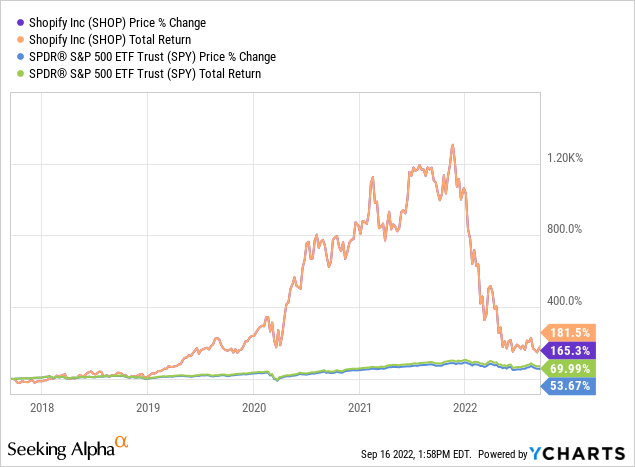

Shopify was one of the darlings of the stock market for the past few years until 2022 started. From the beginning of 2018 until the beginning of 2022, Shopify was one of the best returning growth stocks with over 17x in gains. So much has changed in such a short amount of time, with the market cap valuation dropping 75% in just nine short months. So, is this fall from grace warranted? And has the thesis for this stock completely broken, causing the share price to fall off a cliff?

It is true the company went from producing earnings of nearly $880M to -$1.2B a year later. So how did Shopify generate a -$2B swing in earnings in one year? It’s a simple answer, Shopify overestimated the growth rates of e-commerce post COVID by hiring too many employees, a war in Ukraine and Russia began, and global inflation incurred. Revenue growth decelerating in 2022 and macro-economic inflation forced the company to have to reduce their workforce by 10%. It is never a pleasant company experience having to let go of employees, but it was fiscally responsible considering they over-hired in anticipation of continued exponential e-commerce growth in 2022.

The other cause for the loss in earnings was due to this year, being a year of investment in expansion and growth for the long term. The company committed to expanding their flywheel in their business model by making the biggest acquisition of their history by purchasing global logistics company Deliverr for $2.1B. President of Shopify Harley Finkelstein will share later the value this acquisition adds for the company and the problem it solves for merchants on and off the Shopify platform.

So, the question is has Shopify stock been de-risked since going from one of the largest stocks in the market to 75% smaller in market cap size? And can Shopify recover and regain its dominance?

The Risks and Valuation

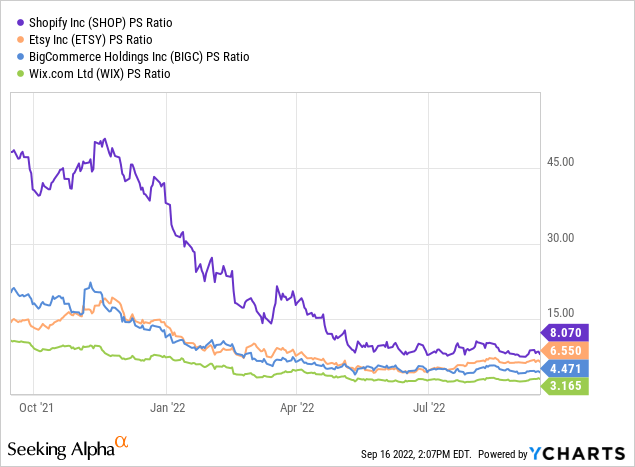

The valuation for Shopify has come down significantly with a price multiple of 38 price-to-sales ratio in January 2022 to now a more reasonable 8.5. However, the current stock market is a market that is not in favor of non-profitable, decelerating growth retail companies. In addition to the state of the stock market, inflation has been impacting the spend of the consumer in the United States and globally. This consequently impacts Shopify and the entrepreneurs and SMB merchants utilizing their platform. So, is this company still overvalued against its peers? And is growth and earnings not able to be returned to a level that Shopify experienced before 2022?

If you compare Shopify stock to its peers on a purely price-to-sales ratio it appears more expensive. However, it is more affordable than the stock has ever been, has a much more complete ecosystem and end-to-end business model, and with a much stronger balance sheet. If you are looking for a stock for the short-term beware this is a very volatile one to consider. But for the long-term I fully believe Shopify is primed for expansion and delivering market beating returns for shareholders consistently. Remember, the wise quote from the great investor Benjamin Graham, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” I believe due to the exceptional forward-thinking and strategic leadership of CEO Tobi Lütke and President Harley Finkelstein they will take this company to new all-time highs in the long-term.

The Execution of Leadership:

Shopify is a founder-led company with Tobi at the helm and Harley has been with the company for nearly 13 years himself. I consider them to be one of the best one-two punches in leadership in the software or e-commerce space. They lead a very mission driven company that has always been extremely aspirational in changing how entrepreneurship and commerce is done.

The company’s mission statement supports their customer audience’s expectations of creating a successful business. Shopify’s mission statement reads, “Make commerce better for everyone”, and they elaborate on this as follows, “We help people achieve independence by making it easier to start, run, and grow a business. We believe the future of commerce has more voices, not fewer, so we’re reducing the barriers to business ownership to make commerce better for everyone.”

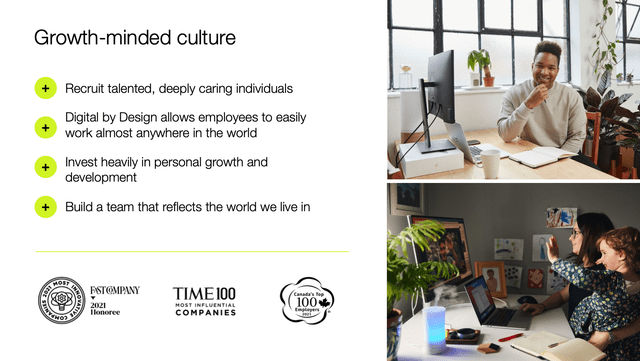

This mission statement is simple, focused, and is something that employees can understand and get behind. The other thing their mission statement creates is the expectation for merchants if they build their business on the Shopify platform, they can focus on what is important and they will be successful. Tobi and Harley have helped build this company around this mission and have been executing to it since going IPO in 2015. Having a well-thought-out company vision and mission statement that aligns to that vision, matters for success. Employees find meaning in their work when they can understand how their work contributes to the larger goal or mission statement. It leads to improved employee retention, productivity, sustainable talent growth within the organization, and attracts new talent.

Tobi is fully aligned to shareholders’ interest as he owns 6.2% of all shares of the company and is the biggest shareholder overall and has 40% of voting rights in the company. This allows him and Harley to continue to drive the company to their mission and for running the company towards long-term goals. Tobi and the leadership team at Shopify want to give employees that same chance to be even more aligned with the long-term success of the company and merchants, by instituting a new compensation system called Flex Comp, where employees can choose how they are compensated via cash, restricted stock units (RSUs), or options. The ability to withdraw the stock is instantaneously, opposed to waiting a full year and this will give flexibility for employees who may need to save for a large purchase like a house for example, opposed to forcing RSUs as the only additional compensation available. Employees will also receive a 5% bonus if they allocate more money to equity than is required under the minimum ‘guard rails’ in the program.

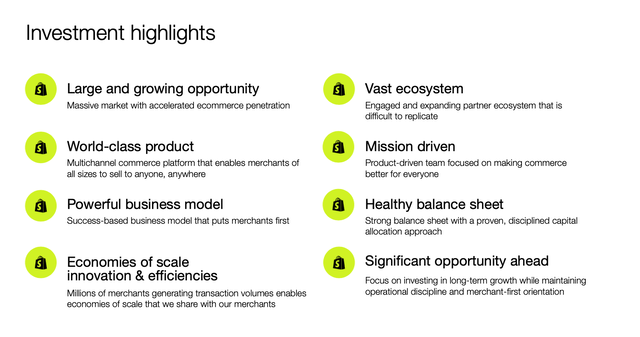

Shopify Q2 Investor Presentation

Now it takes more than just an amazing CEO and President for a company to be a long term-success. It takes great leadership and execution from other parts of the business as well. This leads to the concerns by investors and the media around Shopify since, CFO Amy Shapero is stepping down after nearly 5 years with Shopify and COO Toby Shannan who was with the company for the last 13yrs will not be in role anymore as of a few weeks ago.

However, investors need to always examine any news around their holdings with a frame of perspective, “understand the why”, and examine it in context. Toby Shannan had been with the company for a very long time and is retiring and will be joining the Board of Directors for Shopify on January 1, 2023. The backfill for Toby is VP of Merchant Services, Kaz Nejatian who has been with Shopify for the last three years. Kaz has also worked previously at Facebook as a Product lead for Payment Platform and Billing teams, as well as creating his own company Kash, which was an alternative payment company which used consumer data to underwrite the risk of transactions, which he later sold that off to a publicly traded financial services company. The CFO replacement for Amy Shapero wasn’t a complete outsider as it was Jeff Hoffmeister, who was the banker during the IPO of Shopify. He has helped the company do financing in the past and been and advisor of sorts to Tobi and Harley for years. He brings additional skillsets to the leadership group with his long-standing banking background.

So I believe these leadership changes are being over exaggerated by media, as it is not like Toby is leaving the company. Now, that would be a COMPLETELY different story and maybe even a thesis changer.

Creating the Central Operating System for Business

Tobi and Harley understand that the world is operating in a challenging time right now. They also understand the e-commerce market has gone through a whiplash since pre-COVID and maybe misunderstood. Shopify believes by providing an easy access point of entry into starting your own business and ecosystem of resources, it will level the playing field for all small businesses and all brands. The company believes in a top of the funnel business approach that leads to the most successful merchants becoming large brands and more than making up for any merchants that were to leave the platform.

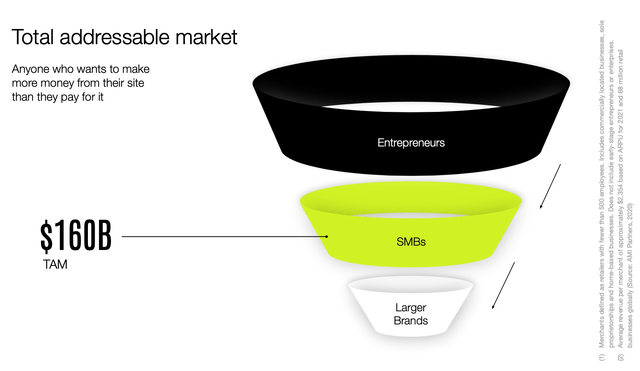

The TAM of Shopify (Q2 Shopify Investor Presentation)

The comments from Harley Finkelstein at the most recent Goldman Sachs Annual Global Retailing Conference in September increased my conviction that they can offer a complete end-to-end business model for merchants. Here is some of the key commentary and direct quotes by Harley on Shopify’s business model and how Deliverr has been integrated into the processes of the business model. After reading this you can see how they have created an operating system that merchants can run their business on and solves the different challenges they may face to scale and be successful.

“Yes. So those of you that know the company or of the company, you’ve seen effectively since the IPO, a couple of things have changed on Shopify. Our history was really to help great brands and merchants start online stores and then scale. And some of those stores that start on the platform have grown to become very large, very publicly traded companies. Allbirds (BIRD), for example, or FIGS (FIGS) or Oatly (OTLY).

But if you look at companies like Gymshark and Fashion Nova, these are companies that started on Shopify at their mom’s kitchen table that are now category leaders. And that if they’ve been able to scale entirely on shop, there’s no graduation of Shopify, which is great. We love that.

But around the IPO time, we began to leverage the economies of scale that we were talking about to do things like payments and then capital and shipping labels. And more recently, things like audiences, which is our take on how to improve return on ad spend for our merchants, but really leaning in on this idea that what if we provided those economies of scale that we’re entitled to every single merchant on the platform. We think that would level the playing field for all small businesses and all brands.

But there was one piece of the business building process that was not helped by the introduction of the Internet, and that was the shipment of actual goods. And so we didn’t really want to go into shipping. That wasn’t really the goal that we want to come as a big logistics provider.

What happened was as we became more and more of that center of business for these millions of merchants on the platform, they ask if we can help them with more things. And so we began to think about, well, what if we were able to find a way in a very software asset-light model to help these merchants to fill their orders, ship their orders? And what we realized was there was sort of this natural glass ceiling on businesses once they got to the point where they acquired a 3PL.

Most 3PL — third-party logistics companies have massive minimums. They’re still expensive, even if you’re shipping tens of thousands of orders, and they’re not really optimized for software. So in a world where omnichannel is steady-state, where omnichannel is like talking about omnichannel, I’m talking about the color TV, it’s everywhere, we felt that merchants needed a single place where they can see the entirety of their inventory from factory to port, right to porch to the end consumer.

And so the approach we took was very different than most traditional logistics companies. When a good is being made in the factory, there’s — the first phase is from the factory to the port. And we’ve announced a partnership with Flexport, which allows us to do that for our merchants very effectively.

Flexport leverages software and works with pretty much every shipping container company to get it from factory to the actual port. Once it gets to the port, and it’s in their shipping container, then it needs what’s called balancing. Someone needs to anticipate where those actual packages go where those products go to — and what warehouse they go to, to eventually get closer to the end consumer.

And so that second phase, which we call balancing, we ended up buying a company called Deliverr. And Deliverr was this company that we had been — we’ve been hearing about from a lot of our merchants. And it was just obvious they were so far ahead of everyone else on that balancing aspect. So that balance in the second phase is really when it arises in a port to where it goes to the fulfillment ever.

So we acquired them a couple of months ago, and they were handling that piece. And then once a get to the fulfillment center, one of the other observations we had was there are thousands — about tens of thousands of these third-party logistics companies — warehouses all over the world that are sitting empty because companies, Forever 21, for example, or Barney’s, for example, use them and are no longer using them at the same level anymore, and they were empty.

And so we went to these third-party business companies and said, we want to create a network, third-party fulfillment centers. We’re going to build our FMS, our fulfillment management software. And we’re also going to — if you’re ambitious, we’re going to give you these checks from a company we acquired called 6 River Systems, which optimized your inventory and your warehouse management. And we are going to give you as many customers as you need to fulfill orders and send to the consumer.

And so the first piece is Flexport. That second piece is Deliverr. And the third piece is really driven by the Shopify Fulfillment Network, which is powered by these third-party partners. And it’s taken some time. It’s not as easy as just releasing Shopify Capital, which we can announce on a Monday. And by Friday, it’s up and running. But we’re at a really good place right now.

And we can do in a way that is not capital-intensive, but we think can actually create huge value add for the merchants on Shopify. And it’s just one more piece of the business that we’re able to democratize for them, and it means we’re even more important in their life.”

Shopify and its Stock is Built for Compounding Growth

Why I am so bullish on Shopify is the company has built a flywheel platform that solves meaningful problems for entrepreneurs, SMBs, and even large corporations. Shopify’s success is built on the backs of their merchants’ success and that keeps merchants coming back for more, especially as more commerce challenges get solved by the Shopify platform.

Shopify also has a wide-scale ecosystem that includes some of the largest commerce players in the market whether it be direct competitor Amazon (AMZN), or Walmart (WMT), TikTok, Pinterest (PINS), Instagram, Google (GOOG) (GOOGL), eBay (EBAY), Spotify (SPOT), Twitter (TWTR), YouTube, JD.com, Meta (META), and in physical retail stores. This ecosystem is focused on product innovation that puts their merchants first and solves challenges around multi-channel scale, shipping & fulfillment, advertising and marketing, money, and traditional retail presence.

Why to Invest in Shopify (Q2 Shopify Investor Presentation)

Shopify’s decelerated growth, loss in profits, and change in management are not being looked at from a perspective of context, which does provide an amazing opportunity for new shareholders in my opinion. The leadership team that is at the top and new in place is exceptional, the mission has not changed, only the evolution and growth towards solving their mission for commerce. I have held the Shopify stock since 2018 so I am still in the green but I experienced the 75% rollercoaster drop as all other shareholders did, but I am more bullish than ever.

Be the first to comment